In the rapidly changing market environment, planning ahead and responding quickly are key to achieving stable returns.

The current global cryptocurrency market is closely linked to overall economic trends. Whether it is inflation rates, central bank policies, or trade data, all can affect the sentiment in the cryptocurrency market and investors' risk appetite.

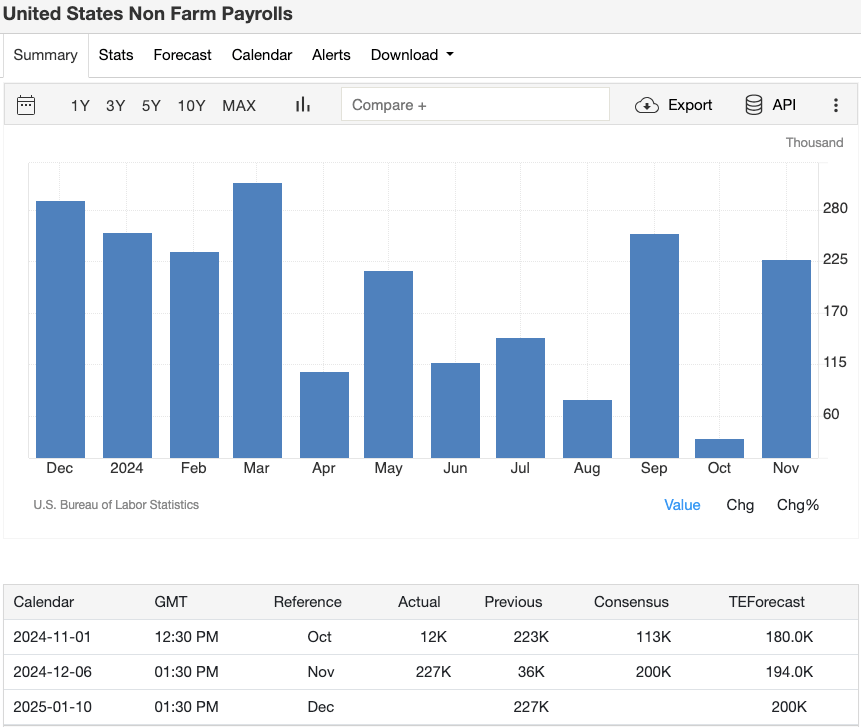

In week 49, China's Caixin Manufacturing PMI and the US ISM index showed that manufacturing performance was decent, but the service sector and consumer performance were relatively weak. This "mixed bag" situation has led many traders to prefer more stable assets like Bitcoin, while also closely monitoring altcoins that benefit from global trade.

Looking ahead to week 50, inflation reports, trade data, and central bank decisions will set the market tone. This information will influence market liquidity, institutional capital allocation, and the price trends of Bitcoin, Ethereum, and other crypto assets.

This report will provide you with:

A review of the major events in week 49.

Predictions for key data and policy releases in week 50.

Trading strategies to cope with the macroeconomic impacts this week.

Market Review of Last Week

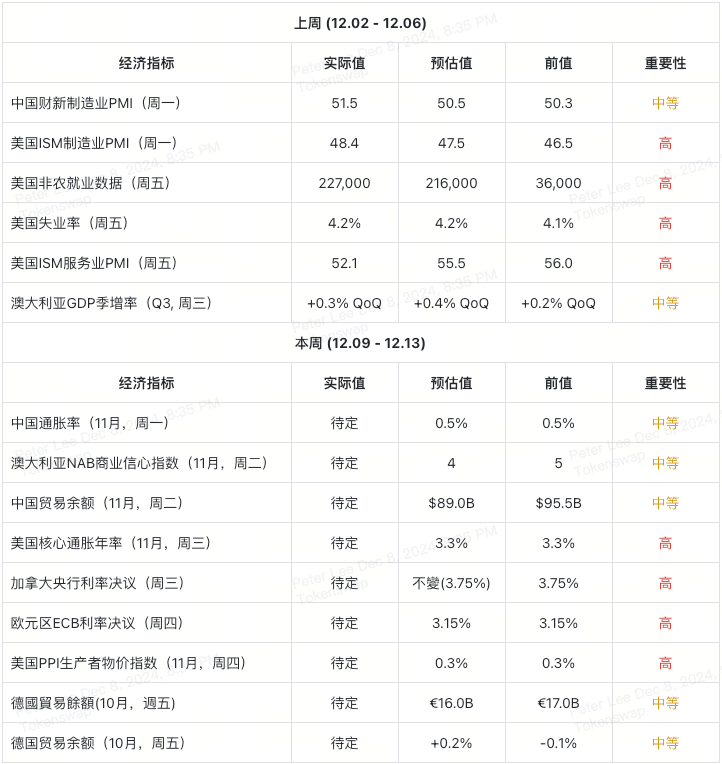

China's Caixin Manufacturing PMI (November: 51.5)

Image source: Trading Economics

China's manufacturing growth exceeded expectations, indicating good trade flow. This positive signal provided a slight boost to cryptocurrency projects related to supply chains and industrial applications.

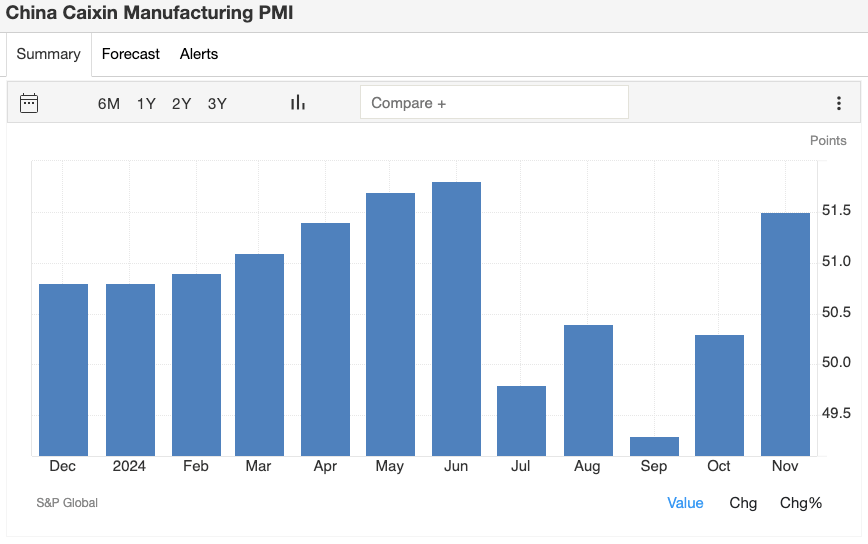

US ISM Manufacturing PMI (November: 48.4)

Image source: Trading Economics

Although US manufacturing is still contracting, the pace has slowed, which slightly boosted market sentiment. Bitcoin and major altcoins saw slight increases, but the Federal Reserve's cautious stance still limited the gains.

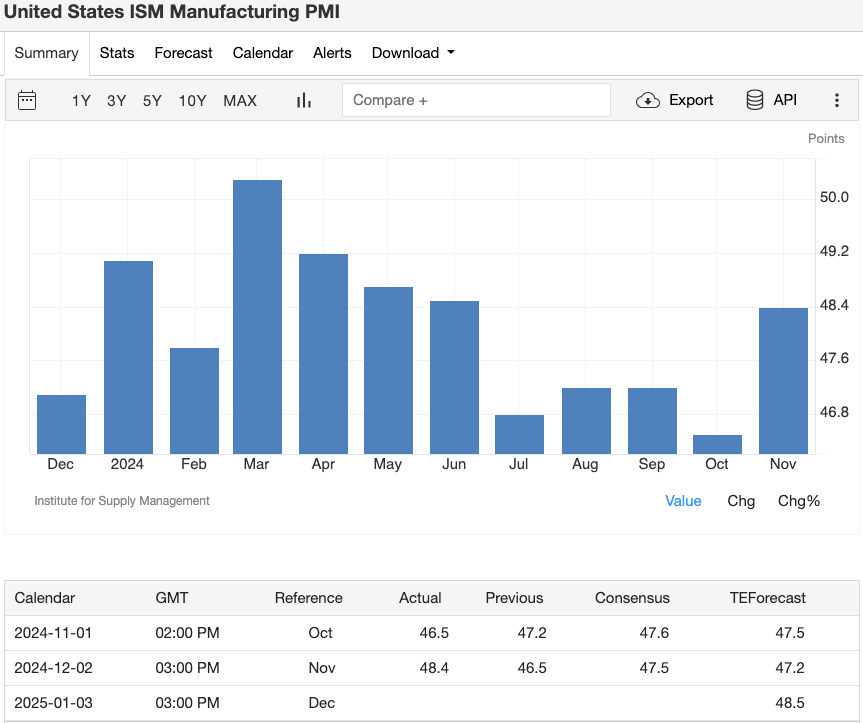

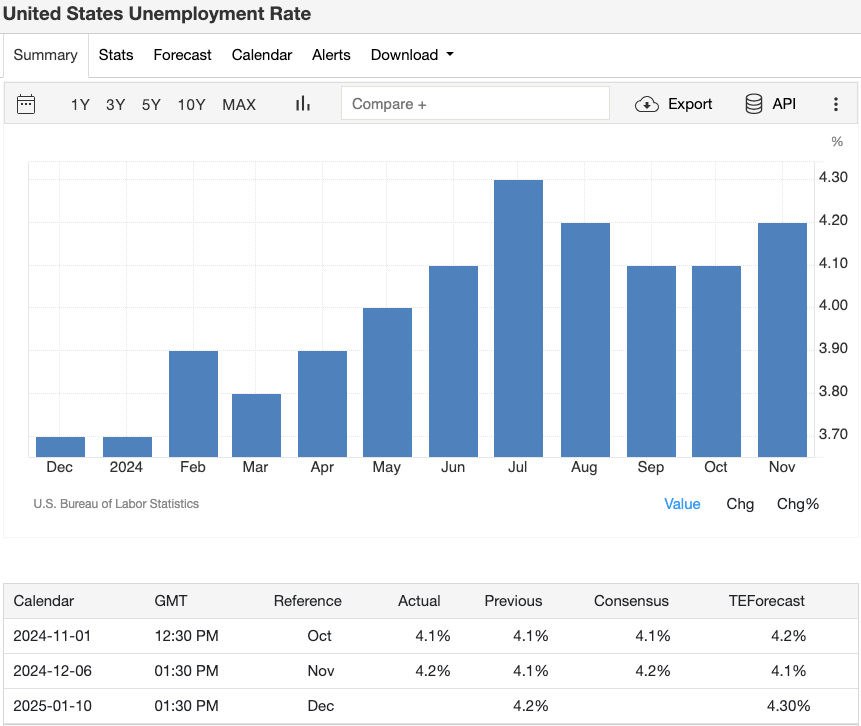

US Non-Farm Payroll Report and Unemployment Rate (New Jobs: 227,000, Unemployment Rate: 4.2%)

Image source: Trading Economics

Image source: Trading Economics

Strong employment data supported the market's risk appetite, but the slight increase in the unemployment rate added uncertainty, prompting some investors to choose Bitcoin as a hedging tool.

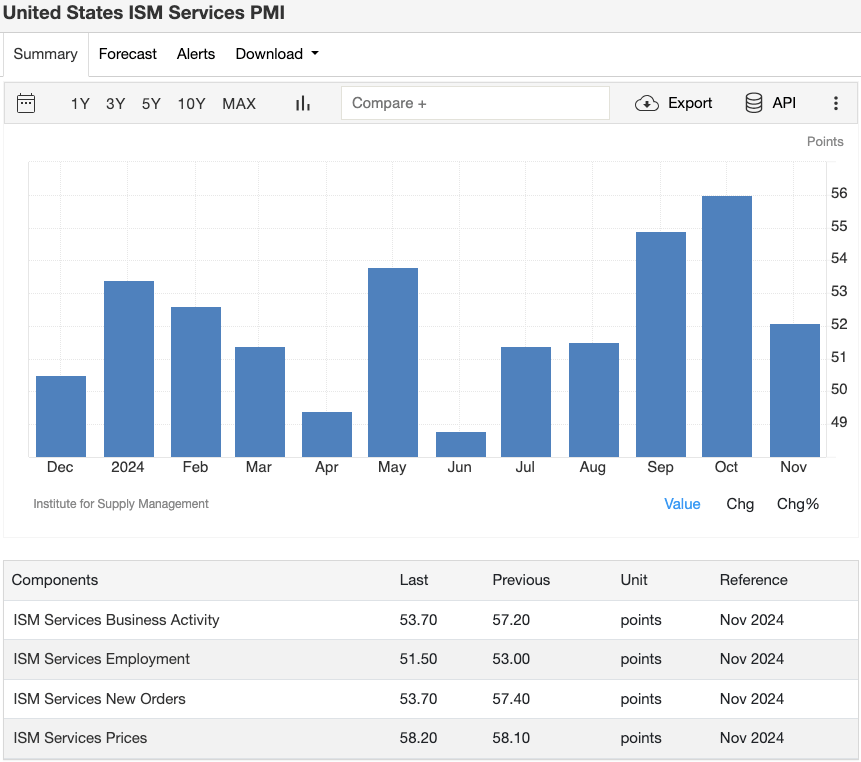

US ISM Services PMI (November: 52.1)

Image source: Trading Economics

Service sector growth fell short of expectations, raising concerns about an overall economic slowdown, which led more traders to choose Bitcoin for hedging.

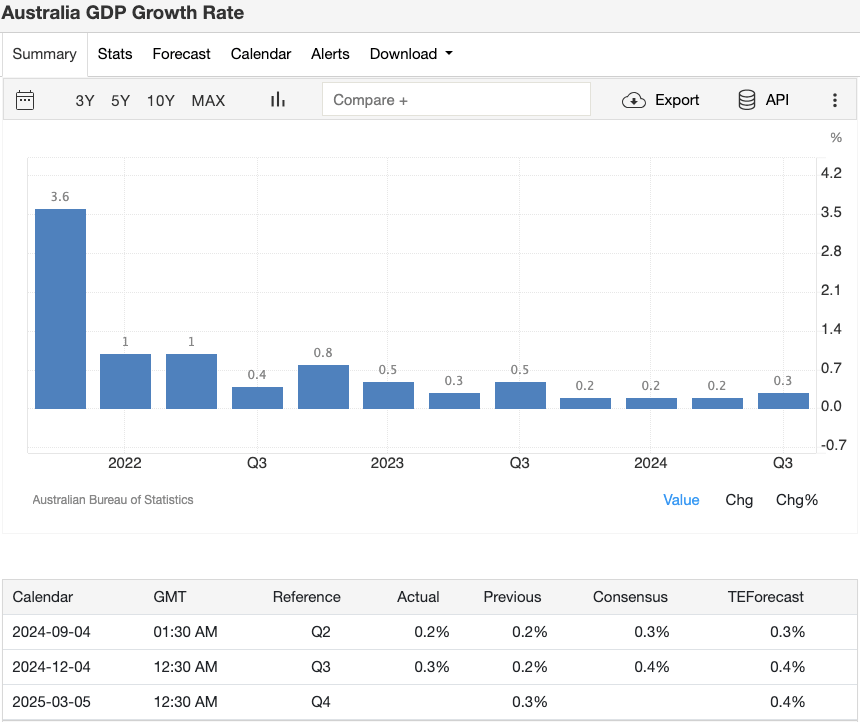

Australia's GDP Quarterly Growth Rate (Q3: +0.3%)

Image source: Trading Economics

Slightly lower-than-expected economic growth weakened investors' interest in high-risk altcoins, with more funds flowing into stable assets like Bitcoin and Ethereum.

Key Conclusions

The data from week 49 was mixed. Manufacturing performance was decent, but service and consumer-related data were relatively weak. As a result, investors adopted a balanced strategy—using Bitcoin as a hedge while selecting specific altcoins that could benefit from global trade growth.

Overview of Key Economic Events This Week (Week 50)

This week's market focus is on inflation data, trade balances, and interest rate decisions from major central banks. This key information will play a decisive role in shaping market sentiment as the year comes to a close. Inflation dynamics, monetary policy direction, and global demand trends will directly impact market liquidity and the risk appetite for crypto assets.

Key Data:

December 9 (Monday)

China's Inflation Rate (November)

Forecast: Year-on-year growth of 0.5% (unchanged from October)

Why it matters: Stable or slightly rising inflation indicates robust domestic demand in China, which helps boost global trade sentiment.

Impact on the crypto market: Stable inflation data will boost demand for tokens related to Asia.

NEO (NEO): "China's Ethereum" may perform positively as domestic economic confidence rebounds.

Conflux (CFX): A Chinese public chain focused on cross-border activities, expected to benefit from regional economic improvement.

VeChain (VET): Deeply collaborates with Asian enterprises, with demand likely to rise as supply chain outlook improves.

December 10 (Tuesday)

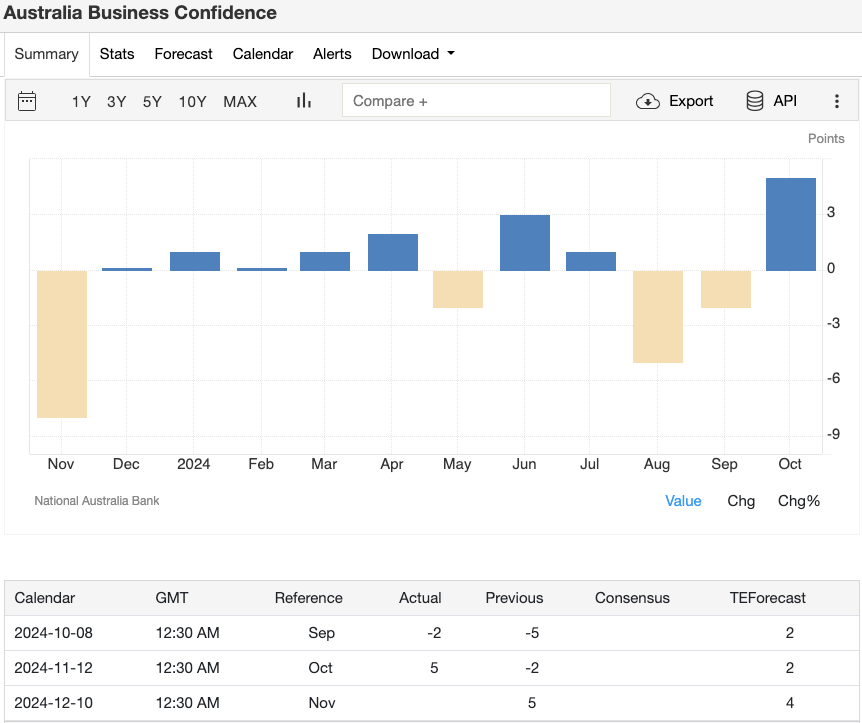

Australia's NAB Business Confidence Index (November)

Forecast: 4 (slightly lower than October's 5)

Why it matters: Although it may decline slightly, it still shows resilience in business confidence, helping to support market risk appetite.

Impact on the crypto market: A good business environment may support DeFi and SME financing projects.

XT.COM Coin (XT): A trading platform token with a background in the Asia-Pacific market.

Synthetix (SNX): An Australian DeFi protocol, with SNX performance worth watching if investor interest increases.

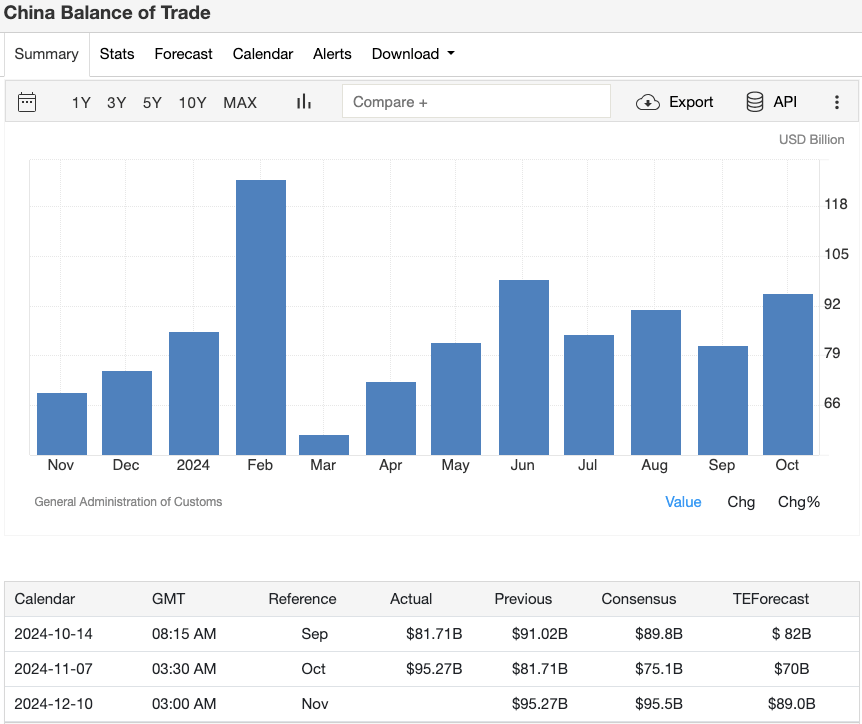

China's Trade Balance (November)

Forecast: $89 billion (down from October's $95.5 billion)

Why it matters: A shrinking trade surplus may reflect a slowdown in global demand, affecting market risk appetite.

Impact on the crypto market: If the data falls short of expectations, it may increase the appeal of safe-haven assets like Bitcoin, while reducing interest in trade-related tokens.

- OriginTrail (TRAC): A protocol focused on supply chain data, reliant on strong global trade momentum for support.

December 11 (Wednesday)

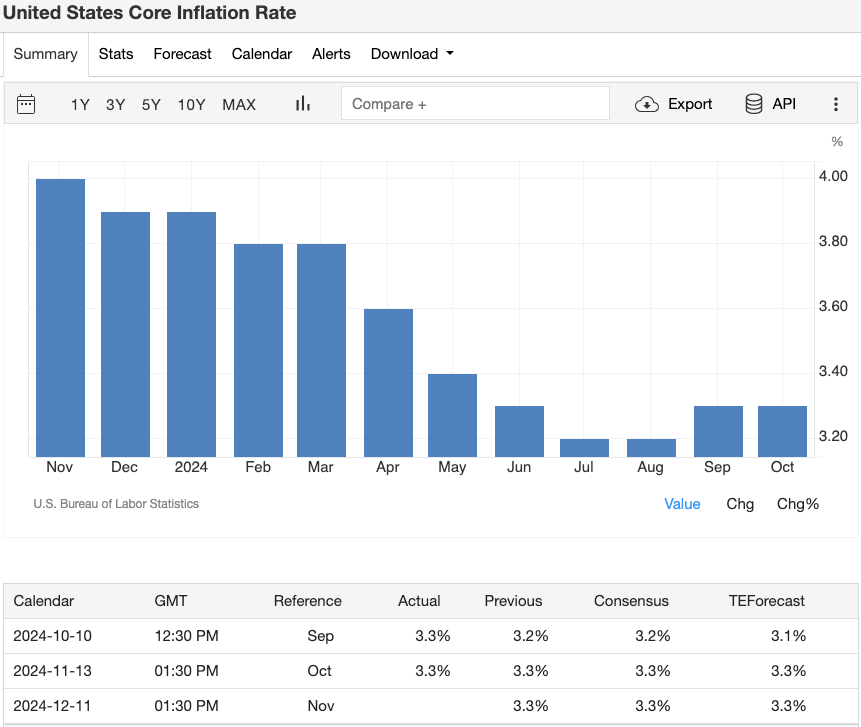

US Core Inflation Year-on-Year (November)

Forecast: 3.3% (unchanged from October)

Why it matters: Core inflation is an important reference for the Federal Reserve's policy-making, and stable readings may reduce the urgency for further rate cuts.

Impact on the crypto market: Stable inflation data may lead to Bitcoin and Ethereum consolidating, as the market awaits clearer policy signals.

Bitcoin (BTC): If inflation unexpectedly rises, it may strengthen its position as a safe-haven asset.

Ethereum (ETH): Improved liquidity may drive demand for ETH within the DeFi ecosystem.

PAX Gold (PAXG): If inflation concerns escalate, tokenized gold may become an alternative choice.

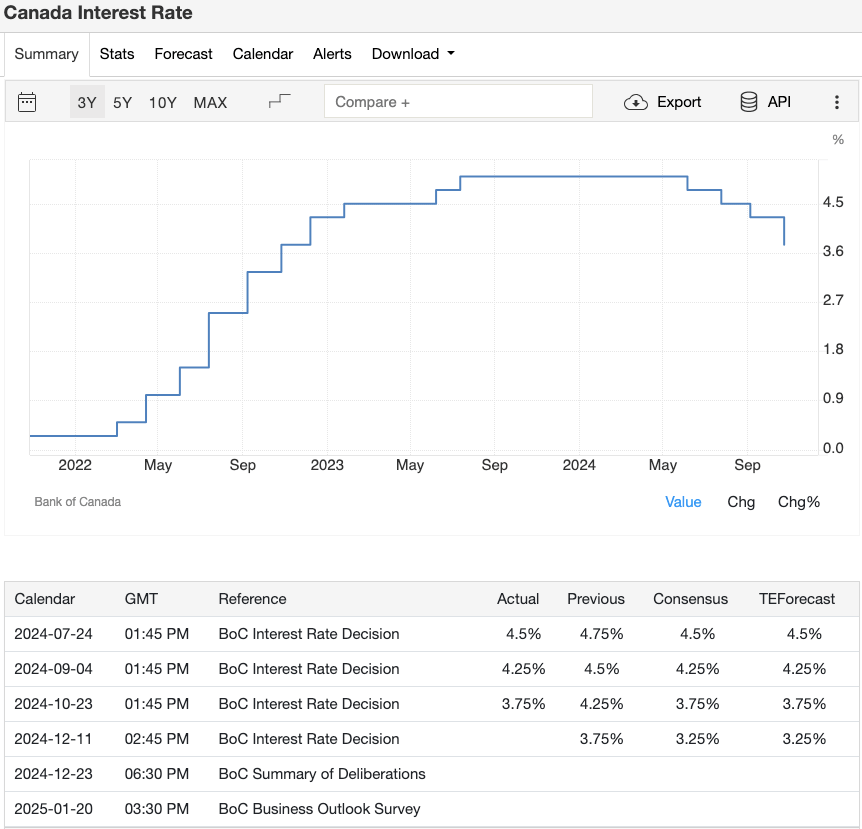

Bank of Canada Interest Rate Decision

Forecast: Maintain at 3.75%

Why it matters: A moderate stance from the Bank of Canada will suggest potential easing in the global monetary environment, benefiting high-risk assets.

Impact on the crypto market: Easing expectations may stimulate capital flows into DeFi projects and high-growth tokens.

Aave (AAVE): As a leading lending protocol, increased liquidity will enhance its attractiveness.

Maker (MKR): The core protocol supporting the DAI stablecoin, where rate easing can promote market lending demand.

December 12 (Thursday)

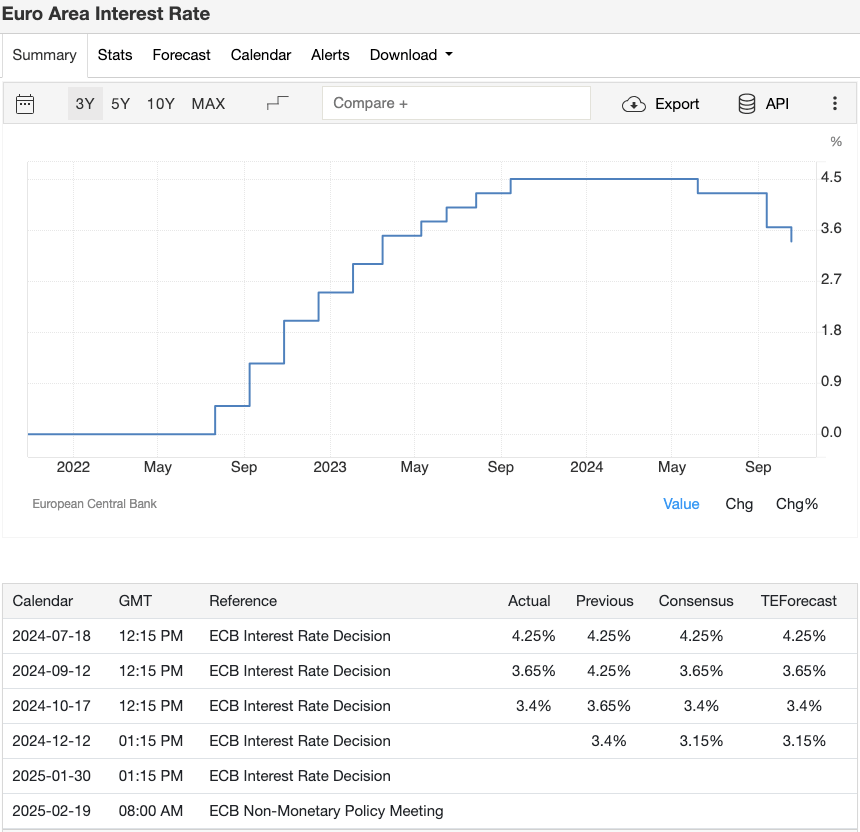

Eurozone ECB Interest Rate Decision

Forecast: 3.15% (unchanged)

Why it matters: The ECB's stance on inflation and economic growth will determine the direction of the regional liquidity environment.

Impact on the crypto market: If the ECB's position is neutral or dovish, it will benefit the DeFi ecosystem and euro stablecoins related to Europe.

- LCX (LCX): A compliant trading platform token based in Liechtenstein, where policy easing may increase market demand.

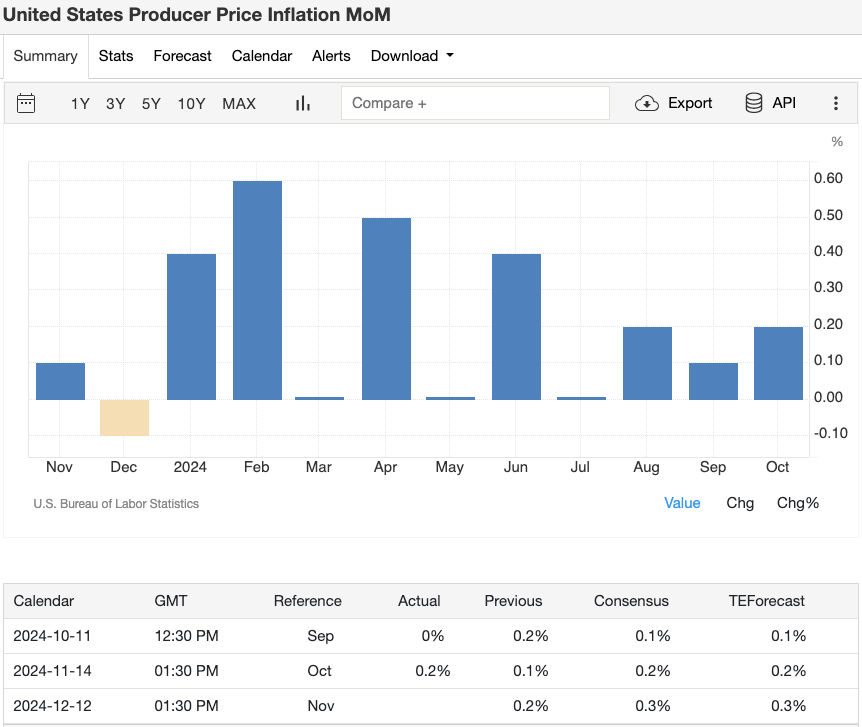

US PPI Producer Price Index (November)

Forecast: Month-on-month growth of 0.3% (unchanged from last month)

Why it matters: PPI is an important indicator of production costs for businesses, directly affecting future consumer price trends.

Impact on the crypto market: A rise in PPI may trigger inflation concerns, thereby increasing demand for Bitcoin as a safe-haven asset. If PPI remains stable or below expectations, it may benefit DeFi and growth tokens.

Bitcoin (BTC): Its safe-haven properties are particularly prominent during rising inflation concerns.

Ethereum (ETH) and Polygon (POL): If PPI pressure is limited, demand for these Layer-2 solutions in the DeFi and NFT ecosystems may increase.

December 13 (Friday)

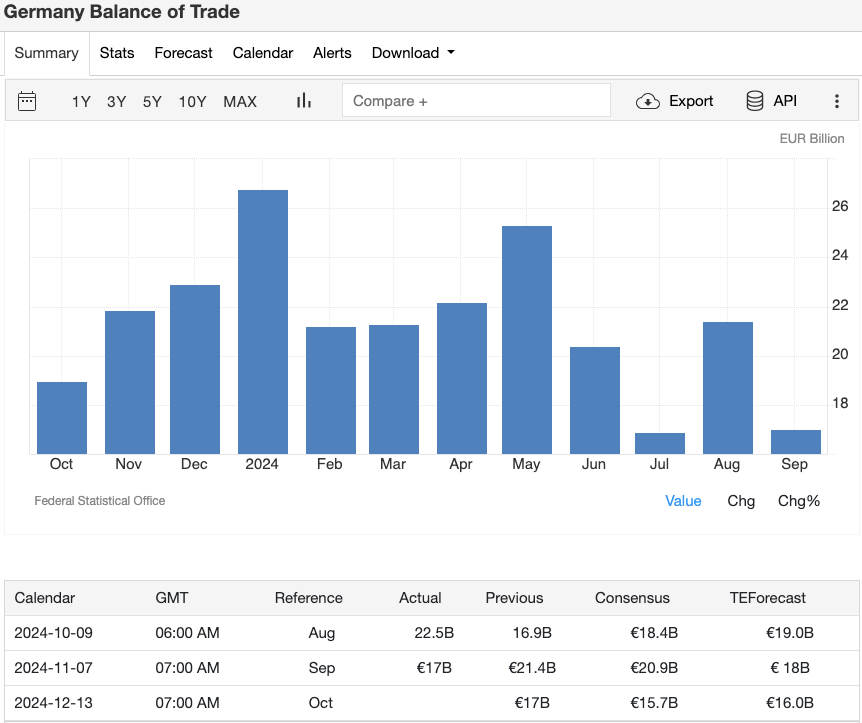

Germany's Trade Balance (October)

Forecast: €16 billion (down from €17 billion)

Why it matters: As the largest economy in Europe, Germany's trade data is a key indicator of global demand strength.

Impact on the crypto market: If the trade surplus narrows, it may weaken risk appetite and increase interest in safe-haven assets like Bitcoin.

- IOTA (MIOTA): Focused on the industrial IoT, if external demand weakens, market expectations for its application ecosystem may decline.

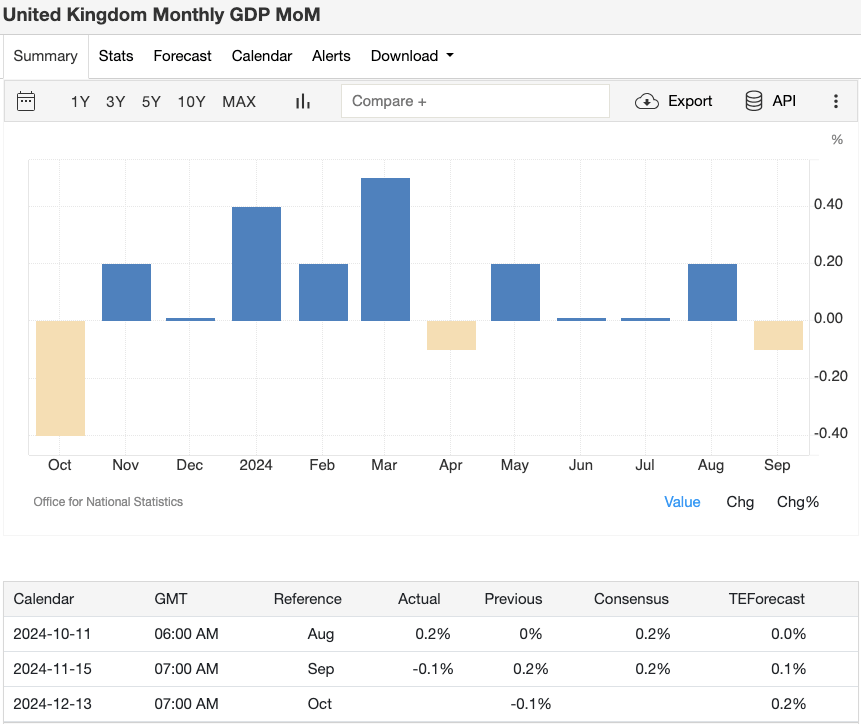

UK GDP Monthly Rate (October)

Forecast: +0.2% (rebounding from the previous -0.1%)

Why it matters: Signs of economic recovery will boost market sentiment, especially for investment projects linked to the European market.

Impact on the crypto market: Recovery in the UK economy will help support demand for regional tokens.

Quant (QNT): A cross-chain project based in London, where demand may increase if economic confidence rebounds.

Chiliz (CHZ): Closely related to the European sports and entertainment sector, improved consumer confidence may drive its growth.

Week 50 Market Theme Summary:

Inflation Dynamics: Whether the data meets expectations will determine the degree of market volatility.

Monetary Policy Direction: Decisions from the ECB and BoC will directly impact capital liquidity and the performance of risk assets.

Global Demand Strength: Trade data (China, Germany) and growth signals (UK GDP) will guide market sentiment.

Crypto Trader Insight Guide

- Inflation Trends (US, China, Europe):

If US inflation remains stable, Bitcoin and Ethereum may show range-bound movements in the short term, lacking a clear direction. If China's inflation data indicates a strong economic rebound, tokens focused on the Asian market, such as VeChain or Conflux, may benefit. Should US inflation unexpectedly rise, investors may turn to Bitcoin as a hedge.

- Central Bank Policies (ECB, BoC):

If the Bank of Canada (BoC) remains patient or the European Central Bank (ECB) takes a neutral stance, it may indicate a more favorable liquidity environment, benefiting DeFi and growth tokens. For example, in a dovish scenario for the BoC, DeFi protocols like Aave or Maker may benefit; if ECB policies remain stable, euro stablecoins or projects like LCX focused on Europe may also profit.

- Trade and Economic Growth Data (China, Germany, UK):

If China's trade data is strong, supply chain-related tokens (such as OriginTrail) may respond positively; conversely, if Germany's trade data is weak, it will prompt investors to choose Bitcoin as a safe-haven asset. If the UK's GDP performs better than expected, it may boost tokens focused on the European market (such as Quant or Chiliz).

Trading Opportunities by Asset Class

Bitcoin (BTC): During times of inflation or concerning trade data, Bitcoin is typically the preferred macro hedge. If US inflation data falls short of expectations or Germany's trade performance is poor, funds are expected to shift towards Bitcoin as a safe haven. Keep a close eye on the US core inflation rate on December 11 and the ECB decision on December 12.

Ethereum (ETH): Ethereum benefits under stable liquidity conditions, especially when DeFi activity is robust. If inflation remains stable, liquidity does not contract, and growth data such as UK GDP and US PPI reveal positive signals, ETH is expected to benefit and gain additional growth momentum.

Altcoins & DeFi Tokens:

If China's economic and trade data perform well, tokens focused on supply chain and cross-border activities, such as VeChain (VET), Conflux (CFX), or OriginTrail (TRAC) may strengthen.

If the Bank of Canada (BoC) or the European Central Bank (ECB) signals a dovish stance, funds are expected to shift towards DeFi protocols and eurozone-related tokens, such as Aave (AAVE), Maker (MKR), or LCX.

Improvement in UK GDP data will help boost Quant (QNT) and Chiliz (CHZ), as these tokens are closely tied to the European market dynamics.

Stablecoins (USDT, USDC): A good way to remain neutral before major data releases is to park funds in stablecoins. After the market reacts to the data, reinvest in Bitcoin, Ethereum, or specific altcoins based on the situation to seek better entry opportunities.

Market Sentiment and Investor Behavior

Risk Appetite vs. Risk Aversion: When economic performance or central bank attitudes exceed expectations (such as robust inflation data, positive UK GDP, or dovish central bank policies), market sentiment often shifts towards risk appetite, driving altcoins and DeFi tokens higher. Conversely, if trade data is weak or inflation does not stabilize as expected, investors will prefer Bitcoin or stablecoins to reduce risk.

Institutional Movements: Pay attention to the movements of large institutional funds after key data releases (such as inflation or central bank decisions). These funds often make adjustments first and can be indicative of mid-term market trends. The positioning of institutional funds in Bitcoin and Ethereum, especially after inflation or interest rate news, often signals the market direction for the coming weeks.

Practical Trading Strategy Recommendations

Short-term (days to weeks):

Prioritize using stablecoins for hedging before important data releases (such as the US inflation data on December 11 and the ECB decision on December 12) to reduce volatility from market uncertainty.

Capture short-term price fluctuations in BTC and ETH before and after key inflation reports and PPI data releases to gain profits from short-term volatility.

Mid-term (weeks to months):

Diversify based on regional advantages. If China's trade data remains strong, consider supply chain-related tokens; if the liquidity environment is loose, position in DeFi platforms.

After macro signals stabilize, closely track signs of institutional funds flowing into BTC and ETH, as these movements usually indicate upcoming market trends.

Long-term (months to years):

Focus on projects with solid fundamentals, real-world applications, and active developers, such as Bitcoin, Ethereum, and Layer-2 solutions.

Combine staking and yield strategies with your macro views, while observing the regulatory direction indicated by central bank policies, prioritizing regions that support the development of the crypto industry.

Comprehensive Analysis and Conclusion

Week 50 will see the release of several important macro data points, which will not only challenge traditional markets but also profoundly impact the crypto market. From inflation indicators, central bank decisions to trade data, each piece of data has the potential to reshape market liquidity, investor sentiment, and risk tolerance. Whether it is the stability of US inflation, the policy signals from the European Central Bank, or the trade conditions in China and Germany, as well as the performance of UK GDP, this information has the potential to change market expectations and narratives.

Key Themes to Focus On:

Central Bank Signals: A cautious European Central Bank (ECB) or a patient Bank of Canada (BoC) may inject new vitality into high-risk crypto assets, enhancing market liquidity expectations.

US Inflation: If the data remains stable, market sentiment will stay steady; however, if unexpected changes occur, volatility may significantly increase, and crypto assets will react quickly.

Global Trade Signals: Trade data from China and Germany will reflect the strength of global demand. Positive trade data benefits supply chain-related tokens; conversely, if the data is poor, it may prompt funds to flow into safe-haven assets like Bitcoin.

By closely tracking the economic calendar and understanding the potential impact of each data point on the crypto market, you can better manage your investment strategy. In a rapidly changing market environment, planning ahead and reacting quickly is key to achieving stable returns.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。