Key Points:

● The total market capitalization of cryptocurrencies is $3.84 trillion, up from $3.63 trillion last week, with a weekly increase of 5.2%. Bitcoin's market capitalization is $1.98 trillion, accounting for 51.44%.

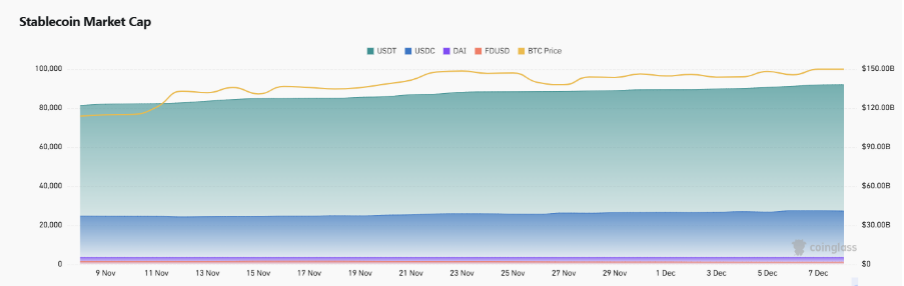

● The total market capitalization of stablecoins is $204 billion, representing 5.32% of the total cryptocurrency market capitalization. Among them, USDT has a market capitalization of $138 billion, accounting for 67.6% of the total stablecoin market; followed by USDC with a market capitalization of $41 billion, accounting for 20% of the total stablecoin market; and DAI with a market capitalization of $5.37 billion, accounting for 2.6% of the total stablecoin market.

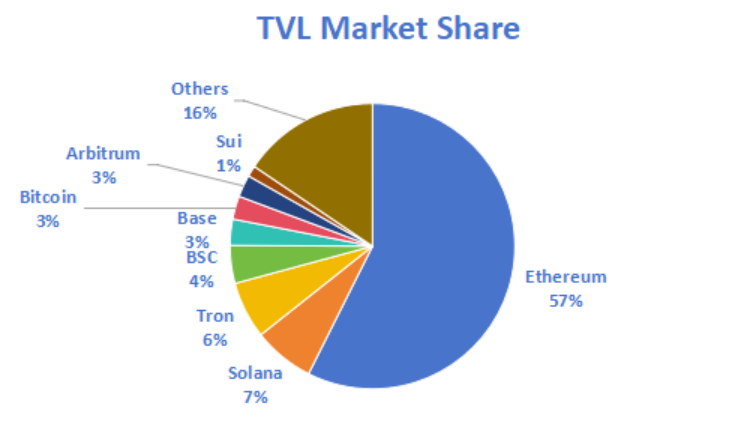

● This week, the total TVL of DeFi is $137.4 billion, an increase of 8.8% compared to last week. By public chain classification, the top three public chains by TVL are Ethereum with 57%; Solana with 7%; and Tron with 6%.

● On-chain data shows that daily trading volumes for ETH and BNB are trending downwards, while SOL remains relatively stable. Additionally, SUI's daily trading volume shows a significant upward trend, increasing from $120 million last week, with a growth rate of 75%. In terms of daily active address growth, BNB shows a notable increase this week, with a growth rate of 10.4%. The DeFi TVL for ETH is $78.9 billion, with a circulating market capitalization of $447.2 billion, still far exceeding other public chains.

● Innovative projects to watch: Jade.Money: Jade is a decentralized stablecoin platform that allows users to mint $JSD. $JSD is a yield-bearing stablecoin pegged 1:1 to $USDC. Users can earn yields while maintaining the stable value of their assets by depositing USDC into Jade; Nerocity: Nerocity is a platform built on the Solana blockchain that allows for the creation and deployment of autonomous AI agents. As a decentralized launch platform, it enables creators to quickly deploy AI agents that can interact with users on Telegram and X; Econyx AI: optimizes token economics using AI agents to balance supply, demand, and growth, providing a sustainable economic mechanism.

I. Market Overview

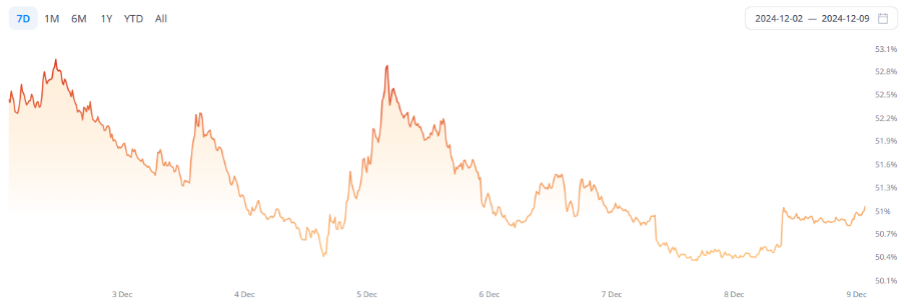

1. Total Cryptocurrency Market Capitalization / Bitcoin Market Capitalization Ratio

The total market capitalization of cryptocurrencies is $3.84 trillion, up from $3.63 trillion last week, with a weekly increase of 5.2%.

Data Source: cryptorank

As of the time of writing, Bitcoin (BTC) has a market capitalization of $1.98 trillion, accounting for 51.44%. Meanwhile, the market capitalization of stablecoins is $204 billion, representing 5.32% of the total cryptocurrency market capitalization.

Data Source: coingecko

2. Fear Index and ETF Inflow/Outflow Data

The cryptocurrency fear index is at 78, indicating greed.

Data Source: coinglass

3. ETF Inflow/Outflow Data

As of December 9, 2024, the cumulative net inflow for U.S. Bitcoin spot ETFs is approximately $33.4 billion, and for U.S. Ethereum spot ETFs, it is approximately $1.4 billion. On December 8, Nate Geraci, president of The ETF Store, stated on social media that Ethereum spot ETFs have seen net inflows for 10 consecutive days. Two of those days recorded inflow amounts that set new highs since their launch in July, indicating that advisors and institutional investors are just beginning to pay attention to this area.

Data Source: CoinW Research Institute, sosovalue

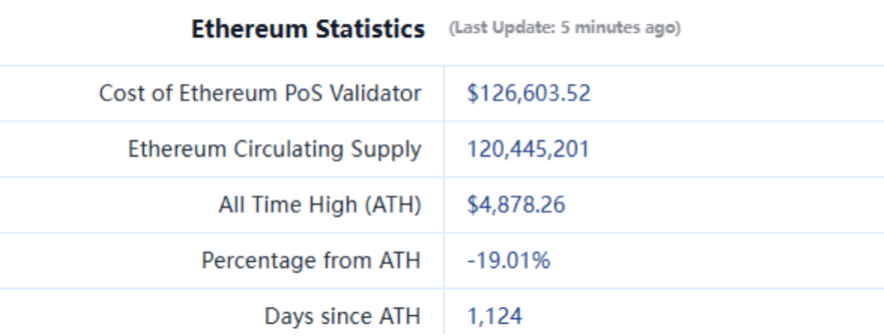

4. ETH/BTC and ETH/USD Exchange Ratios

ETHUSD: Currently at $3,954, with a historical high of $4,878.

ETHBTC: Currently at 0.039685, with a historical high of 0.1238, a decrease of approximately 67.9%.

Data Source: ratiogang

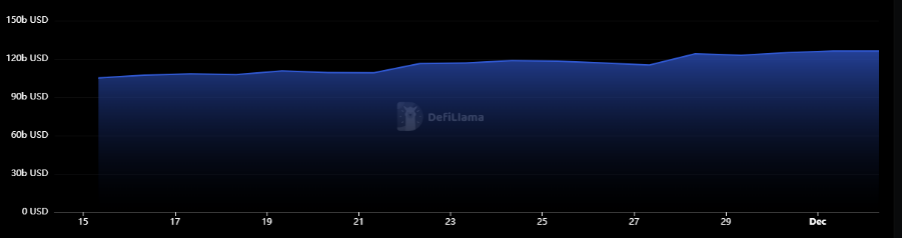

5. Decentralized Finance (DeFi)

According to DeFiLlama, the total TVL of DeFi this week is $137.4 billion, an increase of 8.8% compared to last week.

Data Source: defillama

By public chain classification, the top three public chains by TVL are Ethereum with 57%; Solana with 7%; and Tron with 6%.

Data Source: CoinW Research Institute, defillama

Data as of December 9, 2024

6. On-Chain Data

Mainly analyzing the relevant data of major public chains ETH, SOL, BNB, TON, SUI, and APT based on daily trading volume, daily active addresses, transaction fees, and total locked value (TVL).

Data Source: CoinW Research Institute, defillama, Nansen

Data as of December 9, 2024

● Daily Trading Volume and Transaction Fees: Daily trading volume and transaction fees are core indicators of public chain activity and user experience. In daily trading volume, ETH and BNB show a downward trend, while SOL remains relatively stable. Additionally, SUI's trading volume shows a significant upward trend, increasing from $120 million last week, with a growth rate of 75%. This also reflects the significant changes in on-chain trading volume as SUI tokens break new highs.

● Daily Active Addresses: Daily active addresses reflect the ecological participation and user stickiness of public chains. In terms of daily active addresses, SOL still occupies the first position. In terms of daily active address growth trends, BNB shows a notable increase this week, with a growth rate of 10.4%.

● Total Locked Value (TVL) and Circulating Market Capitalization: Reflecting the maturity of DeFi and the level of user trust in the platform. In terms of TVL, ETH remains the absolute leader in the DeFi space, with a DeFi TVL of $78.9 billion and a circulating market capitalization of $447.2 billion, still far exceeding other public chains.

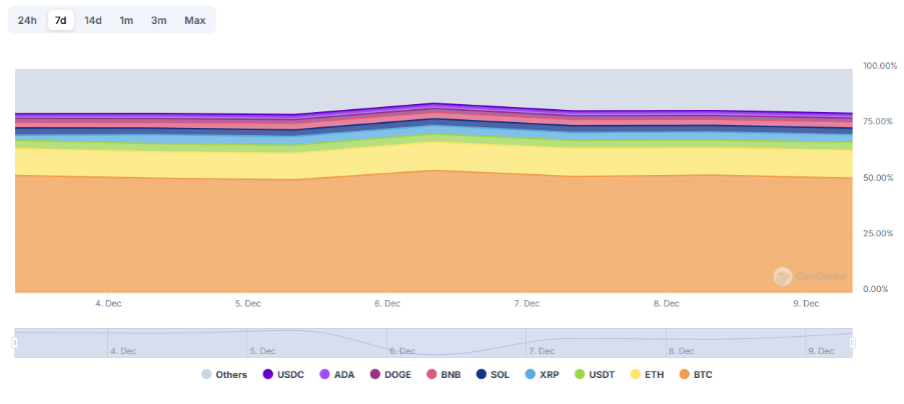

7. Stablecoin Market Capitalization and Issuance

According to Coinglass data, the total market capitalization of stablecoins is $204 billion, setting a new historical high, with a weekly increase of 5.6%. Among them, USDT has a market capitalization of $138 billion, accounting for 67.6% of the total stablecoin market; followed by USDC with a market capitalization of $41 billion, accounting for 20% of the total stablecoin market; and DAI with a market capitalization of $5.37 billion, accounting for 2.6% of the total stablecoin market.

Data Source: CoinW Research Institute, Coinglass

Data as of December 9, 2024

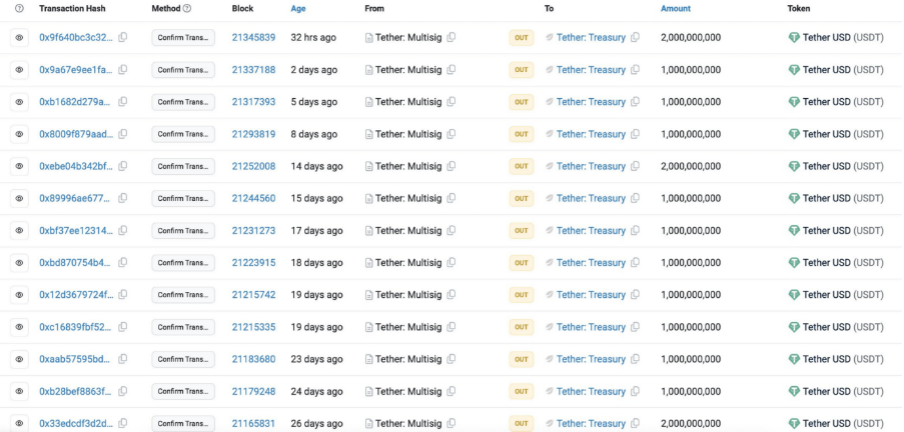

According to Cointelegraph data, Tether has minted a total of 20 billion USDT since November 6.

Data Source: Cointelegraph

II. This Week's Hot Money Trends

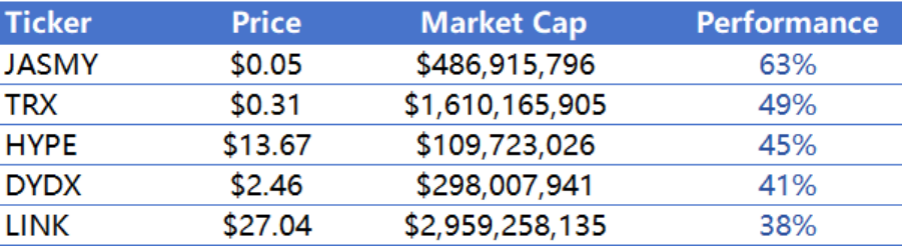

- Top Five VC Coins and Meme Coins by Growth This Week

The top five VC coins by growth over the past week

Data Source: CoinW Research Institute, Coingecko

Data as of December 9, 2024

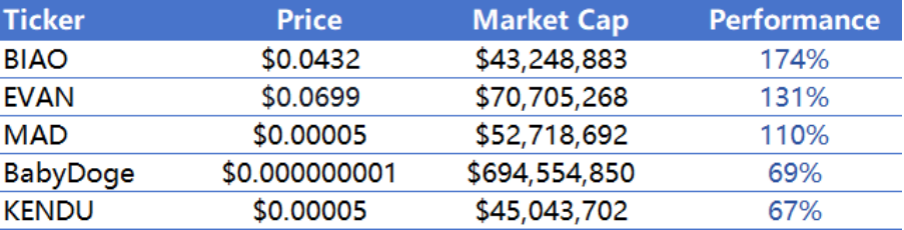

The top five Meme coins by growth over the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of December 9, 2024

2. New Project Insights

● Jade.Money: Jade is a decentralized stablecoin platform that allows users to mint $JSD. $JSD is a yield-bearing stablecoin pegged 1:1 to $USDC. Users can earn yields while maintaining the stable value of their assets by depositing USDC into Jade.

● Nerocity: Nerocity is a platform built on the Solana blockchain that allows for the creation and deployment of autonomous AI agents. As a decentralized launch platform, it enables creators to quickly deploy AI agents that can interact with users on Telegram and X.

● Econyx AI: Optimizes token economics using AI agents to balance supply, demand, and growth, providing a sustainable economic mechanism.

III. Industry News

1. Major Industry Events This Week

● Gravity announced its Litepaper and will launch its testnet in Q1 2025: The L1 blockchain Gravity, launched by the Galxe team, has released its Litepaper and will launch its testnet in the first quarter of 2025. The team stated that Gravity can achieve over 1 billion hashes per second, millisecond-level finality, and parallel EVM computation capabilities, while providing enterprise-level security through a re-staking protocol, along with seamless cross-chain interoperability.

● Wormhole launches staking reward program with an initial reward of 50 million W: The cross-chain interoperability platform Wormhole announced the launch of the W staking reward program (SRP) on December 4, supporting Solana and all EVM chains. Users participating in governance staking can earn rewards, with an initial reward pool of no less than 50 million W tokens.

● Manta Gas Gain first round rewards are open for collection, with an average yield of over $1,000 per address: The first round of rewards for the Gas Gain activity launched by the modular L2 project Manta Network is now open for collection. The top 400 users can claim rewards on the Gas Gain official website, with an average real yield of over $1,000 per address.

● XION announces token economic model, with community and launch accounting for 15.19%: The Layer1 project XION has released a white paper on its token economics, introducing its token model based on the Proof of Abstraction mechanism. The total supply of XION tokens is 200 million, with an initial circulating supply of 25,559,333 tokens, accounting for 12.78%. In the token distribution plan, ecosystem incentives and project incubation account for 23%, strategic investors account for 27%, the team accounts for 20%, protocol development and foundation account for 15%, and community and launch account for 15.19%.

● Trump nominates Paul Atkins as SEC Chairman: U.S. President-elect Donald Trump has chosen Paul Atkins to serve as the Chairman of the Securities and Exchange Commission (SEC). If this appointment is confirmed, it will be an important step for Trump to fulfill his campaign promise, bringing a more favorable regulatory environment for the cryptocurrency industry.

2. Major Events Coming Next Week

● Ethereum Layer2 Superseed will launch its token sale on December 9.

● The Magic Eden Foundation announced that the ME token will have its TGE on December 10.

● The Sui ecosystem lending protocol Suilend will launch its token SEND on December 12.

● Optimism Governance Season 6 will run until December 11, 2024. The theme for the sixth season is "Optimizing to Support the Superchain."

● Cardano (ADA) will unlock approximately 18.53 million tokens on December 11, representing 0.05% of the current circulating supply, valued at approximately $22 million.

The Financial Accounting Standards Board (FASB) has introduced new rules for the fair value accounting of Bitcoin, requiring companies to adopt fair value accounting for Bitcoin starting in the fiscal year beginning after December 15.

3. Important Financing Events Last Week

● Public, Series A, raised $135 million, with investment from Accel. Public announced the launch of cryptocurrency trading services in 2021, expanding from trading U.S.-listed stocks and ETFs to include cryptocurrencies, government bonds, and artworks. (December 3)

● Brighty, Series A, raised $10 million, with investment from Futurecraft Ventures. Brighty is an integrated application that combines digital banking and crypto banking, allowing users to save, send, spend, and earn up to 10% annually in stablecoin rewards, paid daily. Brighty aims to enable individuals to purchase cryptocurrencies and enter the crypto economy more securely. (December 3)

● Union, Series A, raised $12 million, with investments from gumi Cryptos Capital, LongHash Ventures, Borderless Capital, Blockchange Ventures, Foresight Ventures, Dispersion Capital, TRGC, Gate Ventures, and others. Union is an efficient interoperability protocol that connects all blockchains and rollups within any ecosystem. It is based on consensus verification and does not rely on trusted third parties, oracles, multi-signatures, or MPC. (December 4)

● Interlace, Series B, raised $10 million, led by Bitrock. Interlace is a Singapore-based enterprise-level global card issuance and digital asset management company founded in 2019, providing cross-border, multi-currency, and cross-system financial solutions for Web3, cross-border e-commerce, B2B trade, and developers. (December 4)

● Earos, Pre-Seed round, raised $10 million, led by Lemon Ltd. Earos is a platform that leverages digital twin technology to unlock the potential of AI agents, currently building a decentralized AI ecosystem that integrates AI agent model layers, allowing global nodes to collaborate on AI model training, deployment, and validation. Developers can also create and deploy their own AI agents, and the project is expected to use tokens to reward participants providing computing power, validating AI agent workstations, and running nodes. (December 4)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。