In just over a month, the Ordinals protocol will celebrate its 2nd anniversary on the Bitcoin mainnet. In 2023, the Bitcoin ecosystem went from being overlooked to a frenzy of inscriptions. This year, with the historic 4th Bitcoin halving, the Bitcoin ecosystem has undergone many changes, such as the development of runes, new meme communities, discussions about OP_CAT, and more.

In May of this year, Bitcoin Asia, Ordinals Asia, and various Bitcoin-related side events were held in Hong Kong with great enthusiasm. At that time, everyone was looking forward to the Bitcoin ecosystem in the second half of the year, especially Bitcoin Layer 2 and runes. Now, as we approach the end of 2024, with Trump's election, Bitcoin has surged, and we finally see Bitcoin prices reaching six figures.

However, the performance of the Bitcoin ecosystem seems sluggish compared to Bitcoin's fierce rise.

Runes, currently the most influential token protocol in the Bitcoin ecosystem, still has a total market cap of less than $2 billion. After Trump's election, the total market cap of runes briefly surpassed the $2 billion mark. However, it has struggled to maintain even that modest growth, currently challenging the $2 billion mark again, with a total market cap of about $1.92 billion.

Yes, just from the data perspective, pulling a top-level meme coin from Solana could surpass the market cap of runes…

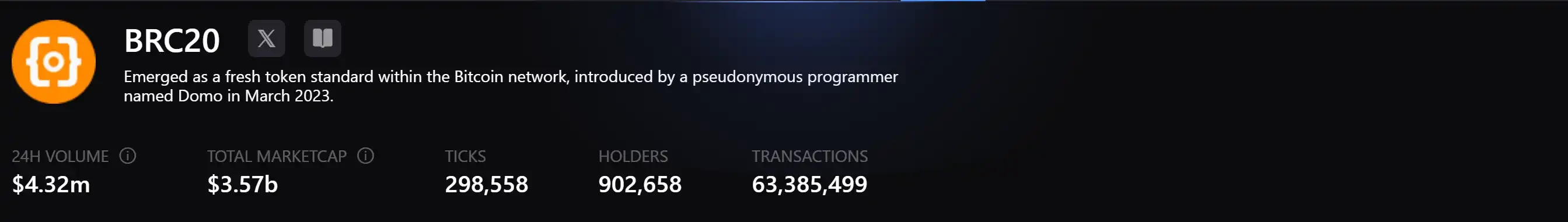

Another familiar old friend, BRC-20, currently has a total market cap that still exceeds that of runes, nearing $3.6 billion. Although it still wins in terms of data, BRC-20 also faces some issues, such as the fact that the market cap composition includes nearly half from the spot listings of $ORDI and $SATS on Binance, leaving many long-tail assets. Some active Western communities, primarily with $PUPS and $WZRD, have already transitioned or are about to transition to the rune ecosystem.

Rhythm BlockBeats invited three deep players from the Bitcoin ecosystem to review the performance of the Bitcoin ecosystem over the past year. Will they feel more optimistic or pessimistic about the future? Has the development logic of the Bitcoin ecosystem quietly changed in their eyes? What interpretations will they provide for some unique phenomena within the Bitcoin ecosystem?

Interview Guests:

Dr. Jingle (@ordjingle): Contributor to the Ordinals protocol

Ivan (@ivantkf): Former community operations head for the Asia-Pacific region at Magic Eden, author of the BRC-1155 protocol

An anonymous senior dev, one of the deep contributors to the BRC-20 protocol

Bitcoin has surpassed the $100,000 mark, so why is the Bitcoin ecosystem still lukewarm?

Looking back over the past year, Bitcoin has indeed dominated the crypto market, and with Trump's election, it has surged past the $100,000 mark, creating history in cryptocurrency once again.

However, Bitcoin's continuous rise does not seem to have significantly boosted the Bitcoin ecosystem. Centralized exchanges (CEX) show little interest in listing rune tokens, especially since Binance has yet to list any rune token contracts or spot markets. Among the Bitcoin Layer 2 projects that gained attention mid-year, aside from Fractal and Merlin, there seem to be no other projects that left a deep impression.

Currently, the total market cap of runes is even less than that of a top Solana meme coin. In the NFT space, the top 10 Bitcoin NFT projects only have Bitcoin Puppets at 10th place, with Node Monkes at 11th, while ETH NFTs still hold a higher status and influence in the NFT market.

Why hasn't the Bitcoin ecosystem been driven by Bitcoin's price surge?

Dr. Jingle: The narrative of the Bitcoin ecosystem is still valid, such as the significance of Bitcoin as a medium of value and the importance of fully on-chain data. However, the novelty of simply issuing tokens on Bitcoin has worn off. Both runes and BRC-20 have entered a phase of community building that requires a longer-term accumulation.

From the perspective of VC investment, top crypto VCs are not completely absent from investing in Bitcoin ecosystem-related projects, but they have not engaged deeply, treating it more like "non-mainstream" investment. If they do not show a strong willingness to "bet" on the Bitcoin ecosystem, then the opportunities in the Bitcoin ecosystem may remain relatively limited in the short term.

For Tier 1 CEXs, the possible reason for not listing rune tokens is simple: the trading of rune tokens is not yet widespread and active enough to meet CEX listing standards. If listing rune tokens does not bring traffic growth or significant fee income, CEXs lack the motivation to list them.

However, the Bitcoin ecosystem is not entirely unaffected by Bitcoin's price surge. Whether it's runes, BRC-20, or Bitcoin NFTs, they have all experienced noticeable correlated price increases alongside Bitcoin's rise. This increase, though small, indicates that the Bitcoin ecosystem is still recognized by the market, but it remains a niche track that has not yet attracted widespread or significant capital.

Ivan: For assets that are not listed and require using Bitcoin for purchases on-chain, in such a market environment where Bitcoin's price has risen significantly, if one were to exchange Bitcoin for runes or other Bitcoin ecosystem assets, it may not outperform Bitcoin's own price increase. Moreover, if Bitcoin were to drop, it could lead to a double whammy.

If it were a story like last year's BRC-20 that drove the entire market crazy, such concerns would not exist, as Bitcoin's price was also lower then. But now, such stories are happening on Solana rather than Bitcoin, with Bitcoin reaching a price of $100,000. People are willing to part with their precious Bitcoin to buy any "altcoin" based on the expectation of better returns than Bitcoin, but currently, using Bitcoin on the Bitcoin mainnet to exchange for other assets is not cost-effective.

This bull market is primarily driven by ETFs, providing traditional institutional funds with a stable channel to connect with Bitcoin. Everyone knows that there is a lot of capital in Bitcoin, and through capital overflow, it can disperse market funds to promote the development of Bitcoin's on-chain ecosystem. In contrast, Solana has attracted new and old retail investors to exchange funds for SOL, driving up the price and sustaining on-chain development due to the flourishing meme ecosystem and multiple wealth stories. Therefore, for the Bitcoin ecosystem to explode, it still lacks a narrative that can truly land and create the next $ORDI wealth myth, which would attract funds from the crypto space back to the Bitcoin ecosystem.

Dev: Solana is currently very popular, and not just among Bitcoin ecosystem players; anyone making money on Solana will feel a gap compared to players in other ecosystems.

However, the Bitcoin ecosystem had already experienced a significant explosion last year during the bear market. After such a large explosion, time is needed for adjustment and accumulation, waiting for new events to attract more incremental players.

But such events have not yet arrived. Although there are runes this year, they primarily cover the original audience already engaged with Ordinals, with no additional points to attract players from other ecosystems. Without a breakthrough in narrative, the immaturity of ecosystem infrastructure further limits the entry of liquidity. Whether it's BRC-20 or runes, the trading experience without listings is not much different from NFTs, which raises concerns for large funds wanting to enter about potential exit issues.

Has the fundamental situation of the Bitcoin ecosystem changed in the context of the U.S. embracing Bitcoin?

This year, as Bitcoin continues to hit new highs, the expectation of a comprehensive U.S. embrace of Bitcoin following Trump's election has shifted the narrative. Previously, the "miner income theory" was one of the optimistic views on the long-term development of the Bitcoin ecosystem. However, now, the narrative of "U.S. embrace" seems to have delivered a dimensional blow to the entire crypto market, with past voices questioning the usefulness of innovations in the crypto space almost disappearing amid the excitement of rising prices.

For the Bitcoin ecosystem, which has many values built on the strong narrative of "Bitcoin mainnet," has the market's largest narrative quietly shifted, and has it had any impact?

Dr. Jingle: If Bitcoin truly becomes a strategic reserve for the U.S. and even for various countries, I might lean towards the idea that doing nothing is the best approach, as the security of Bitcoin must be prioritized. From this perspective, any potential impact on Bitcoin's security is a hidden danger to Bitcoin's greatest interests. If sovereign nations can treat Bitcoin as a strategic reserve, that would be the greatest boost for Bitcoin.

Previous views, such as increasing miner income, naturally take a backseat to maintaining network security in the current context of being "officially embraced." If Bitcoin can be given a higher legal status by more sovereign nations, nothing could be more out of the ordinary than that.

From this angle, the revival of OPCAT on the mainnet may have a low probability of occurring in this bull market. When Bitcoin's price was not rising, there was a sense of urgency to innovate to activate the network, but now that it has improved, the necessity to take risks on this uncertainty has significantly diminished in the short term. However, attempts like OPCAT on Fractal, such as CAT20, are very good and meaningful.

Ivan: For miners, the rise in Bitcoin prices brought about by the U.S. embracing crypto certainly makes the fees from the Bitcoin ecosystem seem less substantial in comparison. While some of it is certainly good, even without it, Bitcoin's price has already risen more than five times from its lowest point.

Additionally, the funds from ETFs are also not flowing into the Bitcoin ecosystem. The combination of these factors makes the current Bitcoin ecosystem not much different from other chains, where experienced degens are engaged in PvP activities. This is why there is a strong desire for Binance to list runes, as many believe that if this happens, it could ignite the entire ecosystem like a spark.

Dev: I have always felt that miners are not very concerned about Ordinals or the Bitcoin ecosystem. Most miners I have encountered are quite pragmatic; they just calculate the costs of mining, how much Bitcoin needs to be sold at what price to avoid losses, and so on.

They do not consider fundamental issues like whether Bitcoin prioritizes security or innovation; they are simply focused on mining, which is quite normal. Miners in Web2 extracting gold, silver, copper, and iron do not think about the sustainability of the mining area; that is just real life.

Bitcoin Core developers, as well as players, are generally more interested in this issue than miners.

If we step outside the Bitcoin ecosystem and look at the entire market, we are currently in a bull market. The Bitcoin ecosystem will eventually rise with the bull market, as liquidity will always overflow into this track. In past bull markets, no relatively low-positioned track with a reliable narrative has been overlooked by later speculators. So from my perspective, the fundamentals of the Bitcoin ecosystem have not changed significantly; there will be opportunities, but it is uncertain at what stage of the bull market these opportunities will arise.

Has BRC-20 Declined?

Although BRC-20 currently has a total market cap more than double that of runes, players deeply involved in the Bitcoin ecosystem can directly feel that the ecological activity of BRC-20 is gradually being outpaced by the rune ecosystem. Some active Western communities, primarily with $PUPS and $WZRD, have already transitioned or are about to transition to the rune ecosystem.

Nevertheless, BRC-20 remains the only Bitcoin asset protocol with two spot listings on Binance. In contrast, runes still have zero, which is still a significant advantage for BRC-20 at this stage.

In the past half month, the "ground promotion" concept led by BRC-20 has garnered some renewed attention, but is this a good thing or a bad thing? Has BRC-20 declined?

Dr. Jingle: BRC-20 is indeed not as popular as it was last year, but I do not think it has "declined." After all, BRC-20 is the first Bitcoin FT protocol that emerged after the Ordinals protocol, and its historical significance is there.

As a Bitcoin FT protocol, the updates of the BRC-20 protocol and the advancement of related infrastructure have been ongoing. However, these actions seem like minor innovations compared to the initial "debut" of BRC-20 that drew the entire market's attention to issuing tokens on Bitcoin.

The "ground promotion" concept is quite interesting. If we do not preemptively label tokens like "PUPS" and "FIFA" as "ground promotion," and instead look at it from the perspective of asset issuance and development, it may just be a meme targeting an audience we are not familiar with.

For example, we often joke that runes and BRC-20 are "not picking up each other's calls." If we look at the meme communities popular on runes, such as $PUPS and $BDC, they can be seen as a spontaneous "ground promotion" by the younger Western audience. For every token, how to gain acceptance from more people is a challenge. If there can be a breakthrough on this issue, then the so-called "ground promotion" does not seem so bad from the perspective of the crypto market.

Ivan: Although BRC-20 is not very popular right now, it cannot be said to have "declined." The overall market cap and trading volume of the BRC-20 ecosystem are not weak; Chinese capital is quite familiar with BRC-20 tokens like $ORDI, $SATS, and $PIZZA. The current market focus is on Solana, and funds tend to concentrate in lively areas, so both BRC-20 and runes may be waiting for the next breakthrough opportunity.

The migration of tokens like $PUPS and $WZRD to the rune ecosystem may be primarily because their audience is mainly Western. Therefore, migrating to the more influential rune ecosystem in the West may help expand the community size of the token itself. Another possible reason is that Binance has not yet listed any rune tokens; if a rune token aims to get listed in the future, the potential breakthroughs could be greater.

Dev: The phrase "Ordinals are dead" has basically become a meme, but last year it carried some self-deprecation and insecurity. At that time, there was more skepticism, and jokes were made about "death." The current situation of BRC-20 is far from that bad; I do not believe BRC-20 has entered a phase of "decline."

In fact, I view runes and BRC-20 as part of a whole sector. If liquidity overflows into the Bitcoin ecosystem, it will be like last year's inscription bull market, where everything related to BRC-XXX skyrockets. People won't even worry about whether a new thing is a true innovation or a fake one; they are just afraid of missing out, and it has nothing to do with the project's fundamentals. Instead, they will buy whatever is cheap and has potential for a rebound, or whatever is a new project that can provide free tokens.

From the user's perspective, the infrastructure of the BRC-20 ecosystem is still iterating. The timing and opportunity for BRC-20 to rise again cannot be predicted, but what is more important is that when the wind blows, the existing infrastructure can accommodate greater liquidity.

Why is the "not picking up each other's calls" phenomenon very obvious in the Bitcoin ecosystem, while there is no such barrier on Solana or other chains?

On Solana, although there are many meme tokens whose "angles" are not easily understood by the Chinese community, they are quickly covered by relevant "popular science information," and there are no obvious tokens that only appeal to either the Chinese or English audience. However, in the Bitcoin ecosystem, it is very clear that Chinese players generally have little interest in runes, while English players were also rarely involved when BRC-20 was booming last year.

Why does this phenomenon occur?

Dr. Jingle: First of all, there are indeed cultural understanding differences. This interesting phenomenon reminds me of an interview with Jack Ma and Elon Musk. Jack Ma's English is quite good, and during the interview, he made a statement that roughly meant "99.9% of tools are not smarter than humans," which was an exaggerated and somewhat humorous remark. However, Musk took this as a data expression and made a joke about it, which Jack Ma did not get.

In the Bitcoin ecosystem, Casey often creates some English compound words that they think are great and amusing, but we who did not grow up in an English environment cannot feel where the humor lies. This situation is also common with various memes in runes.

From a technical perspective, runes do have innovations compared to BRC-20, and some foreigners do appreciate this. However, a token protocol is still closely related to making money. Foreigners indeed missed the wave of BRC-20, and coincidentally, runes resonate more with their cultural context. This phenomenon is caused by multiple factors.

Ivan: In the early days of Ordinals, foreigners did participate, but they were more involved in OTC trading of small images on Discord, while we were doing OTC trading of BRC-20 on WeChat. From the beginning, there was a divergence in the participation direction or focus between the Chinese and foreign communities.

Last year, when OKX had already achieved a very smooth trading experience for BRC-20 on mobile, many foreigners were still unaware of it. The Chinese community has been a direct driving force behind the BRC-20 ecosystem, not only due to the enthusiastic involvement of players but also because a significant amount of infrastructure was built by the Chinese community. Naturally, everyone would think that since our system has been tested for stability without major security issues like double spending, we can confidently engage with it.

Dev: The hardcore foreign players in the Ordinals community were mainly focused on NFTs. When BRC-20 first emerged, they did not have a favorable view, thinking it was just about writing a JSON text to inscriptions and that transferring would require creating another inscription, which seemed cumbersome.

These individuals were already supporters of Casey, who initially did not like this concept, believing that Ordinals should be used for artwork. Unexpectedly, the Chinese community had immense power and directly propelled BRC-20. I had direct communication with Domo, who indicated that most of the builders reaching out to him were from the Chinese community.

The explosive popularity of BRC-20 certainly shocked foreigners, so after the launch of runes, the Western community also actively participated. They no longer hold biases against issuing tokens on Bitcoin, but they are certainly not interested in taking over old assets. The distinction between investing in new versus old tokens is not limited to cultural backgrounds.

The Chinese community is a backbone force in the BRC-20 ecosystem; $ORDI is something we have promoted, and builders in the BRC-20 ecosystem, such as UniSat and OKX, also have Chinese backgrounds. For the Chinese community, after the emergence of runes, those of us who originally had actual holdings in BRC-20 may feel that runes are a diversion—after all, we have built so much in BRC-20, and the entire protocol is running quite stably. How can foreigners say it won't work?

How would you rate the development of the Bitcoin ecosystem this year?

In 2023 and 2024, Bitcoin activities in Hong Kong have transformed from a niche spontaneous exchange into a week-long "Bitcoin Week." Many more people are now aware of and optimistic about the Bitcoin ecosystem. However, the Bitcoin ecosystem that players expect is one that can stand shoulder to shoulder with Solana and Ethereum, which currently seems to lack any short-term hope of catching up. As 2024 is about to end, how would you rate the development of the Bitcoin ecosystem?

Dr. Jingle: 70 points. It has neither exceeded expectations in a negative way nor in a positive way. The value points that make people optimistic about the Bitcoin ecosystem have not changed, and more people are becoming aware of it. Although 2024 does not have the shocking wealth myth of last year's $ORDI, the roots of this ecosystem have stabilized and are sprouting new shoots.

I think this is quite good; rapid development may lead to rapid decline. As a new narrative that has just grown in this cycle, the Bitcoin ecosystem still has a long way to go and should move forward steadily.

Ivan: 60 points. The main reason is that expectations were quite high last year, such as the famous dream pie chart comparing BRC-20 and ERC-20.

Originally, everyone thought the Bitcoin ecosystem would accelerate to retrace the path taken by the Ethereum ecosystem, with breakthroughs in various types of projects like stablecoins and Layer 2. However, the development results now seem to fall short of expectations.

But this year is only the second year of the Bitcoin ecosystem; perhaps next year, the scale of activities in Hong Kong and globally will be larger. The Bitcoin ecosystem will continue to develop, and more and more people will join. It is still too early to draw conclusions now. NFTs are a good example; they were born in 2017 but exploded in 2021. The Bitcoin ecosystem is still in its early stages.

Dev: I won't give a score; I tend to be more pessimistic.

I hope to see something like the revival of OP_CAT, allowing Bitcoin to truly implement Turing-complete smart contracts, which would enable extensive development based on that. Only then can the Bitcoin ecosystem truly develop. This is still a consensus issue; if the consensus is incomplete, the concept of the Bitcoin ecosystem may be a false demand, and everyone can only use "unorthodox methods" to do things on Bitcoin.

Nevertheless, I believe that in this bull market, liquidity will definitely overflow into the Bitcoin ecosystem, and we will have opportunities to play in this bull market. However, in the long run, I do not believe the Bitcoin ecosystem can truly develop without changes to the Bitcoin mainnet.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。