No support for competitor network upgrades, bridging corporate assets to Base, the worst Solana support among mainstream exchanges… An overview of Coinbase's selfish bias against public chains.

Written by: Alex Liu, Foresight News

Coinbase is the only cryptocurrency exchange listed on the U.S. stock market, wielding significant influence in the industry.

However, despite its leading position, many controversial actions by Coinbase have drawn criticism from various industry figures, such as the "selfish" bias in "public chain support." This "selfish" bias manifests in many ways.

Discrimination Against Solana

"Thoughtful" Reminder

When you send cryptocurrency using the Solana network on Coinbase, a "thoughtful" reminder appears at the bottom of the page:

Send crypto for less

Use a faster and cheaper network for future sends

Abnormal Deposit and Withdrawal Times

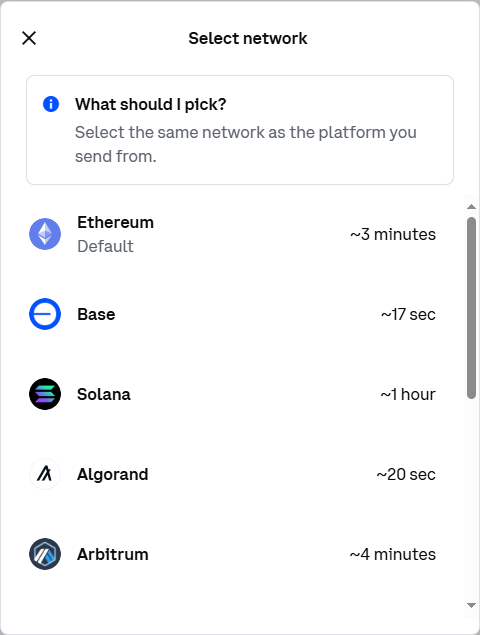

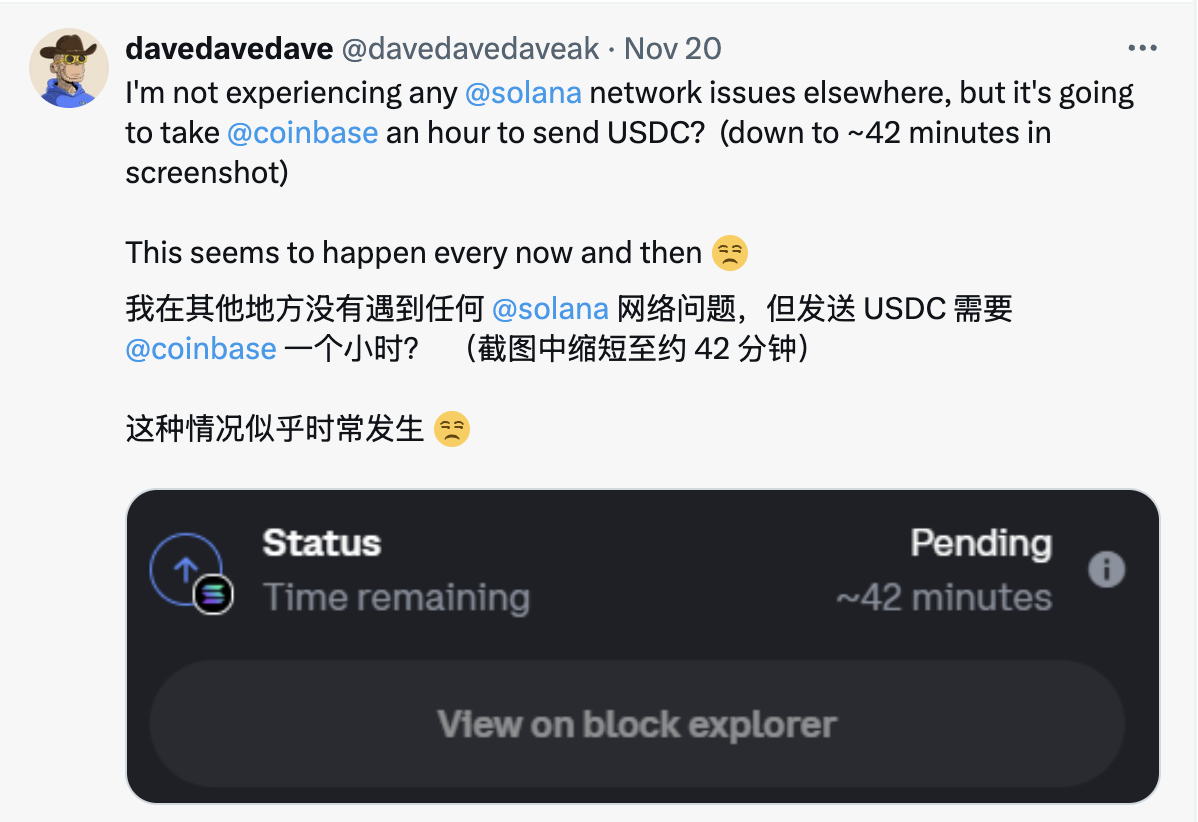

Frequent users of Solana for sending and receiving cryptocurrency know that transactions usually arrive within seconds. Deposits and withdrawals of cryptocurrencies like USDC through centralized exchanges on the Solana network can also be confirmed within minutes. However, when withdrawing USDC from Coinbase, we found that Coinbase defaults to using the Ethereum mainnet, which takes about 3 minutes—compared to Coinbase's own Ethereum Layer 2 Base, which only takes 17 seconds, while Solana takes about 1 hour.

This situation has been confirmed by multiple Coinbase users on social media.

On-chain, but Not Including Solana

You can earn rewards just by holding USDC in an "on-chain" wallet.

However, the Solana network is not counted as "on-chain," even though it may be more popular than other networks on the list.

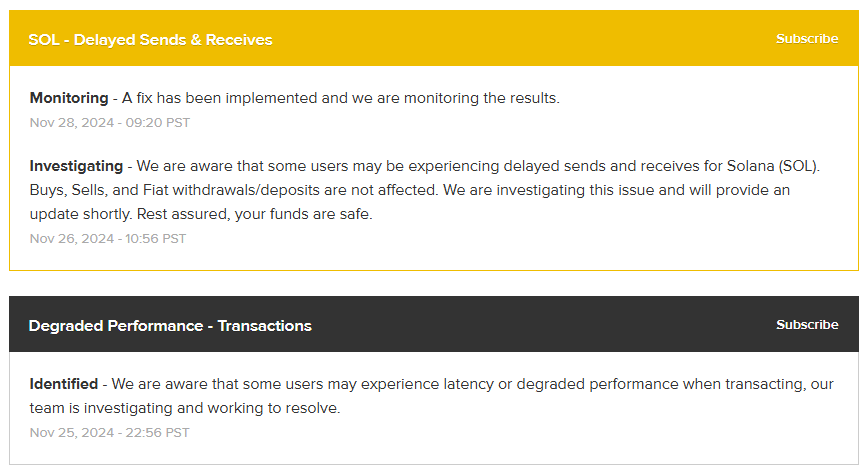

Extremely Poor Solana Support

Coinbase's support for the Solana network is extremely poor, often experiencing network delays and performance degradation.

This has led Placeholder partner and well-known VC Chris Burniske to publicly urge Coinbase to improve its support for the Solana network.

What’s the Reason?

Coinbase is heavily promoting its own Ethereum Layer 2 Base. In terms of comprehensive fees, application ecosystem, and user numbers, Solana is the biggest competitor to the Base ecosystem. By providing extremely poor support for Solana, Coinbase is "artificially" lowering the user experience of Solana.

Transferring Assets to Base

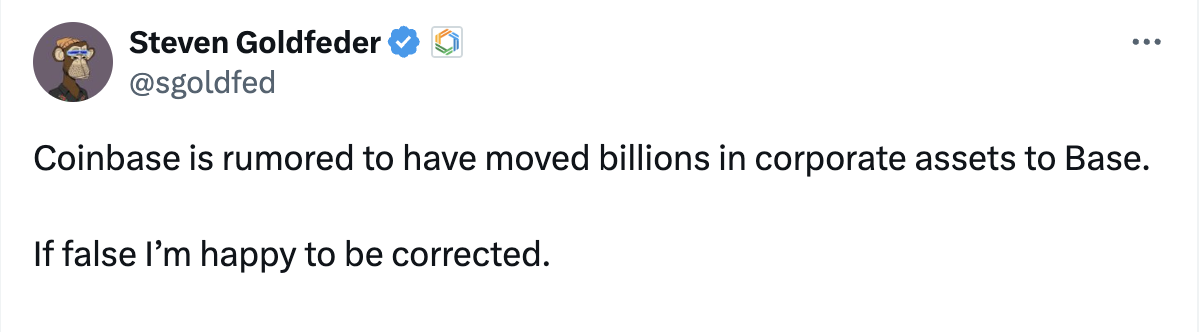

According to Arbitrum co-founder Steven Goldfeder, Coinbase is suspected of transferring billions in corporate assets to Base to increase "TVL."

No Support for Competitor Network Upgrades

After the L1 public chain Celo announced its transformation into L2 (through a hard fork upgrade), Coinbase stated it would not support this upgrade. This will directly lead to the delisting of the CELO token from Coinbase after it becomes L2.

This action has also been viewed by the community as a typical case of Coinbase suppressing L2 competitors for Base, not supporting the ecological expansion of Ethereum, and has received widespread criticism from community members.

Conclusion

As a leading exchange in the industry, Coinbase should bear more industry responsibility. Such "selfish" bias is truly disappointing for users and practitioners. It is hoped that they can recognize the impropriety of their actions, allow for fair competition in the market, and promote healthy industry development.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。