Author: Deep Tide TechFlow

The NFT sector, which has been absent from the bull market feast for a long time, has recently started to stir. First, Magic Eden opened the airdrop share query yesterday, and today, the leading NFT in the ETH ecosystem, "Pudgy Penguins," announced its token issuance plan via Twitter.

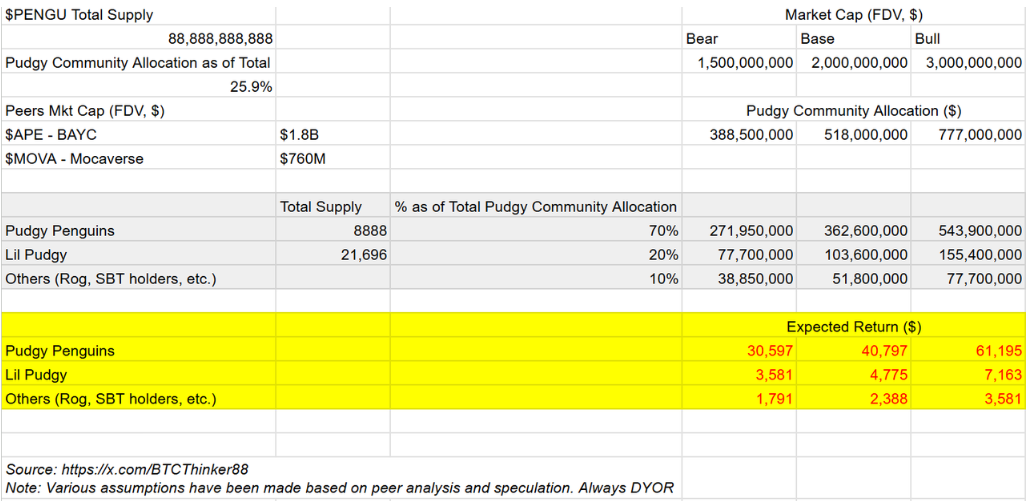

Although the specific date and distribution details have not yet been announced, the general token distribution ratio has been released, with the largest share (25.9%) allocated to the Pudgy community; meanwhile, 24.12% is allocated to other communities, and even 0.35% is reserved for $FTT holders.

According to community user @BTCThinker88's analysis, the $PENGU token airdrop scale is still considerable, with Pudgy Penguins holders expected to receive between $31,000 and $61,000 (7.9 ETH-15.8 ETH) each. If Abstract Chain also provides token distribution for the penguin community, this could become one of the largest airdrop events in 2024, following HYPE.

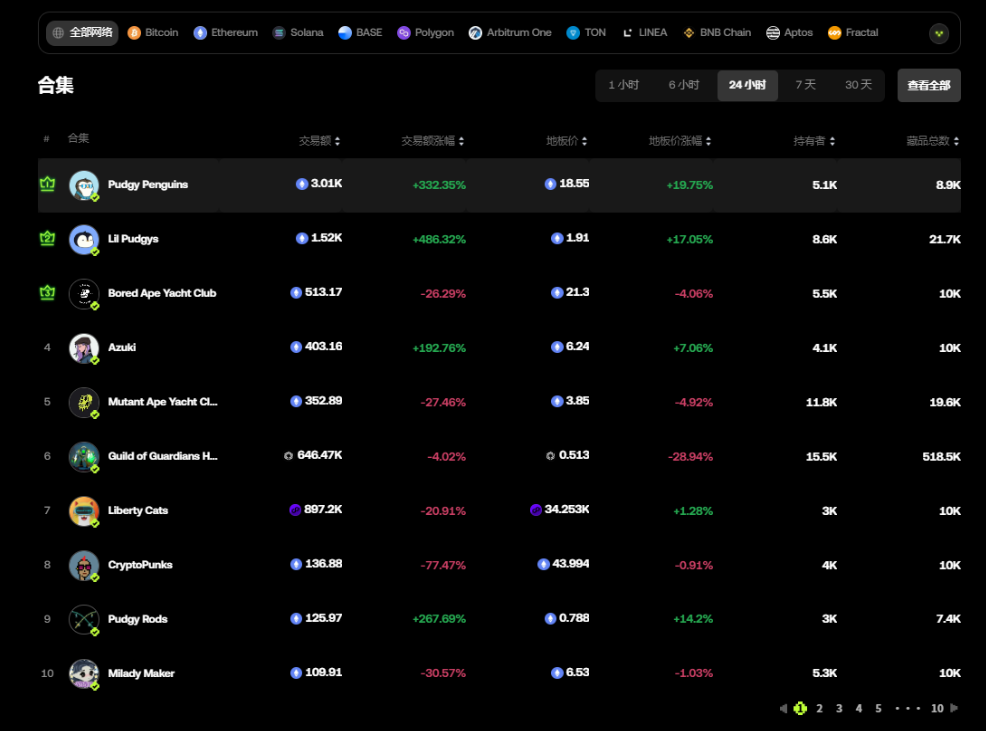

Indeed, the biggest benefit for projects is the ability to stimulate prices. As soon as the token issuance news broke, the floor prices of the Pudgy Penguins and Lil Pudgys NFTs rose sharply: the current floor price of Pudgy Penguins is reported at 18.55 ETH (approximately $72,600), while Lil Pudgys is at 1.91 ETH (approximately $7,500), with daily increases close to 20%, and trading volume surging by 3-5 times.

NFT Rebound: Can Projects Capitalize on the Trend to Thrive?

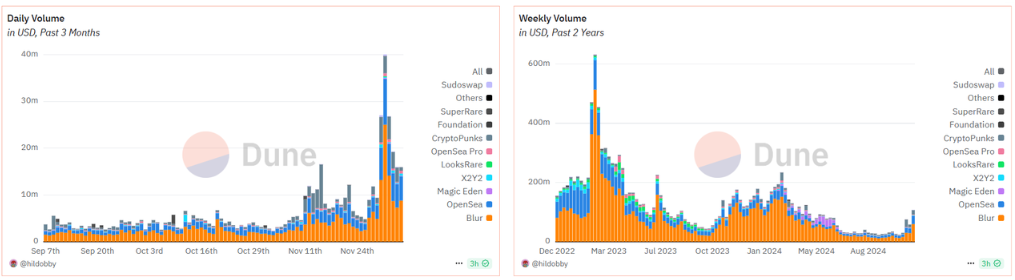

As the overall market continues to rise, excess funds have also flowed into the NFT ecosystem. According to Dune user @hildobby's data, the total sales of NFTs have started to warm up, with daily trading volume peaking close to $40 million and weekly trading volume exceeding $100 million.

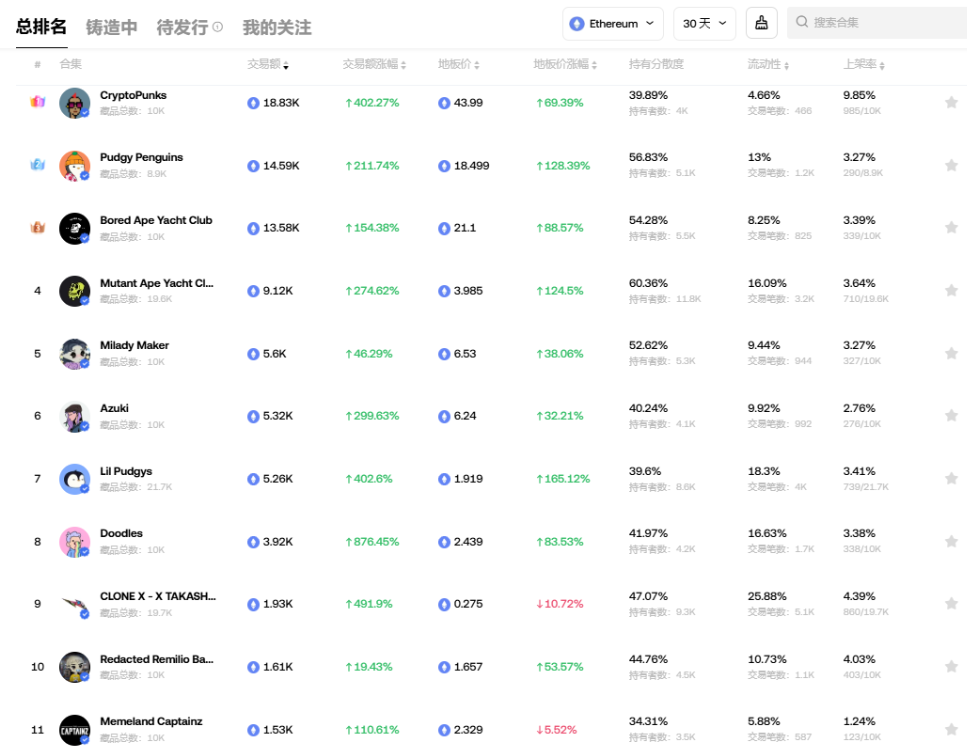

Blue-chip NFTs are also seeing impressive gains. According to OKX data, the floor prices and trading volumes of blue-chip NFTs on the ETH mainnet have both seen significant increases over the past 30 days.

Some projects have ceased operations, while others continue to benefit from airdrops.

During the bear market of the past two years, the NFT sector has faced significant challenges compared to altcoins. The once-prominent blue-chip NFTs like Bored Ape Yacht Club and Azuki encountered community FUD and large sell-offs, causing prices to plummet. The market gradually lost its allure for NFTs, which became more of a "promissory note" for future airdrops or mere commemorative tokens, with most NFTs losing their utility as investment/speculative assets. Even some major projects were not exempt; on December 3, the once-popular NFT brand RTFKT, which was even acquired by Nike, announced it would gradually cease operations as the crypto bull market approached, which was disheartening.

Aside from sporadic new project hotspots, only a few blue-chip projects have maintained relative heat, and the polarization among NFT projects has become increasingly severe: some blue-chip NFTs continue to perform well even in a bear market. Strong community projects like Milady, Pudgy Penguins, and Madlads have received substantial airdrops from various popular projects like Ethena ($ENA), Aethir ($ATH), Zksync ($ZK), and Wormhole ($W) this year, with the total airdrop value far exceeding the project's floor price.

Staying close to the market is clearly a viable path.

From the existing distribution plan, the Pudgy Penguins community clearly understands the market, and the "customer acquisition" skills of this established top NFT are indeed impressive. Not only does the community share a large portion of the distribution, but it is also generous in allocating to other communities. This internal and external distribution plan accounts for half of the total token amount.

In addition to providing substantial allocations to the community, Pudgy Penguins, which originated on the ETH mainnet, has also chosen to issue tokens on Solana, which is currently the hottest platform. Indeed, whether in terms of liquidity or player sentiment, choosing the meme-crazy Solana for a cartoon NFT project like Pudgy Penguins is undoubtedly a better choice for launching the project's price.

How Are Other Old NFTs Doing?

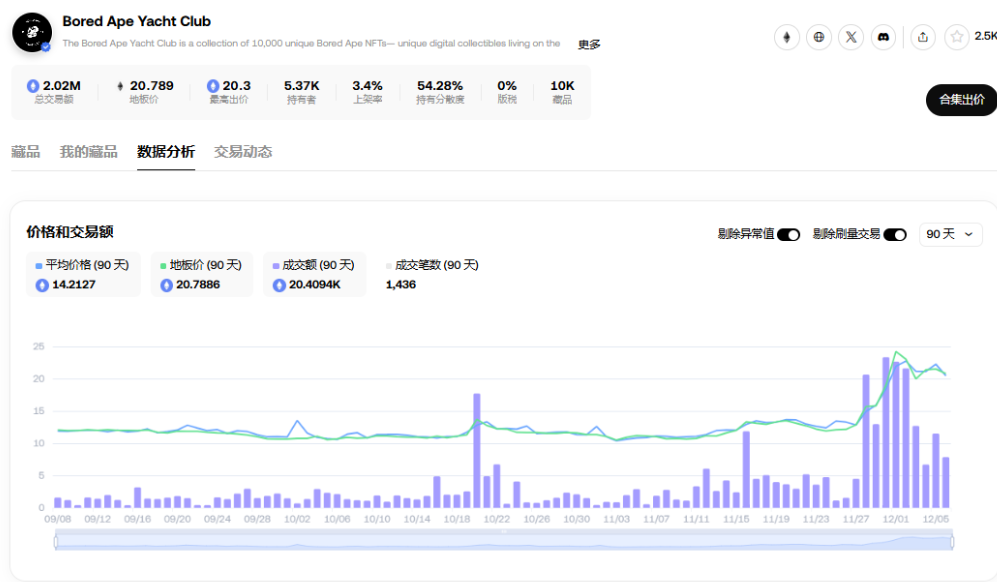

Bored Ape Yacht Club

Current floor price: 20.7888 ETH

Historical highest average transaction price: 340 ETH

90-day average price: 14.21 ETH

90-day transaction volume: 20,409 ETH

As one of the most prominent NFTs, BAYC has been criticized for not keeping up with the times during the bear market. Indeed, since the sky-high transactions and token issuances in 2021 and 2022, the Bored Ape series has not made any substantial innovations. In October of this year, Apechain announced it would start its own Meme Pump, and BAYC's short-term trading volume increased accordingly, but as the hype faded, it fell back again, only recently recovering as the sector collectively warmed up.

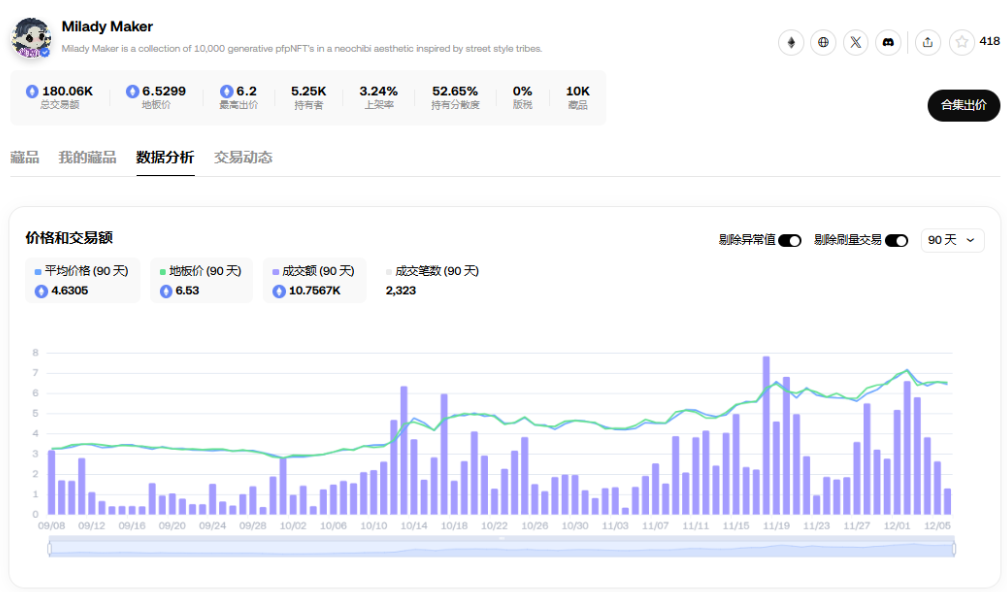

Milady Maker

Current floor price: 6.53 ETH

Historical highest average transaction price: 7.11 ETH

90-day average price: 4.63 ETH

90-day transaction volume: 10,756 ETH

Relatively low-key but with a strong community, Milady has recently maintained an upward trend, with the average floor price exceeding the time when Musk issued the Milady-themed meme pack last May. Moreover, as the ETH price approaches $4,000, in USD terms, Milady's price has more than doubled compared to the last peak.

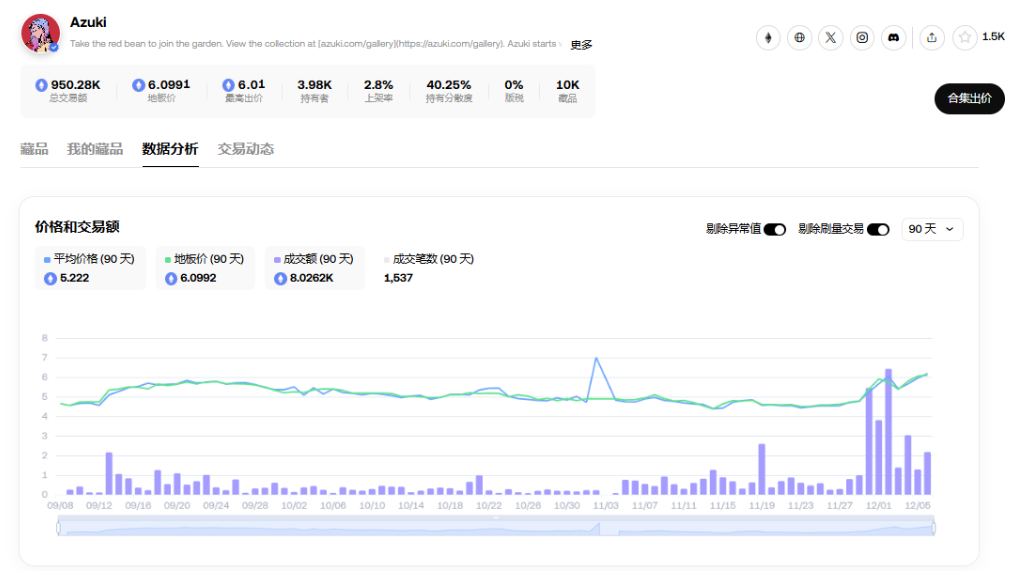

Azuki

Current floor price: 6.1 ETH

Historical highest average transaction price: 40.77 ETH

90-day average price: 5.222 ETH

90-day transaction volume: 8,026 ETH

Azuki's current floor price of 6.1 ETH is still a distance from the average price of 16 ETH during the community FUD and steep decline in June 2023. Clearly, the current price cannot be considered a "recovery," but rather an increase along with the overall market rebound.

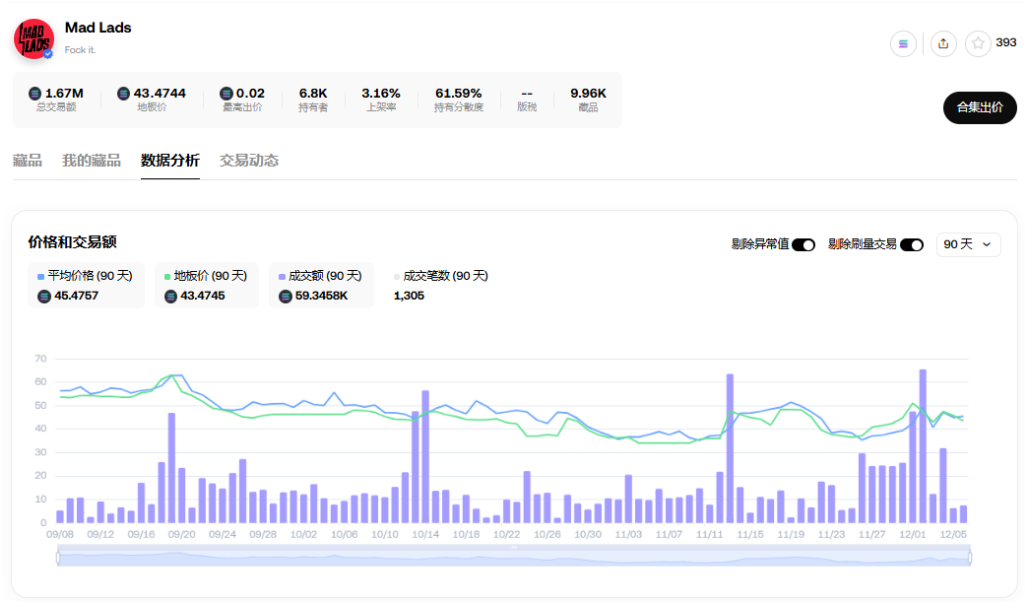

Mad Lads — Solana

Current floor price: 43.5 SOL

Historical highest average transaction price: 173.58 SOL

90-day average price: 45.47 SOL

90-day transaction volume: 59,345 SOL

As a representative project of Solana, Mad Lads has also enjoyed various project airdrop benefits, with projects like Wormhole and Backpack allocating a significant portion of airdrop shares to the Mad Lads community. Perhaps influenced by the overall downturn in the Solana NFT ecosystem, Mad Lads' price has been declining since its peak in March, but with the recent market improvement, the price has rebounded.

Conclusion

Choosing to announce the token issuance on the liquidity-rich Solana chain at a time when ETH breaks new highs and market sentiment is positive, Pudgy Penguins' token issuance plan is strategically successful, and the market has clearly responded positively to this action.

From the price trends of $APE over the past few years, it can be seen that token issuance is not a panacea for NFT projects. To avoid token issuance becoming the final dance of value realization for project parties, we need to observe the subsequent actions of the project parties regarding price and token use cases. However, one thing is certain: not only for NFT projects but for all old projects looking to revive, grasping trends and staying close to the market is the main theme to follow in this bull market. For market participants, regardless of how projects hype themselves, maintaining observation and making calm and well-informed investment decisions is the most important survival strategy in a bull market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。