Bitwise Senior Investment Strategist Juan Leon stated that the discount of Bitcoin on South Korean exchanges reflects the "congestion" of liquidity within centralized venues.

Written by: BitpushNews

Political black swans can appear at any moment.

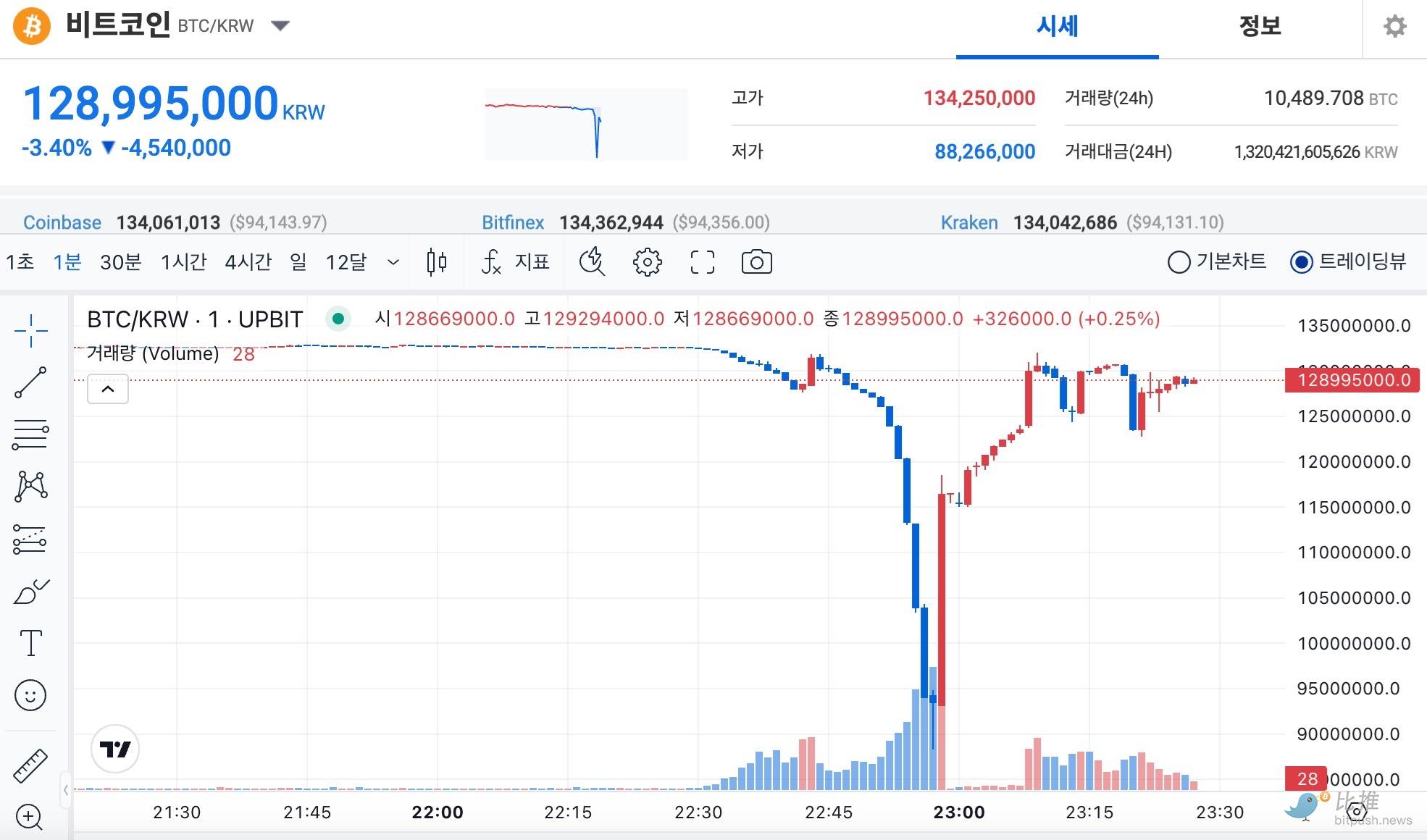

Affected by the turmoil of the South Korean martial law, the Korean won and Korean stocks plummeted, with the price of BTC on South Korea's largest crypto exchange, Upbit, briefly spiking to $61,600. Upbit data shows that following the announcement of martial law, the exchange rate of Bitcoin against the Korean won (KRW) plummeted from 130 million KRW to 93.6 million KRW, a drop of nearly 33%. Major altcoins also saw double-digit declines on the platform, including the recently surging XRP, as well as tokens like Shiba Inu and Dogecoin.

Whales Scoop Up Tokens at a Discount

This event created arbitrage opportunities for savvy traders.

Unlike in previous years, when smart money could buy Bitcoin at lower prices on exchanges in Hong Kong and North America and then sell it in Korea at a "kimchi premium," this time the situation could be reversed.

According to Lookonchain, as the Korean market fell, many whales transferred large amounts of USDT to Upbit to buy tokens at discounted prices.

Data shows that within an hour of the South Korean president announcing the emergency martial law, large traders transferred over $163 million in USDT to Upbit. Lookonchain stated on X: "Many whales transferred large amounts of USDT to Upbit, possibly looking for bottom-fishing opportunities." Due to the influx of panic sellers and bottom-fishers, Upbit announced that its app and open API services were suspended due to increased traffic, resulting in delays.

In the early hours of the 4th, Yoon Suk-yeol announced the lifting of the martial law, just over 6 hours after he had announced its implementation the previous night. The price of Bitcoin on Upbit slightly rebounded, reaching around $88,600 at the time of publication.

Bitwise Senior Investment Strategist Juan Leon stated in a statement that the discount of Bitcoin on South Korean exchanges reflects the "congestion" of liquidity within centralized venues. He noted that although Bitcoin is a decentralized asset traded around the clock, chaos can still occur when "special circumstances in a certain place" create sudden restrictions.

XRP Whale Activity Soars to All-Time Highs

According to Bitpush data, the price of XRP tokens has surged fourfold in the past month, making it the third-largest crypto asset by market capitalization.

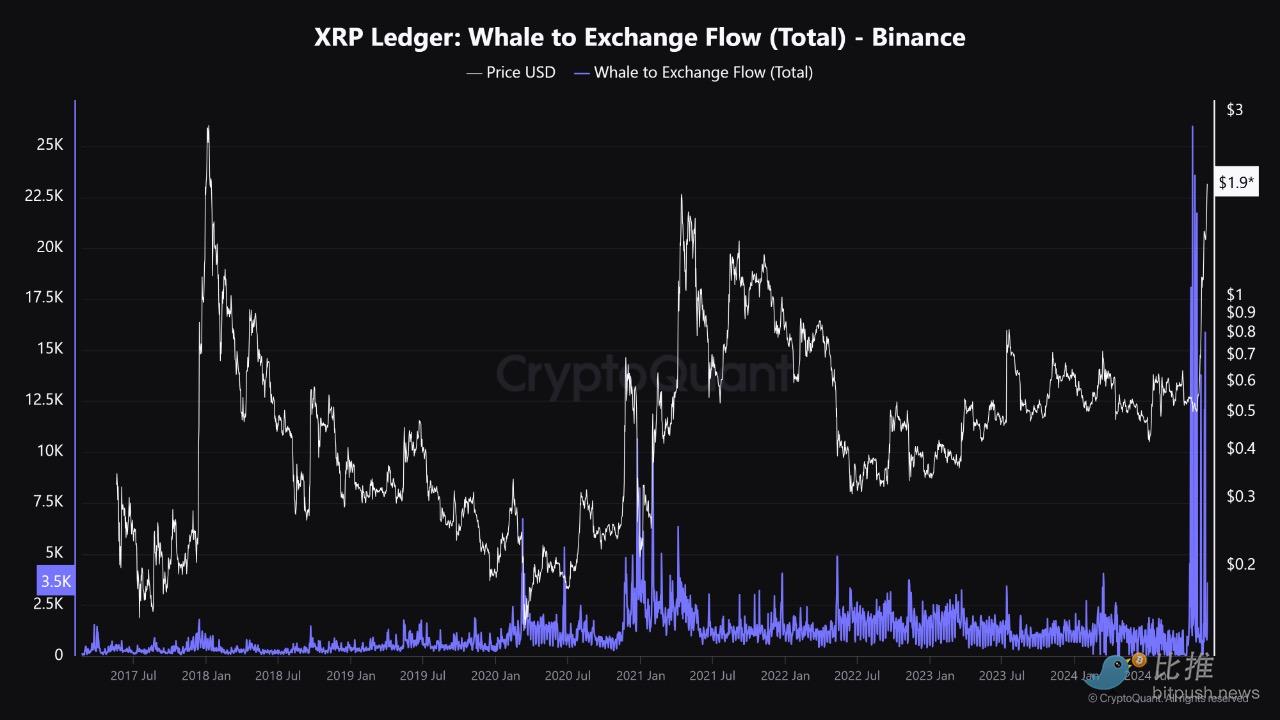

CryptoQuant data shows that XRP whale activity has reached an all-time high. CryptoQuant analyst Woominkyu pointed out that historically, significant spikes in whale XRP trading activity "are closely related to peaks in XRP prices." These trades have recently surged, pushing the coin price to around $2.6, indicating that whales may be "preparing for potential profit-taking or increased market activity."

Analysts believe that the price momentum of XRP is driven by the launch of Ripple's stablecoin, potential changes in SEC leadership that are favorable to crypto, and expectations for the approval of a spot XRP ETF. Recently, at least five companies have applied to list spot XRP exchange-traded funds (ETFs) in the United States, including Grayscale, WisdomTree, Bitwise, 21Shares, and Canary Capital.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。