This morning, BTC experienced a sharp plunge, crashing the market and hitting a low of $89,711, with a short-term volatility close to 8%! During the BTC drop, a large number of long positions were liquidated in the futures market, especially on the two major platforms, Binance and OKX, where the liquidation amount exceeded $25.5 million. Currently, the BTC price has recovered to above $97,000, and despite the intense market fluctuations, the overall upward trend seems to be continuing.

According to an analysis by AICoin (aicoin.com), there are three main reasons for this drastic movement in BTC:

First, market sentiment and leverage effect

Current market sentiment is high, and some investors have increased their leverage operations due to FOMO (fear of missing out), leading to market corrections.

Second, Asian market washout

During the BTC fluctuations, the premium on Coinbase surged by 215%, with a premium rate of 0.338%, indicating that the price gap between the Asian market and the American market has widened (with Asian market prices lower than American market prices), meaning that the panic selling pressure in the Asian market is greater.

Third, long-term holders begin to take profits

Data shows that since October 7, investors holding Bitcoin for over a year have started to take profits, with the proportion of their holdings dropping from 65.75% to 63%. Especially after November 23, investors holding for over five years have also begun to reduce their positions, with the proportion dropping from a high of 31.22% to 30.97%. However, ultra-long-term investors holding for over ten years remain steadfast, with only a reduction occurring on December 3.

Currently, the market focus is shifting to the upcoming U.S. non-farm payroll data for November. Expected data indicates that the non-farm employment population is expected to increase by 200,000, with the unemployment rate slightly higher than the previous value, recorded at 4.2%. Given the distortion in non-farm data in October due to hurricanes and Boeing strikes, tonight's data will more accurately reflect the current state of the U.S. labor market.

According to the latest views from Federal Reserve Chairman Powell, the U.S. labor market has not yet stabilized and is still softening. As of the time of writing, the interest rate market is betting on a 70% probability of a 25 basis point rate cut by the Federal Reserve in December, with a 30% probability of maintaining the current rate. However, if the non-farm data is unexpectedly strong, the likelihood of the Federal Reserve halting rate cuts in December will increase.

Historically, BTC often experiences significant volatility after the release of non-farm data, but in the long term, the expectation for Bitcoin's rise remains unchanged, based on the following:

First, bullish sentiment from major players

According to large order and full-depth data, Bitstamp whales are firmly bullish up to $118,000, with a large sell order that has been placed for over 12 days at this level. Coinbase whales are heavily betting on $120,000, accumulating a total of $37.795 million in sell orders (≈315 BTC).

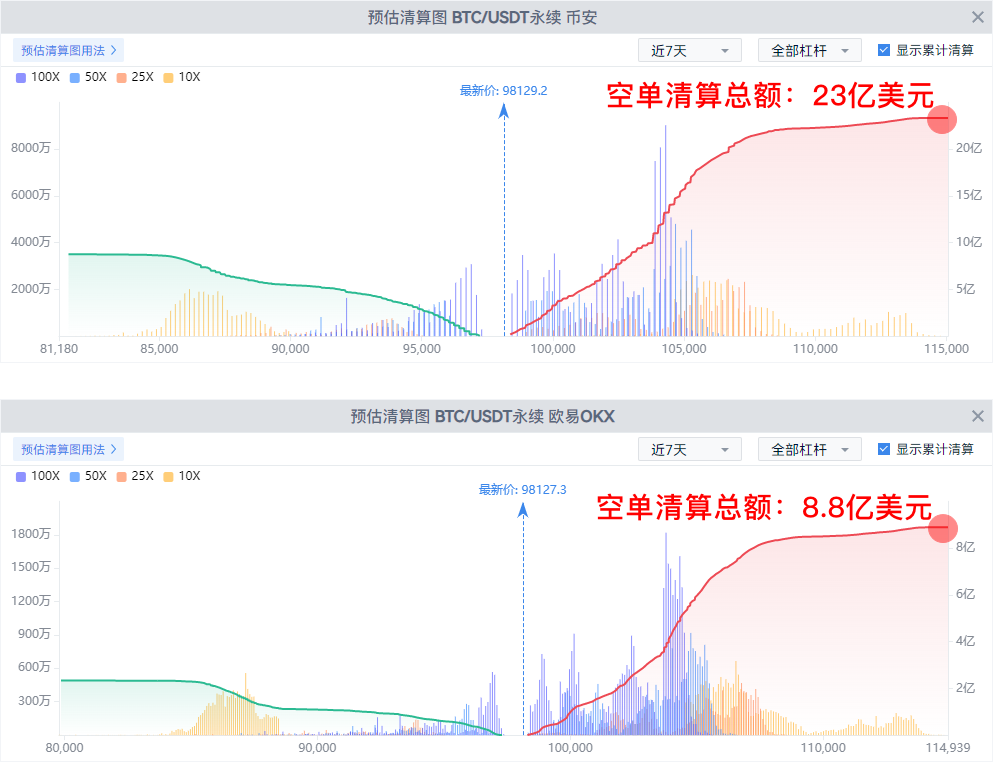

Additionally, according to estimated liquidation chart data, $115,000 is a crucial level, with Binance BTC/USDT perpetual contracts expected to have up to $2.3 billion in short liquidations at the $115,060 price point; OKX BTC/USDT perpetual contracts are expected to have $880 million in short liquidations at $114,939.

Estimated liquidation chart usage: https://www.aicoin.com/zh-Hans/article/375042

Second, extremely strong demand

The demand for Bitcoin as a strategic reserve asset continues to grow. Companies like MicroStrategy have added over $6 billion in collective debt to their balance sheets to purchase Bitcoin, reflecting institutional recognition of Bitcoin as a strategic reserve asset. U.S. public companies like Hoth Therapeutics and LQR House Inc. have also announced plans to purchase Bitcoin as part of their capital management strategy.

Moreover, the asset management scale of Bitcoin spot ETFs continues to expand, now exceeding $111 billion, with a cumulative net inflow of $33 billion since its listing.

ETF data tracking: https://www.aicoin.com/zh-Hans/web3-etf/us-btc?lang=cn

Third, policy support

Trump has nominated crypto advocate Paul Atkins as the new chairman of the U.S. SEC, a move seen by the market as a significant positive for cryptocurrencies. Paul Atkins has long supported the development of digital assets, and his appointment will undoubtedly bring a more inclusive regulatory environment to the cryptocurrency market.

Russian President Putin has also publicly expressed support for Bitcoin, stating that no one can ban Bitcoin, further boosting market confidence.

Fourth, increased liquidity

Funds continue to flow into the cryptocurrency market, with trading demand rising exponentially. Tether has been continuously issuing USDT, with the total issuance nearing 142 billion, having surged by approximately 16.13 billion in one month, an increase of 12.8%.

However, behind the market frenzy lies potential risks. The fear and greed index remains high, and the market's enthusiastic sentiment can easily lead to greater volatility. The window for crypto policy implementation and the ongoing rise in market leverage also add to market uncertainty. Deribit data shows that options investors are betting on a deep correction in BTC before the end of February next year, with particular attention needed on the $75,000-$70,000 range, where there are a large number of outstanding put options totaling $109 million.

In such a turbulent market environment, it is essential to invest rationally and manage risks effectively!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。