Master Discusses Hot Topics:

Yesterday's market was exceptionally lively, especially with the sudden crash of Bitcoin in the Korean market, dropping by 60,000, which left many people dumbfounded. As of now, I personally believe that this sharp decline was primarily triggered by panic selling in the local market due to the political turmoil in Korea, compounded by system issues at Upbit, and we cannot rule out the possibility of a chain liquidation effect.

What I need to reflect on is that behind this event lies a larger question: Is Bitcoin a safe-haven asset or a risk asset?

From a purely price movement perspective, Bitcoin is clearly a risk asset; just look at its volatility, which resembles a roller coaster. However, we must not forget Bitcoin's global liquidity, which indeed gives it a safe-haven attribute. After all, you can't just exchange Korean won for US dollars and expect to use them freely around the world, can you?

Yet, the reaction of the Korean market is puzzling. Why would investors choose to sell off Bitcoin first during political turmoil? Are they planning to exchange won for dollars?

I believe that, in theory, the cryptocurrency market has a stronger safe-haven capability than traditional currencies. For instance, after the Russia-Ukraine conflict, Bitcoin and USDT's acceptance capabilities far surpassed those of various national currencies. As for why Korean investors chose to sell during a crisis, that is truly difficult to understand.

Although I haven't figured this out yet, one thing is certain: this 30% drop has triggered widespread panic and caused a chain reaction. It is precisely because of this that the market rebounded quickly. After all, retail investors are not accustomed to such sharp declines, and after panicking, they begin to fight back vigorously.

As for why the Korean market fell so sharply while the global market reacted less severely, there are several reasons: First, the difficulty of arbitraging Korean won trading pairs is higher than that of dollar-denominated pairs. Second, this crash lasted only 13 minutes, unlike previous continuous sell-off waves.

Furthermore, the trading volume in the Korean market is relatively small, limiting its influence. Of course, if this flash crash had occurred during Asian trading hours, the impact might not have been so small. Every time we mention "opportunity and risk coexist," it truly proves to be the case, vividly reenacted!

Now, let's take a look at the recent trend of Bitcoin. I personally feel that this week resembles a special week of needle-like rebounds, as the speeches from Federal Reserve officials continue to stimulate market volatility.

The early drop on Monday can actually be seen as a preemptive move by the market. According to my previous analysis, Bitcoin is expected to pull back to the 93,800-94,666 range, which is relatively stable and has not completely broken down as of now.

I have already taken several positions in the 94,000-94,666 range, and when it first touched 93,800, it rebounded quickly but then fell again. In the short term, below 93,800 is a good support point, and taking long positions at lower levels is currently the most reasonable strategy.

Unlike the situation of a one-sided decline, every support level now shows a relatively strong rebound. The lower the pullback, the stronger the rebound. The short-term volatility is significant, and if one does not take timely profits or stop losses, they may get stuck at a certain point. For instance, those who did not take profits in batches may easily be caught in the rebound after the sharp drop.

For the medium term, it is difficult for Bitcoin's adjustment to reach 85,755 in one go, as the support around 90,000 is very strong. For bears looking to make a profit of ten thousand points from the medium to long term, the difficulty of the situation and the psychological challenges are no less than those of small wave operations.

Therefore, maintaining long positions at lower levels remains the most reasonable strategy in the current market, and the game of risk and opportunity is still ongoing. Speaking of which, let’s not forget that today’s market is filled with retail investors who have been cut; sometimes, it’s not about watching the market but understanding the mindset that constitutes the great wisdom of trading.

Master Looks at Trends:

Resistance Levels Reference:

First Resistance Level: 96,750

Second Resistance Level: 98,000

Support Levels Reference:

First Support Level: 95,000

Second Support Level: 93,700

Today's Suggestions:

Despite the significant drop, the current rebound strength is quite strong. Therefore, from the perspective of yesterday's decline, we can shift to a view of a rebound for recovery.

Market buying remains active. We anticipate a retest of the highs and a re-entry into the marked important upward channel. If the price falls below 94.7K~95K again, the downside risk will increase.

At this time, we should maintain the current position and gradually raise the bottom, while paying attention to the movement of the 20-day moving average to see if there is a resistance test of the upward channel. In today’s operations, we can still maintain a rebound perspective in the short term, but if Bitcoin fails to enter the upward channel, we should pay attention to trading volume and shift to a short-term bearish view.

Entering the market during a sharp decline is not easy, so during the downturn, it is best to observe the charts, wait for rebound signals, and confirm whether the candlestick stabilizes above the moving average before considering entry.

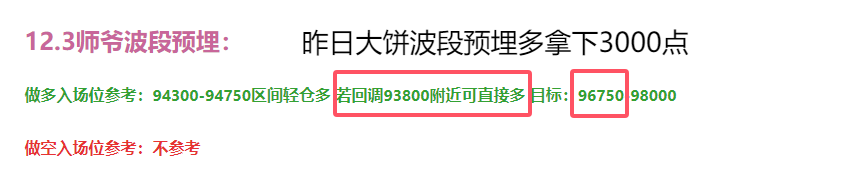

12.4 Master’s Wave Strategy:

Long Entry Reference: 92,800-93,300-93,550 range can take light long positions. If it pulls back to the 92,450-91,900 range, go long directly. Target: 95,000-96,750

Short Entry Reference: Not applicable

This article is exclusively planned and published by Master Chen (WeChat: Coin Master Chen), with the same name across the internet. For more real-time investment strategies, solutions, spot trading, short, medium, and long-term contract trading techniques, operational skills, and knowledge about candlesticks, you can join Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Warm reminder: This article is only written by Master Chen on the official account (as shown above), and any other advertisements at the end of the article or in the comments are unrelated to the author!! Please be cautious in distinguishing authenticity, thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。