Why should we allocate some $ASTR in this bull market cycle?👀

Bitcoin has already reached $100,000. For those who missed the first wave of the upward trend and are still looking for low-position Alpha targets, pay attention.

Today, let's talk about Astar, which is transforming from a Japanese national chain to Sony's Web3 business ecosystem, and its native protocol token $ASTR.

1⃣ $ASTR: An "Interesting" Alpha Asset

First, let's look at some data and charts that traders find more attractive than http://pump.fun live broadcasts:

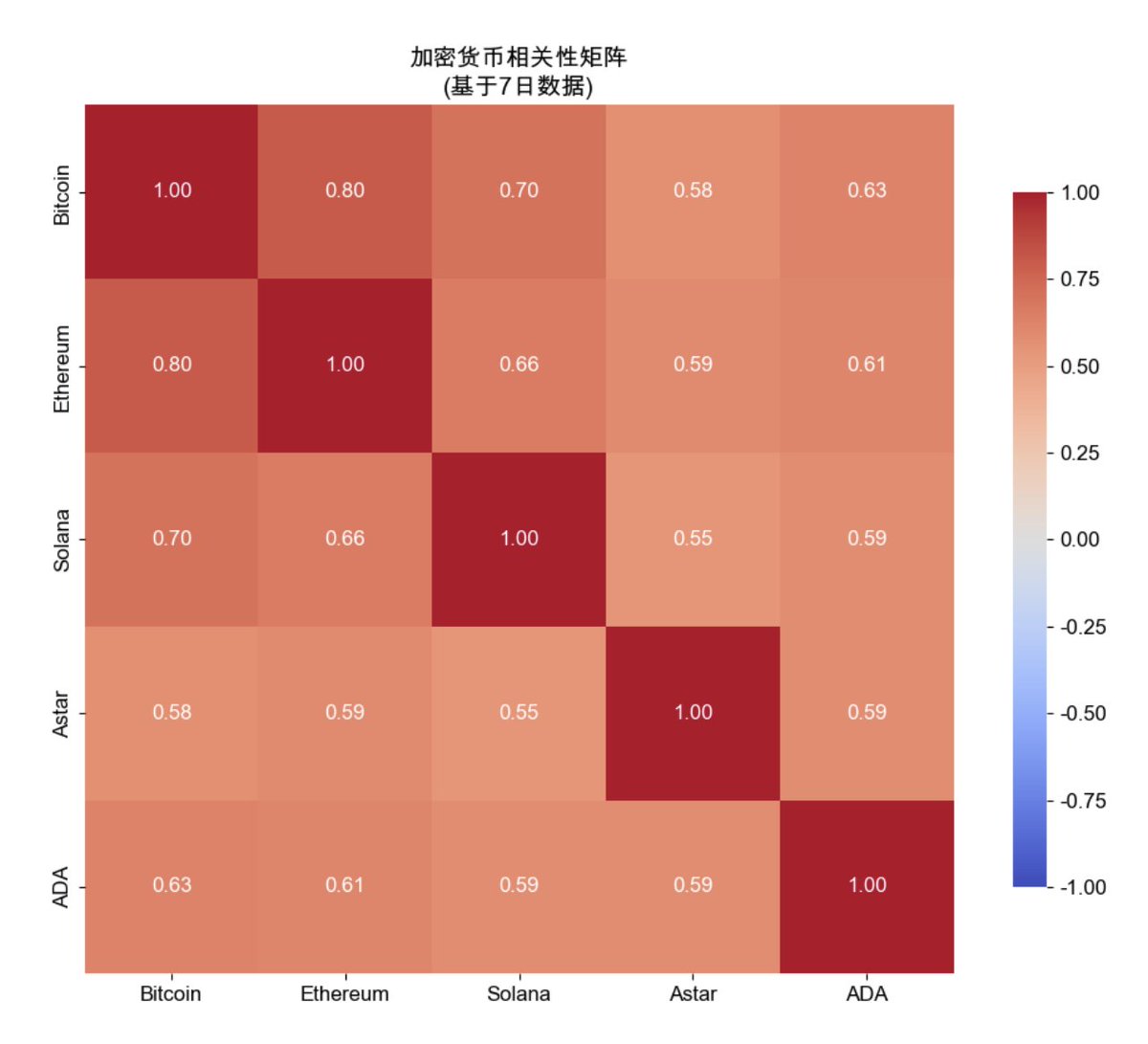

Correlation statistics of $ASTR with Bitcoin:

Ethereum Solana Astar ADA

Average Correlation 0.769 0.694 0.643 0.709

Maximum Correlation 0.994 0.995 0.978 0.992

Minimum Correlation -0.277 -0.636 -0.687 -0.381

Correlation Standard Deviation 0.216 0.281 0.289 0.249

Current Correlation 0.579 0.180 -0.200 -0.162

From the above data and the correlation heatmap, we can see:

-- Mainstream coins generally have a correlation with BTC above 0.7 (ETH 0.769, SOL 0.694)

-- But $ASTAR has only an average of 0.643 over the past year, with a large fluctuation range (-0.687 to 0.978)

-- Recently, it has played out differently, with its correlation to BTC dropping to -0.200, starting to move independently.

We know that in a crypto market where sectors are interconnected, low Beta + high volatility often means more opportunities for price discovery.

Interestingly, this is precisely the reason that BlackRock and "Stone Sister" used to persuade Wall Street's old money to allocate to BTC.

2⃣ Sony's "Backdoor Listing": An Undervalued Transformation Story

But what’s truly interesting is not the market data characteristics of $ASTAR, but the transformation Astar is undergoing: from an ordinary Layer 1 project to an Infra+ new collaborative entity supporting Sony Group's Web3 business.

Astar's role has also shifted from "Japanese national chain" to "Sony Web3 ecosystem token."

You might ask, what’s special about this narrative?

Let me share three facts:

-- Astar and Sony jointly established Soneium (Sony Chain), which is Sony's official foothold in Web3.

-- 70% of Sony's revenue comes from IP (movies, music, PS5), and monetizing through Web3 is a major trend.

-- ASTR will serve as the core asset of the Soneium ecosystem and is currently the only tradable "Sony Web3 concept stock."

In fact, there is no second "Sony Web3 concept stock" that can be traded in any financial market globally.

If MSTR is the Warp version of BTC traded in the US stock market, then $ASTAR can be seen as the Warp version of Sony's Web3 business traded in the crypto market.

How to play this game?

Sony's path is very clear:

-- Build a public L2 (Soneium) on Ethereum, rather than a company chain or consortium chain;

-- Deploy top-tier infrastructure (Chainlink/LayerZero) to ensure security, liquidity, and interoperability;

-- Bring real users through IP monetization and distribution channels, forming a grounded business with real revenue and cash flow;

And all the ecological value will be embedded in the ASTR token.

However, the market seems not to fully understand this reverse Wrap (Sony Web3 business) logic. Just like before BTC soared, MSTR also went through a "value undervaluation period."

3⃣ Opportunities and Risks Coexist

Bullish Logic:

Scarcity: The only Sony Web3 concept token in the entire market.

Time Window: Important milestones are concentrated in 2024-2025.

Valuation Reasonable: Market cap is still in the mid-range of the L1/L2 track.

Strong Defensiveness: As Japan's "national chain," the fundamental base is solid.

Risk Factors:

Ecological construction may fall short of expectations.

Market sentiment fluctuations.

Uncertainty in Web2 giants' layout in Web3.

4⃣ Final Thoughts

In the past bull market, we witnessed too much "concept hype." But this time is different. With the election of the "King of Understanding," Musk's cabinet appointment, the introduction of a crypto legal compliance framework, and the large-scale adoption of Web3 will arrive simultaneously.

The previous approach of building infrastructure for To Vitalik and To Binance will become a thing of the past. The future tracks that the market generally favors, such as chain abstraction, PayFi, CeDeFi, AI Agent with Crypto Wallet, etc., all need to be To consumers and Go To Market.

Sony is deploying the most expensive infrastructure and investing the most core IP resources… This is not just storytelling or concept hype; it is about building with real money.

And $ASTR happens to be the "ticket" to enter this game.

That’s all.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。