This winter in Seoul seems to show signs of repeating the "Seoul Spring."

Written by: Pzai, Foresight News

On the evening of December 3, South Korean President Yoon Suk-yeol unexpectedly conducted a television broadcast from the presidential office, announcing the implementation of "emergency martial law." That night, there was a standoff in front of the South Korean National Assembly involving members of the opposition party, but at 4 a.m., after the martial law was voted invalid by the South Korean parliament, it was announced to be lifted by Yoon Suk-yeol. This was the first martial law issued since 1980, but it lasted only 6 hours. The impact of this martial law on the financial market, especially the volatility in the cryptocurrency market, was quite severe.

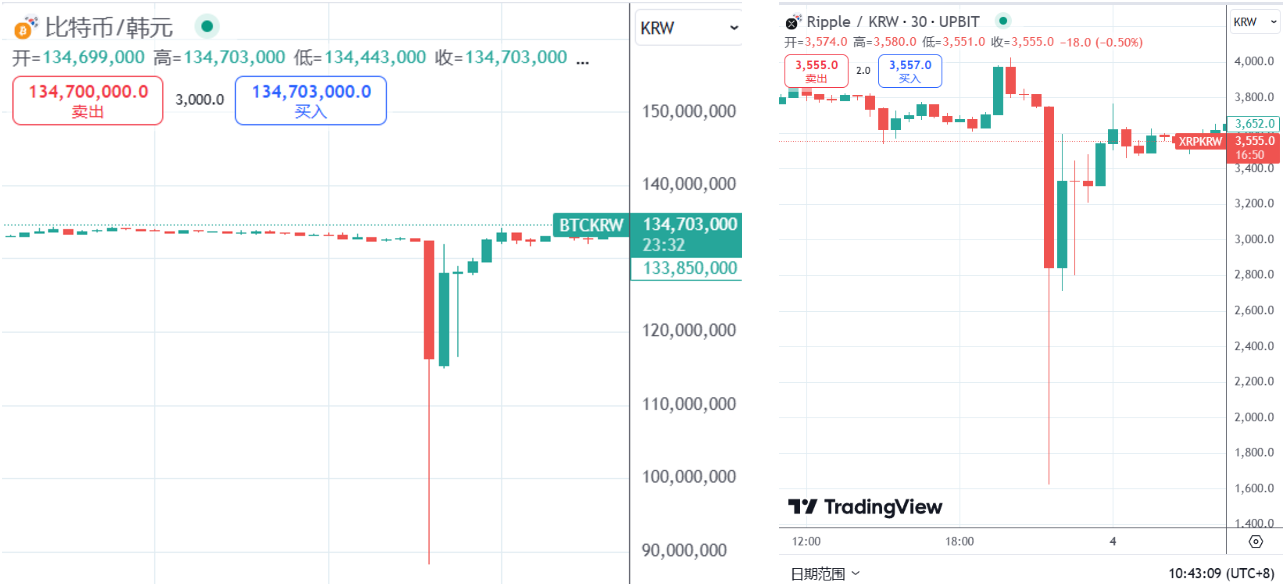

As of the time of writing, trading pairs on the Upbit platform have basically returned to normal. The price of Bitcoin is reported at 134,640,000 won (approximately $95,000).

Market Reaction

After the announcement of martial law, the South Korean cryptocurrency exchange Upbit experienced trading interruptions due to excessive traffic, with the Bitcoin/KRW trading pair briefly spiking below 90 million won (approximately $63,300), and the USDC/USDT exchange rate briefly rising to 1.2.

Additionally, it is worth noting that the XRP token, which is popular among South Koreans, briefly dropped from $2.9 to $1.16. As a relatively mature cryptocurrency market, South Korea's retail trading volume reached $18 billion on December 2, primarily led by altcoin trading (such as DOGE and XRP), with XRP alone accounting for $6.3 billion. DOGE also briefly dipped below $0.23 during this turmoil.

In terms of related token performance, the South Korean public chain KAIA token briefly fell below $0.25 during the incident last night before rebounding to $0.338.

In terms of exchange inflows, within one hour of the announcement of "martial law," over 163 million USDT flowed into Upbit, as traders sought to capitalize on the volatility. After the South Korean authorities announced that they would provide "unlimited liquidity" to the market and following the parliamentary vote, the market's volatility was quickly smoothed out by the influx of funds.

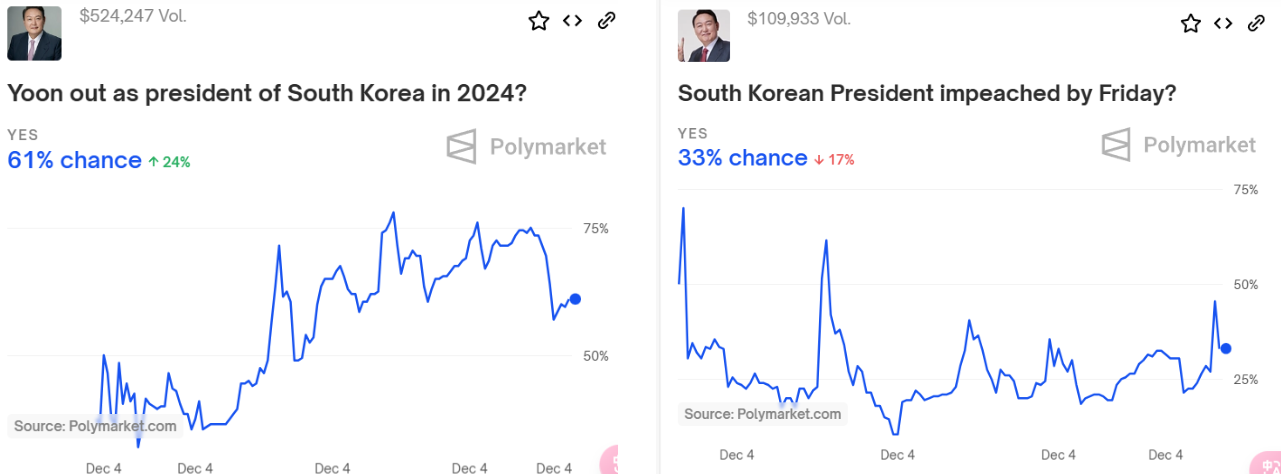

On Polymarket, the probability of the South Korean president being impeached began to attract attention and buying from traders, with the probability of Yoon Suk-yeol stepping down this year predicted at 61%. By this Friday, the probability of his impeachment also rapidly surged to 45%, before dropping to 33%.

Market Perspective

After the incident, South Korean regulatory authorities stated that they are ready to deploy a 100 trillion won stock market stabilization fund and will take measures to normalize the financial market. The market responded accordingly to South Korea's bailout measures, with the South Korean stock market opening as usual today, and related tokens subsequently rebounding to normal levels.

Strategic consulting firm The Geopolitical Business stated that if the political crisis continues, both domestic and international measures in South Korea may face various obstacles and paralysis. The lifting of martial law and the announcement by the South Korean Joint Chiefs of Staff to temporarily control troop movements, except for monitoring and alert operations, have also temporarily eased market sentiment.

Before this martial law incident, South Korea's cryptocurrency market was attracting an increasing number of middle-aged and elderly participants. Recently, the number of user accounts over 60 years old on South Korean exchanges Upbit and Bithumb has increased by 30.4% compared to the end of 2021. The aftershocks brought about by the political turmoil will become a primary factor for users when considering asset storage, including the increased distrust in the South Korean local stock and foreign exchange markets, leading to a demand for cryptocurrencies, with Upbit's XRP trading volume surpassing that of the South Korean KOSPI stock index.

Moreover, this volatility also reflects that the relatively isolated fiat exchanges, as the main trading venues for South Koreans, are significantly affected by geopolitical factors, and it is expected that some South Korean users will shift towards on-chain liquidity trading and asset storage in the near future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。