Track real-time hotspots in the cryptocurrency market and seize the best trading opportunities. Today is Thursday, December 5, 2024, I am Wang Yibo! Good morning to all crypto friends ☀️ Die-hard fans check in 👍 Like to make big money 🍗🍗🌹🌹

💎

💎

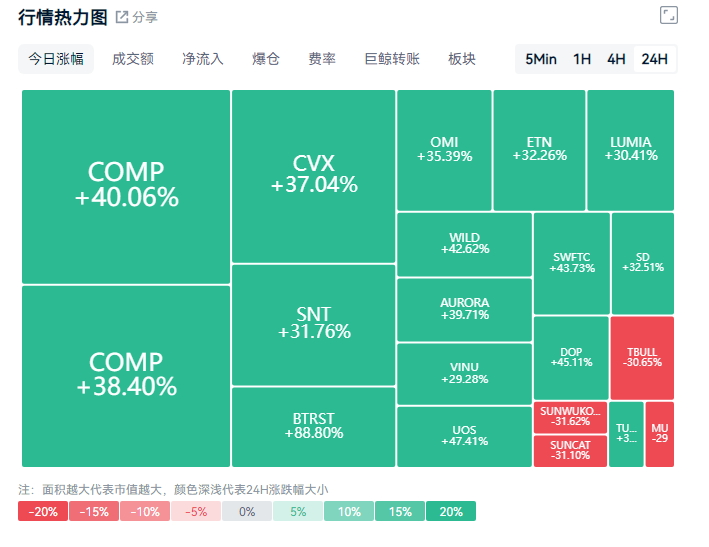

The three major indices closed higher overnight, with the Dow Jones up 0.69%, the Nasdaq up 1.30%, and the S&P 500 up 0.61%, all three indices hitting record closing highs. Last night, Powell was very clear in an interview, signaling a potential interest rate cut, stating that the current unemployment rate is still low and that cuts can continue. He also publicly endorsed Bitcoin, comparing it to gold, which can be seen as an official recognition of Bitcoin as digital gold over the years. He emphasized that the interest rate cut cycle will not change. After the news broke, Bitcoin broke through a multi-day blockade, and the cryptocurrency market once again showed a chaotic surge, with most old coins doubling in value. However, this trend may soon see sector rotation. If you blindly chase high prices during such trends, you might find yourself trapped again.

💎

💎

In this cycle, there is no talk of an altcoin season; it feels like we are constantly experiencing validation and falsification in a loop. Indeed, who could have predicted that VC coins would be so weak this year, or that after Trump took office, old coins would surge? LTC, BTC, ETH, EOS, and XRP have all seen significant increases in recent weeks. The cryptocurrency industry is so thrilling that no one can perfectly predict it; there are always surprises and shocks. Yet, during this intense surge in altcoins, many people still complain that they haven't made money; they are either trapped or cutting losses. The reason is simple: you are always out of sync with the rhythm of the market and the rotation of sectors, jumping around without believing in the power of news and narratives. The trading strategy is always probing expert predictions, but many "experts" base their analysis on moving averages, candlesticks, cycles, and various signals, without having their own trading system and rhythm. In financial markets, trading should follow the market's flow, not the rhythm of these "experts"!

💎

💎

After Bitcoin retraced to around 94,650, the bulls welcomed another rebound. With the support of the retracement, Bitcoin reached a high of 99,099 in the early morning. Bitcoin has been rising continuously, and the price has returned to around 98,000. A large bullish candle has broken through the previous resistance, indicating that today is likely to directly break through 100,000. We will continue to follow the trend to go long; in this market, any pullback can be a buying opportunity. The previous resistance has been broken, and significant movements are frequent. From an hourly perspective, the price has shown strong upward momentum. As long as the larger trend remains unchanged, all pullbacks could be seen as potential traps for shorts. This means that when the market experiences a brief pullback, one should calmly analyze the overall trend and support levels. As long as the bullish momentum remains effective, the long positions can be maintained. It is expected that there will be another wave of upward movement in the morning. Friends who haven't entered the market yet can wait for a pullback to buy in.

💎

💎

After Ethereum retraced to around 3,736 at midnight, it synchronized with an upward movement, reaching a high of 3,891 in the early morning, refreshing the high again. The price is currently undergoing a process of testing highs and facing resistance, continuously confirming the high points, with the overall trend showing a rhythm of consolidation and correction. The market space is gradually converging, and the competition within the high range is becoming increasingly fierce. In the medium term, we still need to patiently wait for the opportunity to break through. On the 4-hour chart, the price is rising around the middle track and gradually recovering the losses from the previous decline. In the short term, as long as it does not fall below the starting point, the downside will be somewhat limited, maintaining a bullish outlook.

💎

💎

In this market, ultimately, it comes down to ability. If your ability is insufficient, the market will eventually take back what it has given you. Therefore, when your wealth exceeds your ability, you need to control your drawdown. Although this control may be in vain, that kind of arrogance and hubris from profits will ultimately destroy a person's rationality. However, we do not need to worry about our wealth being below our ability in the capital market because such disharmony will eventually be corrected by time. If it has not been corrected, there is only one reason: your ability is insufficient. If you are still in a state of confusion, not understanding technology, unable to read the market, not knowing when to enter, unable to set stop losses, not knowing when to take profits, randomly increasing positions, getting trapped while trying to catch the bottom, unable to hold onto profits during volatility, and missing out when the market moves, these are common problems among retail investors. But it’s okay; you can come to me, and I will guide you to the correct trading mindset. A single profitable trade speaks louder than a thousand words. Instead of repeatedly losing, come find Yibo! Frequent operations are not as good as precise trades; let each trade be valuable. What you need to do is find Yibo, and what we need to do is prove that our words are not empty. 24-hour real-time guidance; the market is volatile, and due to the effectiveness of review, the subsequent market trends will be based on real-time arrangements. Friends who need contract guidance can scan the QR code at the bottom of the article to add my public account.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。