BTC breaks through $100,000, and we witness the moment when Bitcoin first ascends to six figures, with the market cheering wildly!

However, this initial entry into the six-figure throne brings not only excitement but also showcases the cruelty and bloodshed of the capital market!

First, let's look at the 24-hour liquidation chart. Due to a sharp drop at 6 AM to $90,500, it is estimated that some data may not have been accounted for yet. From the chart, it is clear that Bitcoin's breakthrough of $100,000 triggered FOMO sentiment, ultimately leading to a violent spike downwards that hit the market participants who chased the highs, wiping them out completely!

This is the true face of the market, unadorned and unpretentious, with spikes up and down, all in one go!

Just yesterday morning, when the market broke $100,000 and emotions were at their peak, the community founder promptly issued a clear reduction signal in the muted group:

I believe that those in the community who saw this information and strictly followed it were able to reduce more than half of their positions at the highest point, and now they can comfortably wait for new major buying points to re-enter.

Making contrarian decisions during the most frenzied market moments is extremely difficult; it requires immense market perception and technical skills. Looking back, the community fervently reminded everyone of the best bottom-fishing opportunity when Bitcoin was at $49,000 on August 5, during the most panic-stricken times, and firmly reduced positions when the market sentiment was high at $100,000. I believe that facts speak louder than words, and no further explanation is needed!

Returning to the current market situation, Bitcoin's surge past $100,000 created a trap for buyers, followed by a severe counterattack. The market chose the most opportune moment to raise the slaughter knife! Whether this will trigger a major market reversal remains unknown, but at the very least, a daily-level downward correction is hard to avoid.

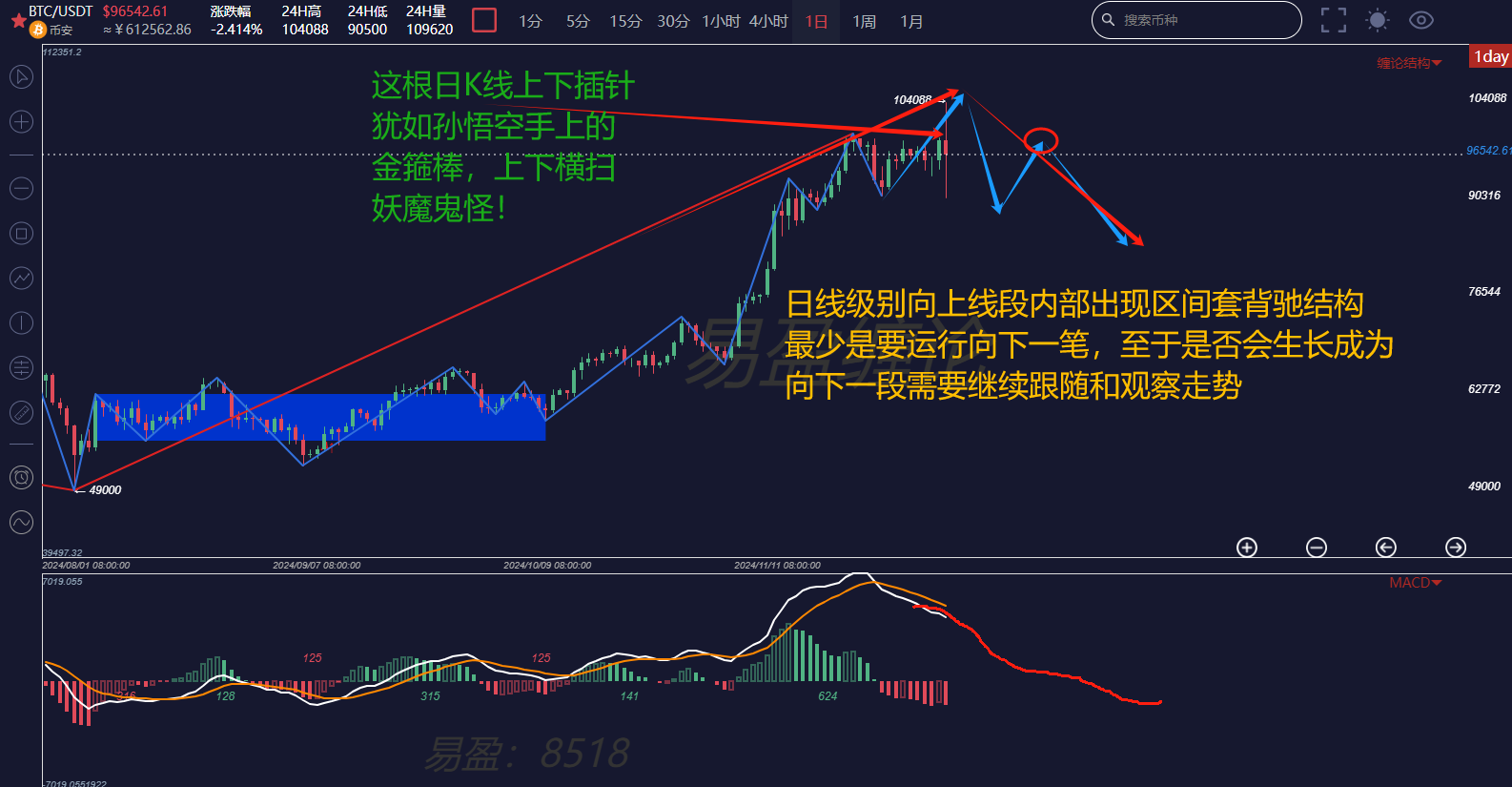

Looking at the daily chart, yesterday's daily candlestick was like the golden staff in Sun Wukong's hand, sweeping away the monsters in the market! This spike is highly likely to trigger at least a downward correction on the daily chart. Since Trump was elected president, the market has not had a proper correction, which is unhealthy. The bullish momentum will eventually come to an end; through violent washouts at high levels, followed by consolidation, the foundation can be solidified, allowing Bitcoin to reach even greater heights.

Now looking at the 4-hour chart, it is clear that yesterday morning's surge past $100,000 did not see significant volume, representing a classic trap for buyers: three buys turning into one sell! Moreover, the yellow and white lines and the green bars are diverging. This morning's spike reached the lower edge of the new 4-hour yellow central zone. If a sell occurs and breaks below the central zone, the market needs to be cautious.

Regardless, the market has just begun to show signs of correction, and it is still early to re-enter for replenishment. We should wait for the internal structure of the next downward segment on the 4-hour level before making any decisions.

Reflecting on the recent daily video analysis strategies from this account, from the one-hour level's second sell to reduce positions, to the second sell turning into a third buy to replenish positions, and then to yesterday's reduction at the high of $100,000, each wave of rhythm has been perfectly executed!

The above analysis is for reference only and does not constitute any investment advice!

Friends, if you are interested in the theory of trading, want to obtain free learning materials, watch public live broadcasts, participate in offline training camps, improve your trading skills, build your trading system to achieve stable profit goals, and use trading techniques to escape peaks and bottom-fish in a timely manner, you can scan the QR code to follow the public account and privately chat to get and add this account's WeChat!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。