Since the mainnet launch in July 2023, Mantle has become the fourth-ranked L2 by TVL, supported by an extremely large treasury of 2.6 billion USD.

Written by: Klein Labs + Web3Labs

1. Overview of Mantle

1.1 Project Introduction

Overview

The public chain track has always been the main battlefield of Web3. Since the birth of Ethereum, there have been numerous challengers. Based on Ethereum, a route dispute of L2 has emerged, leading to the current era of a hundred flowers blooming in L2. We gradually see that merely having technological innovation and high performance is not enough; a public chain is like a digital kingdom that requires a sufficiently prosperous ecosystem and a consensus among a large number of developers and users to continuously generate "tax revenue."

Mantle has emerged as a dark horse in this fiercely competitive track. Since the mainnet launch in July 2023, it has quickly become the fourth-ranked L2 by TVL, supported by an extremely large treasury of 2.6 billion USD, and has become one of the leading L2s with the momentum to become a first-tier public chain. So, how has Mantle reached this point step by step, and what greater developments can we expect in the future? We will explore this in depth in this article.

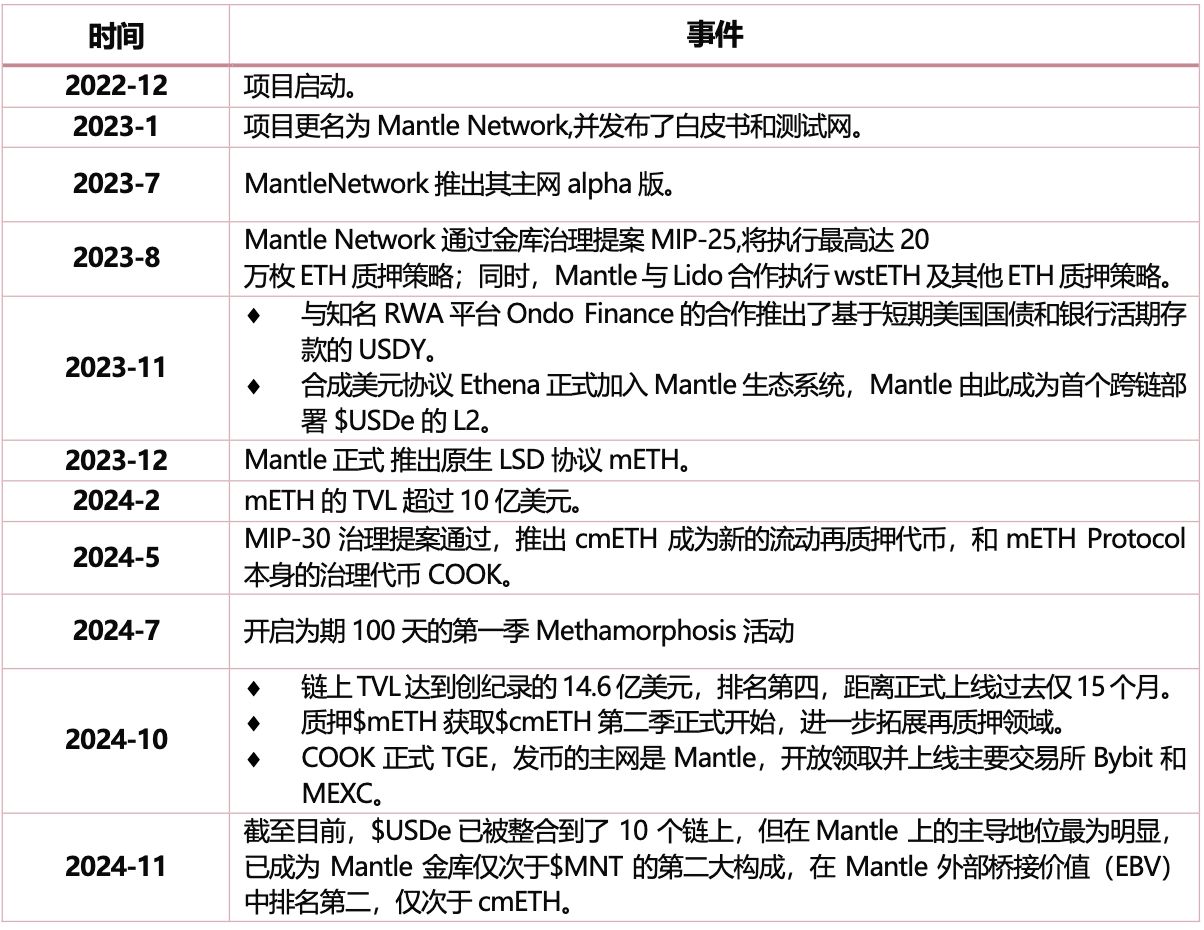

Important Development Milestones

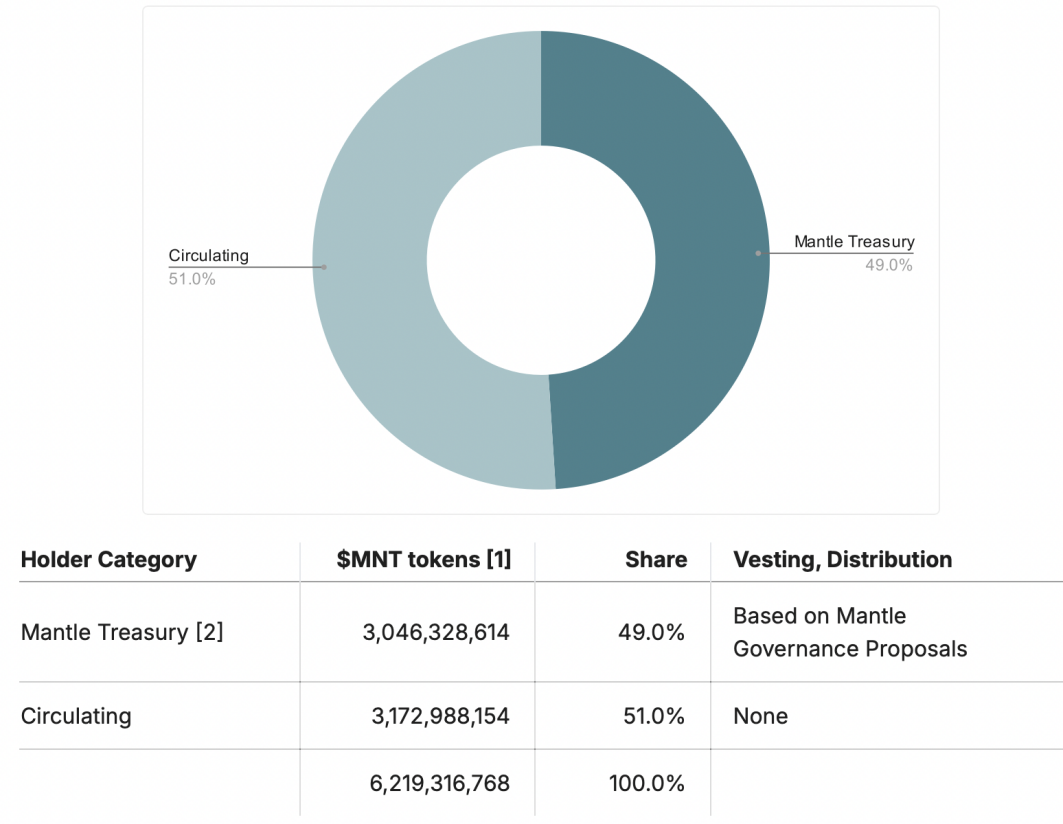

1.2 Token Economics

The $MNT token is the governance and utility token within the Mantle ecosystem, with a total supply of 6.219 billion tokens. As a governance token, each $MNT has voting rights in the Mantle governance process. As a utility token, $MNT can be used to pay for gas fees on the Mantle network and is also the main asset for Mantle rewards. This is a significant difference between Mantle and other L2s, as it consumes $MNT as gas fees, which is beneficial for the value appreciation of $MNT.

According to the initial distribution snapshot of $MNT provided by the official on July 7, 2023, the distribution of $MNT is as follows:

Source: Mantle

From the distribution chart, it can be seen that the Mantle Treasury holds nearly half of the $MNT tokens, which are "non-circulating." The allocation of $MNT tokens in the Mantle Treasury must comply with the Mantle governance process, and the budgeting, fundraising, and allocation processes follow strict procedures. After the initial distribution, the sources of $MNT in the Mantle Treasury include: irregular donations from third parties and gas fee income from Mantle's mainnet.

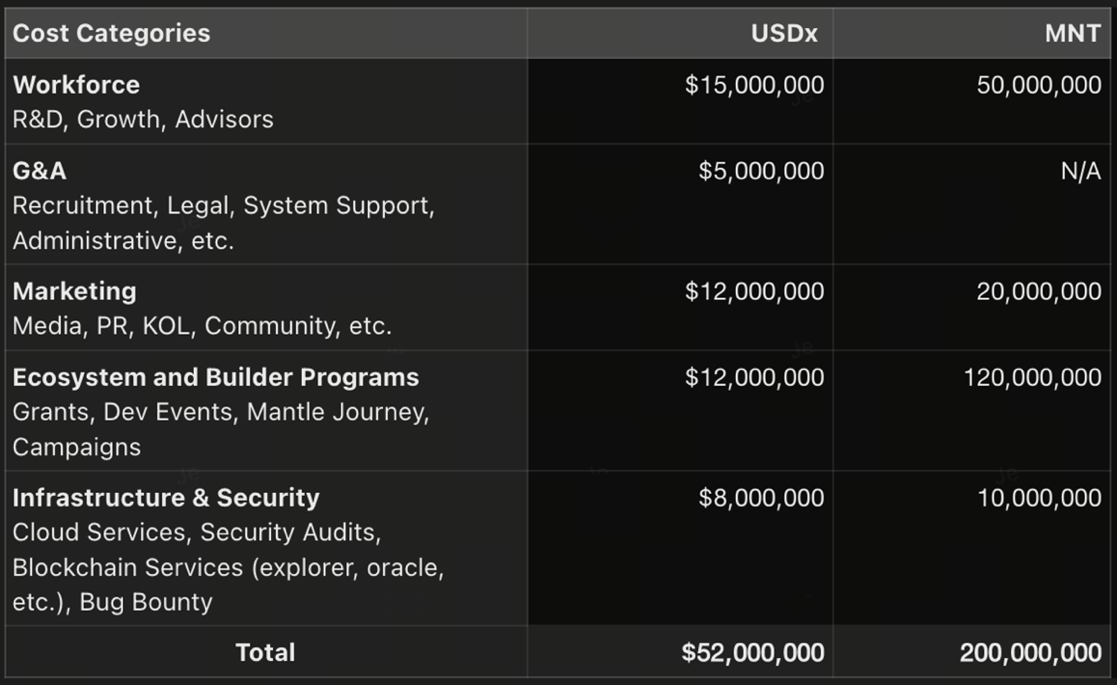

The core budget of Mantle is the main expenditure of $MNT, used for the following payments and rewards: labor, general and administrative expenses, marketing, ecosystem and builder programs, as well as infrastructure and security.

In the recently passed MIP-31 in September 2024, Mantle has planned its second budget cycle (for the 12-month period from July 2024 to June 2025), with the main expenditures being: R&D and growth (15 million $USDx and 20 million $MNT), and marketing (12 million $USDx and 20 million $MNT). In fact, Mantle has already collaborated with various marketing agencies and research entities, including well-known media and research institutions such as Bankless, Unchained Podcast, Delphi Digital, Messari, and influential thought leaders who have reported on Mantle.

Mantle's budget composition, Source: Mantle

1.3 Data Overview

Project-related Data

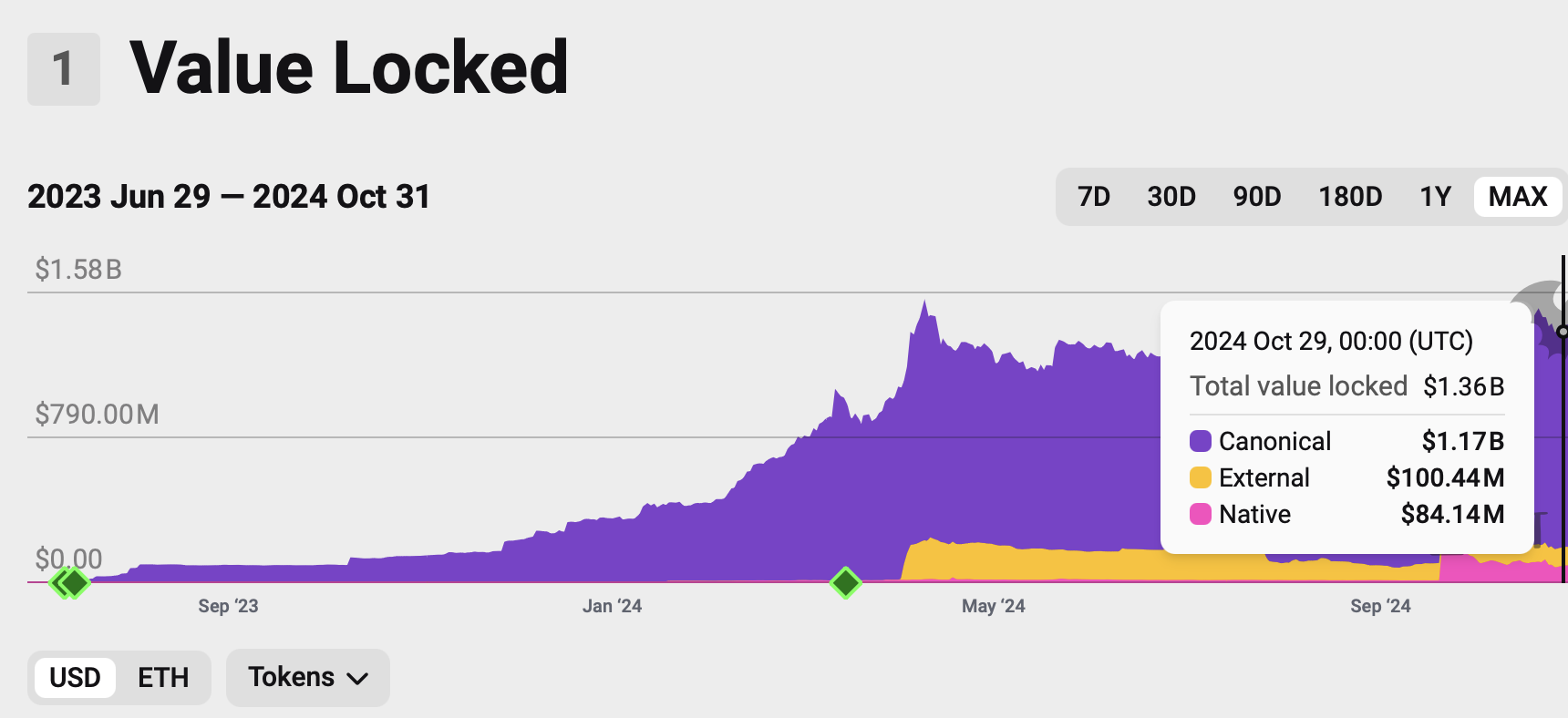

Now, let's establish a concrete perception of Mantle's growth over the past year through multiple sets of data. We know that Mantle's mainnet went live on July 17, 2023. After a period of stability, it experienced explosive growth in early 2024.

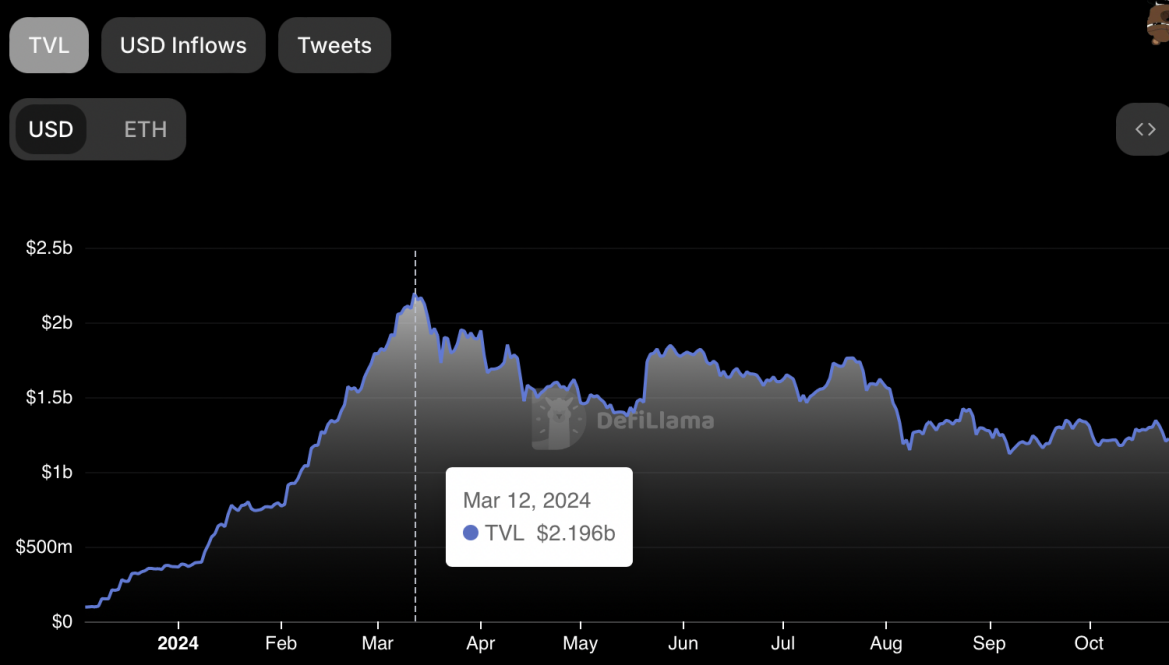

In terms of TVL, Mantle's on-chain TVL just surpassed 400 million USD in early February this year, and then it began to soar, reaching nearly 1.5 billion USD in April 2024, a growth of over 300% in just four months. As of the publication date, Mantle's latest on-chain TVL data is 1.38 billion USD, ranking fourth among L2s. As a fundamental metric for assessing L2 development, TVL largely reflects user participation, market confidence, and the health of the ecosystem. Rapidly growing TVL often represents user trust and acceptance, and is also one of the proofs that Mantle can provide stronger liquidity.

Mantle's TVL, Source: l2beat, 2024/10/31

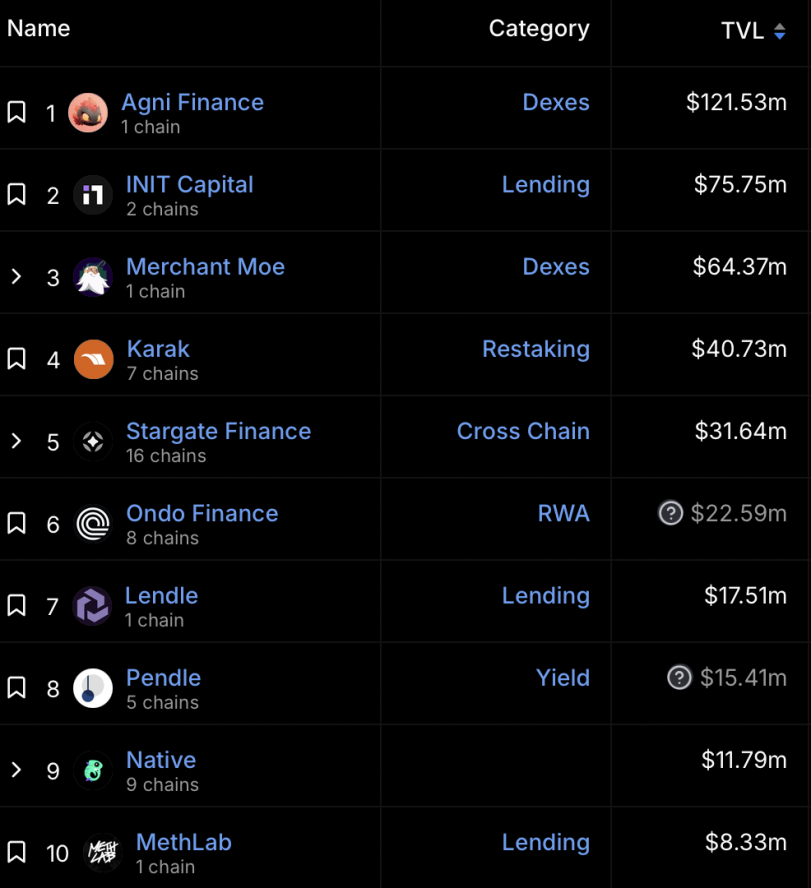

From the In-dApps TVL perspective, the DeFiLlama data dashboard provides a more intuitive observation of its ecosystem composition. It is not difficult to find that the core sources are from DeFi areas such as Dex, lending, and Restaking, with Dex TVL rapidly growing and occupying a high proportion. This also indicates that DeFi is a key focus for Mantle.

Mantle ecosystem project's TVL, Source: DeFillama, 2024/10/24

After reviewing the fundamentals of TVL, let's take a look at Mantle's on-chain activity. With more and more L2s emerging, it is like spending a lot of time and effort building highways, but due to a lack of demand, there are very few cars driving on them. This is a common problem faced by many L2s: a lack of quality applications. Therefore, measuring the prosperity of L2 through user numbers, transaction volumes, and other data is more meaningful in reality, and we can see the outstanding user activity reflected in Mantle's growth data.

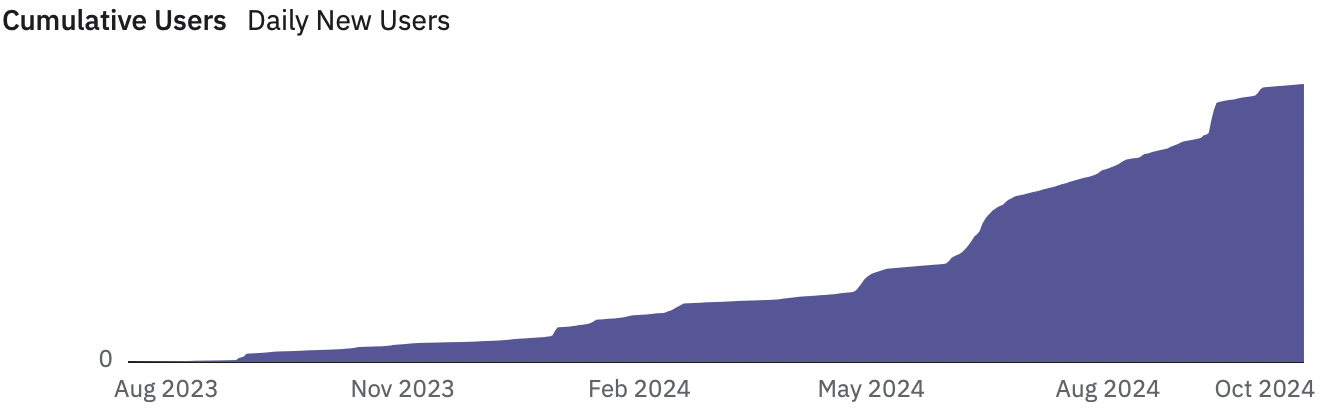

In terms of total users, Mantle had about 330,000 users in December 2023, and by October 15, 2024, the total user count had exceeded 4.42 million, a 13-fold increase in less than a year, indicating that more and more users are entering the Mantle ecosystem.

Mantle's user data, Source: Dune, 2024/10/24

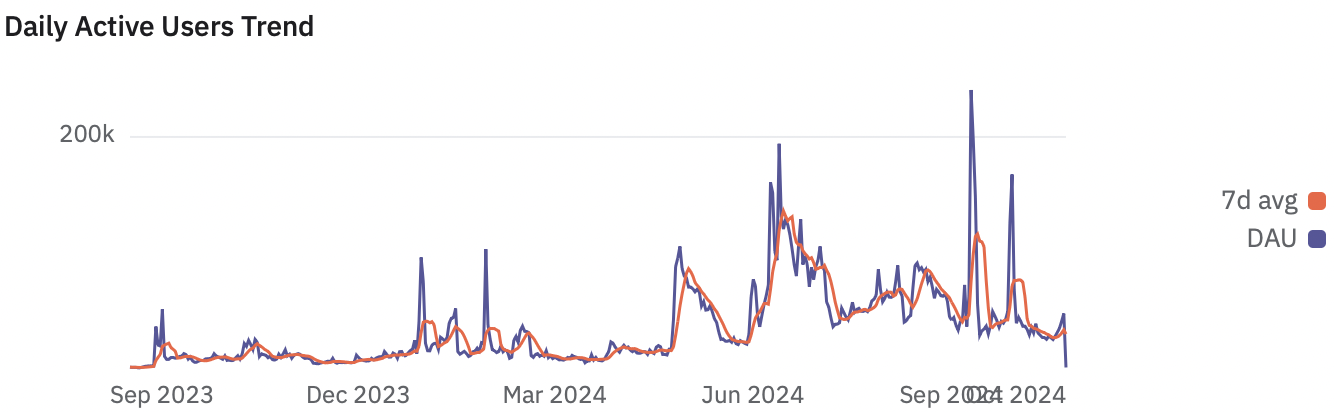

In terms of daily activity, Mantle's monthly active users saw a significant increase at the end of April 2024 and have maintained a higher average level since then. The current monthly active users are around 40,000, nearly tripling compared to the level of around September 2023.

Mantle's daily activity data, Source: Dune, 2024/10/24

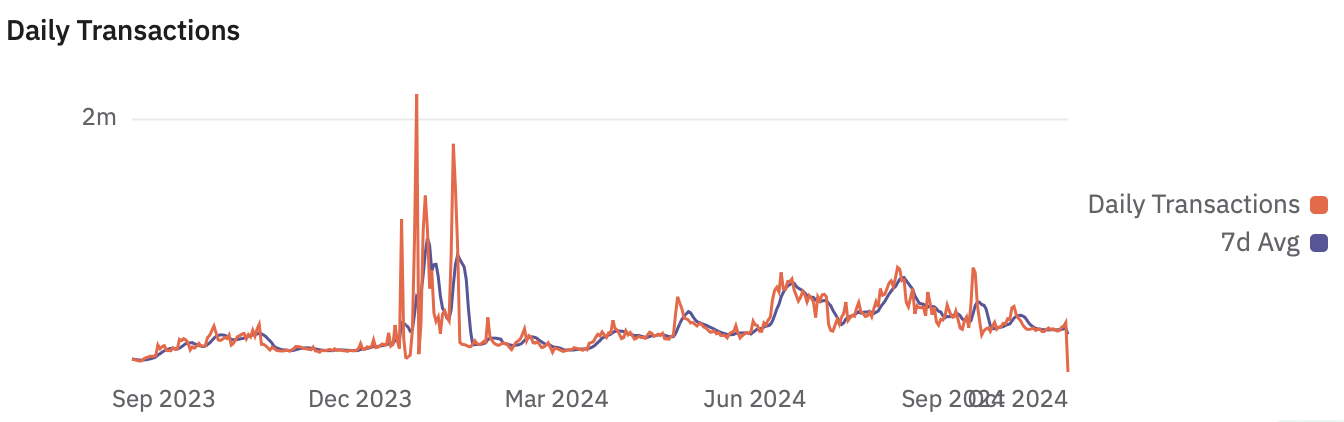

Additionally, in terms of transaction volume, as of October 23, 2024, the total transaction volume on the Mantle chain has exceeded 150 million transactions, with daily transaction peaks exceeding 2.2 million, demonstrating strong on-chain activity. The more active the on-chain transactions, the higher the network's transaction fee income, which largely represents the network's stronger self-sustaining capability.

Mantle's transaction data, Source: Dune, 2024/10/24

Social Media Related Data

As of October 24, 2024, Mantle has accumulated over 800,000 followers on X, and the community on Telegram and Discord is very active, with over 200,000 members participating in discussions, AMAs, and project updates. Currently, Mantle's Discord community has attracted nearly 440,000 members, with daily online users exceeding 10,000, making it one of the most popular channels. Meanwhile, Twitter updates are frequent and interactive.

Moreover, Mantle has conducted over 120 AMAs on its official social media channels and ecosystem channels, featuring KOLs and project team members as speakers. These include series of events such as Mantle Ecowaves and Mantle Showcase Radio, which have played an important role in promoting user participation and adoption. Additionally, Mantle's presence can be seen globally, with over 50 offline events held.

1.4 Technical Architecture Principles

L2 Rollup is mainly divided into two types: OP (Optimistic Rollup) and ZK (Zero-Knowledge Proof Rollup). Mantle Network implements an L2 scaling solution based on OP Rollup while developing its own modular component DA layer.

Modular design significantly reduces transaction costs

When we discuss modular blockchains, we must first understand the concept of monolithic blockchains. Taking Ethereum as an example, a mature monolithic blockchain can generally be divided into four architectures: Execution Layer, Settlement Layer, Data Availability Layer (DA Layer), and Consensus Layer, each with its unique functions and roles. In simple terms, Mantle's modular design processes the four key functions of a blockchain at different levels, rather than completing them on a single network layer like most monolithic blockchains. These four functions are:

Transaction Execution: Conducted on Mantle's EVM-compatible execution settlement layer, where Mantle's sequencer generates blocks on the L2 execution layer and submits the state root data to the main blockchain.

Consensus and Settlement: Managed by the Ethereum L1 network.

Data Availability: An independently developed data availability layer based on Eigen DA, allowing Mantle to submit only the necessary state roots to the Ethereum mainnet for storing callback data that is typically broadcasted to L1.

Data Retrieval: Other nodes retrieve transaction data from Mantle DA through DTL services for verification and confirmation.

In the current blockchain architecture, OP Rollup requires high Calldata fees to submit all transaction data to Ethereum's data availability layer. As transaction volumes grow, this portion of fees can account for 80-95% of total costs, severely limiting the cost efficiency of Rollups. Mantle Network has successfully reduced operational costs through its independently developed modular data availability layer. Additionally, the modular design makes it easier to integrate new technologies.

Decentralized Sequencers Eliminate Centralization Risks

Sequencers are the core role in L2 solutions responsible for collecting and ordering transactions, computing states, and generating blocks, which is crucial for the network's security. In traditional Rollup solutions, sequencers are often a single centralized node, making them susceptible to failures, manipulation, or censorship. Mantle replaces centralized sequencers with a permissionless sequencer cluster, bringing the following benefits:

Increased network availability, eliminating single points of failure and ensuring continuous network operation.

Enhanced consensus reliability, preventing manipulation or censorship of sequencers, ensuring fairness and transparency in transactions.

Improved incentive compatibility, driving compliant behavior of sequencers through reward mechanisms, ensuring the long-term sustainability of the network. In contrast, centralized sequencers face the public goods dilemma.

1.5 Competitive Landscape

The era of Ethereum congestion has created the grandest narrative. Vitalik Buterin proposed three major technological transitions that Ethereum needs to undergo in his article "The Three Transitions": transitioning to L2 scaling, where everyone moves to Rollup; transitioning to wallet security, where everyone uses smart contract wallets; and transitioning to privacy, ensuring feasible private fund transfers. Vitalik believes that without the development of L2, Ethereum will fail due to high transaction costs.

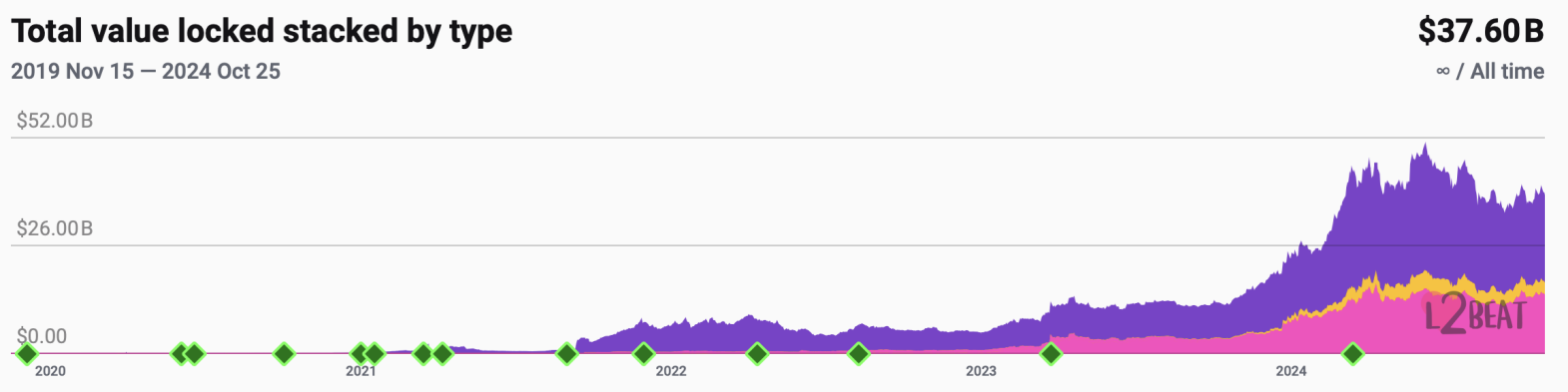

It is against this backdrop that the current L2 track is thriving. According to L2Beat data, there are currently 110 L2 or L3 scaling solutions operating in the market; however, only a few L2s have gained mainstream recognition and generated significant TVL and users. As of October 24, 2024, the TVL of L2 scaling solutions has reached 37.62 billion USD, tripling compared to a year ago, demonstrating strong development momentum and user demand.

Source: l2beat, 2024/10/25

Comparison of Mantle with Mainstream L2s

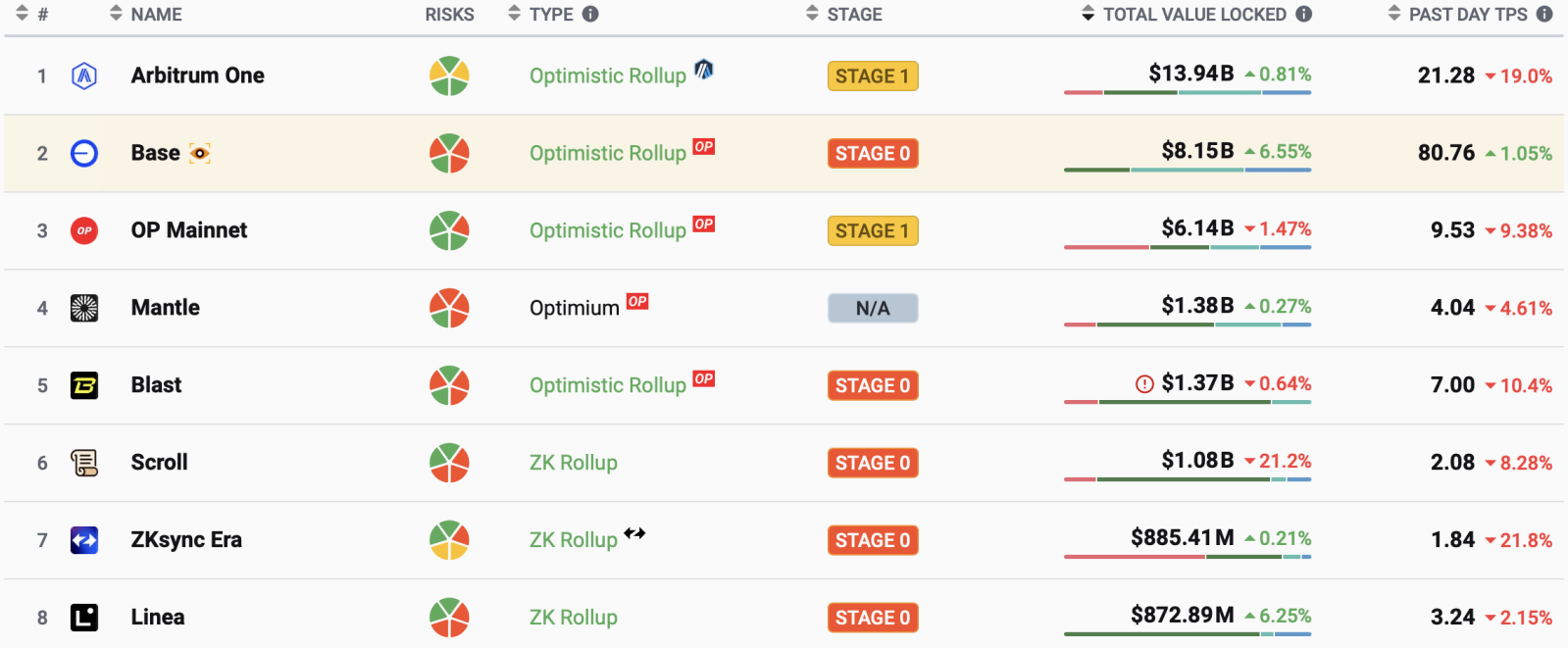

In terms of TVL, the top three are Arbitrum, Base, and Optimism, which together account for over 73% of the market share. Mantle has risen to become the fourth-largest Layer 2 just one year after its launch.

L2 TVL Rankings, Source: L2beat, 2024/10/31

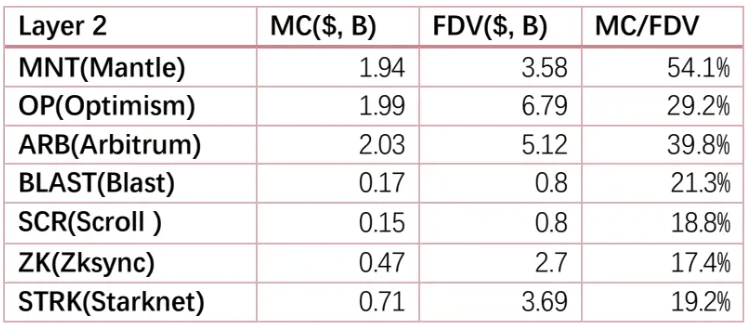

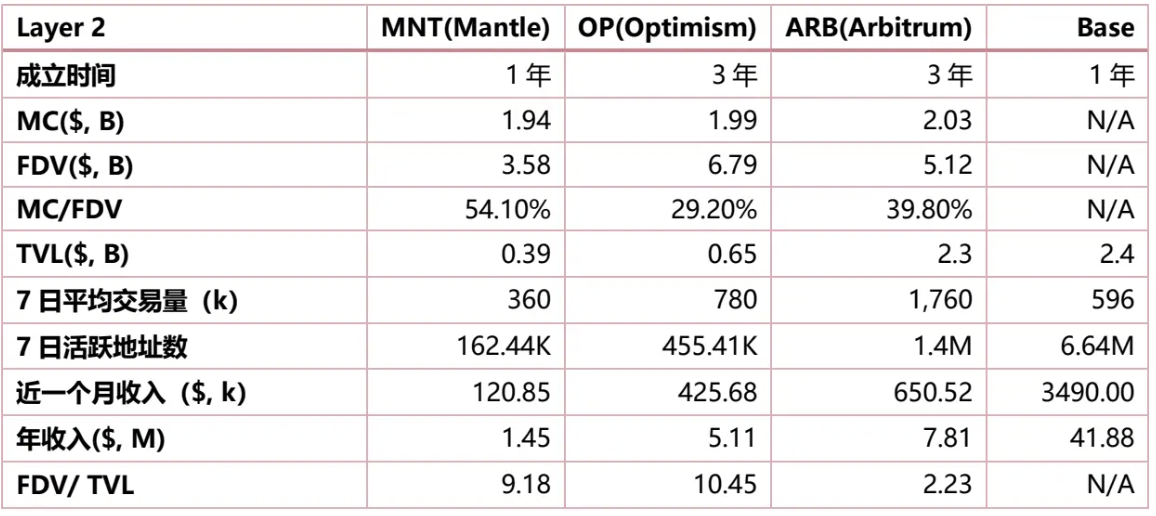

In terms of FDV, Mantle stands at 3.58 billion USD, second only to Optimism and Arbitrum. In terms of MC/FDV, Mantle ranks first at 54.1%, indicating that $MNT will face less selling pressure in the future.

Source: Coinmarketcap, 2024/10/26, compiled by Klein Labs

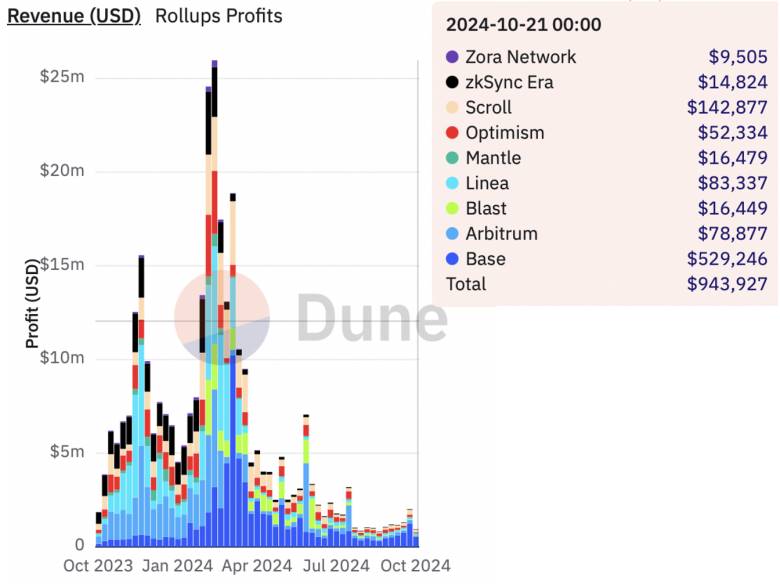

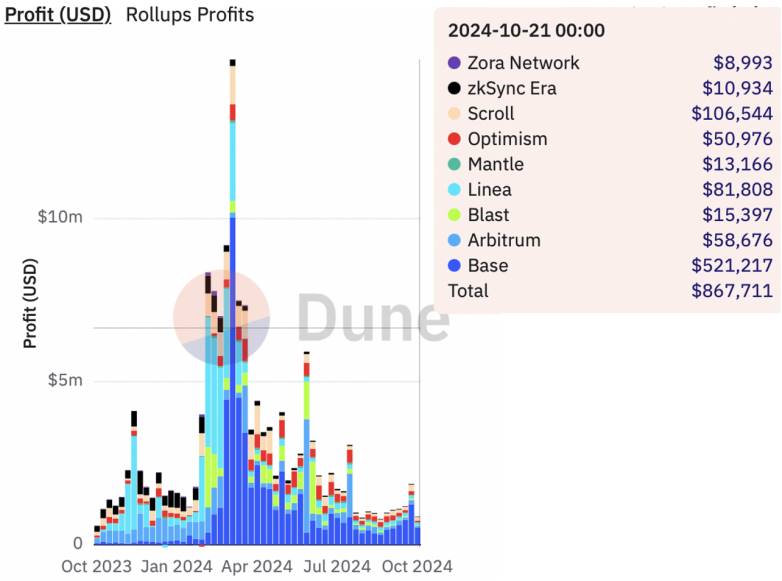

In terms of revenue and profit, Base has surpassed Arbitrum since March this year to become the most profitable L2, while Mantle remains in the top five.

Source: Dune, 2024/10/26

Comparison of Mantle with Exchange-Backed Public Chains

Mantle's early supporters include the third-largest exchange, Bybit, which gives it a unique advantage. In this section, we will also look at other L2s backed by exchanges for comparative analysis.

When mentioning exchange-supported public chains, we know that Binance incubated BNB and opBNB chains, Coinbase incubated Base, and OKX supports X Layer, among others. On October 24, the exchange Kraken also announced plans to launch its L2 network, Ink, expected to go live on the mainnet in early 2025.

Before introducing these L2s, let's take a look at the major exchanges behind them. According to Coinmarketcap rankings, Binance, Coinbase, and Bybit are the top three cryptocurrency exchanges, with OKX and Kraken ranking fourth and sixth, respectively. This means that among the top six exchanges, five support at least one public chain. This is also an important strategic choice for exchanges.

The entry of exchanges into the public chain field is not only about expanding service boundaries but also an exploration of transitioning from "off-chain" to "on-chain." This trend will guide a larger scale of users and assets to gradually migrate from centralized exchanges (CEX) to on-chain (decentralized finance, DeFi) platforms, moving the trading ecosystem towards decentralization. Public chains and exchanges share commonalities, as both require new assets to be issued and traded on them to generate revenue. The rich asset operation experience and quality industry resources of exchanges are also competitive advantages for this type of public chain.

1.5.2.1 BNB Chain

BNB Chain (formerly Binance Chain) was created in 2019. At that time, the utility token BNB, launched in 2017, migrated from the Ethereum network to BNB Chain. BNB Chain was renamed from BSC. Although it is an L1, due to its strong Binance background, we will briefly introduce it here.

BNB Chain currently has a TVL of 4.7 billion USD. Leveraging Binance's exchange background and financial support, BNB Chain has successfully established DeFi as a strong sector, with PancakeSwap being the most well-known.

Binance's funding and technical support are undoubtedly significant advantages for BNB Chain, but the close relationship with the exchange has also raised questions about its level of decentralization. For example, during the hacking incident in 2022, Binance requested all validators to pause transactions on BNB Chain to quickly control the situation. This centralized operation reflected the limited number of on-chain validating nodes at that time, meaning that most nodes were directly or indirectly controlled by Binance.

How to reasonably utilize the resources of the exchange behind it while gradually achieving on-chain governance independence and truly practicing the decentralized Web3 concept is a key issue that public chains incubated by exchanges will face.

Additionally, in Q2 2023, BNB Chain launched opBNB, an EVM-compatible L2 scalability solution based on OP Stack. According to DeFiLlama data, opBNB currently has a TVL of 21.6 million USD and is still in the early development stage.

1.5.2.2 Base

Base is an Ethereum L2 public chain incubated by Coinbase. Due to Coinbase's need to comply with SEC regulations, Base itself finds it difficult to issue tokens, which means it lacks a natural token economic incentive advantage compared to other L2s.

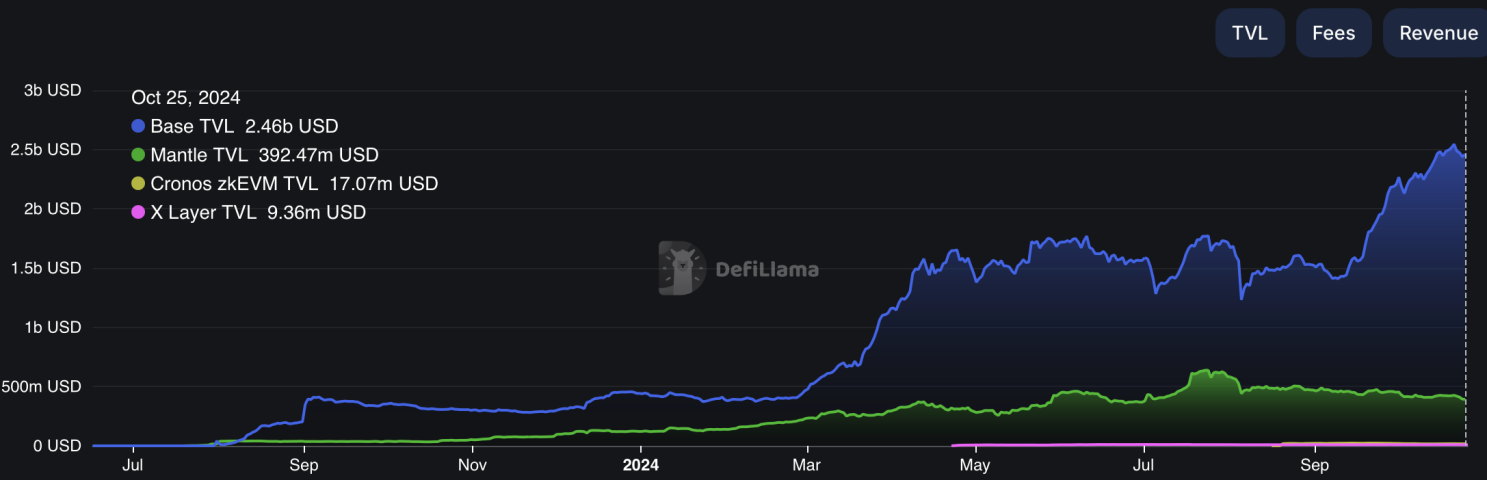

Despite this, Base has achieved remarkable success within a year of its launch, with its TVL experiencing explosive growth in April and September of this year, currently exceeding 2.4 billion USD. We have also seen innovations like Friendtech on Base.

The top five projects contributing to Base's TVL all come from the DeFi sector. Notably, the top-ranked Aerodrome Finance contributed nearly 54% of Base's TVL with 1.3 billion USD. Aerodrome launched on Base on August 28, 2023, and is a DEX based on automated market makers (AMM).

1.5.2.3 Cronos zkEVM

Cronos is a blockchain launched in November 2021 by the cryptocurrency exchange Crypto.com (ranked 13), an Ethereum-compatible L1 network, but its TVL has not seen significant improvement since its launch. Subsequently, the Cronos development team, Cronos Labs, partnered with Matter Labs to launch the zk-based L2 network Cronos zkEVM, which just went live on the mainnet in August this year.

Currently, Cronos zkEVM's TVL remains stable at around 17 million USD, which is relatively small compared to the larger chains.

1.5.2.4 X Layer

X Layer is an L2 based on zk rollup, jointly launched by OKX and Polygon Labs in April this year. X Layer uses OKB as its native token, which can be used to pay for gas fees. In future plans, X Layer will continue a series of technical architecture optimizations and scalability improvements, such as decentralizing the sequencer. X Layer currently has a TVL of 9.3 million USD.

In terms of TVL comparison, Base is relatively ahead, Mantle ranks second, while Cronos zkEVM and X Layer are still at a smaller scale.

Source: DeFiLlama, 2024/10/26

1.6 Preliminary Value Assessment

By horizontally comparing different Layer 2 networks, we can intuitively judge the ecological prosperity and valuation levels of the networks, thus better assessing the development potential of Layer 2.

Before making comparisons, we need to note that unlike other L2s that use ETH as the gas token, the MNT token is used as the gas token for the Mantle chain, which should be taken into account when comparing with other L2 networks. We mainly calculated the following indicators:

Data comparison, Source: Dune, DeFiLlama, compiled by Klein Labs, 2024/10/26

As we can see, compared to other OP Rollup track Layer 2 networks, Mantle's ecosystem is still in an early stage. However, the native token MNT has over 50% circulation, which means its future selling pressure is smaller compared to other public chains. Additionally, Mantle has achieved such high levels in hard data indicators like TVL and on-chain revenue in such a short time, giving us reason to believe that as the Mantle ecosystem continues to improve and prosper, its competitive position in the L2 track will continue to rise to a new height.

2. Mantle's Ecosystem

As Vitalik said, the ecosystem of a public chain is its killer feature. A rich and diverse ecosystem can not only attract more new users but also incentivize existing users to engage in more frequent and diverse interactions within the ecosystem. From this perspective, while the market cycle has indeed brought positive effects to Mantle, more importantly, it is the continuously enriching ecological landscape of Mantle that provides support.

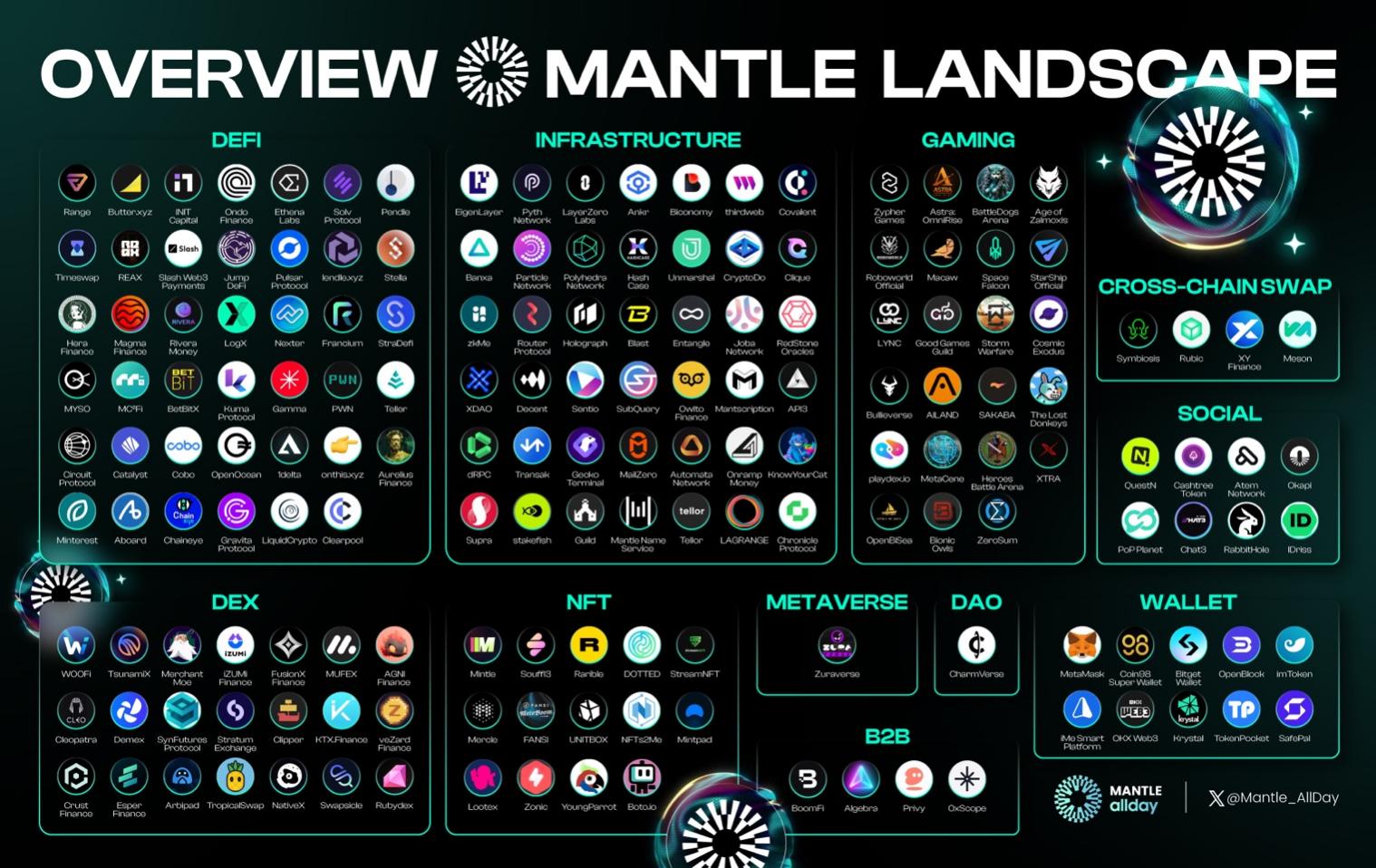

According to the latest data, the Mantle ecosystem has onboarded over 240 dApps, including 89 in DeFi, 96 in infrastructure, and 20 in GameFi. DeFi and infrastructure occupy a significant portion, reflecting the prosperity of DeFi as the infrastructure of the public chain on Mantle.

Source: Mantle, 2024/10/24

Next, we will analyze some projects in its ecosystem from these main categories:

2.1 DeFi Track

DeFi is the foundation of a public chain, and the completeness of DeFi infrastructure greatly influences the potential and upper limits of the entire ecosystem's development. Among Mantle's DeFi projects, 36 are DEXs, while the rest include lending, re-staking, and more. Below are some of the projects we will introduce:

2.1.1 Agni Finance

Project Introduction: Agni Finance was established in 2023 and is Mantle's native AMM-based DEX, currently ranking first in TVL on Mantle (121 million USD), with a total trading volume of 3.92 billion USD. Agni currently offers 6 currencies and 20 trading pair services, with its most active trading pair being METH/WETH. According to CoinGecko, Agni's latest 24-hour trading volume is $4.36M.

Agni Finance's TVL saw a doubling surge in July this year and has since stabilized at over 100 million USD, achieving a doubling growth compared to Q2.

X: @Agnidex

2.1.2 INIT Capital

Project Introduction: INIT Capital was established in 2023 as a platform for dApp and user interaction, providing permissionless access to a unified liquidity pool and efficient yield management. As a DeFi liquidity infrastructure, INIT offers various activities, including lending and yield strategies. INIT is now live on Mantle & Blast. As of the time of writing, INIT Capital's market size has reached 110 million USD, with total loans exceeding 24 million USD.

INIT Capital announced the completion of a $3.1 million seed round financing at the end of February 2024, led by Electric Capital and Mirana Ventures.

X: @InitCapital_

2.1.3 Merchant Moe

Project Introduction: Merchant Moe is a DEX established in 2024, a product under Trader Joe, designed and built specifically to serve the Mantle ecosystem and community. It went live on the mainnet in January 2024, and the $MOE token was also officially launched. Currently, it offers trading services for 14 currencies and 22 trading pairs, with the most active trading pair being METH/USDT.

According to MIP-28, Merchant Moe will receive liquidity support from the Mantle Treasury. Additionally, Merchant Moe has also received seed investment from the Mantle EcoFund.

X: @MerchantMoe_xyz

2.1.4 Ondo Finance

Project Introduction: Ondo Finance is a financial protocol focused on the RWA track, primarily working within a compliant framework to tokenize high-quality assets such as U.S. Treasury bonds and money market funds for investment and trading by blockchain users. The RWA U.S. Treasury track has seen a 6-fold increase in TVL over the past year, making it a major driving force in the RWA industry. Ondo Finance's TVL has grown rapidly since April and currently ranks third in the RWA track, holding a certain first-mover advantage, with promising future development. Ondo Finance currently supports 8 chains, ranking third in TVL on Mantle, surpassing Aptos, Arbitrum, and Sui.

X: @OndoFinance

2.2 Wrapped Assets

Technically, Wrapped Assets belong to a category of DeFi, but given Mantle's significant achievements in this area and its recent sustained efforts and focus, we will analyze this segment separately.

On October 23, Bybit launched cmETH and plans to introduce the governance token COOK for mETH, quickly igniting interest across the network. Before delving into cmETH and COOK, we need to understand what mETH is.

2.2.1 mETH

mETH is a permissionless, non-custodial ETH liquid staking protocol, allowing users to obtain mETH (1:1) by staking ETH. Currently, mETH has 15,025 validating nodes, staking over 480,000 ETH.

As Mantle's native LSD protocol, mETH has achieved rapid growth since its launch on December 4, 2023, reaching a TVL of 1.22 billion USD in less than a year, making it the fourth-largest Ethereum LSD product.

Looking back at the background of mETH's birth, in June 2023, Ethereum successfully transitioned from PoW to PoS, while Lido Finance had already established a market leadership position with a TVL of 13 billion USD, followed closely by competitors like Rocket Pool (rETH), making the liquid staking (LSD) track highly competitive. For mETH, which had just undergone its first round of discussions on the Mantle governance forum, it clearly did not have a first-mover advantage.

However, after thorough community governance discussions and technical preparations, on December 8, 2023, the ETH liquid staking protocol aimed at all users was officially launched (at that time as Mantle LSP). With strong performance, mETH quickly emerged in the competitive LSD track, becoming a "new player" at that time.

According to DeFiLlama data, within a week of its launch, Mantle LSP's TVL surpassed 100 million USD, and it continued to climb, peaking at nearly 2.2 billion USD in March this year, currently stabilizing at over 1.2 billion USD, making it the fourth-largest LSD product on Ethereum. Additionally, official data shows that mETH has over 8,000 wallet users on Ethereum, while on the Mantle network, it has 26,000 wallet users, demonstrating impressive user numbers and activity.

Source: DeFiLLama, 2024/10/25

mETH holders can access various DeFi platforms for liquidity pools, yield farming, and other financial activities without needing to unstake ETH. Here are a few examples of dApps available for users:

For trading, Bybit offers mETH/USDT and mETH/ETH pairs, while NativeX provides mETH/WETH pairs and other exchange options.

In lending, INIT Capital allows users to deposit/borrow positions using ETH, Timeswap utilizes ETH as collateral, and MYSO Finance offers zero-fee swaps and customized zero-liquidation loans.

In terms of liquidity, Merchant Moe provides various liquidity pools, while Butter.xyz allows liquidity to be added to any available tokens, including ETH and MNT.

This is precisely where mETH's unique advantage lies: backed by Mantle's rich and mature ecosystem, mETH enjoys more liquidity scenarios, leading to a richer yield space and stronger demand for mETH. This healthy cycle of positive development further drives the continuous growth and prosperity of mETH.

2.2.2 cmETH

At the end of May 2024, six months after the official release of mETH, the MIP-30 governance proposal was passed, launching cmETH as a new liquid re-staking token (LRT). Specifically: mETH serves as a liquid staking token, allowing users to stake ETH to obtain mETH; while cmETH serves as a liquidity re-staking token, enabling users to re-stake mETH and receive cmETH on a 1:1 basis.

Like mETH, cmETH will be highly composable within the Mantle ecosystem (including EigenLayer, Symbiotic, Karak, Zircuit, etc.), allowing users to explore more yield opportunities through L2 and decentralized applications and protocols while retaining the advantages of mETH. Compared to mETH, cmETH's core advantage lies in covering more yield opportunities beyond basic staking rewards, including rewards from major re-staking points (airdrop expectations), re-staking AVS rewards, and more.

In short, cmETH is a choice with a higher risk-reward inclination compared to mETH, making it more suitable for users who wish to attempt to obtain higher returns within a certain risk range. Additionally, the MIP-30 governance proposal's launch of cmETH also previewed the issuance of $COOK as the governance token for mETH.

Here, we also mention the grand first season of the Methamorphosis event that Mantle began hosting in July 2024: during this 100-day event, mETH once again leveraged its ecological advantages, officially announcing 23 partners, including well-known projects like EigenLayer, Symbiotic, Karak, Zircuit, Pendle, and others. Users holding mETH can participate in interactions and complete tasks to earn rewards, which can be converted into COOK tokens in the future.

Source: Mantle

Although the first season has ended, on October 23, mETH announced that the second season of Methamorphosis is also about to begin, and undoubtedly, the Mantle ecosystem will experience another wave of explosive growth.

2.2.3 FBTC

Mantle's Wrapped Assets are not limited to ETH. In its ecosystem, FBTC, launched in collaboration with Antalpha, represents another important form of liquidity asset. Bringing BTC into the Ethereum ecosystem, WBTC was previously successful but sometimes fell into trust crises. In this case, FBTC will be a better choice.

FBTC is a full-chain Bitcoin asset, pegged 1:1 to BTC, and provides cross-chain bridging and trading functions on the Ethereum and Mantle networks, thereby enhancing the accessibility and utility of Bitcoin. By introducing FBTC, Mantle not only enriches the types of on-chain liquidity assets but also creates new options for cross-chain trading, optimizing the overall user experience.

FBTC, along with products like mETH, forms a multidimensional layout for Mantle in the liquidity and cross-chain fields, helping to build its DeFi yield ecosystem on-chain. Thanks to the support of the Mantle ecosystem, this multi-chain asset layout will propel it to become a strong competitor in the Layer 2 and cross-chain liquidity space.

2.3 Game

The head of the game sector in the Mantle ecosystem is Grant Zhang. Zhang has an extensive background in the gaming industry, having led the publishing teams for games like "League of Legends" and "Game of Thrones," with the projects he participated in accumulating over 500 million downloads.

In the layout of the gaming sector, Mantle's strategy is distinctly different from most other ecosystems, primarily reflected in the Mantle team. In other ecosystems, the development of the gaming sector is often led by excellent investors, while Mantle's gaming team is composed more of experts in game publishing and operations. Therefore, Mantle can provide its game partners with more substantial support, including token design, economic models, game publishing, financing, and user acquisition.

Moreover, although Mantle has the largest treasury in the Web3 space, it remains very cautious in selecting the games it supports. Unlike other ecosystems that may attempt to introduce hundreds of games through a "scattergun" approach, Mantle has only chosen about 7-8 games for deep cooperation, providing genuine support. As a result, the funding and support that these selected cooperative games can receive are significantly more substantial.

Below, we introduce some core game projects:

2.3.1 Catizen

Catizen is a cat-themed game mini-program built on the Telegram mini-program platform, where players can raise cats by swiping and earn rewards. According to a tweet from Telegram CEO Pavel Durov, as of July 30, 2024, Catizen has over 26 million players, just over four months after its launch on March 19, 2024.

Catizen example, Source: Catizen

In April 2024, Catizen established a strategic partnership with Mantle. However, the collaboration between Mantle and Catizen, along with its publisher Pluto Studio, dates back to August 2023. Whether in game design, token economics, user acquisition, or even collaboration with TON, Mantle has provided comprehensive support. The reason Catizen chose to collaborate with Mantle is as mentioned above: Mantle's unique team structure can provide professional and practical support for game projects, which can significantly drive the project's success—something other ecosystems cannot achieve.

For Mantle, hyper-casual games like Catizen and Tap to Earn are just the beginning. These types of games are very suitable for attracting users and can bring a massive Telegram user base into mini-games. Mantle's future plan is to develop alongside the Telegram mini-game ecosystem and continue to release more suitable game products at each evolving stage.

As of the time of writing, Catizen has over 600,000 users on the Mantle blockchain. CATI ranks first in Mantle's Natively Minted Value with 76.63 million USD.

X: @CatizenAI

2.3.2 MetaCene

MetaCene is a massive multiplayer online role-playing game (MMORPG) that incorporates Web3 elements. It combines NFTs, blockchain mechanisms, and AI technology with classic game mechanics such as PvP battles and land management. MetaCene was founded by experienced game developer Qunzhao (Alan) Tan.

As a large MMORPG, MetaCene has more complex requirements in terms of cost, rules, and economic model design. Mantle has teams like Game7, Hyperplay, Yeeha, and Community Gaming that can provide comprehensive support in user acquisition, engagement, wallet infrastructure, entry, and security, offering more practical support for MetaCene.

Notably, the founder of the leading professional blockchain gaming guild expressed that after deeply experiencing MetaCene, the game's depth of design is reasonable, and its player composition is international, which indirectly proves the game's playability.

As of the time of writing, MetaCene has over 510,000 users, with daily active users exceeding 360,000 at one point.

X: @MetaCeneGame

2.3.3 Funton.ai

Funton.ai is a new member of the Mantle ecosystem that joined in October this year. As a leading modular multi-platform in the TON ecosystem, Funton.ai aims to create a decentralized GameFi ecosystem that combines artificial intelligence and gaming, providing a one-click game generation service. As of July this year, its monthly active users have exceeded 350,000. The collaboration with Mantle will help attract hundreds of millions of Telegram users into the Mantle ecosystem. Funton.ai has also customized Flappy MNT for Mantle, allowing users to earn $MNT + FUN Points by connecting wallets containing $MNT while playing the game.

It is worth mentioning that Funton.ai has recently collaborated with several organizations, including Gate Exchange and OKX Wallet, to conduct airdrop activities for its token $FUN, further expanding its market influence and user base. At the same time, Funton.ai has entered the acceleration programs of Web3Labs and KuCoin Labs, gaining further recognition from mainstream Web3 institutions.

X: @funton_ai

3.4 Other Ecosystem Related

Mantle has consistently invested significant effort in the development of ecosystem support, setting an example among various public chains. Here are some related information on ecosystem support and activities:

2.4.1 EcoFund

The Mantle EcoFund is an ecosystem fund of up to $200 million provided by the Mantle Treasury, aimed at promoting the adoption of developers and dApps on the Mantle network. It prioritizes investments in teams building high-quality and innovative projects within the Mantle ecosystem and increases investments in potential outstanding projects when appropriate.

Currently, according to the official website, EcoFund has funded over 13 projects, including INIT Capital, Catizen, Merchant Moe, and several others that have grown into the backbone of the Mantle ecosystem.

2.4.2 Mantle Grants

To further promote the vitality of the ecosystem, Mantle has created two incentive programs:

The Mantle Scouts program, launched in April 2024, empowers 16 industry leaders to issue $1 million in MNT token grants to high-quality projects within the ecosystem to support innovative projects. This program provides mentorship, networking resources, and financial support to accelerate project success within the Mantle ecosystem.

Public Grants funding. Mantle provides grants (worth up to $20,000 in MNT) to early-stage projects to foster a vibrant developer community.

2.4.3 Game 7

As gaming is a key focus for Mantle's ecosystem development, Mantle has partnered with Game7 to launch a game accelerator program. Based on the Mantle Network infrastructure, Game7 provides essential tools for game developers, such as NFT marketplaces, cross-chain bridging, and game DAOs, to offer a high-quality user experience and ecosystem connectivity for the games they incubate and invest in. Both parties are committed to promoting the development of a permissionless and interoperable gaming world.

2.4.4 Sozu Haus

In terms of developer activities, Mantle has sponsored and hosted 26 hackathon events globally, along with numerous technical seminars and online AMA sessions. Over 900 hackathon projects have been submitted. Mantle has also organized six exclusive Sozu Haus events (Mantle's mini-accelerator and maker space program) while hosting large global crypto events to attract top founders and developers.

2.4.5 Other Ecosystem Partners

Beyond its own vast ecosystem, Mantle is also actively collaborating with other partners in the industry. These partners not only support the expansion of the Mantle ecosystem but also provide technical and liquidity resources in areas such as capital support, user traffic, development resources, market trust and industry endorsement, and developer education.

For instance, Mirana Ventures continuously provides funding and resource support for the Mantle ecosystem. Mirana Ventures was also shortlisted as one of the Top 100 investment institutions by RootDada in 2023. Its fund manages tens of millions of dollars and has established and incubated multiple projects. Representative investment projects include TON, Morpho, Zircuit, Story Protocol, and more. Additionally, Mantle is the only technical partner of Eigenlayer.

In the developer community, Moledao is also a supporter of the Mantle ecosystem. Moledao is dedicated to providing resource connections and support for early Web3 projects and developers. Through a series of public welfare courses, hackathons, and other offline activities, Moledao has helped Mantle connect with and attract numerous outstanding blockchain projects and developers. As a developer community, Moledao continuously provides technical innovation support and talent reserves for Mantle, helping it rapidly build and improve its blockchain ecosystem.

2.4.6 Ecosystem Incentives

Mantle's massive treasury (nearly $3 billion, the second largest globally) is the greatest source of confidence for Mantle. The PoS interest income from the treasury can be directly returned to users, such as through the restaking rewards from EigenLayer, which can serve as ecosystem incentives. This reward mechanism significantly increases user participation motivation within the ecosystem. Users can support ecosystem development through interactions or staking, while also receiving a share of the Treasury's income, making the entire ecosystem more vibrant.

3. Highlights Summary

Over the past year, Mantle has demonstrated its strong competitiveness in the L2 track through impressive growth data. For users at this stage, with the deep integration of the ecosystem and the arrival of cmETH and COOK, Mantle is poised for continued strong growth. In light of this foreseeable growth, we have the following viewpoints:

Strong endorsement from Bybit: Based on the close relationship between Mantle and Bybit, outstanding projects within the Mantle ecosystem will have the opportunity to launch on Bybit and be discovered by more investors through Bybit's recommendations. This is an attractive resource and exposure channel for dApps development teams.

Support from the world's largest treasury: The nearly $3 billion Mantle Treasury serves as a strong backing for projects built on the Mantle Network and is the greatest source of confidence for its ecosystem development. Mantle is creating a more rewarding financial and consumer-oriented on-chain application center, where interest income generated from the treasury can create additional subsidies for users.

Advantages of technical architecture: Mantle's modular design provides significant scalability and cost optimization advantages, making Mantle more flexible and open to innovation.

The fourth largest Ethereum LSD product: The top four TVL contributions of Mantle come from the DeFi sector. Achieving liquidity integration as envisioned in DeFi is crucial, and the Mantle ecosystem is committed to solving the problem of liquidity fragmentation, placing heavy bets in the liquid staking field. With advanced underlying design and strong ecosystem empowerment, mETH has rapidly grown to become the fourth largest Ethereum LSD product.

A thriving gaming ecosystem: As of now, the gaming sector within the Mantle ecosystem has launched 7 flagship products, with projects like Catizen and MetaCene performing outstandingly in their respective niches. Mantle plans to gradually release all gaming products in the coming quarters to further drive ecosystem growth.

Comprehensive support for developers and founders: The Web3 industry needs more innovation and crypto application cases. Mantle has implemented a variety of developer incentive programs, such as the Hacker House program of Sozu Haus and the $200 million EcoFund, actively seeking and supporting top developer talent. For talented, creative, and passionate developers, Mantle is an ideal growth platform.

As a Layer 2 project that is both cost-effective and aligned with future trends, Mantle has the potential to lead the development of on-chain transactions and applications, providing an ideal ecosystem for DeFi and decentralized applications. We should not only recognize Mantle's potential as a Layer 2 but also compare it within the entire public chain track, as its performance, ecosystem, and TVL have surpassed most Layer 1s. Considering its relatively short growth history, strong financial backing from its treasury, and its good performance in "doing the right thing," we have every reason to expect the surprises Mantle will bring to the Web3 world.

Perhaps the next paradigm-level innovation will happen at Mantle?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。