As of December 1, the data statistics for BTC, ETH, and TON on the TrendX platform are as follows:

The discussion count for BTC last week was 14.31K, down 26.18% from the week before; the price last Sunday was $96,743, down 1.7% from the Sunday before.

The discussion count for ETH last week was 5.11K, up 7.53% from the week before; the price last Sunday was $3,699, up 6% from the Sunday before.

The discussion count for TON last week was 785, down 1.1% from the week before; the price last Sunday was $6.63, up 20% from the Sunday before.

From Ethereum's smart contracts to EOS's public chain, and then to Layer 2, cross-chain, metaverse, and chain games, technology continues to advance, and new concepts emerge endlessly. However, as airdrops transform into point systems and high-threshold activities increase, retail investors may feel confused, limiting the growth of new users. In contrast, the narrative style of Meme projects is simple and direct, relying on shared cultural genes to build consensus without needing to delve into technical details. With the rise of Solana and the popularity of one-click token issuance platforms like Pump.fun, the participation difficulty in Meme projects has decreased, and code vulnerability issues have been resolved, allowing core features such as cultural attributes, capital, and community to play a more direct role.

The Rise of Meme and Capital Following

The changes mentioned above reveal two trends in the crypto community: on one hand, new projects are becoming increasingly complex with higher participation thresholds; on the other hand, Meme projects have lowered the participation threshold through minimalism and specialized division of labor. In a market with limited capital and users, the market balance seems to be tilting towards Meme projects.

As retail interest in Meme coins grows, institutional investors are also beginning to turn their attention to this area. Wintermute, known for its high hit rate in Meme coins, has been continuously increasing its holdings in NEIRO on Ethereum since September 6. As of October 15, Wintermute held approximately $10.52 million worth of PEPE, making it its third-largest holding token, while also holding $3.48 million worth of NEIRO, becoming the market maker with the most public holdings. Three other market makers and one venture capital firm also hold NEIRO_ETH tokens. Jump Trading also holds $1.2 million worth of SHIB.

From a capital perspective, the motivation to invest in Meme coins is evident. Compared to traditional value projects, venture capital (VC) requires a large initial investment and waits for long-term development and operation of the project. In contrast, investing in Meme coins is more direct, allowing investors to choose market-validated targets, hold non-locked tokens, and leverage capital advantages for trading, achieving liquidity and high returns at any time, which aligns more with capital's pursuit of interests.

Characteristics of Wealth Creation Effect of Meme Coins

Do not interpret the wealth creation effect of Meme coins as a pejorative concept of brainless nouveau riche; this is a neutral and striking feature of Meme coins that attracts capital and draws retail investors in, rapidly affecting every participant in the crypto industry.

Recently, LBank released a poster on social media showcasing the recent price increases of Meme coins. The poster indicated that since GOAT was first launched on the platform, its maximum increase reached an astonishing 10,599.20%, while newly launched Meme coins had an average increase of 1,895.81%. Although traditional sectors in the crypto field hold a skeptical attitude towards Meme coins, frustrating some users, this has instead spurred their motivation to seek social recognition and data support. They not only actively promote Meme coins within the community but also establish emotional connections with like-minded individuals in the process.

According to official data from LBank, the platform launched over 50 Meme coins in the third quarter, with 28 of them increasing by over 200%, 14 by over 500%, and 9 by over 1,000%.

However, it is also worth noting that while some people make money, others lose everything; smart investment in Meme coins is crucial. A recent report from CoinWire indicated that two-thirds of over 1,500 Meme coins promoted by hundreds of KOLs are "dead," with declines exceeding 90%. In contrast, among Wintermute's holdings in the top 25 Meme coins, 64% of the tokens have been listed on Binance, showcasing a frighteningly high hit rate, with tokens like PEPECOIN, NEIRO, GOAT, POPCAT, and REKT among its top holdings.

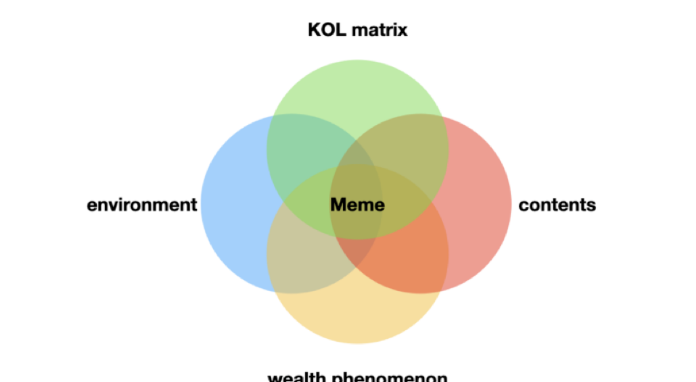

To invest smartly in Meme coins, one must understand the driving factors behind the success of a hundredfold or thousandfold Meme.

Driving Factors Behind Hundredfold and Thousandfold Success

We can analyze the driving factors behind the success of a Meme coin from the following four aspects:

- Emotional Resonance Triggered by Narrative Content:

Meme coins convey emotions and stories through images, such as the affinity of $Doge for dog lovers, and the sad frog and sloth images of $PEPE, which were already popular meme characters and movie roles before becoming memes. In terms of emotional transmission, the narratives of Meme coins are simple and direct, easy for the public to understand and accept. Similar to the evaluation in "The Three-Body Problem" that "every added formula will lose ten thousand viewers," down-to-earth content is more likely to become popular, easily building a simple yet pure grassroots foundation.

- Macroeconomic and Market Environment:

The current bull market has indeed attracted many new investors, but they may feel confused and unsure how to engage with complex technical concepts. In contrast, Meme coins, with their simplicity and low price, provide an opportunity that is easy to understand and participate in. Additionally, the downturn in the traditional economic cycle has also promoted the popularity of Meme coins, as the weakness of the traditional economy has reduced the public's desire to explore new technologies, and Meme coins meet market demand with their low energy consumption and easy absorption characteristics.

- KOL Promotion and Community Dissemination:

KOLs play a key role in the creation, issuance, and promotion of Meme coins. Their statements are highly provocative and can influence people's investment decisions. Community promotion is also an important part of Meme coin marketing; the interaction between KOLs and the community helps form consensus and drive price bubbles.

- Wealth Creation Effect and FOMO Emotion:

The development of Meme coins benefits from their wealth creation myth and the FOMO panic of missing out. Through pump-and-dump schemes and the rapid wealth stories promoted by community dissemination, the FOMO emotions can give a boost to the already poised Meme, resulting in multiple buffs that often lead to soaring prices.

The Combination of Meme and DeFi

The integration of Meme and DeFi opens up novel pathways, allowing users to play more diversified roles in the token economy, transcending mere market speculation and trading behavior. Users can now actively participate in the Meme ecosystem through various means such as staking, mining, and liquidity support.

Staking Mechanism: Holders of Meme coins have the opportunity to stake their tokens on DeFi platforms in exchange for rewards. These rewards may come in the form of additional Meme or other tokens, providing incentives for users to hold and actively engage in the Meme ecosystem.

Mining Process: Mining typically involves lending out held Meme through smart contracts in exchange for interest income. On Meme's DeFi platform, these lending activities facilitate various activities such as trading and liquidity support, allowing users to earn returns from their participation.

Liquidity Support: Meme can also create liquidity pools, allowing users to deposit their held Meme tokens into the pool for others to trade on decentralized exchanges. This process not only enables users to share transaction fees but also contributes to improving the liquidity and trading efficiency of the Meme coin market, allowing users to receive corresponding rewards.

Conclusion

In summary, we can see that the success of Meme coins is not merely hype but the result of multiple factors working together. When discussing the future development of Meme coins, we can adopt an open mindset towards their integration with DeFi, as this combination may provide holders of Meme coins with more diversified participation avenues, thus transcending simple market speculation to some extent. This integration may signal that Meme coins are not just short-term wealth creation tools but have the potential to evolve into a community-driven new economic model. In the future, Meme coins may continue to attract more innovation and capital, bringing new vitality and possibilities to the global economy.

Research Report

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。