Original|Odaily Planet Daily (@OdailyChina)

As the price of ETH gradually warms up, tokens in the DeFi sector have also welcomed their "surge moment." OKX market data shows that as of the time of writing, SUSHI is priced at $2.54, with a 24-hour increase of 32.68%, leading the DeFi-related tokens. In addition, tokens like UNI, HYPE, and CRV have all seen increases of over 30% in the past week, prompting the question: Is DeFi 2.0 really coming?

Odaily Planet Daily will briefly analyze the subsequent direction of DeFi 2.0 in conjunction with a series of recent actions by Sushi for readers' reference.

Frequent Moves, Does Sushi Fire the "First Shot of DeFi Revival"?

In October, Sushi's official account hinted that "something big is coming." On October 21, Sushi posted "Tomorrow" in the early hours, suggesting that major news would be announced soon. At that time, the price of SUSHI tokens had experienced a slight increase, standing at only $0.8318.

On the same day, Sushi's CEO Jared Grey stated that "tests show that Sushi outperforms major aggregators on competitive networks in key metrics such as price, gas, and latency, and the aggregation volume is steadily increasing month by month. Additionally, Sushi is about to announce a strategic acquisition that will allow it to introduce built-in invisible innovative DeFi primitives into the AMM and perps vertical."

Since then, as a well-established DeFi platform, Sushi has taken the lead in firing the "first shot of DeFi revival."

Subsequently, Sushi's official account announced the Super Swap roadmap, which includes:

Multi-chain expansion: Sushi has launched on over 35 chains and will add more in the future. This extensive network ensures seamless trading between new and old ecosystems, allowing users to access through an intuitive Sushi user interface.

Route Processor: The Route Processor provides the most decentralized cross-chain aggregation stack in the industry. By aggregating liquidity from hundreds of sources, RP5 ensures competitive pricing and optimal trading paths for diverse assets, even on fragmented networks.

Swap API: Powered by the Route Processor, our swap API enables partners to directly integrate Sushi's seamless swapping experience into their applications. Future updates will introduce a fee capture mechanism, opening new revenue streams for partners.

SushiXSwap: SushiXSwap has now entered its second version, supporting cross-chain swaps across 15 networks, with plans for further expansion.

Trader-focused features: Sushi's user experience is trader-centric, offering essential tools such as tax token support, dollar-cost averaging (DCA), limit orders, mini portfolios, and a simplified token selector.

Blade: Blade is Sushi's upcoming AMM designed to address the impermanent loss (IL) issue for liquidity providers. With Blade, liquidity providers can expect stable returns on quality assets without worrying about the risks of impermanent loss.

Kubo: A DeFi perpetual contract primitive aimed at enabling liquidity providers (LPs) to generate returns through delta-neutral strategies across multiple networks.

ALM Smart Pool: Steer's smart pool simplifies V3 concentrated liquidity management with user-friendly strategies that typically outperform standard LP methods.

From ecological expansion to product aggregation, from seamless integration to cross-chain swapping, from LP risk management to LP process simplification, Sushi has begun a new round of product iteration updates in multiple aspects, hoping to attract liquidity on a larger scale and more users.

Subsequently, Sushi has integrated with ecosystems such as zkLink Nova and ApeChain, taking steps towards the planned multi-ecosystem integration.

In terms of the current trend of Meme coins, Sushi has also provided its own "solution"—on November 28, Sushi announced that the Dojo proxy and Tweet Tokens feature are now live, allowing users to tokenize their favorite posts or directly publish their created Meme coins from Twitter (i.e., the X platform). Posting tokens from Twitter is completely free, but please note that there is a 5-minute interval between each user's token creation to avoid spam.

Thanks to a series of positive developments at the project level, the SUSHI token has also risen sharply, breaking the $1.36 mark in early December, representing an increase of over 200% compared to four months ago. A trader's address that previously acquired 1.5 million SUSHI (approximately $2.01 million) on August 9, unable to resist the urge to take profits in the face of a 134% gain, sold it off, making a profit of $1.17 million.

If that trader had held until now, their profit would have doubled to around $2.4 million. Of course, the market has no "what ifs," and the recent rise in the SUSHI token is closely related to a series of positive developments and the price recovery of ETH.

On December 6, according to the Snapshot page, the Sushi community initiated a vote on the "Treasury Diversification Proposal," with voting ending at 5 AM on December 14. Sushi CEO Jared Grey explained that currently, 100% of Sushi's treasury assets are in SUSHI tokens. In the proposed diversification strategy, 70% of the treasury holdings will be converted to stablecoins, 20% to blue-chip assets (BTC, ETH), and the remaining 10% to DeFi tokens (such as AAVE). If this operation is executed, the Sushi treasury will systematically liquidate its current SUSHI holdings within the specified timeframe to minimize market impact, implementing an average cost strategy during the sell-off and executing sales under favorable market conditions.

The goals of the proposal include:

- Reducing volatility: Minimizing the impact of SUSHI on the value of treasury holdings;

- Enhancing liquidity: Increasing the liquidity of operational and strategic assets;

- Generating returns: Exploring opportunities for staking, lending, or liquidity provision.

Currently, the proposal has received support from 774,000 SUSHI tokens, leaving a gap of approximately 84.5% from the required 5 million SUSHI for the proposal to be fulfilled.

On December 8, Sushi CEO Jared Grey again summarized a comprehensive governance reform passed by Sushi DAO in April and released the Sushi 2025 product roadmap, which includes:

Wara (wara.exchange): A new integrated trading experience based on Solana;

Susa (susa.exchange): A new on-chain order book perpetual DEX launched by Sushi;

Kubo (kubo.bid): A new native perpetual contract product launched by Sushi Labs, starting new markets through delta-neutral strategies;

Blade (part of SushiSwap): A new LVR AMM solution that eliminates MEV for blue-chip assets;

SushiSwap Aggregator: This product is already in development but will expand its distribution through the integration of new partners.

At the same time, in response to community comments, it was stated that a multi-token airdrop had already been announced back in April.

Sushi official homepage background image

In this regard, Sushi's ambition to make a strong push into the Solana ecosystem is evident.

Additionally, the “Referral Rebate Program” launched at the end of November has also shown initial results—referrers will receive 75% of the transaction fees, while the referred users will receive the remaining 25%, making it one of the measures where "the platform benefits the users."

With Sushi's actions, many crypto users have high expectations for the revival of the DeFi sector that once led the market, which is naturally the result of the efforts of various DeFi protocols and platforms.

How will DeFi 2.0 be initiated? New and old platforms are each coming up with unique strategies.

According to SoSoValue data, after experiencing a sector rotation increase, the cryptocurrency market is seeing a pullback today, with most crypto sectors down about 1.5% to 3% in the last 24 hours. Among them, the previously strong CeFi, Layer1, AI, and PayFi sectors have seen significant pullbacks, with a 24-hour decline of around 3%. In contrast, the DeFi sector remains relatively strong, maintaining a 0.63% increase over 24 hours, with Chainlink (LINK) and Uniswap (UNI) performing well, rising 6.66% and 2% respectively in the last 24 hours.

Additionally, according to previous news from IntoTheBlock here, thanks to the continued surge in DeFi and Memecoin trading, Ethereum's protocol revenue has increased by nearly 40% this week, reaching around $57 million. A closer look reveals the current situation of DeFi protocols and platforms as follows:

Hyperliquid: An L1 Public Chain Driving DeFi 2.0

In a previous article titled “Single Number Average Up to $30,000, HyperLiquid Becomes the ‘Biggest Airdrop of the Year’?”, we provided a detailed introduction to Hyperliquid, which has recently garnered significant market attention. After the article was published, the platform's token HYPE surged from $8 to nearly $14, setting a new high.

It is evident that Hyperliquid's decision not to initially launch the HYPE token on CEX has created a wave of "reverse marketing," and its positioning as an "L1 public chain" has significantly raised its project ceiling. Coupled with a series of measures previously opened by Hyperliquid in response to community requests, such as “3x Leverage Long or Short HYPE” and auctioning off spot listing quotas, the project has ambitious goals, and the token price may have further room for growth.

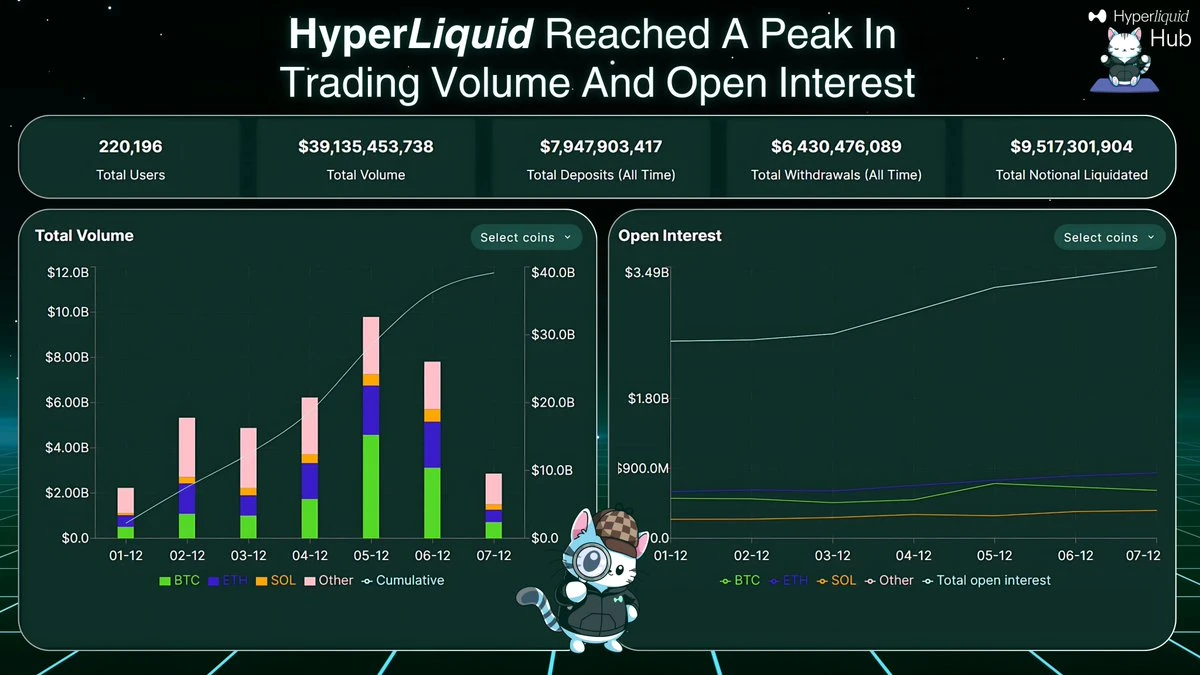

According to the latest statistics from Hyperliquid Hub, Hyperliquid achieved a daily trading volume of $10 billion within 7 days; the daily open contracts reached $3.5 billion; and it has over 220,000 users, showcasing impressive market performance.

Hyperliquid's impressive performance

Uniswap: Unichain Poised for Launch

The established DEX platform Uniswap is also not falling behind. It previously announced the launch of Unichain, and analysts have stated that Uniswap has long been a key driver of activity on the Ethereum mainnet. As Uniswap transitions to its own chain, Ethereum network validators may lose approximately $400 million to $500 million in annual revenue. However, more serious than this economic loss is the threat it poses to Ethereum's fundamental narrative as a deflationary currency. Uniswap's universal router is the largest gas-consuming account, accounting for 14.5% of Ethereum's gas fees, equivalent to the destruction of $1.6 billion worth of Ethereum, which means the effectiveness of the burn mechanism will weaken, further undermining Ethereum's economic position.

In the recently concluded month of November, Uniswap achieved a monthly trading volume of $38 billion, nearly a 50% increase from October, breaking the previous record of $34 billion; the total monthly fees reached $5.44 million, ranking sixth among DeFi protocols; Arbitrum also became the first L2 to exceed $20 billion in monthly trading volume on the Uniswap protocol. Recently, Uniswap Labs officially announced a partnership with digital asset operations and payment platform Fireblocks. Through Fireblocks, asset managers, hedge funds, and other financial companies can directly access Uniswap's deep liquidity and competitive pricing.

Thus, Uniswap has successfully established an "institutional-level user service system."

Others: ORCA, RSR, DYDX, CRV

Among other DeFi-related tokens, ORCA, RSR, DYDX, and CRV have also performed well for various reasons:

ORCA's price surged due to its listing on Binance;

RSR gained market attention due to the appointment of Paul Atkins, the new chairman of the SEC, as an early advisor to the project;

DYDX remains among the industry leaders in trading volume and has responded quickly to market hotspots like Meme coins;

CRV has achieved a sixfold increase over the past month after overcoming previous "liquidation turmoil."

Based on the current market performance of projects with good protocol revenue, the future of DeFi 2.0 looks promising. (For details, refer to the article “Curve Sixfold in a Month, Who is the True ‘Value Coin’ from the Perspective of Protocol Revenue?”)

Conclusion: When DeFi Meets Memecoins, MemeFi May Lead the Next Round of Industry Growth

As one of the popular sectors that led the market after BTC's price broke $100,000, the DeFi track is also seeking new paths and directions in keeping with the times. Some market views suggest that MemeFi may become the "engine" driving the next round of industry growth—combining the yield from DeFi mining with the low barriers and high-frequency operations of Memecoins to attract more new investors and liquidity into the market. Various Meme coin projects on Hyperliquid can also be seen as new attempts in this direction.

Additionally, LPs from Meme coin project teams have also become a popular play recently; for details, refer to the article “The Meme Wave is Not Just PVP, ‘Mining’ is Also a Good Choice”.

In the near future, we may also witness another "Meme coin track wealth creation star" beyond pump.fun.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。