The information, opinions, and judgments regarding the market, projects, and cryptocurrencies mentioned in this report are for reference only and do not constitute any investment advice.

The cyclical wheel is turning, pushing a market that was recently filled with fear and doubt into a new phase, as trading heats up with sudden intensity.

As we predicted in our October report titled "Monthly Increase of 10.89%, BTC May Reach New High After Chaos of US Elections": the internal consolidation of the crypto market has been completed, and this month welcomes an external trigger point—on November 6, the US presidential election concluded with Republican candidate Trump, who holds a friendly attitude towards Crypto, winning, causing BTC prices to continuously reach new highs, approaching $100,000.

The resolution of this major annual event has allowed traders in various financial markets to gradually emerge from chaos and uncertainty, returning to a set trading rhythm, with US stocks resuming their upward trend. Expectations of "Trump's economic policies" have become the main trading point, with Tesla, MicroStrategy, and others becoming the biggest gainers.

BTC suddenly surged from its downturn at the end of October, breaking through multiple technical resistances such as the "new high consolidation zone" and "upward trend line," continuously setting historical new highs, peaking at $99,860, and recording a significant increase of 37.42% for the month.

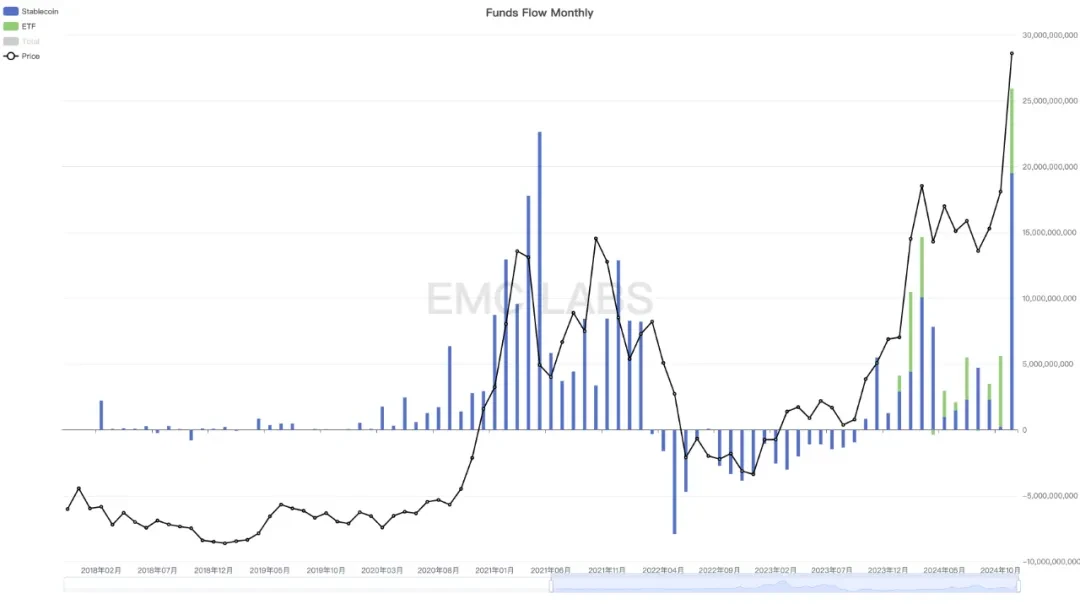

With the trading market heating up, November saw a massive influx of funds, recording $25.9 billion in inflows for the month, making it the largest inflow month in the history of the Crypto market.

Against the backdrop of BTC approaching the $100,000 mark, the continuous influx of funds has finally triggered a sharp rise in Altcoins, represented by ETH, leading to a broad market rally.

EMC Labs comprehensively judges that the second wave of the "upward phase" of the current crypto market cycle has begun, and funds will gradually flow into Altcoins, forming a broad market rally.

However, the potential high inflation triggered by "Trump's economic policies" and the conflict with the Federal Reserve's ongoing interest rate cuts become the biggest uncertainty. Yet, this uncertainty is merely a slight discord in the face of a larger certainty, insufficient to change the trend of market operation.

Macroeconomic Finance: Trump's Economic Policies

"Trump's economic policies" mainly include tax cuts and deregulation, protectionist trade policies, energy independence and support for traditional energy, fiscal expansion and debt risk, immigration and labor policies, and political and debt management.

These economic policies, guided by the spirit of "America First," will pose significant challenges to the existing global trade and financial order, leading to unpredictable conflicts and chaos. Even within the United States, there will be seemingly irreconcilable contradictions in areas such as economic growth, illegal immigration, and the financial system.

Deporting illegal immigrants and raising tariffs may push inflation higher, while federal interest rates remain relatively high, leading to a rebound in inflation that could hinder rate cuts. Without rate cuts, the government's fiscal expansion will undoubtedly face greater difficulties, and the high debt levels will further burden the US government.

The Federal Reserve, in the process of rate cuts and balance sheet reduction, also faces a dilemma. In November, the US CPI showed a rebound as expected, while employment data and economic conditions remained strong, indicating that the necessity for rate cuts has significantly weakened. Although the dot plot and the minutes from the Federal Reserve's meetings suggest that a 25 basis point rate cut in December is still likely, the rate cut process in 2025 is likely to slow down.

Powell hopes to maintain professionalism, ensure economic stability, and normalize inflation levels. However, Trump has made it clear that he will fulfill his campaign promises through reform and conflict—lowering corporate taxes and increasing import tariffs to provide more domestic jobs. The positions of the two are almost irreconcilable, and their contradictions have become public.

Despite the significant uncertainty, traders in various markets have already taken sides and made decisions—betting on the US economy, with the most optimistic outcome being "high inflation and high growth."

In November, the Nasdaq, Dow Jones, and S&P 500 recorded increases of 6.21%, 7.54%, and 5.74%, respectively, while the RUT2000, which represents small and medium-sized enterprises, recorded an increase of 11.01%, reaching a historical high.

In terms of US Treasury bonds, at the end of the month, long-term and short-term yields were 4.177% and 4.160%, respectively, both showing a slight decline, indicating that the bearish risk for US Treasuries has temporarily decreased.

The US dollar index continued to rise, closing at 105.74 in November, an increase of 1.02% from the previous month, while the euro, renminbi, and yen all depreciated against the dollar. In the future, global funds are optimistic about the US financial market, and the trend of buying dollar-denominated assets continues.

Correspondingly, gold, which attracts global risk-averse funds, fell 3.41% in the month, recording the largest monthly decline in 14 months. As we gradually emerge from the post-pandemic era, liquidity is becoming increasingly abundant, and global risk appetite is rising. Equity assets, as well as Crypto represented by BTC, are beneficiaries of this increase.

Crypto Assets: BTC Hits Historical New High, Altseason Could Start Anytime

In November, BTC opened at $70,198.02 and closed at $96,465.42, with an increase of 37.42%, a volatility of 47.12%, and a significant increase in trading volume.

After returning to the "200-day moving average" and crossing the "downward trend line" in November, BTC continued to achieve significant breakthroughs in technical indicators, breaking through the upper resistance of the "new high consolidation zone" that had been stuck for eight months, and once again stepping onto the "upward trend line" after four months.

BTC Daily Price Trend

On a monthly basis, BTC achieved three consecutive months of increases with continuously moderate volume expansion, showing a healthy upward trend.

BTC Monthly Price Trend

In previous research reports, we have repeatedly emphasized that over 30% of BTC experienced address transfers in the new high consolidation zone from March to October this year. This upward repricing has repeatedly occurred in past cycles, becoming internal structural support for future price increases.

However, the final breakthrough in price requires external conditions to trigger it.

The biggest global event in November was Trump's re-election as President of the United States, and his previous enthusiasm for Crypto and "commitments" during the campaign became the emotional catalyst for BTC to break through the "new high consolidation zone" that had been stagnant for eight months.

Is BTC's "Trump rally" sustainable? EMC Labs believes that whether it is last year's proposed "21st Century Financial Innovation and Technology Act," this year's "US Bitcoin Strategic Reserve Draft," or the recently passed "Bitcoin Rights Bill" in the Pennsylvania House of Representatives, all indicate that the US's adoption of Crypto is gradually shifting from "allowing" to "promoting." The goal is to gain control over crypto assets and the blockchain industry (public chains, infrastructure, and decentralized application projects) through legal regulations and national strategies, ensuring that the US gains a dominant advantage in this emerging field.

Therefore, in the coming years, support from US policies and the adoption of Crypto by traditional institutions, including financial institutions and publicly listed companies, can be expected to continue to increase. At no point in history have the blockchain industry and crypto assets received such a strong level of acceptance and adoption.

Surging Liquidity: Two Major Channels Resonating to Create Historical Records

Continuous inflow of funds is the material support for a bull market.

In November, the combined inflow from the BTC Spot ETF and stablecoin channels reached $25.9 billion, setting a record for the largest single-month inflow ever recorded. Among them, the ETF channel accounted for $5.4 billion, and the stablecoin channel accounted for $19.5 billion. In November, the inflow scale of the ETF exceeded that of February, becoming the largest inflow month.

Monthly Statistics of Fund Flow in the Crypto Market

Since October, as the US elections approached their conclusion, the first to activate was the ETF channel funds. This channel's funds began to gradually increase since September, with inflows of $1.2 billion, $5.4 billion, and $6.4 billion from September to November, respectively. We previously emphasized that the funds in the ETF channel possess independent will and will gradually control BTC's price movements. This has been fully reflected in the recent market.

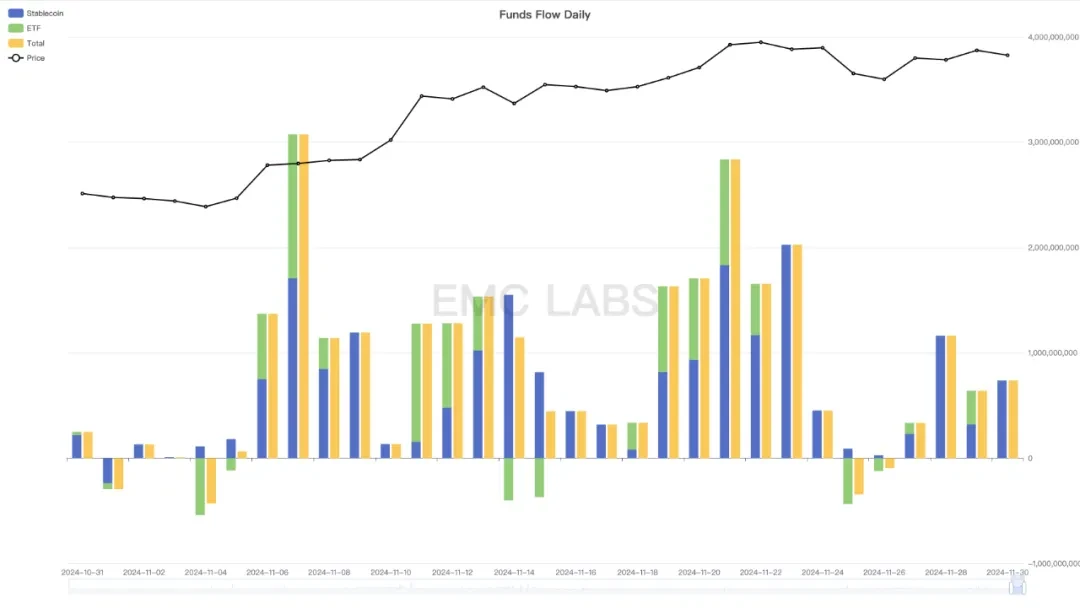

In contrast to the "leading brother" taking on the heavy burden, the stablecoin channel funds appeared to be slightly late to the party. After entering November, the influx began to show a significant increase only as BTC prices continued to break through. However, the total inflow of stablecoin channel funds for the month reached $19.5 billion, far exceeding the ETF channel funds.

Daily Statistics of Fund Flow in the Crypto Market

On November 22, when BTC was challenging the $100,000 mark, market funds began to activate ETH, which saw a daily increase of 9.31%. In November, ETH's cumulative increase reached 47.05%, surpassing BTC, and the market seems to be opening up to Altseason.

EMC Labs believes that after BTC breaks through the $100,000 mark, Altseason will gradually open up. Once Altseason opens, the market will gradually present: 1. ETH breaking through historical highs; 2. a broad market rally; 3. the main market trends gradually being recognized.

Long-Short Game: Liquidity Triggers Second Wave of Selling

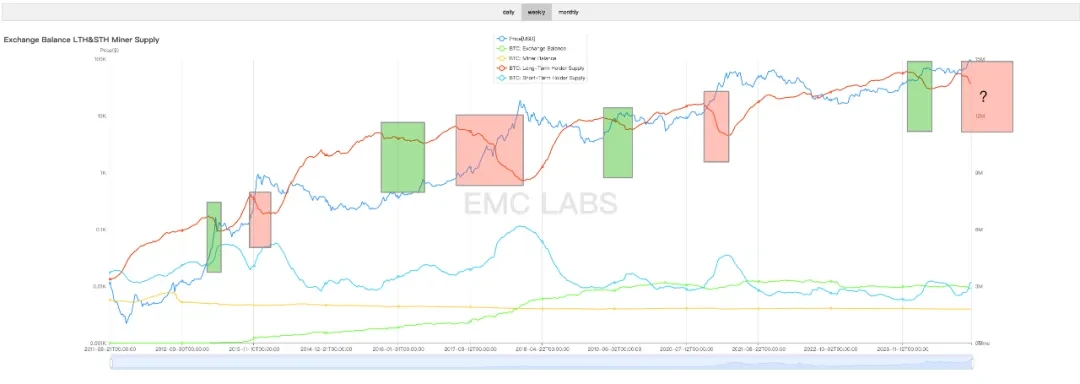

The cycle is a game of collecting and distributing chips within the time-space range between long and short hands.

Long hands collect chips during the downward phase, bottoming phase, and repair phase, while continuously selling during the upward phase and transition phase until liquidity can no longer absorb the selling pressure, leading to a market reversal.

Since January 2024, long hands have initiated the first large-scale selling in this cycle, and after the market entered consolidation in March, they returned to a state of chip accumulation. In November, as liquidity recovered and prices reached new highs, long hands have initiated the second wave of selling, which is also the last large-scale selling in this cycle.

15-Year History of Long-Hand Selling of BTC

As of the end of September, long hands held 14.22 million BTC, and by the end of November, the selling position had reached 13.69 million BTC, resulting in a "selling scale" of 530,000 BTC over two months.

During the upward phase, the motivation for long hands to sell is the price increase brought about by liquidity, and the price increase is also a self-affirming process for the market, which will trigger more capital inflows.

The second wave of selling by long hands has just been underway for two months, and with the continued increase in liquidity, it is expected to persist into the first half of 2025.

Conclusion

In November, the cycle once again demonstrated its powerful market adjustment capabilities.

EMC Labs believes that the fundamental reason for the price increase of BTC and the entire crypto market lies in the complete internal structural consolidation, along with the continuous interest rate cuts by major global economies and a significant increase in investors' risk appetite. Additionally, the substantial increase in adoption and expectations of US national policies also provide great emotional and material momentum.

We believe that these external factors will continue to provide support for the crypto market in the coming year. Therefore, after the restart of the crypto bull market, it will continue to rise, with some fluctuations along the way, but the latter half of the upward phase is destined to offer more substantial returns for long-term investors.

EMC Labs was founded in April 2023 by crypto asset investors and data scientists. It focuses on blockchain industry research and investments in the crypto secondary market, with industry foresight, insights, and data mining as its core competencies. It is committed to participating in the thriving blockchain industry through research and investment, promoting the benefits of blockchain and crypto assets for humanity.

For more information, please visit: https://www.emc.fund

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。