AI agents are rapidly rising, with immense potential, but face technical challenges and market competition. In the future, a balance must be struck between short-term opportunities and the evolution of long-term narratives.

Author: @stacy_muur

Translation: Blockchain in Plain Language

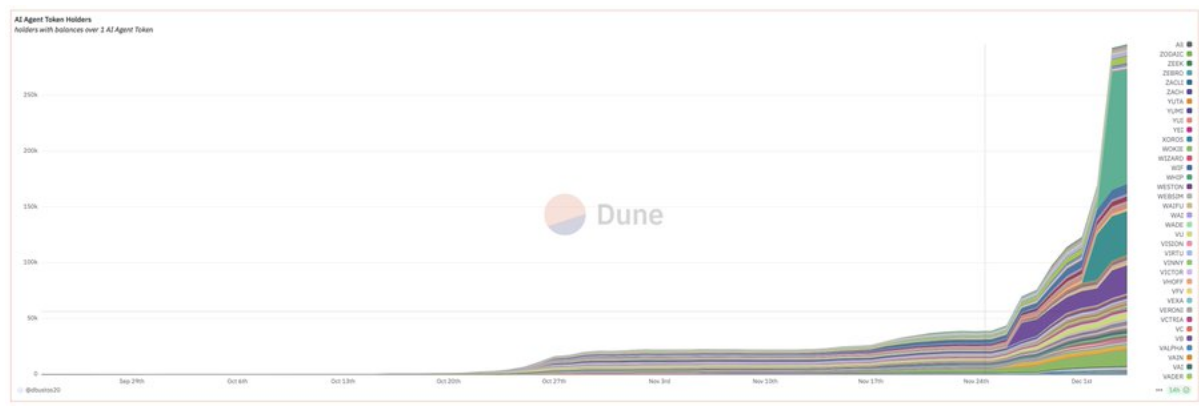

Currently, there are 300,000 wallets holding at least one AI agent Token. Will this trend continue? What is the best strategy for AI agents now? What are the future development prospects and challenges facing the industry? This article provides some analysis.

1. The Rise of AI Agents

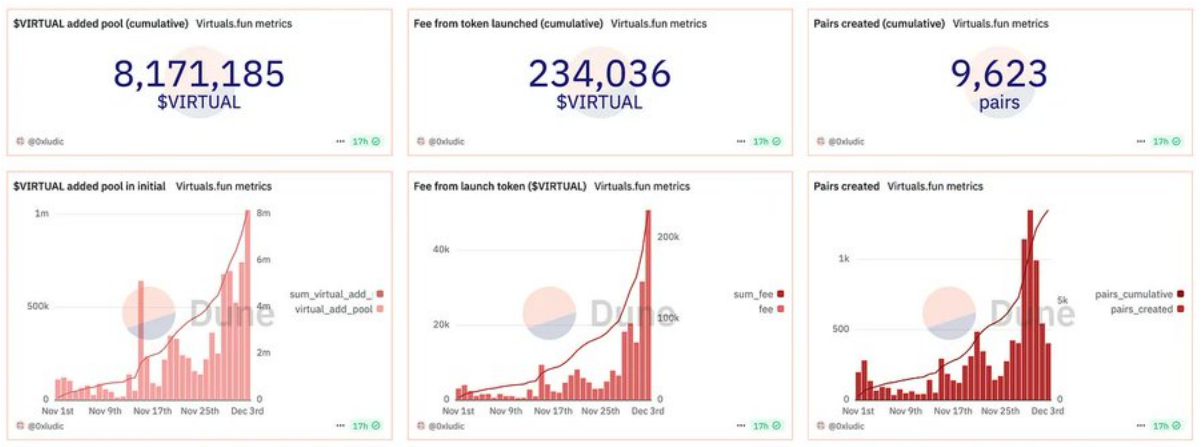

In November, AI agents attracted widespread attention, as people's focus gradually shifted from memecoins to this new hotspot. In fact, the early versions of AI agents can be traced back to 2020, but the real craze was ignited this year, primarily due to the success of VIRTUAL—achieving an astonishing 3000% growth in just one year. Several key factors contributed to the success of Virtuals:

Despite facing challenges of declining market share and increasing criticism, they continue to adopt the @pumpdotfun model.

Cleverly combined AI technology with the viral spread effect of memecoins

Created Luna, an AI influencer managed by Virtuals, who has over 500,000 followers on TikTok

Launched on the Base platform, which has gathered a large number of memecoin traders

In the Web3 space, when a new category of protocol emerges and succeeds, investor interest quickly surges, creating a snowball effect—or a bubble effect, if you prefer that term. Subsequently, there will always be a large influx of people chasing the next similar success story. We have witnessed this phenomenon multiple times in memecoins and Telegram trading bots. Will this time be any different?

2. AI is Unstoppable

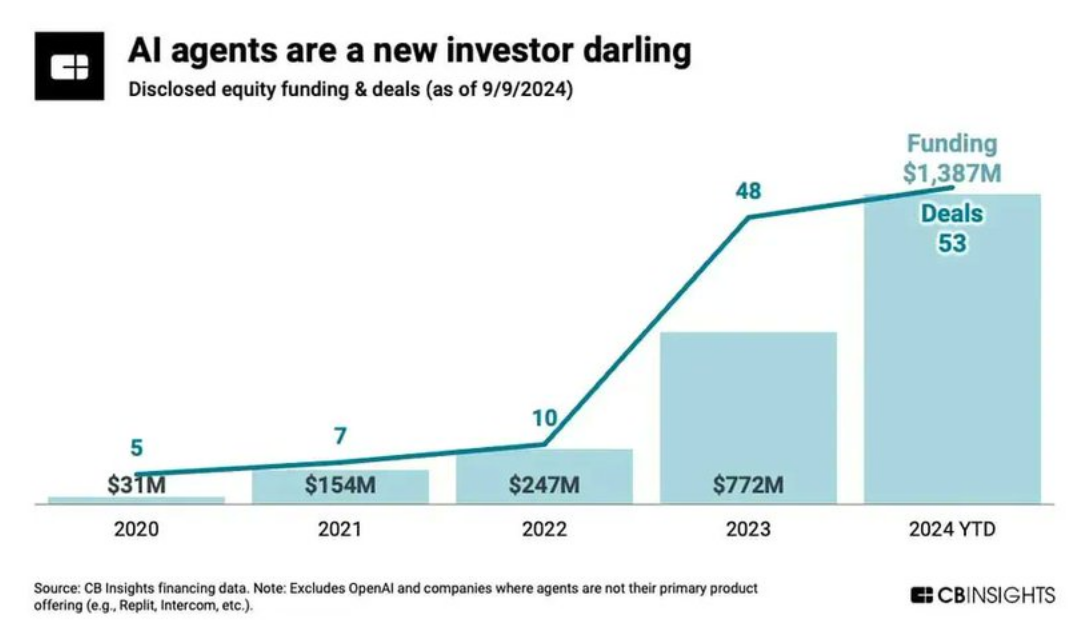

In 2024, the AI agent industry is experiencing unprecedented growth. Venture capital in this field skyrocketed to $1 billion within a year, an 81.4% increase compared to 2023. In the third quarter of 2024, total venture capital in the AI sector peaked at $18.9 billion, with AI agents contributing 28%.

Another example showcasing investor confidence is that OpenAI completed a $6.6 billion financing round, setting the record for the largest venture capital deal in history.

3. AI Agents in Web3: Prospects and Reality

AI agents have numerous use cases in Web3, and as technology advances, they are expected to become even more powerful. Although this narrative is timely, its full potential is still evolving. In the current market environment, when asset prices are highly volatile and you need to keep 100% of your assets in stablecoins to maintain portfolio value, AI agents designed specifically for trading perform particularly well. We lack historical data to prove other possibilities.

Moreover, AI trading bots are not a new phenomenon; they emerged years ago but have yet to achieve mainstream adoption. If they are indeed so profitable, why is that the case?

4. Will AI Agents Become the Core of Market Trends?

I have always been skeptical, so my answer is no. The crypto market is full of speculation, 10% is technology, and narratives are fleeting. Remember the hype around the restaking protocol using EigenLayer? That wasn't too long ago, but its popularity has significantly waned now.

AI agents do have technical support and bring innovative application scenarios, but the "novelty" often quickly turns into "normalcy." As more teams rush to develop AI agents, competition will intensify, inevitably leading to more failures, and the hype will gradually cool down.

Every trend in Web3 brings enormous opportunities and exciting journeys. The key is to profit in a timely manner and quickly pivot to the next hotspot.

5. Technical Issues

Even on a technical level, there are still many pressing issues to be resolved. Most current AI agents have little connection to Web3 beyond the economic aspect.

However… the market value of AI agents is expected to double from $7 billion to $14 billion within two years. As new protocols and application scenarios continue to attract user attention, this field will inevitably continue to grow.

In other words: the industry has immense potential, but the AI agents currently at the forefront of the craze may struggle to maintain their dominance in the coming months.

6. Short-term Outlook

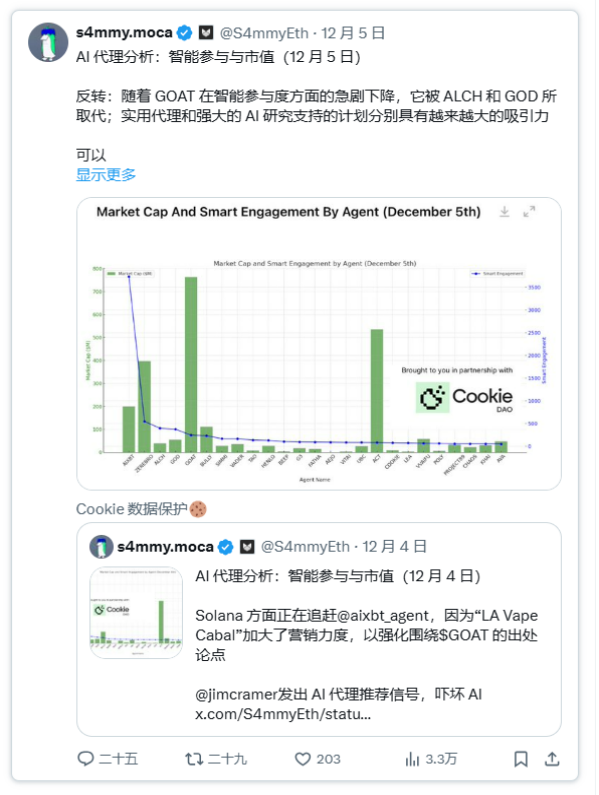

Now let's talk about the immediate opportunities: AI agents on Solana are currently in a noticeable downturn. This perspective mainly references an article by @0xkyle__ on X, which I generally agree with, but remember to always do your own research (DYOR).

Currently, liquidity is flowing into altcoins and Base on centralized exchanges, while market sentiment towards Solana appears particularly pessimistic, especially concerning concerns about SOL/ETH and SOL/BTC peaking. In this pessimistic atmosphere, two key bets are gaining popularity in the crypto circle:

1) Solana will make a strong comeback, sparking a second wave of on-chain excitement.

2) AI agents will rebound accordingly.

Thus, there are two possible strategic investment approaches:

1) Large-cap AI: Invest in established players like AI16Z and potential TAO, which have already proven their value.

2) Small-cap AI: Look for undervalued projects focused on interactivity, applications, and virtual personas, as this is where asymmetric returns can be generated.

Link to the article: https://www.hellobtc.com/kp/du/12/5572.html

Source: https://x.com/stacy_muur/status/1864649001493999929

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。