Macroeconomic Interpretation: Last night, the number of initial jobless claims in the U.S. rose to 224,000, reaching a new high in a month, exceeding the expected 215,000, with the previous value revised to 215,000. Meanwhile, the number of continuing jobless claims decreased by 25,000 to 1.871 million, with the previous value revised to 1.896 million. The increase in initial jobless claims in the U.S. exceeds expectations, reflecting some changes that may be occurring in the labor market, but the decrease in continuing jobless claims also indicates a certain level of stability in the employment market.

The latest data released by the World Gold Council is noteworthy, showing a surge in gold purchases by central banks in October. The net gold purchases in October reached 60 tons, setting a record high for 2024. Among them, the Reserve Bank of India performed outstandingly, increasing its gold reserves by 27 tons, followed by Turkey and Poland, which added 17 tons and 8 tons, respectively. The increase in gold purchases by central banks demonstrates the important position and attractiveness of gold in the global economic environment.

In the energy market, OPEC+ decided to extend the group's overall oil production cut of 3.66 million barrels per day until the end of 2026, delaying the voluntary production cut plan of 2.2 million barrels per day from eight countries by three months until April next year, and extending the originally planned one-year gradual production resumption period to 18 months. The UAE seeks to gradually increase production by 300,000 barrels per day from April next year to September 2026. As a result, the settlement price of crude oil slightly declined. OPEC+'s decision impacts the crude oil market, and the slight drop in oil prices reflects the market's adjustment to the balance of supply and demand.

In terms of financial market performance, the three major U.S. stock indices collectively closed lower last night, with cryptocurrency concepts opening high and then falling. By the close, the Dow Jones fell 0.55%, the Nasdaq fell 0.18%, and the S&P fell 0.19%. The yield on the U.S. ten-year Treasury bond fell by 0.096%, closing at 4.178%, with a difference of 3.2 basis points compared to the two-year Treasury yield. The VIX, or fear index, rose 0.67% to 13.54, and Brent crude oil closed down 0.36% at $72.14. Spot gold fell 0.68% yesterday, reporting $2631.99 per ounce. The U.S. dollar index fell 0.61% yesterday, reporting 105.72.

The decline in U.S. stocks was influenced by various factors, including expectations for non-farm payroll data, and the performance of technology stocks reflected differing views on the prospects of different companies. With the non-farm payroll data about to be released, stock indices lost momentum and collectively closed slightly lower. Tech giants had mixed performances, with Tesla rising over 3%, Microsoft and Amazon increasing, while Meta fell, and Intel continued to decline after replacing its CEO. Bitcoin experienced a high-level correction, leading to a drop in cryptocurrency concept stocks.

The performance of Hong Kong stocks was influenced by various sector factors, with the Hang Seng Index falling 0.92%, the National Index falling 1%, and the Hang Seng Technology Index falling 0.77%. Sector performances varied, with large tech stocks showing mixed results, while sectors like biomedicine generally declined, and cryptocurrency concept stocks continued to rise significantly.

The performance of global assets reflects the complexity and sensitivity of the market, with various factors interwoven, requiring investors to closely monitor macroeconomic data, policy changes, and market sentiment. In terms of global asset performance, international oil prices slightly declined, with WTI January crude oil futures and Brent February crude oil futures both experiencing slight drops. The U.S. dollar index fell about 0.6% on the eve of the non-farm payroll data, and the yen briefly rose above 150.

In the cryptocurrency space, BTC reached a new high of $104,000 before experiencing a significant correction, dropping to below $91,000 in the early morning.

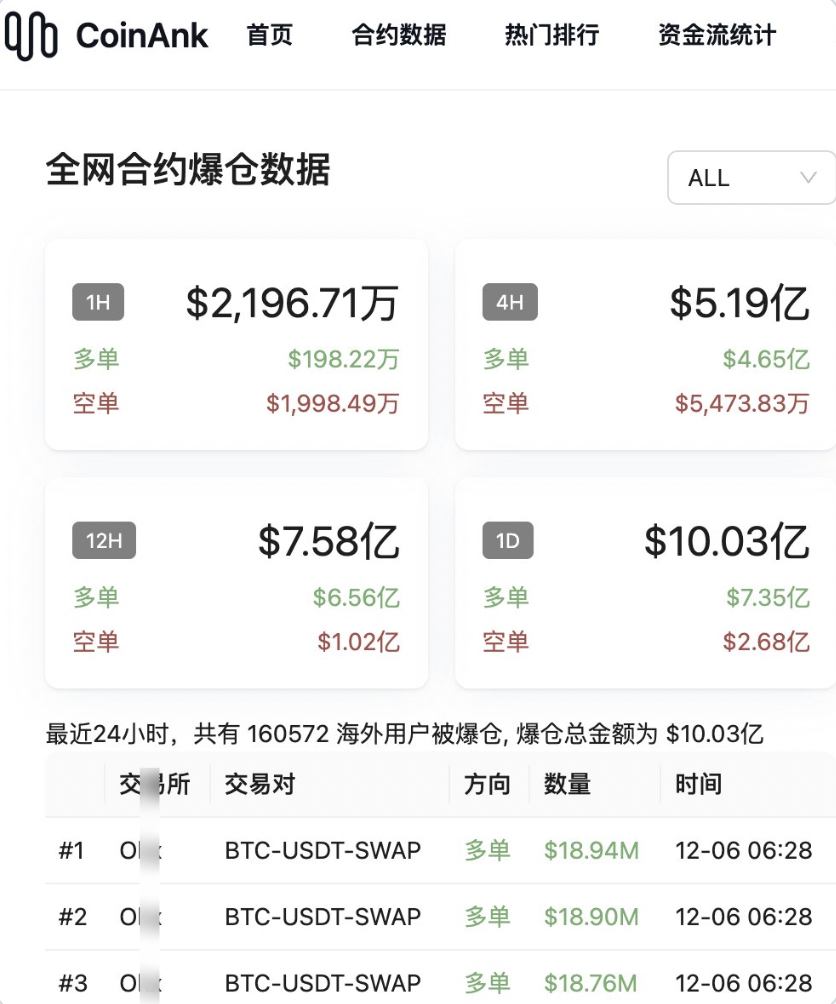

BTC Data Analysis: BTC fluctuated nearly $15,000 yesterday, peaking at $104,630 before falling, with Binance and OK contracts dropping to a low of $90,200 and $88,664.7, respectively. Data shows that over $1 billion was liquidated across the network in 24 hours, with long positions liquidated at $735 million and short positions at $268 million. A total of 160,627 users were liquidated. The three largest liquidations occurred this morning at 6:28 AM on OK, with each liquidation close to $19 million.

In our analysis yesterday, we mentioned, "Currently, the funding rate is very high, reaching a level of 0.1%, and be aware that there may be long position liquidations and speculative short positions leading to a correction before settlement. The support position for bulls continues to reference the rising trend line on the 4-hour chart, which has roughly moved up to around $95,000." Combined with previous analysis, we have repeatedly discussed the support reference area below $91,000, which is a dense area of main force chips, with mid-term support at $87,000 and $85,000, overall aligning with our expectations. Currently, the short-term pressure above is referenced around $101,500 and $104,088. However, U.S. stocks began to slightly correct last night, which will also affect BTC. Tonight, there will be non-farm payroll and unemployment rate data, which can be closely monitored.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。