Recently, the cryptocurrency market has seen several noteworthy developments, covering multiple changes in Bitcoin, XRP, and the Meme coin market. Market sentiment is stirring, and investors are closely watching how these factors will influence the future direction of crypto assets. Here is an in-depth analysis of the latest hot topics.

1. MicroStrategy Acquires Bitcoin on a Large Scale Again, Total Holdings Exceed 402,100 BTC

MicroStrategy has once again purchased 15,400 Bitcoins for approximately $1.5 billion, bringing its total holdings to 402,100 BTC, solidifying its position as the world's largest Bitcoin holder. The company has cumulatively invested $23.4 billion since 2019, with an average cost of $58,263 per Bitcoin. So far this year, its Bitcoin investment has yielded a return of 63.3%.

As institutional and national interest in Bitcoin reserves grows, the value of Bitcoin is expected to rise further.

In addition to MicroStrategy, institutional investors such as BlackRock and MARA Holdings are also increasing their Bitcoin holdings, indicating a sustained interest in Bitcoin as a reserve asset. The inflow of funds into Bitcoin ETFs further demonstrates institutional confidence in the Bitcoin market.

Microsoft shareholders will vote on a proposal on December 10, and if approved, Microsoft may include Bitcoin on its balance sheet, which would undoubtedly bring greater market recognition to Bitcoin and could serve as a significant catalyst for Bitcoin prices to break through $100,000.

Despite the generally optimistic outlook for Bitcoin's future, some analysts point out that profit-taking and large sell orders could pose obstacles to Bitcoin's rise. Additionally, the upcoming important economic data from the Federal Reserve may increase market uncertainty, requiring investors to remain vigilant.

2. XRP Market Cap Surpasses $150 Billion, Rises to the Third Largest Cryptocurrency Globally

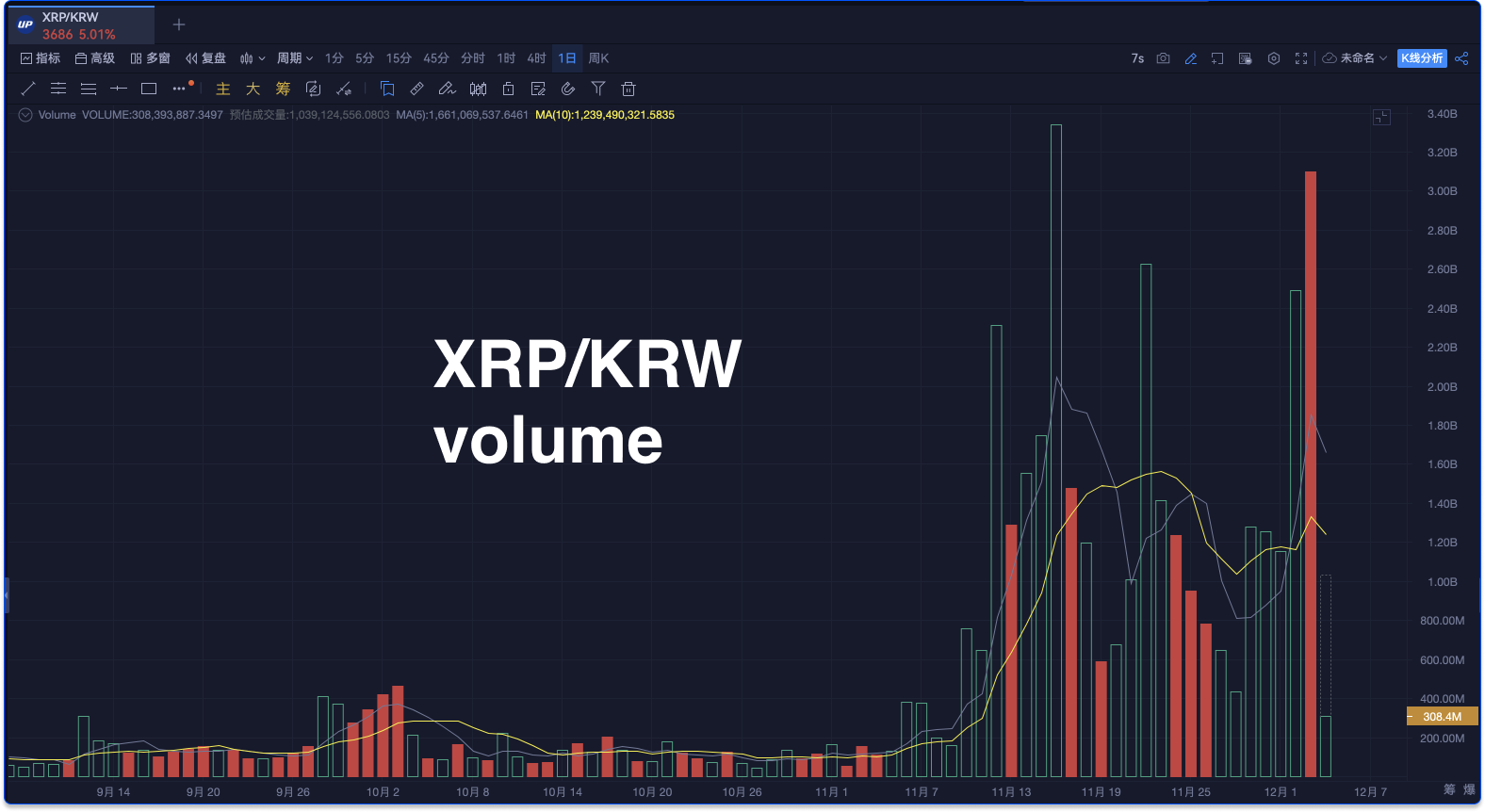

XRP's price has surged nearly fourfold in the past month, surpassing a market cap of $150 billion, successfully overtaking USDT (Tether) and SOL (Solana) to become the third-largest cryptocurrency by market cap. This significant increase has attracted a large number of investors, particularly with a surge in trading volume in the South Korean market, which has been a major driving force behind XRP's price rise.

On November 5, XRP's market cap was only about $30 billion, but by the end of November, it had skyrocketed to $150 billion. On December 3, XRP's price surged 32% within 24 hours, reaching $2.87, successfully surpassing USDT to become the third-largest cryptocurrency globally.

South Korean investors are considered the main driving force behind the recent surge in XRP prices. The trading volumes of XRP on South Korean exchanges Upbit and Bithumb reached $3.8 billion and $1.2 billion, respectively, becoming key factors in driving up XRP. Additionally, accounts holding between 1 million to 10 million XRP accumulated 679 million XRP in just three weeks, indicating institutional investors' confidence in XRP.

The rise in XRP's price is related to Ripple's legal victories and the launch of stablecoins, as well as the gradual improvement of the regulatory environment in the United States. Since 2023, there has been a noticeable shift in the attitude of U.S. regulators, gradually moving towards supporting the development of crypto assets.

In the legal case involving XRP, Ripple successfully countered the U.S. Securities and Exchange Commission (SEC)'s allegations, with the court ruling that XRP sales on public exchanges do not constitute securities, sending a positive signal to the entire crypto industry. This ruling has alleviated the long-standing legal shadow over XRP and boosted investor confidence in its future.

Meanwhile, as the crypto market develops, expectations for the approval of an XRP ETF are increasing. Although XRP has not yet received formal ETF approval, regulatory attitudes towards crypto assets are gradually becoming more lenient, and investors and industry experts generally believe that XRP's ETF approval is imminent. If this process proceeds smoothly, it will bring broader participation from institutional investors, further driving up its market price.

3. The Self-Regulatory Model of the Meme Coin Market Draws Attention

The Meme coin market has recently shown active trading trends, especially against the backdrop of a surge in retail trading volume in South Korea, with DOGE, PEPE, and SHIB becoming the market's focal points. As the self-regulatory model of Meme coins matures, investor attention towards these assets continues to rise.

Some analysts believe that the self-regulation of Meme coins may affect their price volatility and could even become a tool for market manipulation. Recently, a Meme coin named after Enron briefly reached a market cap of $6 million but then saw its price plummet by over 90%, exposing the high instability of the Meme coin market. Whale trading in the Meme coin market has also drawn widespread attention. For example, a whale executed a large PEPE token trade on the Kraken exchange, achieving a profit of 31 times, which drove price fluctuations in the Meme coin market.

2024 is a key year for establishing the foundation of the Meme coin market, and 2025 may become a breakthrough year for Meme coins. As the trading model of Meme coins matures further and the self-regulatory system improves, the future of Meme coins is filled with opportunities and challenges. However, due to significant market volatility, investors still need to exercise caution and implement risk control.

Summary

MicroStrategy Increases Bitcoin Holdings: MicroStrategy's continued accumulation, the Microsoft shareholder vote, and the entry of institutional investors bring positive signals to the Bitcoin market, but short-term price fluctuations and market sell orders remain risk factors for investors to watch.

XRP Price Soars: XRP has successfully risen to become the third-largest cryptocurrency by market cap globally, supported by strong demand in the South Korean market and improvements in the U.S. regulatory environment. However, the risk of price correction still exists, and investors should remain vigilant.

Challenges and Opportunities in the Meme Coin Market: The Meme coin market remains highly volatile; while the self-regulatory model may help stabilize the market, the high price volatility requires investors to operate cautiously and closely monitor market changes.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。