Collaborating with liquidity fund managers can significantly enhance the success rate and market impact of projects.

Author: Ray

Translation: Deep Tide TechFlow

Liquidity funds are regaining significant importance: November is expected to be the strongest month for liquidity fund performance in this cycle, and it will also rank as the fourth-best month since @L1D_xyz began allocations in November 2018!

(Note from Deep Tide: A liquid fund (流动基金) is a type of fund that can be used at any time to meet depositors' withdrawal requests, characterized by high liquidity and safety.)

This data may attract a large influx of institutional capital. As the asset management scale (AUM) between venture capital (VC) and liquidity funds gradually rebalances, let’s explore why more and more founders of crypto projects are beginning to collaborate with liquidity funds and how they are utilizing these funds.

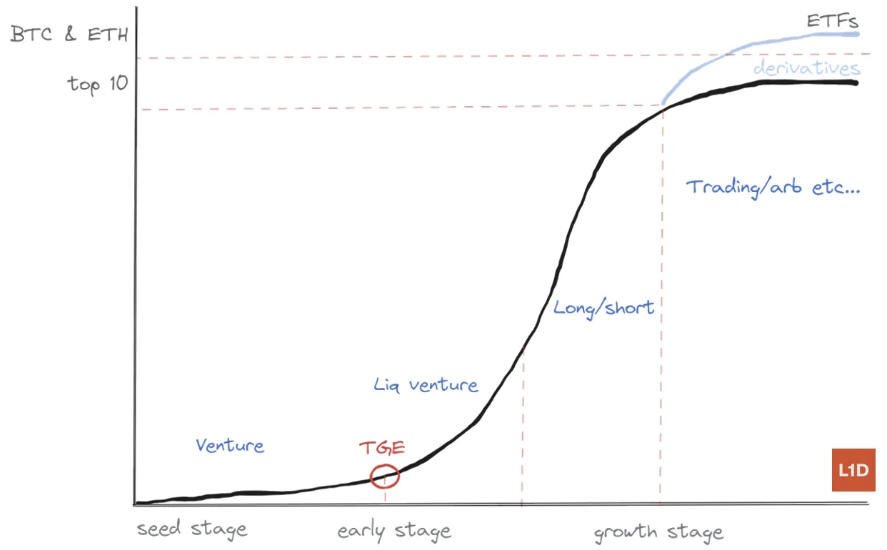

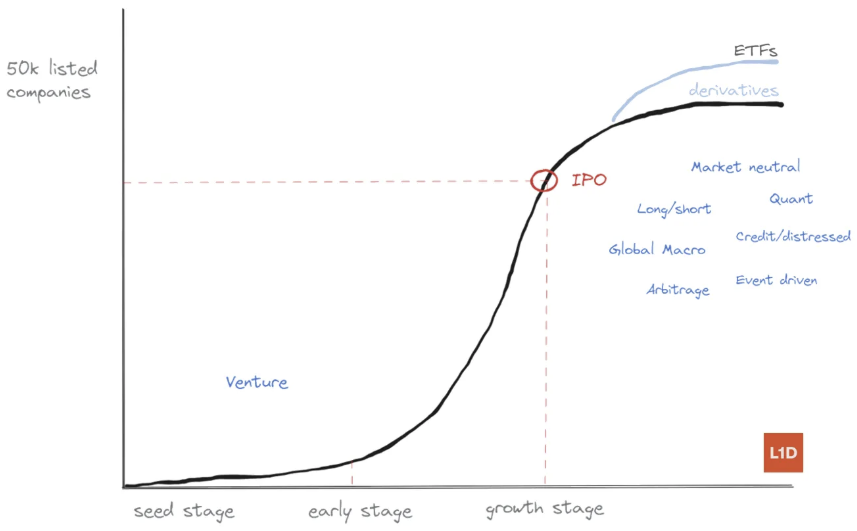

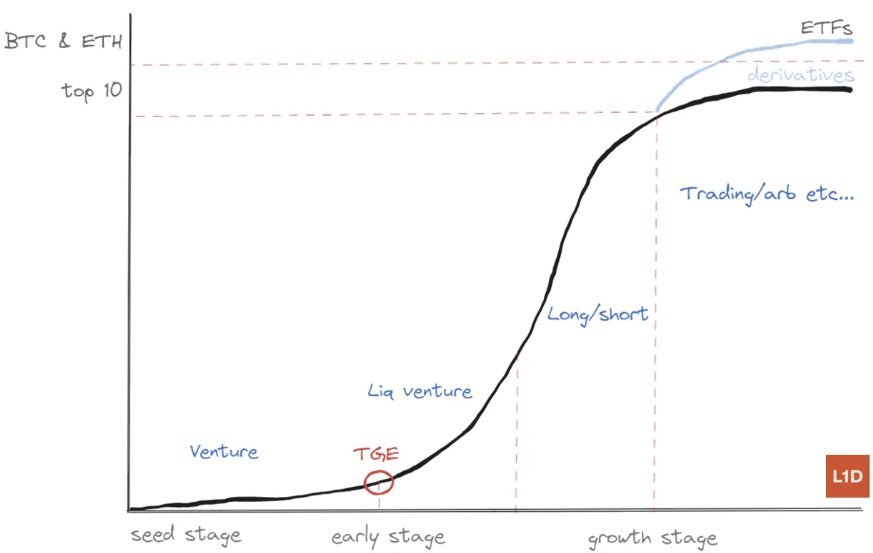

In traditional finance (TradFi), alternative asset management supports companies' development at different growth stages through the classic S-curve.

Venture Stage: From seed rounds to Series A, companies typically focus on validating whether their product meets market demand (PMF), then scale between Series B-D, and finally move towards an initial public offering (IPO).

Public Markets Stage: During the IPO process, investment banks are responsible for guiding price discovery, while hedge funds manage ongoing price discovery in subsequent stages, handling complex matters such as corporate actions and restructuring.

Similarly, in the crypto space, many crypto networks, although typically initiated with venture capital, achieve liquidity through token generation events (TGE). This mechanism marks a fundamental shift in the dynamics of capital markets.

As crypto projects can access liquidity at an early stage, liquidity funds are particularly important for founders in this field.

Understanding the process of this transition is crucial as projects move from private fundraising to liquidity stages. At this point, tokens are not just financing tools for the project but are also part of its core product. The quality of token issuance has a profound impact on the project's market performance and long-term viability.

Many new founders often need assistance at this stage, such as establishing connections with exchanges or designing token economic models or product structures that appeal to active investors and crypto enthusiasts (crypto degens).

In these ways, liquidity funds not only provide early capital support for crypto projects but also become essential tools for founders to achieve project success.

When collaborating with liquidity fund managers, well-known figures like @leptokurtic_ (from Ethena) exemplify the importance of expertise in navigating the complex crypto market.

The strategies of liquid venture capital and long-short funds play a crucial role in price discovery during token generation events (TGE) and risk management in the coming years. Here are some key supports that liquidity funds provide to projects:

Enhancing Visibility and Market Recognition: @multicoincap is active in multiple ecosystems and fields (such as Solana, decentralized IoT DePIN, and fully homomorphic encryption FHE) and frequently shares their views and investment logic on liquid tokens.

@Arthur_0x (from DeFiance) recently proposed the narrative of a "DeFi Renaissance," a concept that successfully inspired many founders in the field, reinvigorating decentralized finance.

Referring Like-Minded Investors: Fair launch projects like Aerodrome recently built a bridge to the crypto capital market through a referral from a respected investor, accelerating the project's development.

Supporting Transformation and Restart Narratives:

Many founders from the previous cycle have achieved project transformations with the help of liquidity funds. For example, Kevin Hu and his Nova Fund (BH Digital) team were important early supporters of the TON project, helping it regain market attention.

Optimizing Equity Structure:

Liquidity funds can help projects maintain a healthy equity structure by providing liquidity to early fatigued investors. For instance, Locked SOL from the FTX legacy was effectively managed through such mechanisms.

Providing Total Value Locked (TVL) at Protocol Launch:

At the initial launch of a protocol, liquidity funds can enhance the project's market credibility by providing initial TVL. For example, Kevin and his Nova Fund (BH Digital) team, along with @CryptoHayes, provided significant early TVL support for Ethena.

Formulating Product Strategies and Development Roadmaps:

Liquidity fund managers not only provide financial support but also assist founders in formulating clear product strategies and future development directions.

Token Design and Economic Model Restructuring:

For example, @TheiaResearch assisted HoudiniSwap (a fair launch project) in restructuring its token design to better align with market demands and attract investors.

Collaborating with liquidity fund managers can significantly enhance the success rate and market impact of projects. Founders should fully leverage this important resource to tackle the complex challenges of the crypto capital market.

Some active liquidity fund managers in the crypto space (not an exhaustive list, only a selection) include:

Liquid Venture Capital: @multicoincap, @1kxnetwork, @paraficapital, @DeFianceCapital, @TheiaResearch, @SyncracyCapital, @Modular_Capital

Long-Short Funds: Republic Digital (Joe, @dim_ss, Armaan, and Gabriel), Nova Fund (BH Digital) (Kevin and @ashwinrz team), BLC…

Disclaimer: @L1D_xyz has invested in many of the funds mentioned in this article.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。