Author: YBB Capital Researcher Ac-Core

TL;DR

In the long term, Bitcoin through ETFs is not beneficial. The trading volume of Bitcoin ETFs in Hong Kong shows a huge gap compared to that in the U.S., and it is undeniable that U.S. capital is gradually enveloping the crypto market. Bitcoin ETFs divide the market into two parts: the white part, which under centralized financial regulation retains only speculative trading as a financial attribute, and the black part, which has more native blockchain activity and trading opportunities but faces regulatory pressure due to being "not legal";

MicroStrategy has achieved efficient arbitrage between stocks, bonds, and Bitcoin through capital structure design, closely linking the volatility of its stock with Bitcoin prices, thus achieving lower-risk returns in the long term. However, MicroStrategy is essentially issuing unlimited debt to elevate its value, which requires a prolonged Bitcoin bull market to sustain its worth. Therefore, Citron's shorting of MicroStrategy has a higher payout than directly shorting Bitcoin, but MicroStrategy is confident that the future price trend of Bitcoin will be a slow rise without significant fluctuations;

Trump's crypto-friendly policies will not only maintain the dollar's status as the global reserve currency but will also strengthen the dollar's pricing power in the crypto market. Trump is firmly holding onto the dollar's dominance with one hand while wielding Bitcoin, the strongest weapon against the loss of trust in national fiat currencies, with the other, thus reinforcing both sides and hedging risks.

I. U.S. Capital Gradually Enveloping the Crypto Market

1.1 Hong Kong and U.S. ETF Data

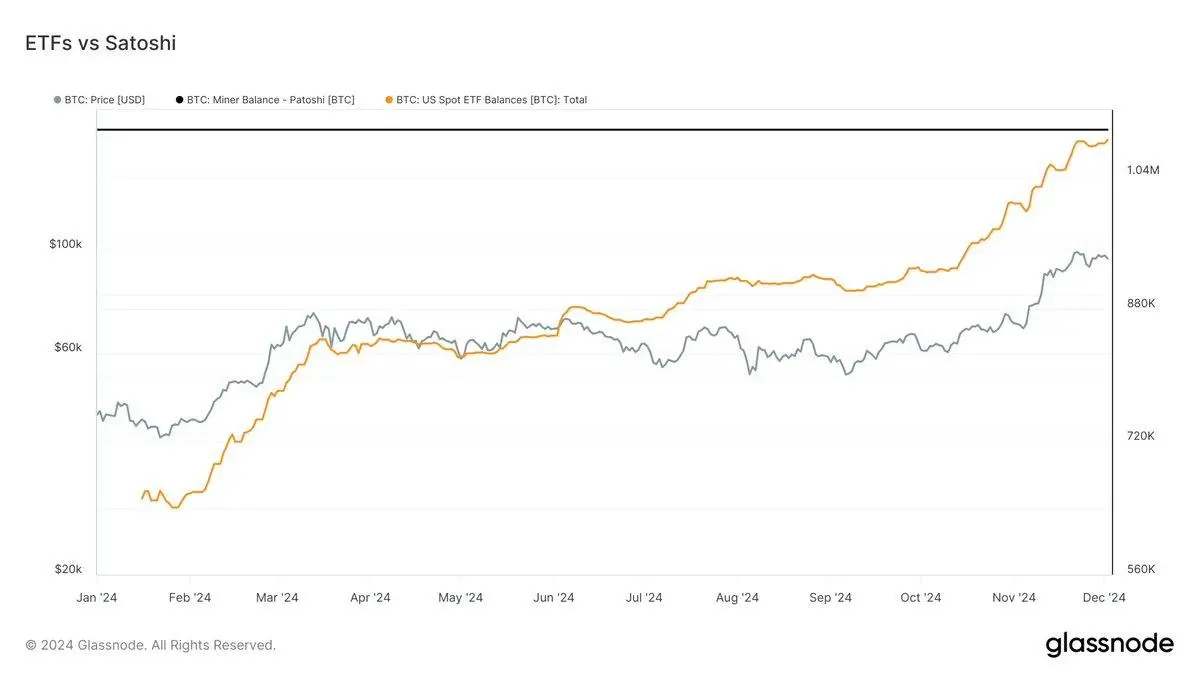

According to Glassnode data on December 3, 2024, the holdings of U.S. Bitcoin spot ETFs are just 13,000 coins away from surpassing Satoshi Nakamoto, with holdings of 1,083,000 coins and 1,096,000 coins respectively. The total net asset value of U.S. Bitcoin spot ETFs has reached $103.91B, accounting for 5.49% of Bitcoin's total market value. Meanwhile, according to Aastocks on December 3, data from the Hong Kong Stock Exchange shows that the total trading volume of three Bitcoin spot ETFs in Hong Kong was approximately HKD 1.2 billion in November.

Data source: Glassnode

U.S. capital is deeply intervening in and influencing the global crypto market, even dominating the development of the crypto industry. ETFs have pushed Bitcoin from an alternative asset to a mainstream asset, but they have also weakened Bitcoin's decentralized characteristics. ETFs have brought a large influx of traditional capital, but they have also firmly placed the pricing power of Bitcoin in the hands of Wall Street.

1.2 The "Black and White Division" of Bitcoin ETFs

Characterizing Bitcoin as a commodity means that it must comply with the same rules as other commodity classes like stocks and bonds under tax law. However, the impact of Bitcoin ETFs being launched is not entirely equivalent to the launch of other commodity ETFs, such as gold ETFs, silver ETFs, and oil ETFs. The currently approved or authorized Bitcoin ETFs differ from the market's recognition of Bitcoin itself:

- The path to commodity ETFization is akin to a person (the trustee) holding physical assets or commodities in one hand needing to have them custodied by an intermediary (like a copper warehouse or a gold bank vault), and authorized institutions to complete transfers and records, while in the other hand, after initiating shares (like fund shares), there will be shareholders to buy and sell shares using funds.

However, in the aforementioned process, the front end (design, development, sales, and after-sales service, etc.) will involve physical delivery, spot delivery, and cash delivery. But the front end of the Bitcoin ETFs approved by the U.S. SEC is a cash delivery method for the subscription and redemption of shares, which is also the point that Cathie Wood has been arguing about, hoping to achieve physical delivery, but this is practically impossible.

Because the cash custodians in the U.S. are all institutions operating under traditional centralized financial frameworks for cash subscription and redemption transactions, this means that the first half of Bitcoin ETFs is completely centralized.

- At the end of Bitcoin ETFs, the centralized regulatory framework is difficult to confirm. The reason is that if Bitcoin is to be recognized, it must become a commodity under the existing centralized financial framework, and it will never recognize Bitcoin's decentralized attributes such as being a substitute for fiat currency and being non-traceable. Therefore, Bitcoin can only engage in various financial derivatives like futures, options, and ETFs if it fully complies with regulatory conditions.

Thus, the emergence of Bitcoin ETFs signifies a complete failure of the Bitcoin ETF part to counter fiat currency, and the decentralization of the Bitcoin ETF part has become meaningless. The front end must rely entirely on the legitimacy of custodians like Coinbase, ensuring that the entire trading chain is legal, public, and traceable.

The black and white of Bitcoin will be completely divided by ETFs:

The current white part: Under the centralized regulatory framework, through extensive financial products, it reduces market price volatility, and as legitimate participants become more widespread, the speculative volatility of Bitcoin as a commodity will gradually decrease. After Bitcoin goes through ETFs, the white part in the market's supply and demand relationship has lost its important demand side (the decentralization and anonymity of Bitcoin), leaving only a single speculative trading financial attribute. At the same time, under the legalized regulatory framework, it also means that more taxes need to be paid, making Bitcoin's original functions of asset transfer and tax evasion no longer exist. That is, the endorsement has shifted from a decentralized chain to a centralized government.

The former black part: The main reason for the crypto market's wild fluctuations lies in its opacity and anonymity, making it susceptible to manipulation. At the same time, the black part of the market will be more open, with more native blockchain value vitality and more trading opportunities. However, due to the emergence of the white part, those unwilling to transition to the white part will forever be excluded from the centralized regulatory framework and lose pricing power, akin to paying fines to the SEC.

II. Trump's Crypto All-Star Cabinet Picks

2.1 Cabinet Picks

In the 2024 U.S. presidential election, Trump's victory compared to the restrictive policies of the SEC, Federal Reserve, and FDIC during the Biden administration may lead the U.S. government to adopt a more developmental attitude towards crypto. According to Chaos Labs data, the nominations for Trump's new government cabinet are as follows:

Source: @chaos_labs

Howard Lutnick (Transition Team Leader and Commerce Secretary Nominee):

Lutnick, as CEO of Cantor Fitzgerald, openly supports cryptocurrencies. His company actively explores the blockchain and digital asset space, including strategic investments in Tether.

Scott Bessent (Treasury Secretary Nominee):

Bessent is a senior hedge fund manager who supports cryptocurrencies, believing they represent freedom and will exist long-term. He is more favorable towards cryptocurrencies than former Treasury Secretary candidate Paulson.

Tulsi Gabbard (Director of National Intelligence Nominee):

Gabbard, with a core philosophy of privacy and decentralization, supports Bitcoin and invested in Ethereum and Litecoin in 2017.

Robert F. Kennedy Jr. (Secretary of Health and Human Services Nominee):

Kennedy openly supports Bitcoin, viewing it as a tool against the devaluation of fiat currency, potentially becoming an ally of the crypto industry.

Pam Bondi (Attorney General Nominee):

Bondi has not made a clear statement on cryptocurrencies, and her policy direction remains unclear.

Michael Waltz (National Security Advisor Nominee):

Waltz actively supports cryptocurrencies, emphasizing their role in enhancing economic competitiveness and technological independence.

Brendan Carr (FCC Chairman Nominee):

Carr is known for his anti-censorship stance and support for technological innovation, potentially providing technical infrastructure support for the crypto industry.

Hester Peirce & Mark Uyeda (Potential SEC Chairman Candidates):

Peirce is a staunch supporter of cryptocurrencies, advocating for regulatory clarity. Uyeda criticizes the SEC's tough stance on cryptocurrencies, calling for clear regulatory rules.

2.2 Crypto-Friendly Policies as a Financial Tool to Hedge Against Insufficient Trust in the Dollar as a Global Reserve

Will the White House's promotion of Bitcoin undermine people's trust in the dollar as the global reserve currency, thereby weakening the dollar's position? U.S. scholar Vitaliy Katsenelson suggests that as market sentiment towards the dollar has been disturbed, the White House's promotion of Bitcoin may shake people's trust in the dollar as the global reserve currency, thus weakening its position. Regarding current fiscal challenges, "what can truly keep America great is not Bitcoin, but controlling debt and deficits."

Perhaps Trump's actions may become a hedge against the risk of the U.S. government losing its dominant position over the dollar. In the context of economic globalization, all countries hope to achieve the international circulation, reserve, and settlement of their national currencies. However, in this issue, there exists a trilemma of monetary sovereignty, free capital flow, and fixed exchange rates. The significant value of Bitcoin is that it provides a new solution to the contradictions of national systems and economic sanctions in the context of economic globalization.

Source: @realDonaldTrump

On December 1, 2024, Trump stated on social media platform X that the era of BRICS countries attempting to break away from the dollar has ended. He demanded that these countries commit not to create a new BRICS currency or support any other currency that could replace the dollar, or they would face 100% tariffs and lose access to the U.S. market.

Now, Trump seems to be firmly holding onto the dollar's dominant position with one hand while wielding Bitcoin, the strongest weapon against the loss of trust in national fiat currencies, with the other, thus reinforcing both the dollar's international settlement power and the pricing power of the crypto market.

III. The Tug-of-War Between MicroStrategy and Citron Capital

On November 21, during U.S. stock trading hours, the well-known short-selling firm Citron Research announced on social media platform X that it plans to short "Bitcoin-heavy stock" MicroStrategy (MSTR), causing MicroStrategy's stock price to plummet, retreating over 21% from its intraday high.

The next day, MicroStrategy Executive Chairman Michael Saylor responded in an interview with CNBC, stating that the company not only profits from trading based on Bitcoin's volatility but also leverages an ATM mechanism to invest in Bitcoin. Therefore, as long as the price of Bitcoin continues to rise, the company can maintain profitability.

Source: @CitronResearch

Overall, the stock premium of MicroStrategy (MSTR) and its strategy to achieve profitability through the ATM (At The Market) mechanism, along with the leveraged operations in Bitcoin investment and the views of short-selling institutions, can be summarized as follows:

- Source of Stock Premium:

Most of MSTR's premium comes from the ATM mechanism. Citron Research believes that MSTR's stock has become an alternative investment for Bitcoin, resulting in an unreasonable premium compared to Bitcoin, leading them to decide to short MSTR. However, Michael Saylor refuted this view, arguing that short-sellers overlook MSTR's important profit model.

- MicroStrategy's Leveraged Operations:

Leverage and Bitcoin Investment: Saylor pointed out that MSTR leverages its investment in Bitcoin through debt issuance and financing, relying on Bitcoin's volatility for profit. The company flexibly raises funds through the ATM mechanism to avoid discounted issuance in traditional financing while utilizing high trading volumes to achieve large-scale stock sales, gaining arbitrage opportunities from stock premiums.

- Advantages of the ATM Mechanism:

The ATM model allows MSTR to flexibly raise funds and transfer debt volatility, risk, and performance to common stock. Through this operation, the company can achieve returns far exceeding borrowing costs and Bitcoin price increases. For example, Saylor noted that by financing at a 6% interest rate to invest in Bitcoin, if Bitcoin rises by 30%, the actual return for the company would be about 80%.

- Specific Profit Cases:

By issuing $3 billion in convertible bonds, the company expects earnings per share to reach $125 within ten years. If the price of Bitcoin continues to rise, Saylor predicts that the company's long-term earnings will be substantial. For instance, two weeks ago, MSTR raised $4.6 billion through the ATM mechanism, trading at a 70% premium, earning $3 billion in Bitcoin within five days, equivalent to $12.5 per share, with long-term earnings expected to reach $33.6 billion.

- Risks of Bitcoin Decline:

Saylor believes that purchasing MSTR stock means investors have accepted the risk of Bitcoin price declines. To achieve high returns, one must bear corresponding risks. He anticipates that Bitcoin will rise by 29% annually in the future, while MSTR's stock price will increase by 60% each year.

- MSTR's Market Performance:

Since the beginning of this year, MSTR's stock price has risen by 516%, far exceeding Bitcoin's 132% increase during the same period, and even surpassing AI leader Nvidia's 195% rise. Saylor believes MSTR has become one of the fastest-growing and most profitable companies in the U.S.

Regarding Citron's shorting, MSTR CEO stated that Citron does not understand where MSTR's premium relative to Bitcoin comes from and explained:

“If we invest in Bitcoin with financing at a 6% interest rate, when the price of Bitcoin rises by 30%, what we actually get is an 80% Bitcoin price difference (a function of the combined stock premium, conversion premium, and Bitcoin premium).”

“The company issued $3 billion in convertible bonds, and based on an 80% Bitcoin price difference, this $3 billion investment could bring $125 in earnings per share over ten years.”

This means that as long as the price of Bitcoin continues to rise, the company can continue to be profitable:

“Two weeks ago, we did $4.6 billion in ATM and traded at a 70% price difference, which means we earned $3 billion in Bitcoin within five days. About $12.5 per share. If calculated over ten years, the earnings will reach $33.6 billion, approximately $150 per share.”

In summary, MicroStrategy's operational model achieves efficient arbitrage among stocks, bonds, and Bitcoin through capital structure design, closely linking its stock with Bitcoin price fluctuations to ensure low-risk profits for the company over the long term. However, the essence of MicroStrategy is to issue unlimited debt on assets and elevate its value with unlimited leverage, which requires a prolonged Bitcoin bull market to sustain its value. Undoubtedly, Citron's shorting of MicroStrategy has a much higher payout than shorting Bitcoin directly, so MicroStrategy is also confident that the future price trend of Bitcoin will be a slow rise without significant fluctuations.

IV. Conclusion

Source: Tradesanta

The U.S. is continuously strengthening its control over the crypto industry, and market opportunities are increasingly shifting towards centralization. The decentralized crypto utopia is gradually compromising towards centralization and "handing over" power. As the saying goes, "a medicine can be toxic," the influx of funds from ETFs is merely a pain-relieving capsule that cannot cure the disease.

In the long run, Bitcoin through ETFs is not beneficial. The trading volume of Bitcoin ETFs in Hong Kong shows a huge gap compared to that in the U.S. Based on the flow of capital, U.S. capital is gradually enveloping the crypto market. Currently, even though China is in an absolute leadership position in the mining sector, it still lags behind in capital markets and policy direction. Perhaps the long-term impact of Bitcoin ETFs will accelerate the normalization of crypto asset trading; this is both a beginning and an end.

Reference:

Fu Peng: Talking about the SEC and Bitcoin ETF - Clear Black and White Centralization

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。