Last night, RSR surged by 50.72% to reach $0.026 before briefly dropping to $0.019. The current price of RSR is $0.023. The RSR concept meme DTF rose from $0.012 to $0.03, experiencing a short-term increase of 235% before falling to $0.015, with the current price at $0.023.

This is because sources say that Trump has chosen Paul Atkins as the next SEC Chairman, and Atkins previously served as an advisor for the RSR project. However, the price of related tokens briefly plummeted after Atkins did not confirm the news and sources reported his hesitant attitude.

Who is Paul Atkins?

Paul Atkins is a former SEC commissioner from the George W. Bush administration, known for opposing "high fines for companies that violate securities laws." He previously opposed the Dodd-Frank Act, which strengthened federal regulatory powers after the 2008 financial crisis.

In 2016, Atkins played a key role in Trump's political transition team after his election, significantly influencing Trump's laissez-faire attitude towards financial regulation.

Currently, Atkins is still serving at his consulting firm, Patomak Global Partners, which he founded in 2009. Since 2017, he has also served as co-chair of the Token Alliance, an industry association advocating for digital assets and the blockchain industry.

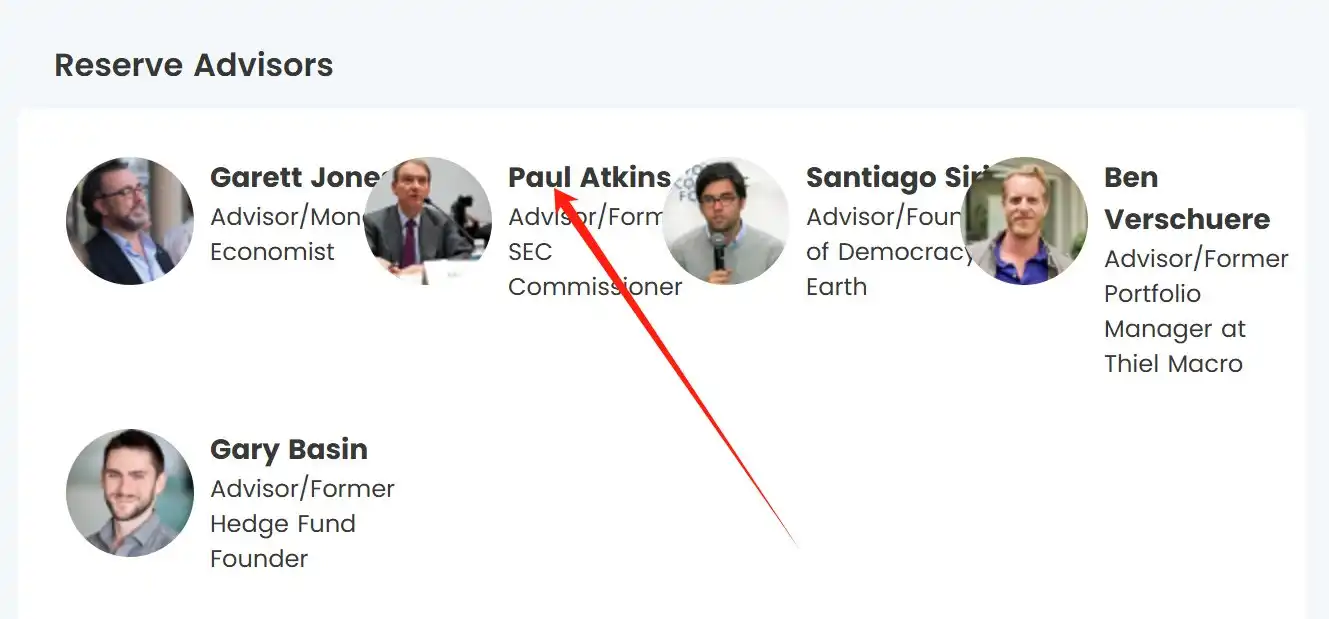

The connection to RSR arises from the community discovering that Atkins had served as an advisor for the project.

Reserve founder Nevin Freeman explained in a post that "Paul is not currently actively involved in Reserve's consulting work; he was just an advisor in the early stages of the project. However, his open-mindedness during our interactions impressed me, and his willingness to publicly serve as an advisor to Reserve indicates his commitment and support for the cryptocurrency space."

As a result, after the news aggregation account db cited Unchained's report stating that Trump chose Atkins as the next SEC Chairman, the price surged.

Unchained's original news article stated: "According to three informed sources, Trump has selected pro-cryptocurrency Paul Atkins to serve as SEC Chairman. One source noted that Trump has contacted Atkins but is still waiting for his formal acceptance of the appointment."

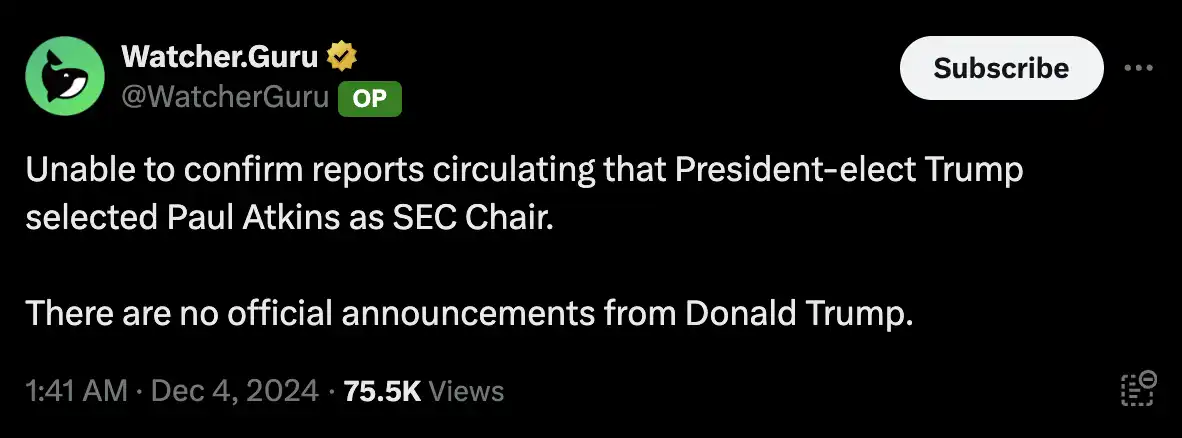

Less than twenty minutes later, another major news aggregation account, Watcher.Guru, reported that "the rumors about President-elect Trump selecting Paul Atkins as SEC Chairman could not be confirmed, and no official statement has been released from Trump's side."

According to Coindesk, a person familiar with Atkins' thoughts indicated that Atkins is hesitant about leaving his global consulting firm to address what he perceives as an overstaffed agency mismanaged by outgoing SEC Chairman Gary Gensler.

Shortly after, another major news outlet, Equation, pushed a notification stating that trader GCR mentioned in Discord that he had sold RSR a long time ago, although this notification has since been deleted.

The trading news relay process above led to the short-term surge and drop of RSR and DTF, essentially reflecting the current market's emotional speculation based on the outcome of the SEC Chairman.

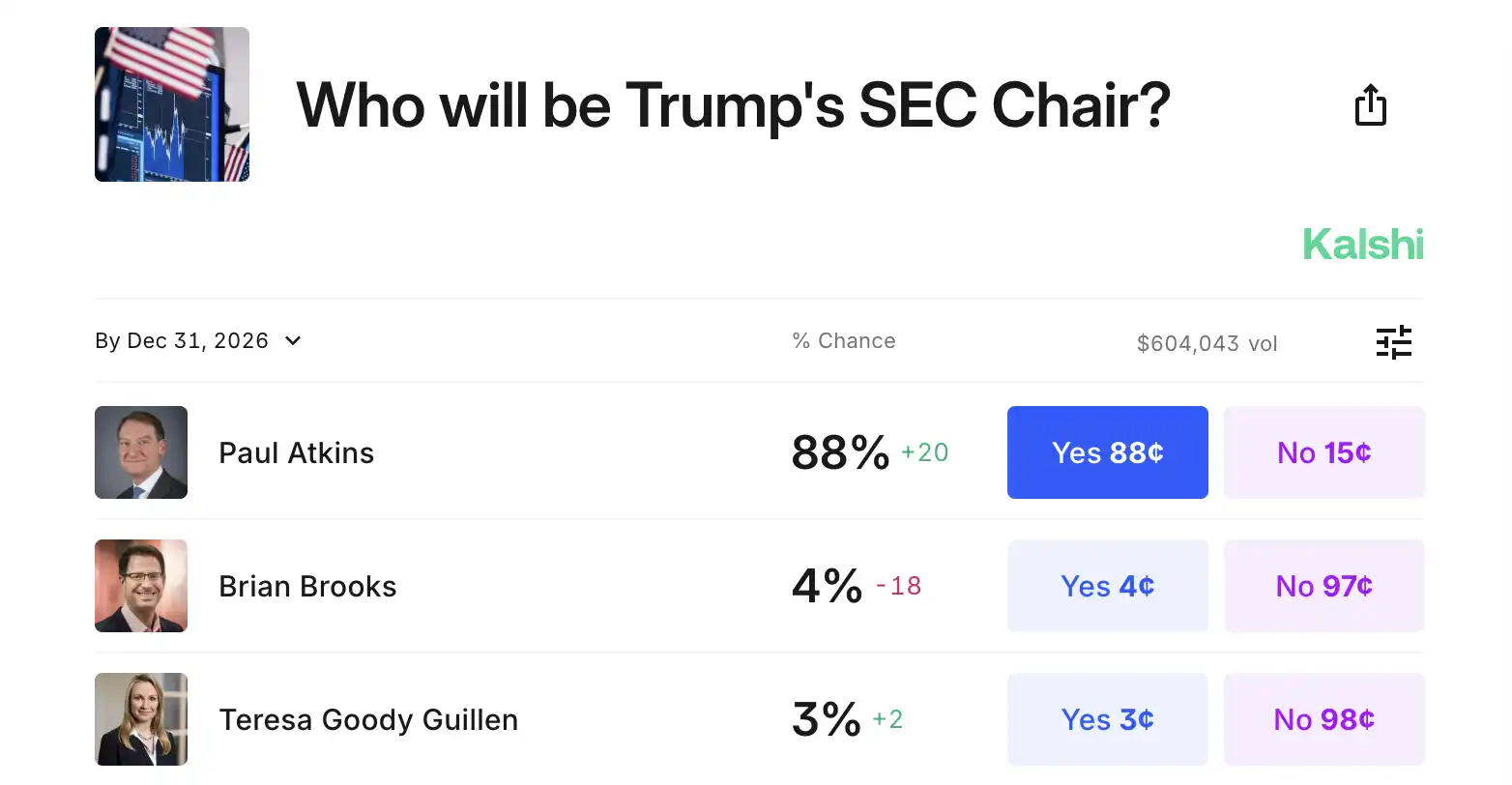

Currently, compliance prediction platform Kalshi shows that the probability of Paul Atkins becoming the next SEC Chairman has risen to 88%.

Previously, according to FOX Business reporter Eleanor Terrett, Trump is expected to announce the successor for the SEC Chairman as early as today. She stated that veteran financial regulator and conservative financial insider Paul Atkins is the most likely candidate. Trump's transition team has also interviewed Paul Atkins, and two sources close to Mar-a-Lago revealed that among the senior members of Trump's transition team, former SEC Commissioner Paul Atkins has the highest likelihood of being selected as SEC Chairman.

What are the speculative concepts for SEC Chair?

RSR

Reserve Rights (RSR) is a dual-token stablecoin platform launched on the Huobi Prime platform in May 2019. Reserve aims to establish a stable, decentralized stablecoin and digital payment system, with its stablecoin characterized by self-regulating supply based on demand and supported by 100% or more on-chain collateral.

The main issue RSR seeks to reduce is volatility, as the volatility of cryptocurrencies limits the market's expansion as a medium of exchange. Merchants have been reluctant to accept cryptocurrencies due to concerns about potential profit losses during market downturns. The Reserve protocol provides the market with a stable store of value, medium of exchange, and standard for deferred payments. Today, the focus of the Reserve Rights ecosystem is to help individuals, treasuries, and DAOs combat inflation.

The total supply of RSR is 100,000,000,000, with a current market cap of $1,390,407,126 and a TVL of $278,254,588.

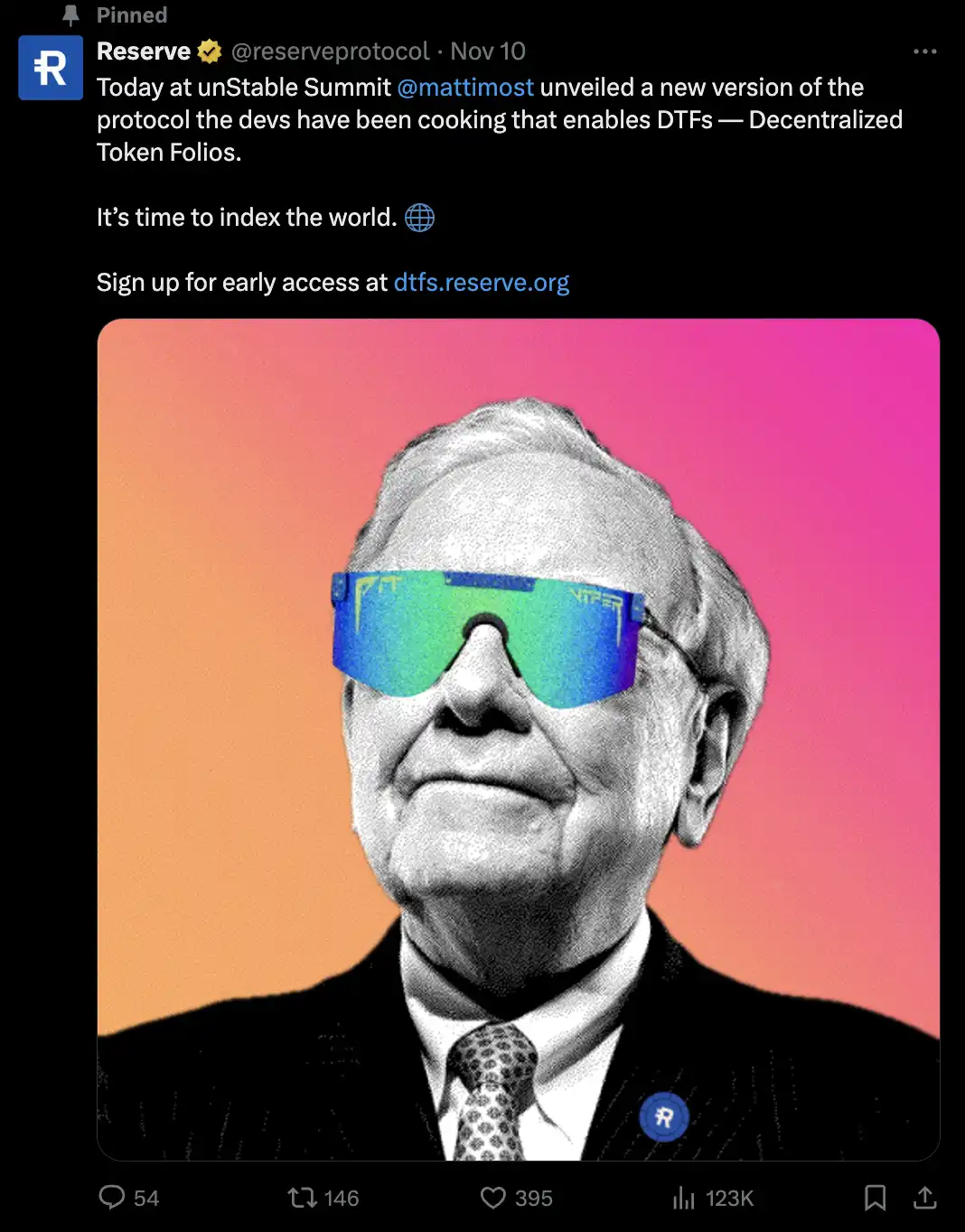

DTF

DTF is a meme coin that has no direct relation to the Decentralized Token Folios protocol launched by Reserve. Its full name is "Believe In Something," corresponding to the DTF website's slogan "Stop trading, believe in something."

Currently, DTF has a total market cap of $23.9 million and a 24-hour trading volume of $20 million.

HBAR

Former Binance CEO and Hedera Foundation board member Brian Brooks is also a leading contender for the next SEC Chairman, which has led to recent speculation around HBAR as a concept coin related to the SEC Chairman.

Hedera is designed for fast, fair, and secure applications, utilizing the efficiency of Hashgraph on a trusted decentralized public network. By limiting the number of nodes involved in key functions such as timestamping and transaction ordering, Hedera Hashgraph can quickly achieve finality, thereby reducing the likelihood of later changes to transaction states.

XRP

XRP has surged fivefold in a month, with its market cap returning to the third position among crypto assets, back to levels seen before the SEC and Ripple lawsuit in 2020, making this long-standing token one of the strongest performers among altcoins recently.

Related reading: "XRP market cap returns to third, what is driving its surge?"

Ripple is a real-time gross settlement system, currency exchange, and remittance network created by the American technology company Ripple Labs Inc. Launched in 2012, Ripple is based on a distributed open-source protocol that supports tokens representing fiat currencies, cryptocurrencies, commodities, or other units of value. It claims to enable "secure, instant, and nearly free global financial transactions of any scale, with no chargebacks."

Since Trump's administration, there have been continuous developments in cryptocurrency-related policies, and XRP's launch trajectory is closely tied to the resignation announcement of the current SEC Chairman. The SEC filed a lawsuit against Ripple and its two executives—CEO Brad Garlinghouse and co-founder Chris Larsen—on the grounds of "conducting an unregistered securities offering of $1.3 billion," and this lawsuit remains unresolved to this day.

On December 1, former CFTC Chairman Chris Giancarlo stated in an interview that the SEC should reconsider its approach, especially in light of recent legal outcomes and the potentially changing regulatory environment. When asked if the SEC would drop the Ripple lawsuit, Giancarlo said, "I think they should… I bet they will."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。