Original Title: The Trillion Dollar Opportunity

Original Authors: Ryan Barney, Mason Nystrom, Partners at Pantera Capital

Original Translation: 0xjs, Golden Finance

Stablecoins represent a trillion-dollar opportunity.

This is not an exaggeration.

While cryptocurrencies are often perceived as volatile, tokenized, and liquid, there is another side to cryptocurrency that quietly champions its adoption: stablecoins. For newcomers, these crypto dollars are pegged 1:1 to underlying fiat currencies, using algorithms (less popular) or reserves (more popular) to maintain the peg.

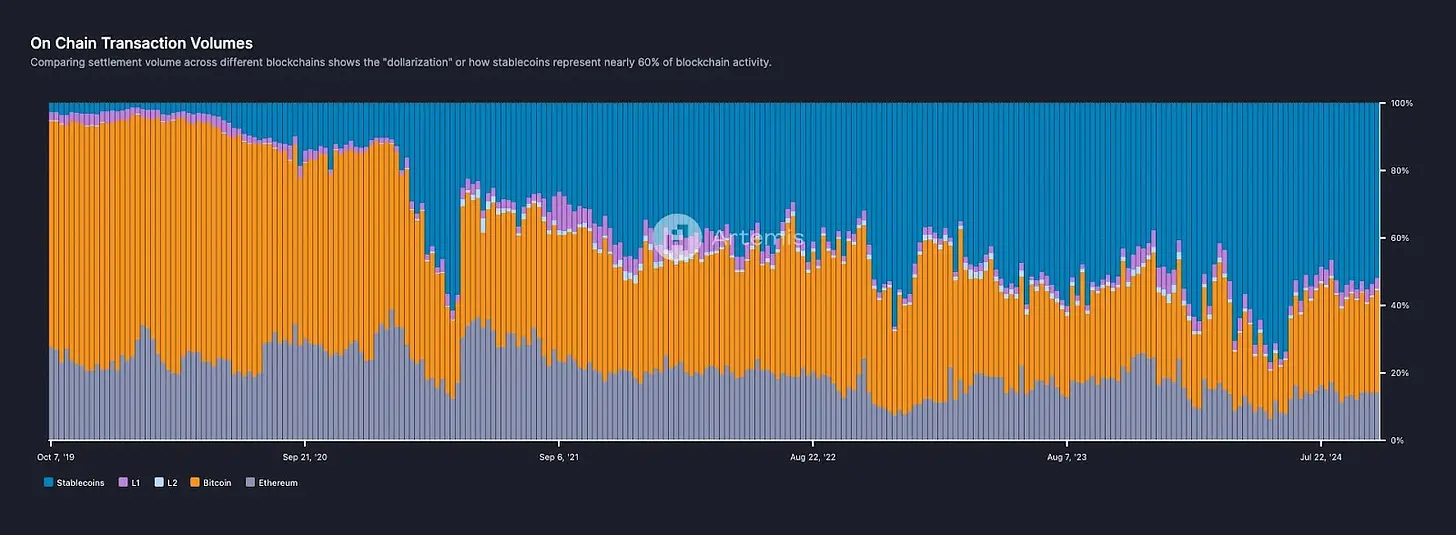

The proportion of stablecoins in blockchain transactions has risen from 3% in 2020 to over 50% now. Stablecoins are touted as the killer application of cryptocurrency; unlike many cryptocurrencies, stablecoins are essentially non-speculative.

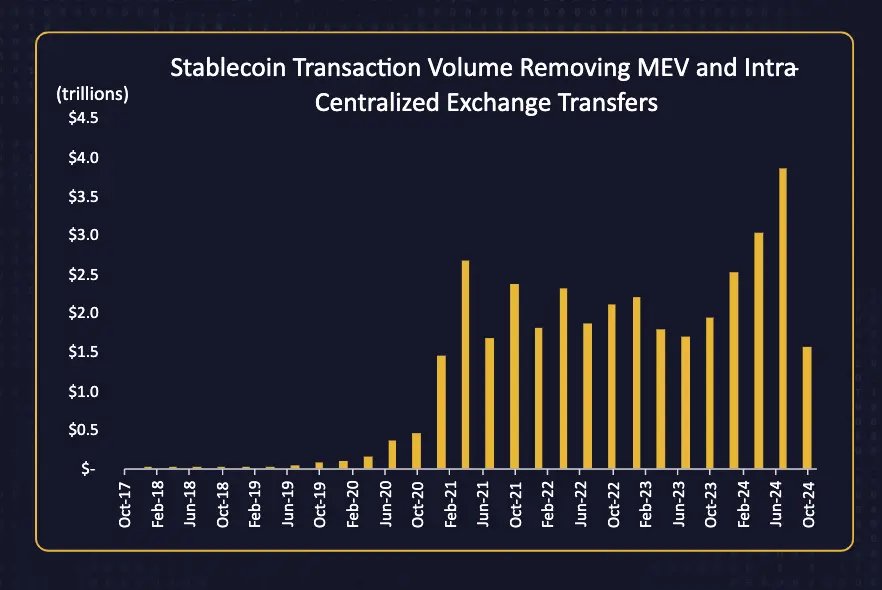

In a short time, stablecoins have demonstrated their potential to become one of the transformative innovations in the cryptocurrency space. 2024 is poised to be a breakthrough year for stablecoins, with adjusted transaction volumes exceeding approximately $5 trillion, and transaction amounts surpassing $1 billion, involving nearly 200 million accounts.

During the last cryptocurrency bull market, stablecoins achieved remarkable growth, but this time, their applications have extended beyond the DeFi ecosystem. Over the past few years, stablecoins have showcased their core value proposition—seamless cross-border payments, initially realized through acquiring dollars. Accordingly, the fastest-growing regions for stablecoins are emerging markets, where demand for dollars is high.

Stablecoins provide a tenfold value proposition over traditional payment methods for B2C payments (such as remittances) and B2B cross-border transactions.

Cryptocurrencies have long been expected to offer solutions for the trillion-dollar cross-border payment market. By 2024, cross-border B2B payments through traditional payment channels are projected to reach approximately $40 trillion (excluding wholesale B2B payments) (Juniper Research). In the consumer payment market, global remittance revenues reach hundreds of billions of dollars annually. Now, stablecoins provide a means to achieve global cross-border remittance payments through crypto channels.

As the adoption of stablecoins in B2C and B2B payment sectors accelerates, the supply and transaction volume of on-chain stablecoins have reached historic highs.

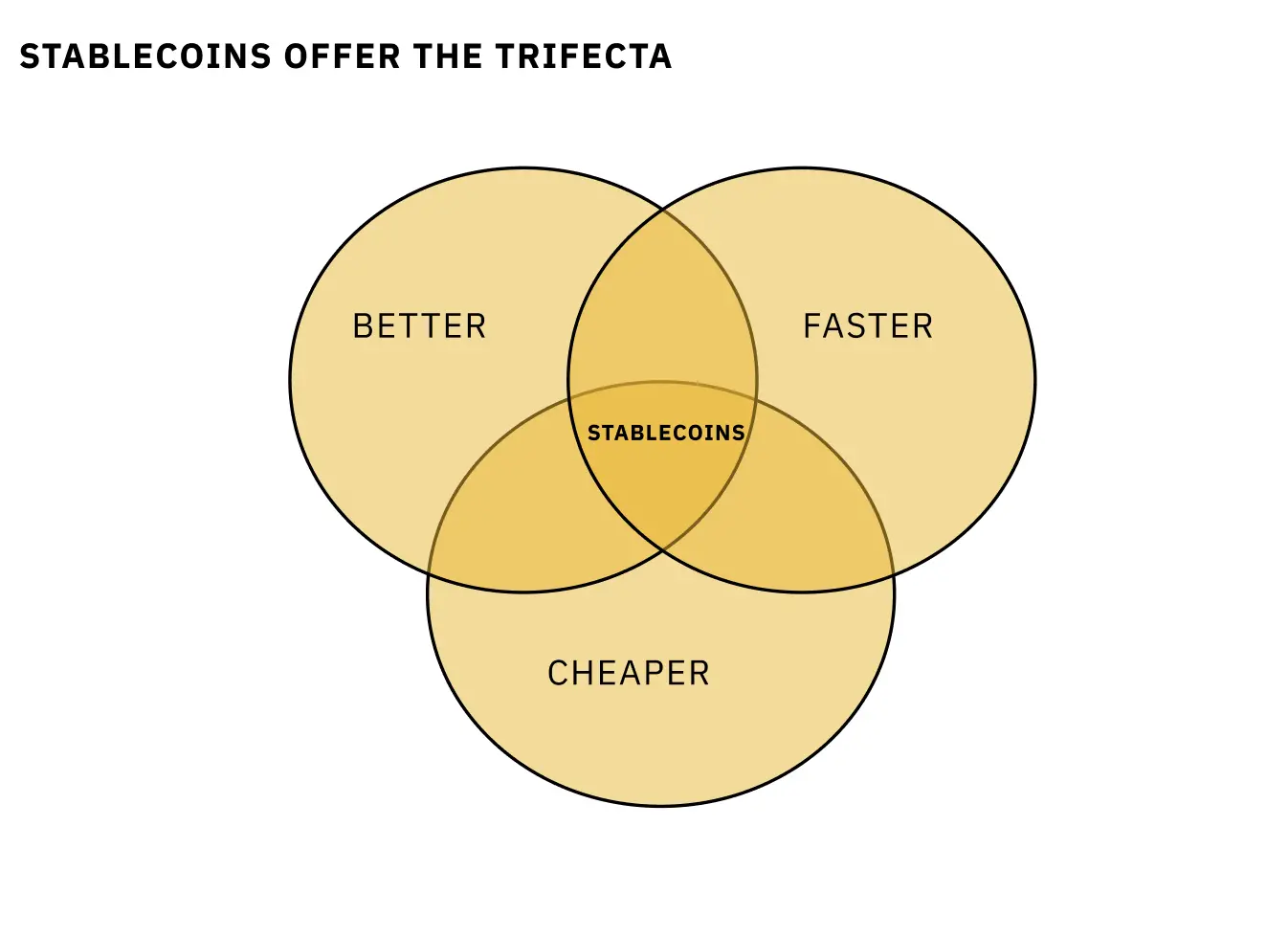

The Stablecoin Trio: Better. Faster. Cheaper.

There’s an old saying in business: few products can simultaneously offer better, faster, and cheaper. Typically, a product can meet two of these conditions at once, but not all three. Stablecoins provide a way to transfer global funds that is better, faster, and cheaper.

For businesses and consumers, stablecoins offer a value proposition that is ten times higher than traditional dollars.

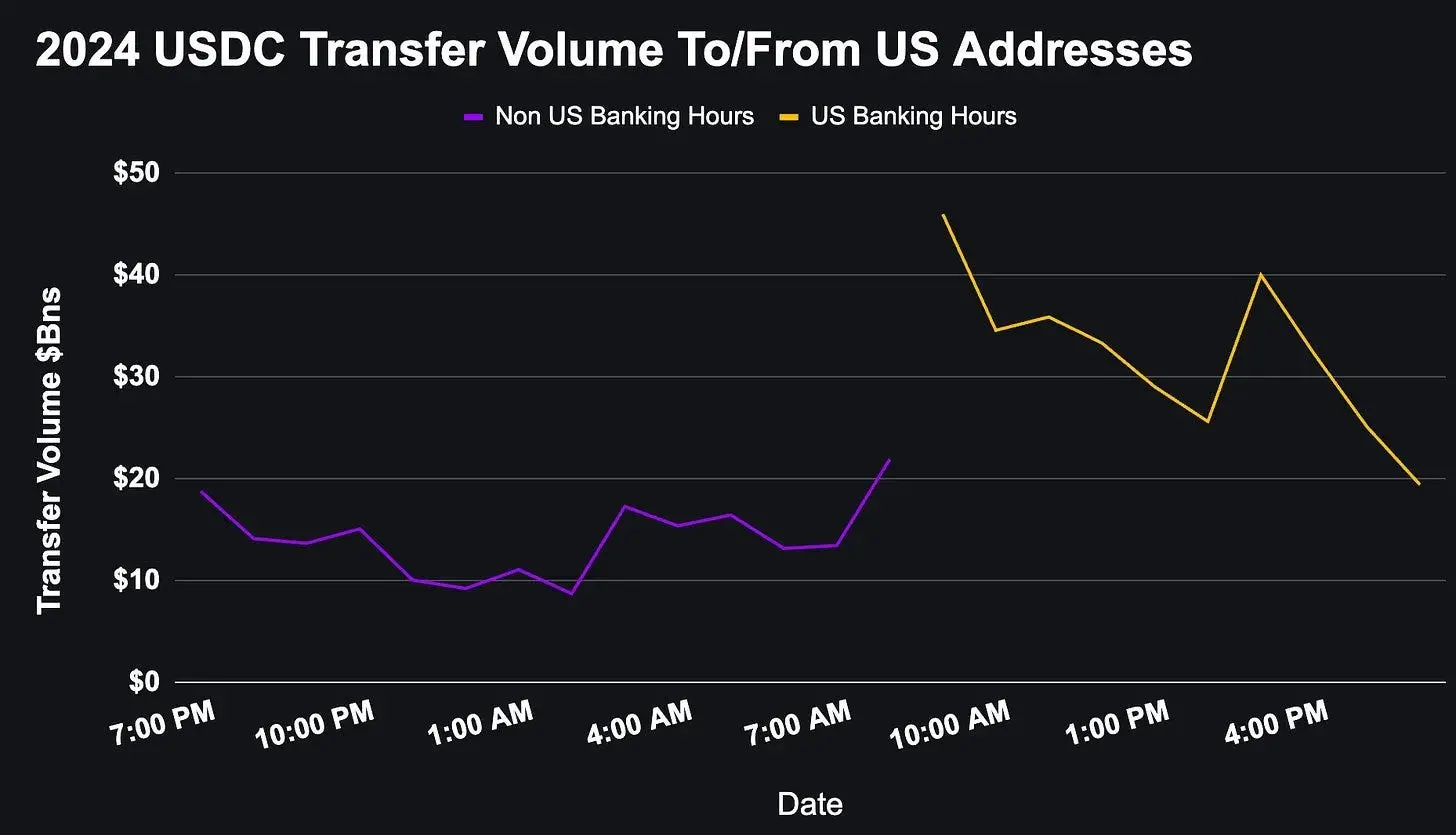

Better: Stablecoins are more accessible products, available 24/7, 365 days a year. They can be easily transferred globally and are programmable, making stablecoins superior to fiat currencies.

Faster: Stablecoins are undoubtedly faster, allowing for immediate settlement rather than requiring T-minus 2 or T-minus 1 days for settlement.

Images from the BVNK report

Cheaper: The costs of issuing, transferring, and maintaining stablecoins are lower than those of fiat currencies. In 2023, Stripe facilitated over $1 trillion in payment volume, with a fee structure starting at 2.9%, plus 30 cents for domestic card transactions. On high-throughput blockchains like Solana or Ethereum L2s like Base, the average cost of stablecoin payments is less than one cent.

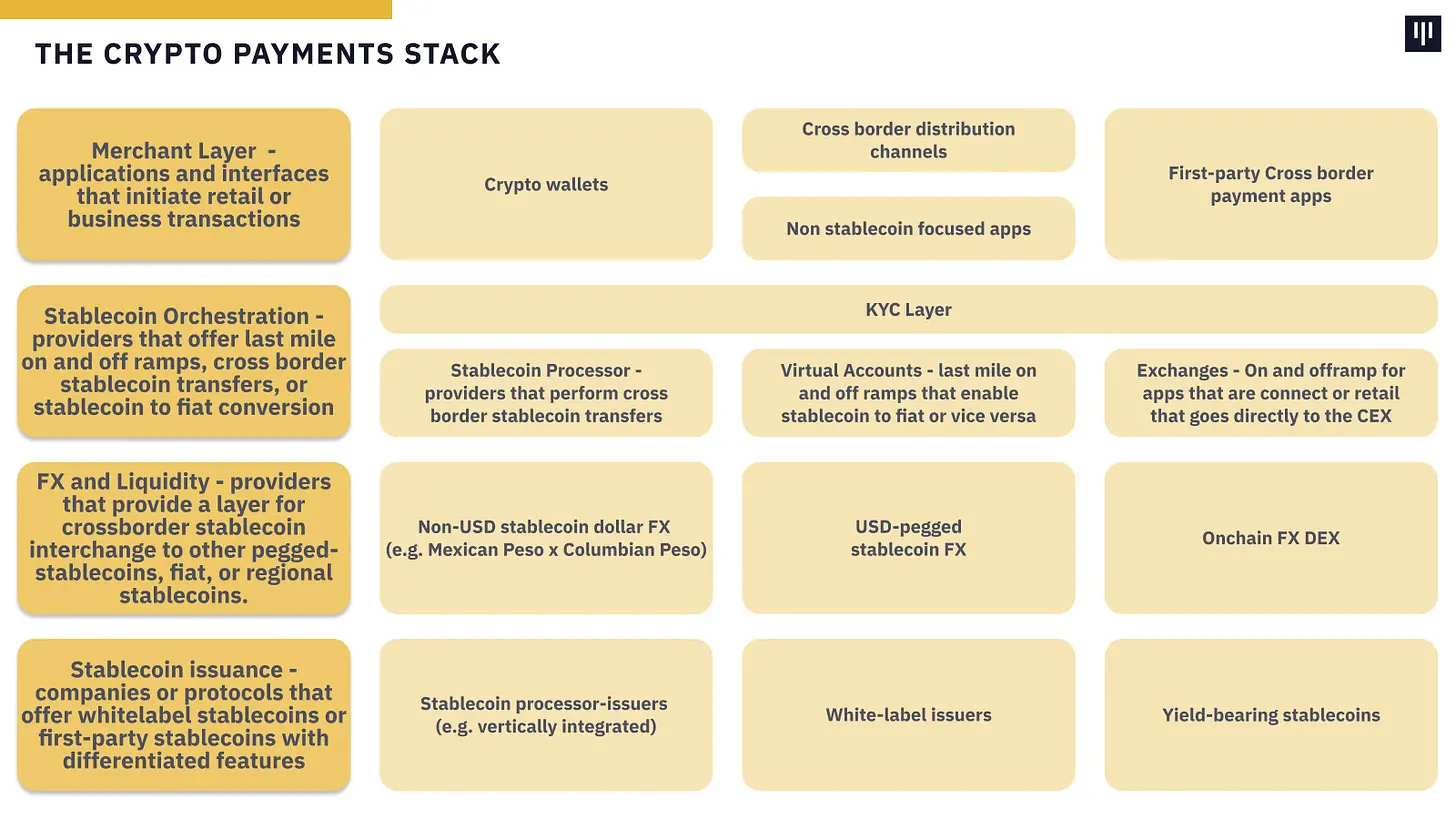

The Emergent Stablecoin Stack

While the stablecoin stack is continuously evolving, several new layers have emerged:

- Merchant Layer—Applications and interfaces that initiate retail or commercial transactions

- Stablecoin Orchestration—Providers that offer last-mile in-and-out channels, virtual accounts, cross-border stablecoin transfers, or stablecoin-to-fiat exchanges

- Forex and Liquidity—Providers that facilitate exchanges between cross-border stablecoins and other dollar-pegged stablecoins, fiat currencies, or regional stablecoins.

- Stablecoin Issuance—Companies or protocols that provide white-label stablecoins or first-party stablecoins with differentiated features

Similar to how cryptocurrency exchanges have emerged worldwide to cater to local participants, we expect various cryptocurrency cross-border applications and processors to arise as they cater to specific stablecoin markets.

Just like in traditional finance and payments, building moats at each part of the stack is crucial for expanding business opportunities beyond the initial value proposition. We have considered which moats are defensible and can scale over time at each layer:

- Merchant Layer—Moats are built by owning the stablecoin flow of users or businesses. This provides opportunities for upselling other services, selling user flows, and owning end-to-end customer experiences. A stablecoin version of Robinhood will likely emerge following a similar strategy.

- Stablecoin Orchestration—Licenses! Who gets the licenses will obtain the most reliable and globally covered services at the cheapest prices. Will it be developer-friendly? Look at the acquisition of Stripe x Bridge to understand where the moats are and how they form.

- Forex and Liquidity—Liquidity generates liquidity, and traffic generates value accumulation. Any participant that can acquire proprietary liquidity and price it effectively will outperform new entrants without it. This is why some large exchanges today service most of the stablecoin traffic for certain major channels. We also believe that the transition from OTC forex to exchange-style forex to on-chain forex will accelerate payments and transactions at this layer.

- Stablecoin Issuance—Over time, issuance will commoditize, inevitably leading to the launch of dozens of major brand stablecoins (e.g., PYUSD). As other layers of the stack grow (i.e., merchants, business processes, and liquidity), we expect these layers to be capable of launching their own stablecoins, whether for revenue generation, building their own branded stablecoins, or creating proprietary stablecoin liquidity and traffic.

As the layers of the stack gradually bundle together, these layers will merge over time. The merchant layer is best suited to aggregate the other layers of the stack, thereby providing more value to end users, increasing profits, and creating more revenue streams. They will have the authority to choose which forex transactions to conduct, which in-and-out channels to own or rent, and which issuers to use.

Furthermore, we anticipate that the issuance of stablecoins will become increasingly common for large fintech companies and e-commerce providers that facilitate significant capital flows. The next generation of neobanks and fintech companies will be defined by stablecoins. Just this month, we heard that major credit card networks like Visa, banks like JPM, and asset management firms like Blackrock are interested in exploring their own stablecoin projects.

Looking Ahead: The Next Decade of the Digital Dollar

The tokenization of the dollar is still in its infancy.

Even as stablecoin MAUs reach historic highs, we believe that their adoption will continue as hundreds of millions of people interact with stablecoins over the next decade.

Importantly, even amid fluctuations in exchange trading volumes, the number of stablecoin users continues to grow. From bull markets to bear markets, stablecoins dominate and expand their digital influence.

As cryptocurrencies rebuild the financial system from the ground up, stablecoins coexist and integrate into traditional financial payment networks.

While large companies like Stripe, Visa, and PayPal have entered the stablecoin market, we see significant opportunities for new protocols and companies focused on stablecoins.

Here are some ideas that excite us:

· New Stablecoin Neobanks—The emergence of mobile devices has created immense value for neobanks. Crypto neobanks will not only provide top-notch payment channels but also support the next generation of consumer financial applications that aggregate payments, trading, earnings, loans, and other core financial services.

· On-Chain Forex—While most stablecoins are currently pegged to the dollar, we expect more currencies to go on-chain, driving the development of the on-chain forex layer. More directly, as a large number of dollar-pegged yield stablecoins offer different yields and value propositions, we anticipate that these initially dollar-pegged stablecoins will require a forex layer.

· Telegram Payment Layer—Telegram offers a native payment wallet, but we also see a unique opportunity to build a new payment layer on top of Telegram using new interfaces like TG mini-programs.

· Remittances on Crypto Rails—Remitly, Wise, Intermex, Ria, MoneyGram, Western Union. All remittance companies, each with hundreds of millions to billions in annual revenue. Remittance companies charge fixed fees, which are meaningful for low amounts (e.g., $6 for a $60 transaction) or high fees (30-100 bps per transaction). Stablecoins reduce the cost of global remittances and make the process seamless. Money. "Remittance profits are the opportunity for stablecoins." - Jeff "Stables" Besos

· Global Venmo—Building a P2P layer that extends Venmo-like functionality globally. Remittances are typically one-way flows, while this will serve social commerce use cases in a more two-way flow.

· Stablecoin-Supported Fund Management and Operations—As the fintech space expands from PayPal payments, it creates billions of dollars in opportunities in wealth management, personal finance, payroll, corporate spending and expense management, neobanking, financial accounting and reporting, loans/mortgages, and more. Similarly, stablecoins provide an opportunity to rebuild many of these cumbersome processes with better rails supported by stablecoins. In the short term, fund management and operations deal with complex operations, making the value proposition of stablecoins potentially disruptive.

Conclusion

Stablecoins represent a trillion-dollar business opportunity. We hope to support founders and visionaries who can see the future potential of stablecoins, unaffected by the financial system.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。