The surge in hype has brought the market's attention back to the decentralized contract (Perp dex) sector. If you missed out, be sure to keep an eye on the upcoming launch of SynFutures (token F). Based on the trading volume over the past 7 days, it ranks second in the sector.

Additionally, @SynFuturesDefi is part of the Base ecosystem, which is currently seeing a significant influx of funds, with market giants like Virtual and Aero emerging. F is the leader in this sector on the Base chain and is likely to attract large investments.

Note the opening time: on Bybit, it is December 6 at 6 PM Beijing time https://partner.bybit.com/b/87777

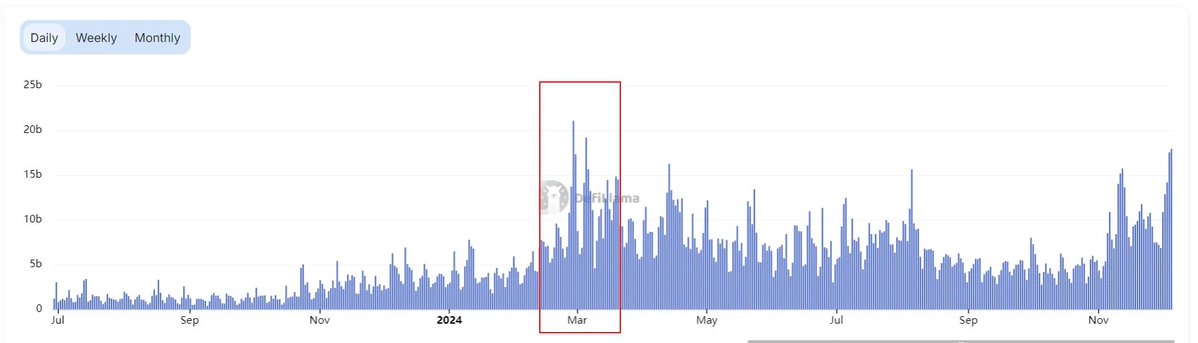

The potential of Perp dex in a bull market is evident. According to data from Defillama, the highest trading volume for Perp dex in the past year was in March 2024, coinciding with the market peak, reaching a daily high of $20 billion. In contrast, during the low period before 2024, contract trading volumes ranged between $1 billion to $3 billion, a difference of about 10 times. Now, following the BTC market's activation, the daily trading volume for Perp dex has risen from $5 billion to $15 billion in September and October. It can be imagined that at the peak of the bull market, there could be at least a 10-fold increase in scale.

Looking at the sector's landscape, SynFutures is a leading player in the derivatives sector, ranking second in trading volume over the past 7 days. The top four rankings are Hyperliquid at $34.6 billion, SynFutures at $5.9 billion, Jupiter at $5.8 billion, and dYdX at $4.9 billion. Previously well-known GMX had a trading volume of $1.8 billion. Although daily trading volumes may fluctuate, overall, SynFutures is certainly one of the top protocols.

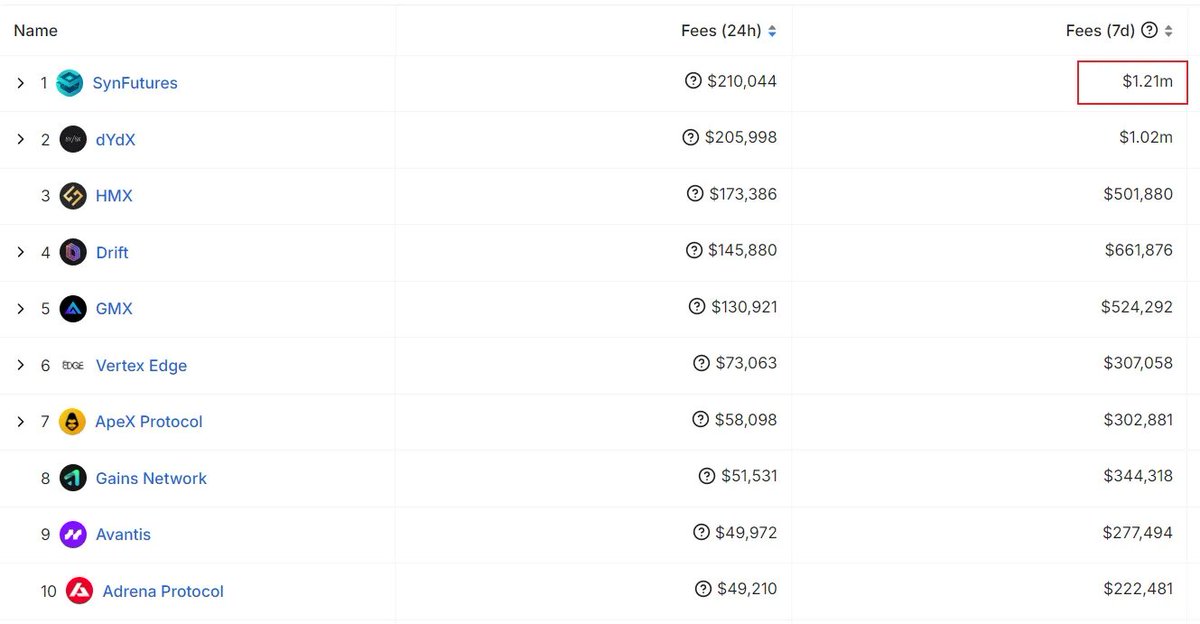

When examining the protocol's transaction fees, this is a good parameter to measure a project's revenue. According to Defillama's data, the protocols with the highest fees over the past 7 days are SynFutures at $1.21 million, dYdX at $1.02 million, Drift at $660,000, GMX at $520,000, and HMX at $500,000. It is clear that SynFutures is in the top position, having real fee income that lays the foundation for the project's long-term healthy operation.

For some reason, Defillama did not include Hyperliquid's data, but even if it ranks first, SynFutures still belongs to the top players.

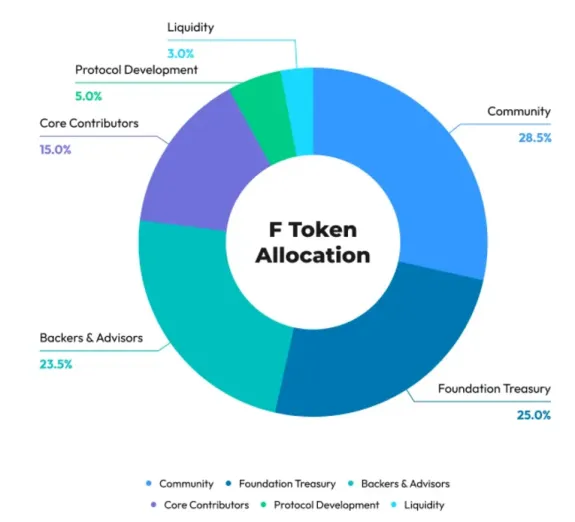

Overview of F Token Economics

According to information provided by SynFutures, the F token is the governance token of the SynFutures ecosystem, with a total supply of 10 billion tokens, of which 1.2 billion will be unlocked at the TGE (Token Generation Event).

Community (28.5%): 2.85 billion F tokens will be allocated to community members, including airdrops, ecosystem development, and liquidity activities.

○ Airdrop (7.5%): 750 million F tokens will be airdropped to users in the first season. All airdrop tokens will be unlocked at TGE.

○ Ecosystem (20.5%): Used to expand the SynFutures ecosystem, including incentive programs, partnerships, developer funding, and community activities. The ecosystem allocation will be unlocked linearly over four years after TGE.

○ Liquidity Activities (0.5%): Used for listing and trading activities on trading platforms. These tokens will be unlocked at TGE.

Supporters and Advisors (23.5%): 2.35 billion F tokens will be allocated to supporters and advisors who provide funding, expertise, and other valuable support for the development of SynFutures. This allocation has a six-month lock-up period, followed by linear unlocking over the next three and a half years.

Foundation Treasury (25.0%): Used to support the long-term stability and development of SynFutures, including strategic partnerships, operational expenses, and new initiatives. To ensure fair use, only 50 million F tokens (0.5% of total supply) will be unlocked at TGE, with the remainder unlocked linearly over the next four years.

Core Contributors (15.0%): A six-month lock-up period, followed by linear unlocking over the next three and a half years.

Protocol Development (5.0%): Used to fund ongoing R&D, engineering, and the implementation of new features and upgrades. 50 million will be unlocked at TGE, with the remainder unlocked over the next four years.

Liquidity (3.0%): 300 million F tokens will be used to ensure sufficient liquidity for the F token on exchanges, facilitating price discovery and seamless trading. All liquidity allocations will be unlocked at TGE.

Token Use Cases

F token holders will enjoy various utilities and rights within the ecosystem. Initially, there will be three main use cases:

● Voting rights and participation in governance: F token holders will become key drivers of the SynFutures ecosystem. The tokens they stake will directly translate into voting power, which can be used to vote on various proposals.

● Airdrop reward enhancement: Staking their tokens to increase the incentive accumulation rate for future airdrops.

● Fee discounts and rewards: Depending on the amount and duration of staked tokens, F token holders will be eligible for fee discounts and potential future rewards.

It can be seen that the largest circulation of SynFutures after launch will primarily be the 7.5% allocated for community airdrops, along with 3% for providing liquidity on exchanges.

The total supply of SynFutures token F is 10 billion, with an initial circulation of 1.2 billion. Currently, the leading player in the sector, Hyper, has a fully diluted valuation (FDV) market cap of $3.6 billion, with an FDV of $13.4 billion. If calculated based on a seven-day trading volume of 6 times, the circulating market cap of F would be $600 million, with a price of $0.5. However, this may be the upper limit for F's price. Considering that there will be 750 million tokens airdropped at TGE, if priced at $0.5, the airdrop would need to reach $400 million, which may not be sustainable in the short term.

If the opening price is around $0.1, then the circulating market cap would be $120 million, which could be a relatively good price. When the airdrop tokens are mostly out, it may be worth considering entering the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。