User data assets are the core of Web3 applications.

Author: KK, Founder of Hash Global

*The article is based on materials from the HG Web3 business closed-door communication meeting.

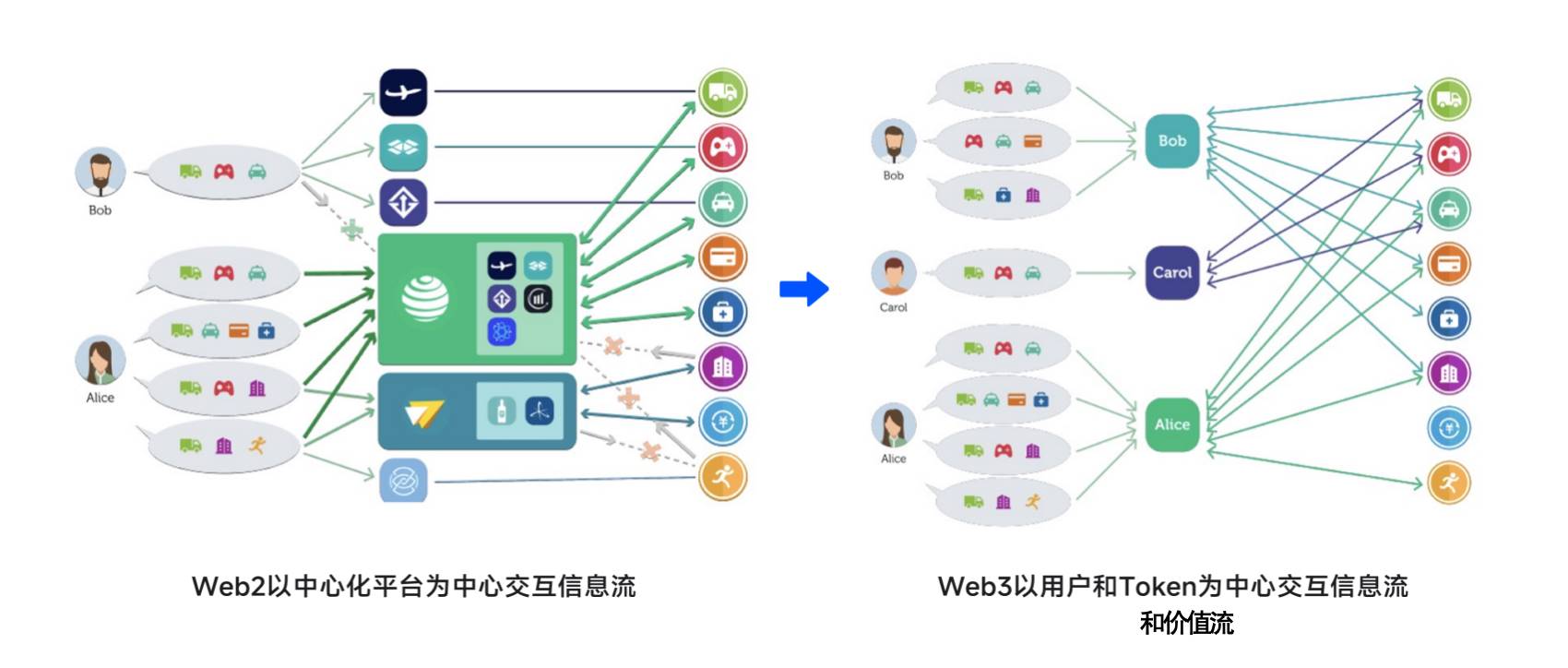

We believe that Web3 is not just about Bitcoin and crypto finance; it is Web3, the value internet, and an evolutionary upgrade of Web2. The arrival of Web3, due to the innovation in underlying data storage methods and payment means, will not be as clearly visible as the upgrade from PC internet to mobile internet, but will be like “a breeze that quietly enters the night, nourishing things without a sound.” What is this “breeze”? We believe it is the user data and data assets that are beginning to be created in large quantities on-chain, as the super user experience of Web3 is to revolve around user data.

The core of Web3 is Own-ownership. For Web3 to become Web3, and not just crypto finance, users must own data assets, not just financial assets. Users owning their own data is the basis for better service experiences, where different users receive different services. The internet has evolved from meeting needs to personalized experiences, and now to personalized services. AI provides us with the productivity for personalized services, but the large-scale value collaboration of these services can only be supported by Web3.

In the early stages, I gained a lot from Professor Zeng Ming's lecture on the stages of AI development (the video is available on the Zeng Ming Academy's public account). The professor told me that the same framework could be used to assess the development of Web3, which inspired me greatly. Our observations and practices over the past few years, the confusions we encountered, and the corresponding investment strategies we formulated can all be validated and framed after having a clear judgment on the development stages, thus reducing our anxiety.

The professor also provided a definition of native applications (Killer Apps):

- Fully utilize the unique technological advantages of new technologies;

- Bring about significant innovation in user experience;

- Explore new business models;

- Deliver super 2C services with exponential growth in massive user numbers.

Based on this standard, Yahoo, which went public in 1996, is the first generation of internet native applications, while Web3 has not yet reached the native application stage. Why is it difficult for other types of applications to emerge, aside from financial native applications? The reason may be simple: we do not yet have enough non-financial Web3 users. No early native internet application emerged out of nowhere; they all underwent a long period of popularization, even grassroots promotion, before becoming killer apps. Without the years of promotion from AOL's internet users, there would be no Yahoo; Alibaba, Tencent, and Ctrip also experienced a long process of user accumulation.

We believe that the development stage of Web3 has duality: the vanguard of Web3—crypto finance is progressing much faster, with active addresses reaching about 600 million, which is equivalent to the number of internet users in 1999. Therefore, we have already seen financial native applications like USDT, wallets, and DeFi; however, the essence of Web3—the next generation internet, is still far from completing user popularization. Only when a large amount of user data assets and services around these data assets appear on-chain will users actively choose to use wallets to interact with the internet and use internet products, thus bringing Web3 to fruition.

For any technology to integrate into the mainstream economic system, it must be carried by commercial applications. In the current development stage of Web3, we need commercial applications from various industries to seize the core technological characteristics of Web3 for their own business purposes, creating and issuing a large number of data assets on-chain for users, and thus developing their new internet business models. In this process, they will create immense commercial value and become the first generation of native applications in Web3.

All internet business unfolds around data, whether centralized or decentralized. Web3's commercial applications focus on data-decentralized dAPPs. The data assets referred to here include user identities, membership levels, movie premiere tickets, concert tickets, highlights of musicals, the first batch of crowdfunding cards for a certain star's debut, the 5000th like on a photo by teacher Kuis, real-time distribution of “Fan Xian's smile” during a specific scene in the drama "Qing Yu Nian," and various types of check-in vouchers, etc. They will all use NFTs as data carriers, while the original content of the data can be stored on decentralized storage infrastructures like Greenfield.

We have outlined five core technological characteristics of Web3: 1) a unified ID across the network; 2) value internet: the integration of the internet and banking networks into one; 3) everything can be assetized: finance and data; 4) the ability to establish complete "live data" across regions and platforms; 5) the ability to directly reach users on both information and value levels.

Web3 commercial applications built around these technological characteristics will have the following five features:

1) Universal data: possessing cross-platform and cross-regional data. Data can be assetized, traded, and authorized to AI models, enabling intelligent user services. The operation of on-chain data will become very important.

2) Good can be given to the right: direct links between content and product producers and consumers, allowing for differentiated experiences and pricing.

3) Value direct connection: embedded financial networks, where value can be transmitted point-to-point like information. Integrated clearing and settlement. Automatic and timely distribution can be achieved through smart contracts.

4) Effective incentives: under the premise of a healthy and sustainable business model, project parties can issue NFTs and ecological tokens to complete the cold start of the project and accelerate ecological development.

5) New types of organizations: the interests of entrepreneurial teams, shareholders, industry upstream and downstream, users, and fans can be unified through tokens, reshaping organizational forms across industries, where company organizational structures are no longer the only choice.

We believe that such Web3 commercial applications align with the current development stage and are truly valuable Web3 applications. Currently, China's internet business and content going global provide the best timing for Web3 commercial application teams. With Hong Kong as a base, there is also geographical advantage. Web3 is the best infrastructure for global business. The output of Web3 technology is standards, and it also embeds finance, with self-completing functions.

The growth path we envision for a Web3 commercial application aimed at the global market could be:

1) Use Web3 to build a globally unified and functionally complete user or fan account system.

2) Use NFTs and tokens as business carriers to conduct business, with NFTs serving as various data tags.

3) Fully utilize public domain traffic, using Web3 tools and various Web2/Web3 wallets to carry and build private domain systems.

4) Quickly establish a complete and continuously updated private domain data system, better developing business based on data analysis and feedback.

5) Achieve cross-industry and same-industry data flow on-chain, cheaply and accurately.

6) Users receive personalized and intelligent services based on their held data assets, gaining a product experience far superior to Web2.

7) Increased product stickiness and good dissemination and retention, forming a self-closed loop of data growth.

The above path is particularly suitable for industries such as ticketing, film and culture, entertainment creation, and IP co-creation. Without a Web3 membership fan system, the content economy and IP economy cannot effectively unfold: helping creators maximize functional value, generating significant emotional and asset value for fans, supporting IP incubation and co-creation, and the value distribution along the entire chain are all areas where Web3 can exert its capabilities. We have begun actively investing in these fields. We also invest in the necessary Web3 commercial supporting infrastructure, including data chains, intelligent tokens, payment, stablecoins, human resources, and global salary distribution services, etc. We hope excellent entrepreneurial teams will come to us; you just need to manage your business logic, and we can find technical teams to support the rest. In the current stage where technological development leads applications, it is the most imaginative and opportunistic phase for entrepreneurship in the commercial field. When discussing this path with CZ, he mentioned that a key factor is the execution ability of the team. Therefore, we place great importance on the past backgrounds and capabilities of the team, and we especially hope to collaborate with resource providers and winners from Web2 to jointly promote the landing of Web3 business.

We think together with project teams: the core of all internet business is data. Whoever helps users create more data will own the moat of future business. Why are Alibaba, ByteDance, and Tencent so profitable? If ByteDance and Tencent opened up user data and traffic, how would we conduct business? Our evaluation criteria for Web3 commercial application projects are:

1) Have they thought clearly about why they want to help users create on-chain data assets? How does going on-chain empower the business itself?

2) How much data assets can be created?

3) How to apply and analyze data, allowing users to gain more attractive experiences (such as retention and upgrade desires)?

4) How to realize data value? How to connect with AI models? How to reduce costs and increase efficiency?

Web2 can no longer be rolled out; we need better and cheaper data traffic. Since Web3 data is open and can be put on-chain, application teams can share data through co-construction, jointly promoting business growth. We encourage and strive to promote various project parties to band together. Open Data, Open Business!

Web3 commercial applications are not the chain reform of a few years ago, nor are they simply industries plus Web3; they will be the first generation of truly native Web3 applications revolving around on-chain data assets. I have not yet mentioned the core of the chain reform back then—token incentives—because I feel that tokens have been overused. Token incentives may seem free, but what is given out must be returned; there is no free lunch in the business world. Just like the formation of Didi's business model, it ultimately had to be coordinated and called off by project parties and VCs. The lag in regulatory policies for Web3 crypto finance, the overuse of token economies, and the forced maturation of value have already diverted the industry's attention; industry talent and capital have been overly attracted and consumed by various genuine and fake financial innovations. Web3 needs to return to the essence of value and the most basic business logic. Can it make money? Can it provide a better experience for internet users? When a Web3 commercial application has real product users, and they all have wallet addresses, only then can we promote the token economy, and token holders will not all be speculators and opportunists. With a solid commercial foundation, the powerful weapon of Web3—the token economy can then take off. Data assets should come first, followed by financial assets, which will be healthier. I told CZ that I hope every commercial application’s token has a solid value foundation and necessity, just like BNB in the exchange industry.

The infrastructure of Web3 has developed to a point where it can support applications and compete with Web2 in acquiring user data. For Web3 to ultimately replace Web2, it must possess more user data than Web2. Geoffrey, the founder of Datadance Chain, said, “The aggregation of content assets online has produced the killer apps of PC and mobile internet; while data assets created on-chain can generate key users for Web3 native applications.” The internet is evolving from online aggregation of content assets to on-chain issuance of data assets.

Mr. Liang Xinjun asked me why AI has developed faster than Web3 in recent years, and I provided my answer: Web3, with its built-in finance, seems like entrepreneurial teams are starting businesses on Wall Street and in Vegas, with many temptations, making it easy to get distracted; while AI feels like starting a business on campus, where focus is sufficient. Mr. Liang said that Web3 and AI are actually one entity, and Web3 must also grasp business logic and solve business problems, which I completely agree with. Now that AI is ahead, Web3 must catch up. If the data assets generated by AI are issued on-chain, rather than entering the data silos and information cocoons of Web2, it can inherently form a self-closed loop of commercial value growth. The future digital economy based on Web3 and AI is promising, and Professor Zeng proposed that the explosive growth in the next decade will be the combination of Web3, AI, and XR technologies.

Web3 to internet business is like Bitcoin to finance. Ethereum was born nearly ten years ago, and Web3 business is just starting. The opportunity to participate in co-building Web3 business now is comparable to buying $100 worth of Bitcoin. If you are interested in Web3 business, whether you are an entrepreneurial team or a resource provider, please contact us. The commercial soul of Web3 needs to keep pace with the body of AI; we need your support and participation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。