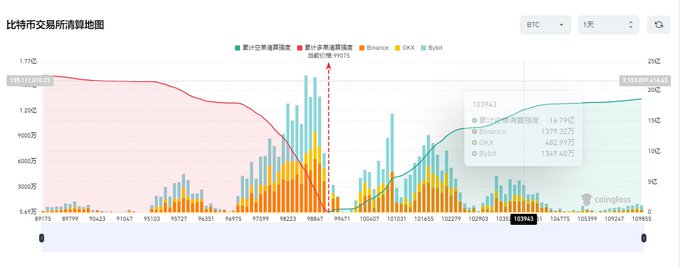

After Bitcoin broke through the $100,000 mark, it has now started to fluctuate around that level. According to market understanding, it is generally in line with market operation rules to allow a certain amount of time for consolidation after significant volatility. After this phase, a new trend typically begins. First, we can see from the image above that after several days of fluctuation, the short positions that were blown up due to the recent surge have started to accumulate again. If the price of Bitcoin rises to $110,000, it could blow up 1.9 billion short positions; if it drops to $89,000, it could blow up 2.3 billion long positions. This number may further increase over time. Another critical time point is the Federal Reserve's interest rate cut, at which point the market may leverage the rate cut to lead a new trend. So, how do you think the upcoming market will unfold?

After Bitcoin broke through the $100,000 mark, it has now started to fluctuate around that level. According to market understanding, it is generally in line with market operation rules to allow a certain amount of time for consolidation after significant volatility. After this phase, a new trend typically begins. First, we can see from the image above that after several days of fluctuation, the short positions that were blown up due to the recent surge have started to accumulate again. If the price of Bitcoin rises to $110,000, it could blow up 1.9 billion short positions; if it drops to $89,000, it could blow up 2.3 billion long positions. This number may further increase over time. Another critical time point is the Federal Reserve's interest rate cut, at which point the market may leverage the rate cut to lead a new trend. So, how do you think the upcoming market will unfold?

As usual, let's first look at the overall trend from the daily chart. The daily chart clearly shows a lot; the candlestick has formed a steady upward trend. After the current price surged past $100,000, it has started to slightly retreat. In the current situation, this level of correction should be very normal and reasonable. Regardless of the macro perspective, the attention of Western powers towards Bitcoin, and the purchasing power of large whales, I believe that most people in the market are optimistic about the subsequent trend. From a technical indicator perspective, there are also no issues; the MACD is in adjustment mode, building momentum for the upcoming trend. The price is testing near the MA5 line, and for the daily level pullback, we should first pay attention to the support strength of the MA20 line. In any case, during a bull market, the daily level pullback in the MA20-30 line range is a significant buffer zone and an important psychological defense line. Overall, in terms of the larger trend direction, the market consensus remains bullish, and the details will depend on how the trend unfolds step by step. Thus, during the adjustment process, Bitcoin is "hiding dangers."

After discussing the daily trend, let's talk about short-term trading issues. Currently, the four-hour trend has started to decline and has formed a large bearish candle, which may indicate a small short-term signal. Due to the selling pressure from the highs in the current fluctuation, I personally believe that the price will continue to search for support today. Therefore, I started to participate in short positions yesterday, and if there is another short opportunity around $99,800 today, I will participate again, with support below at $97,500-$96,500 for buying!

As for Ethereum, it currently cannot support an independent trend. Similarly, the short-term trend will remain relatively synchronized with Bitcoin. Near the $3,950 level, short positions can also be taken, with support below at $3,780-$3,720.

As for altcoins, I won't go into specifics for now. Personally, I have been accumulating pnut, stx, apt, and ice over the past few days. If any of you have coins you are optimistic about, feel free to recommend them to me!

【The above analysis and strategies are for reference only. Please bear the risks yourself. The article is subject to review and publication, and market conditions change in real-time. The information may be outdated, and specific operations should follow real-time strategies.】

Scan to follow the public account!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。