Stake DAO occupies 20% of Curve's boosting weight, providing optimal returns for liquidity providers (LPs).

Author: OurNetwork

Compiled by: Deep Tide TechFlow

Yield

Convex Finance | Stake DAO | Pendle

Convex Finance

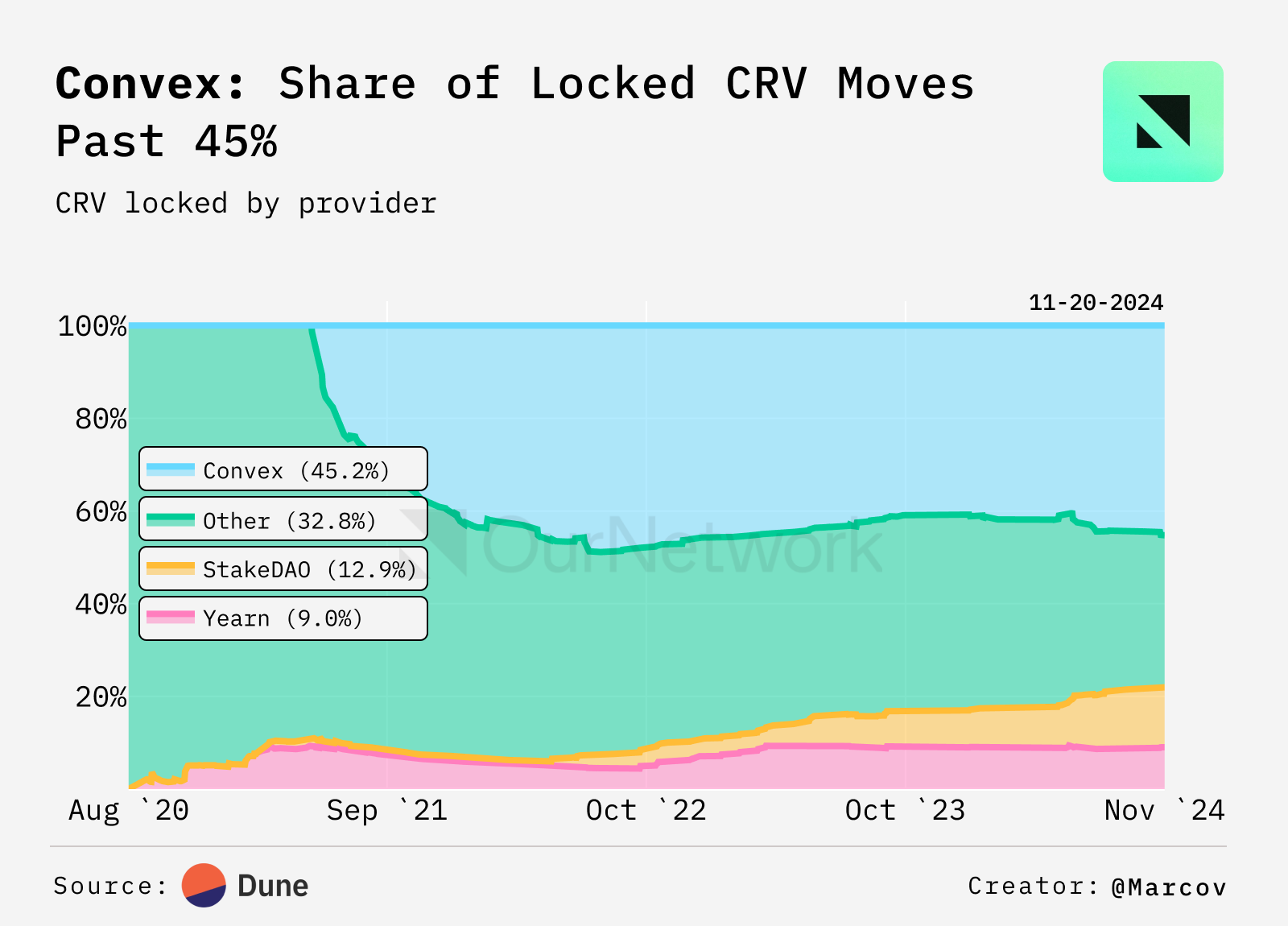

Convex Finance's veCRV market share surpasses 45%

- Convex Finance is a yield optimization platform designed specifically for Curve Finance users. Curve Finance is one of the largest decentralized exchanges (DEX) in the DeFi space, where users can lock CRV (Curve's native token) to earn protocol fees, participate in voting decisions, and boost trading pool rewards. In July of this year, the amount of CRV locked in Convex Finance saw a significant increase, but this number has stabilized in recent months, currently around 416 million. Although the total amount of locked CRV has seen limited growth, Convex's market share of locked CRV is on the rise. This is due to a decrease in the overall amount of locked CRV in the market, which has allowed Convex's share to increase to 45.6%, close to the peak of 48.9% in August 2022.

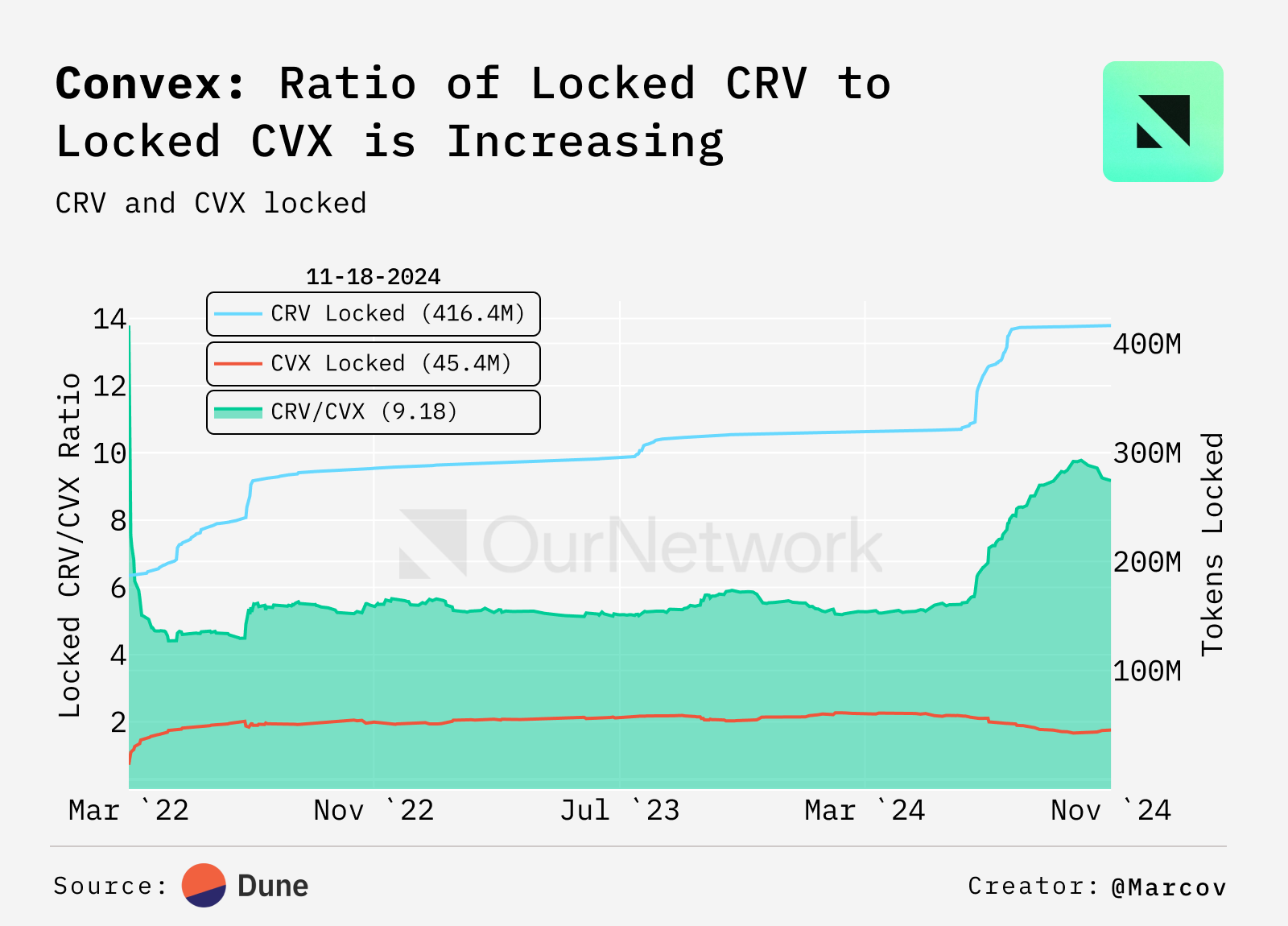

- Similar to locking CRV, Convex's native token CVX can also be locked to earn higher rewards. However, the amount of CVX locked recently has decreased, as some users have opted to stake CVX instead. Unlike locking, staking CVX offers lower rewards but allows users to unstake at any time, providing greater flexibility. This change has led to an increase in the amount of CRV corresponding to each unit of locked CVX, which reached a peak of 9.8. Recently, the amount of locked CVX seems to have rebounded, with the current value at 9.18.

- In terms of Convex Finance's total value locked (TVL), although it has significantly decreased from the peak of $20 billion in 2022, the protocol currently maintains a TVL of $1.16 billion across multiple blockchains. According to statistics from the DeFi data analysis platform DefiLlama, Convex remains one of the top DeFi protocols in the Ethereum ecosystem.

Stake DAO

Stake DAO occupies 20% of Curve's boosting weight, providing optimal returns for liquidity providers (LPs)

- In the competition among yield aggregators surrounding the Curve platform, various platforms are striving to accumulate more veCRV boosting weight. Recently, Stake DAO launched an important feature that allows veCRV holders to delegate their boosting weight to Stake DAO in exchange for a share of the earnings. This initiative attracted Curve founder Michael Egorov, who delegated 50 million veCRV boosting weight to Stake DAO, pushing its market share above 20%. This change significantly enhances Stake DAO's competitiveness in the veCRV boosting market while also strengthening its ability to provide high returns for users.

- To adapt to the new market conditions, Stake DAO subsequently updated its OnlyBoost feature. With this update, the OnlyBoost pool can integrate boosting weights from Stake DAO, Convex, and Egorov, covering 70% of the boosting supply in the market. This allows Stake DAO to provide returns for Curve liquidity providers (LPs) that are, on average, 20%-40% higher than other platforms.

- With this update, the OnlyBoost feature successfully achieves the best annual percentage yield (APY) in Curve pools. This design is implemented through smart contracts, which flexibly allocate deposits between Stake DAO and Michael Egorov's boosting weight or Convex in the most efficient manner.

- Trade Focus: To visually demonstrate how OnlyBoost provides the best returns for Curve pools, here is a recent "rebalancing" transaction example. A user aimed to optimize their alETH/pxETH liquidity position by adjusting the deposit allocation between the Convex and Stake DAO platforms to maximize returns.

Pendle

Delleon McGlone | Website | Dashboard

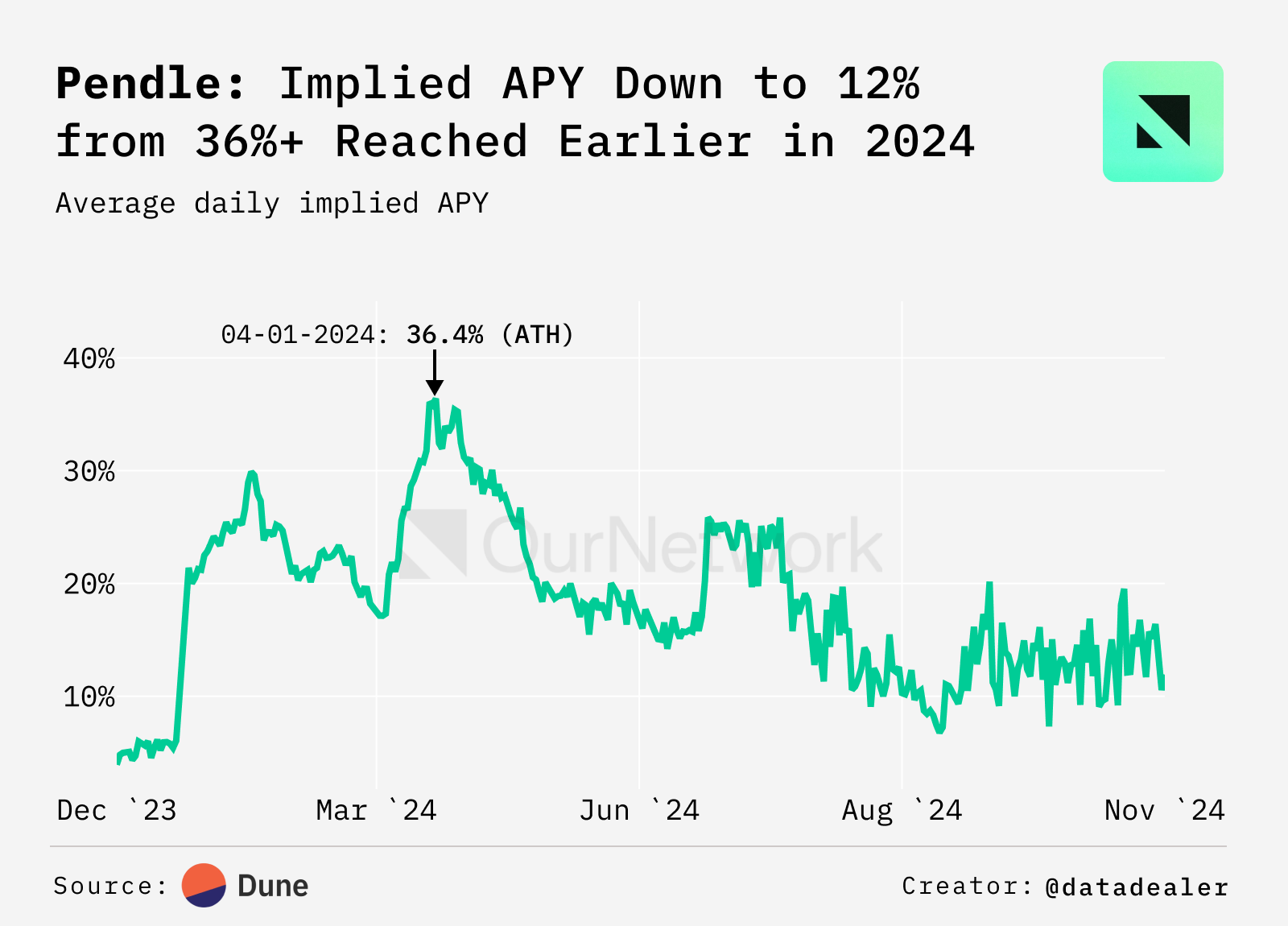

Implied annual percentage yield (APY) drops from 36% in early 2024 to 12%

- Pendle is a protocol focused on yield trading, with its core function being the tokenization of future yields and allowing users to trade them. Currently, Pendle's total value locked (TVL) is close to $4 billion, ranking first among yield protocols on the DeFi data analysis platform DeFiLlama. However, Pendle's yield on Ethereum has been quite volatile, with the average implied annual percentage yield (APY) over the past year ranging from 4% to 36%. In the last 12 days, the yield has decreased by 13%, currently sitting at around 12%.

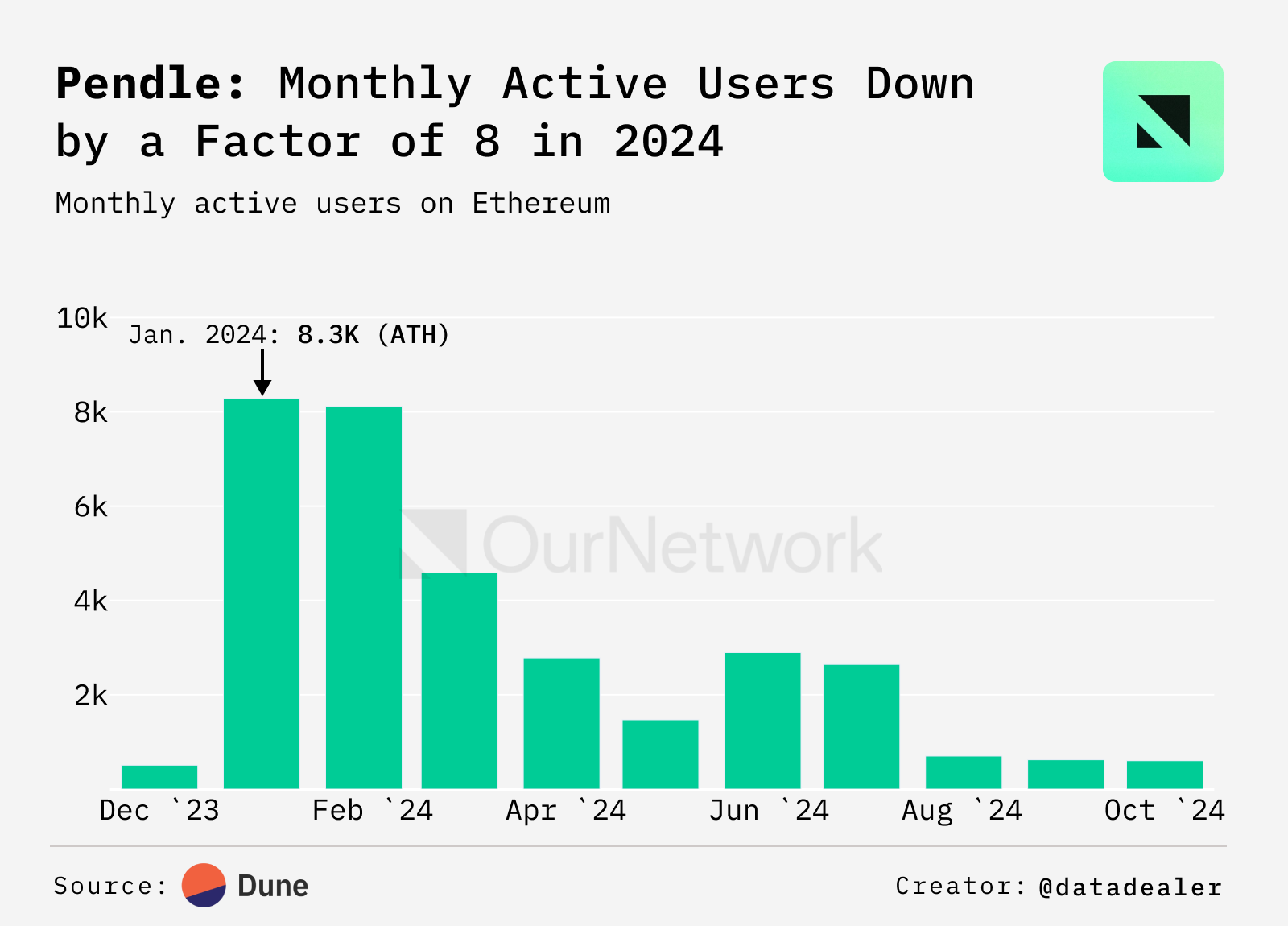

- Earlier this year, Pendle's monthly active users on Ethereum reached a peak of 8,300, but since then, the number of users has shown a declining trend.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。