Macroeconomic Interpretation: Federal Reserve Chairman Jerome Powell recently expressed a series of important viewpoints. He pointed out that over time, the Federal Reserve will gradually move towards a more neutral interest rate, and the rate cut in September is a strong support for the labor market. He also emphasized that U.S. debt is on an unsustainable path, and it is too early to assess the impact of Trump's tariffs and other policies on the economic and interest rate outlook, while ruling out the possibility of a so-called "shadow Federal Reserve Chairman," indicating that the Federal Reserve was created by Congress to act on behalf of all Americans, free from political interference.

Powell's latest remarks also included the following key points: First, the U.S. economy is in good shape, with little downside risk in the labor market, strong economic growth, slightly elevated inflation, and the Federal Reserve will be more cautious in seeking a neutral point. Second, he is confident in working well with the new administration, and once Becerra is in office, he will establish a relationship similar to that with other Treasury Secretaries, believing that the concept of a "shadow Federal Reserve Chairman" is fundamentally impossible. Powell also compared Bitcoin to gold, pointing out its virtual characteristics and high volatility, stating that it is not used as a payment or store of value tool, thus not a competitor to the dollar, but rather competing with gold.

Powell's statements reflect the Federal Reserve's assessment of the economic situation and policy tendencies, with an optimistic attitude towards the economy and a pursuit of neutral interest rates providing some policy guidance to the market. Bitcoin surged significantly due to Trump's nomination actions, demonstrating the influence of policy on the cryptocurrency market. Last night, Trump announced the nomination of cryptocurrency supporter Paul Atkins as the next Chairman of the U.S. Securities and Exchange Commission (SEC). Following this announcement, Bitcoin accelerated its rebound, with prices rising from around $95,000 to $99,000, peaking during the day at approximately $104,088.

From the perspective of economic data, the Federal Reserve's Beige Book shows that economic activity has slightly increased in most regions of the U.S., businesses are more optimistic about future demand, employment levels are stable or slightly increasing, and consumer spending is generally stable. However, the November "small non-farm" ADP report showed an addition of 146,000 jobs, the lowest in four months.

The Federal Reserve's Beige Book indicates slight economic growth but a slowdown in job additions, which requires a comprehensive view of the economic development trend. The strong performance of U.S. stocks reflects market confidence in the economic outlook, but the decline in U.S. Treasury yields may suggest some divergence in market expectations for future economic growth.

We believe that the Federal Reserve's policy direction, the strong performance of the U.S. economy, and the volatility of global assets together paint a complex and changing economic picture. While maintaining its independence, the Federal Reserve is trying to find a balance between supporting economic growth and controlling inflation. The strong growth of the U.S. economy and moderate growth in the labor market provide confidence to the market but also raise concerns about inflation and debt. The performance of global assets, especially the rise of cryptocurrencies, reflects market interest in emerging asset classes and expectations for future economic prospects. These factors will collectively have a profound impact on the global economy and financial markets.

Performance of Major Global Assets: The U.S. stock market performed excellently, with the Dow Jones Industrial Average rising 0.69%, closing above 45,000 for the first time, the Nasdaq rising 1.30%, and the S&P 500 index rising 0.61%, with all three major indices reaching historic closing highs. Large technology stocks generally rose.

In global assets, Trump's nomination of a pro-cryptocurrency SEC chairman candidate prompted Bitcoin to break through the $100,000 mark. The U.S. dollar index fluctuated above the 106 level, ultimately closing up 0.01% at 106.33. U.S. Treasury yields declined, with the two-year Treasury yield closing at 4.132% and the ten-year Treasury yield closing at 4.182%.

BTC Analysis: In the analysis written yesterday afternoon, it was mentioned that "the BTC four-hour chart is operating on an upward trend line, with the current trend line short-term support roughly coinciding with the trend indicator, currently running around 94,000-94,500, indicating a bullish trend if above this level." Bitcoin's lowest point early this morning also reached the upward trend line support near 94,587 before rebounding, aligning with the prediction. The overall rhythm also closely follows the trend of the three major U.S. stock indices reaching historic highs. After Bitcoin reached a historic high, there are no reference resistance levels above, and the right-side trend-following strategy can consider buying on pullbacks. Currently, the funding rate is very high, reaching a level of 0.1% across the network, and be aware that there may be a pullback due to long positions being liquidated and speculative short positions before settlement. The bullish support position continues to reference the four-hour upward trend line, which has currently roughly moved up to around $95,000-$95,500.

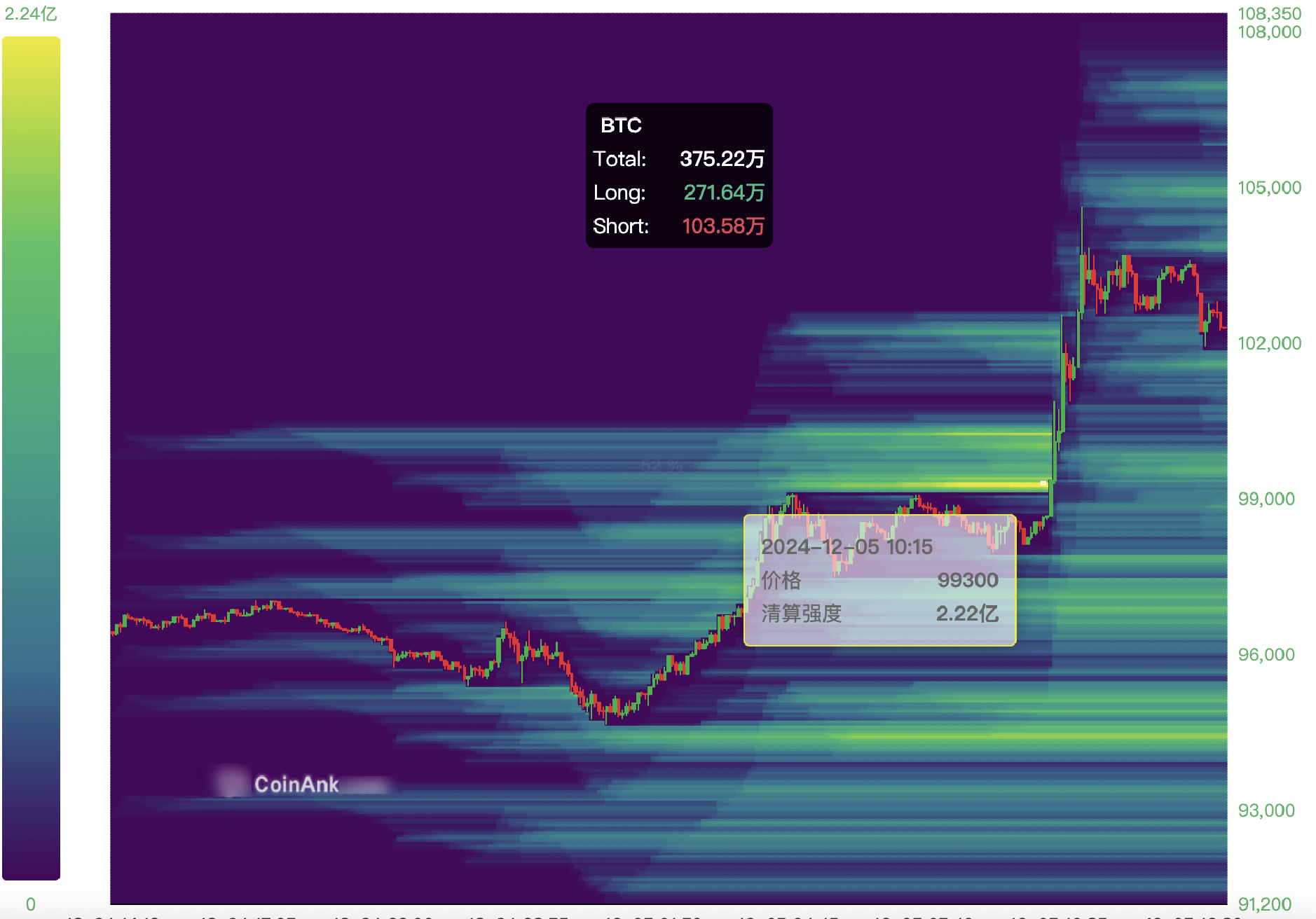

Current liquidation data shows that there are two relatively dense liquidation areas below in the short term. If the price drops to around $100,250, $205 million in positions will be liquidated; if the price drops to around $99,300, $222 million in positions will be liquidated. These can be used as references for risk control or entry points.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。