Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies is $3.54 trillion, with BTC accounting for 54.2491%, amounting to $1.92 trillion. The market cap of stablecoins is $196.8 billion, with a 7-day increase of 4.3%, of which USDT accounts for 69.64%.

This week, BTC's price showed a fluctuating upward trend, with the current price at $100,266; ETH also showed a fluctuating upward trend, with the current price at $3,993.

Among the top 200 projects on CoinMarketCap, most have risen while a few have fallen, including: CVX with a 7-day increase of 141.33%, CRV with a 7-day increase of 132.92%, and HBAR with a 7-day increase of 105.01%.

This week, BTC broke through the $100,000 mark and stabilized, while its market share has seen a slight decline, and the leading projects in the Ethereum sector have also experienced some increases.

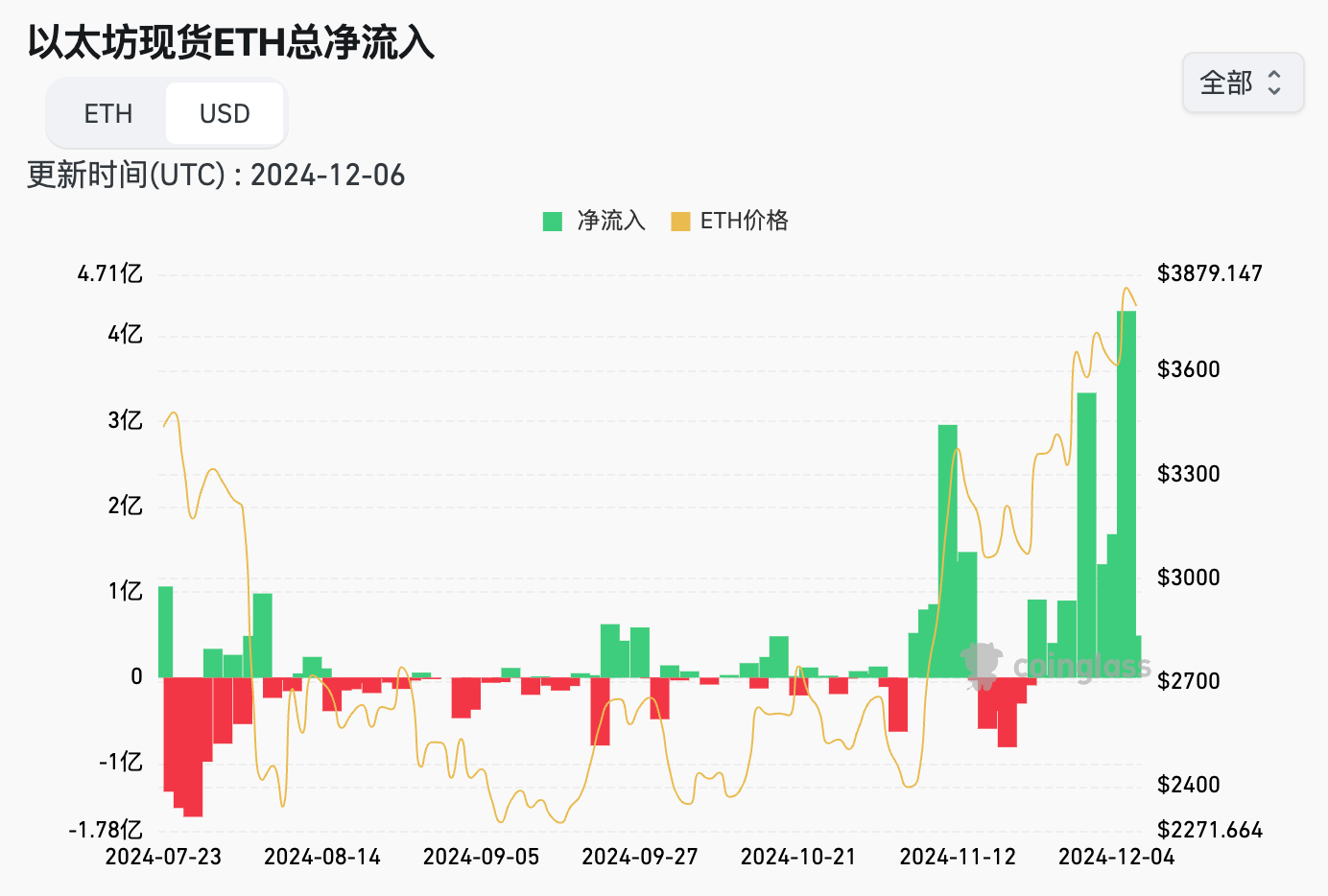

This week, the net inflow for Bitcoin spot ETFs in the U.S. was $2.775 billion; the net inflow for Ethereum spot ETFs in the U.S. was $803.4 million.

The "Fear & Greed Index" on December 7 was 75 (lower than last week), with this week's sentiment: 5 days of greed and 2 days of extreme greed.

Market Trend Prediction: BTC may show range-bound fluctuations, with a focus on profitable protocols or new public chain projects.

Understanding Now

Review of Major Events This Week

- On December 2, South Korea will delay the imposition of a 20% cryptocurrency tax for the third time;

- Sonic Labs: Completed wallet snapshots for holders of six different Sonic Shards;

- Coinbase integrates Apple Pay into its deposit services;

- 10x Research: Retail trading volume in the South Korean crypto market has surged, with altcoins becoming the market focus;

- Sonic Labs' mainnet has generated its first block, and the token airdrop snapshot has been completed;

- Nike's crypto fashion brand RTFKT announced it will gradually cease operations;

- Analysis: The U.S. government transferring Bitcoin to Coinbase may be considered custodial behavior;

- The Trump administration may open the IPO market to cryptocurrency companies;

- The Chief of Staff and Chief Secretary of the South Korean President's Office collectively resigned;

- On December 4, the South Korean Martial Law Command issued the first martial law order;

- On December 5, Trump confirmed Paul Atkins was selected as the SEC Chairman;

- Meteora launched the M3M3 model, encouraging users to stake meme coins for fee rewards;

- OpenAI: Will hold 12 product launch events in 12 days;

- On December 5, Magic Eden's airdrop eligibility and distribution query tool has been launched;

- Trump appointed David Sacks as the head of the crypto sector;

- Pudgy Penguins launched its native token PENGU, based on the Solana network;

- Molecule led the establishment of the DeSci ecosystem fund and has repurchased RIF and URO to support Pump.science.

Macroeconomics

- On December 2, according to market news, global ETF provider WisdomTree submitted an S-1 registration document for an XRP ETF to the U.S. Securities and Exchange Commission (SEC);

- On December 6, according to FOX Business reporter Eleanor Terrett, the SEC has notified at least two of the five potential issuers that it will reject their 19b4 applications for SOL spot ETFs. The current situation is that under the current administration, the SEC will not accept any new crypto ETFs;

- On December 6, according to CME's "FedWatch," before the non-farm payroll data is released, the probability of a 25 basis point rate cut by the Fed in December is 72.1%, and the probability of a 50 basis point cut is 27.9%;

- On December 6, Eric Morley, Managing Director and Co-Head of Global Markets at Citizens, stated that the non-farm employment report for November showed the expected rebound in hiring, with no major surprises. The slight increase in the unemployment rate and the decline in participation should persuade the Fed to continue its gradual easing path in the December meeting.

ETF

According to statistics, from December 2 to December 6, the net inflow for U.S. Bitcoin spot ETFs was $2.775 billion; as of December 6, GBTC (Grayscale) had a total outflow of $20.778 billion, currently holding $21.619 billion, while IBIT (BlackRock) currently holds $52.173 billion. The total market capitalization of U.S. Bitcoin spot ETFs is $114.346 billion.

The net inflow for U.S. Ethereum spot ETFs was $803.4 million.

Envisioning the Future

Upcoming Events

- The Bitcoin MENA Summit will be held from December 9 to 10 in Abu Dhabi, with Trump's son attending the Bitcoin MENA Summit in December;

- Bitcoin MENA 2024 will take place from December 9 to 10 at the Abu Dhabi National Exhibition Centre;

- Blockchain Season Finale 2024 will be held from December 12 to 13 in Dubai;

- Taipei Blockchain Week will take place from December 12 to 14, 2024.

Project Progress

- The Magic Eden Foundation announced that the ME token will undergo TGE on December 10;

- The Bitcoin re-staking protocol Babylon will open Cap-3 staking on December 10, 2024, at 19:00, lasting for 1,000 blocks, with a minimum staking amount of 0.005 BTC and a maximum staking amount increased to 5,000 BTC;

- The Sui ecosystem lending protocol Suilend will launch its token SEND on December 12.

Important Events

- Brazilian digital bank NuBank has suspended trading of its native token Nucoin, offering customers the option to convert it to Bitcoin or stablecoin USDC before December 9.

Token Unlocking

- Bitget Token (BGB) will unlock 5.38 million tokens on December 10, valued at approximately $8.6 million, accounting for 0.38% of the circulating supply;

- Cheelee (CHEEL) will unlock 11.66 million tokens on December 10, valued at approximately $11.4 million, accounting for 1.17% of the circulating supply;

- Aptos (APT) will unlock 11.31 million tokens on December 12, valued at approximately $16.9 million, accounting for 1% of the circulating supply.

About Us

Hotcoin Research, as the core investment research department of Hotcoin, is dedicated to providing detailed and professional analysis for the cryptocurrency market. Our goal is to offer clear market insights and practical operational guidelines for investors at different levels. Our professional content includes the "Play to Earn Web3" tutorial series, in-depth analysis of cryptocurrency industry trends, detailed analysis of potential projects, and real-time market observations. Whether you are a newcomer exploring the crypto space for the first time or a seasoned investor seeking in-depth insights, Hotcoin will be your reliable partner in understanding and seizing market opportunities.

Risk Warning

The cryptocurrency market is highly volatile, and investing carries risks. We strongly recommend that investors conduct investments based on a full understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://www.hotcoin.com/

Medium: medium.com/@hotcoinglobalofficial

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。