The number of new addresses on XRPL has increased by 10%, reaching a total of 105,000.

Author: Matt Kreiser

Translation: Deep Tide TechFlow

Key Insights

In September this year, Ripple and the XRP community announced plans to introduce native smart contract functionality on the XRP Ledger (XRPL) through the upcoming XLS proposal, bringing more flexibility to the ecosystem.

The daily transaction volume on XRPL increased by 94% month-over-month, reaching 1.7 million; the number of new addresses also grew by 10%, totaling 105,000.

In August this year, Ripple announced that its USD-pegged stablecoin RLUSD has entered the private testing phase on the XRPL and Ethereum networks, currently awaiting regulatory approval.

Based on proposals made in the last quarter, XRPL is developing a native lending protocol that allows users to borrow assets through single-asset vaults, including XRP, stablecoins, wBTC, and wETH.

The community has passed several amendment proposals to introduce decentralized identity (DID) functionality to XRPL, supporting verifiable digital identities, while also adding price oracles to provide price references for wrapped assets and bridged assets.

Overview

As a blockchain network that has been operational for over ten years, the XRP Ledger (XRP) offers various functionalities such as cross-currency, cross-border payments, and asset tokenization. The core advantages of XRPL lie in its fast and low-cost transaction capabilities (compared to other currency-centric blockchains) and its rich native features, such as tokens, NFTs, decentralized exchanges (DEX), custodial services, built-in compliance, and token management tools.

With these features, XRPL can perform many tasks that other blockchain networks handle, such as supporting markets for NFTs, stablecoins, and synthetic assets. These functionalities achieve high composability through built-in mechanisms like Central Limit Order Books (CLOB) and Automated Market Makers (AMM). Notably, the base layer of XRPL currently does not support complex smart contracts, a design choice aimed at ensuring the network's security and stability through simplified architecture. However, the XRPL community is actively exploring the possibility of introducing more advanced scripting capabilities, such as Hooks technology. Additionally, through sidechains, XRPL can achieve further functional expansion, bringing more application scenarios to the entire ecosystem.

The development of XRPL is supported by multiple teams and individuals, including Ripple, InFTF (formerly XRPL Foundation), XRPL Labs (and its subproject Xaman), and XRPL Commons. XRPL serves not only individual users but also provides digital payment infrastructure for traditional financial institutions such as commercial banks and fintech companies. The community has shown strong interest in developing B2B and B2C financial solutions. For complete introductory information on the XRP Ledger, please refer to our coverage launch report.

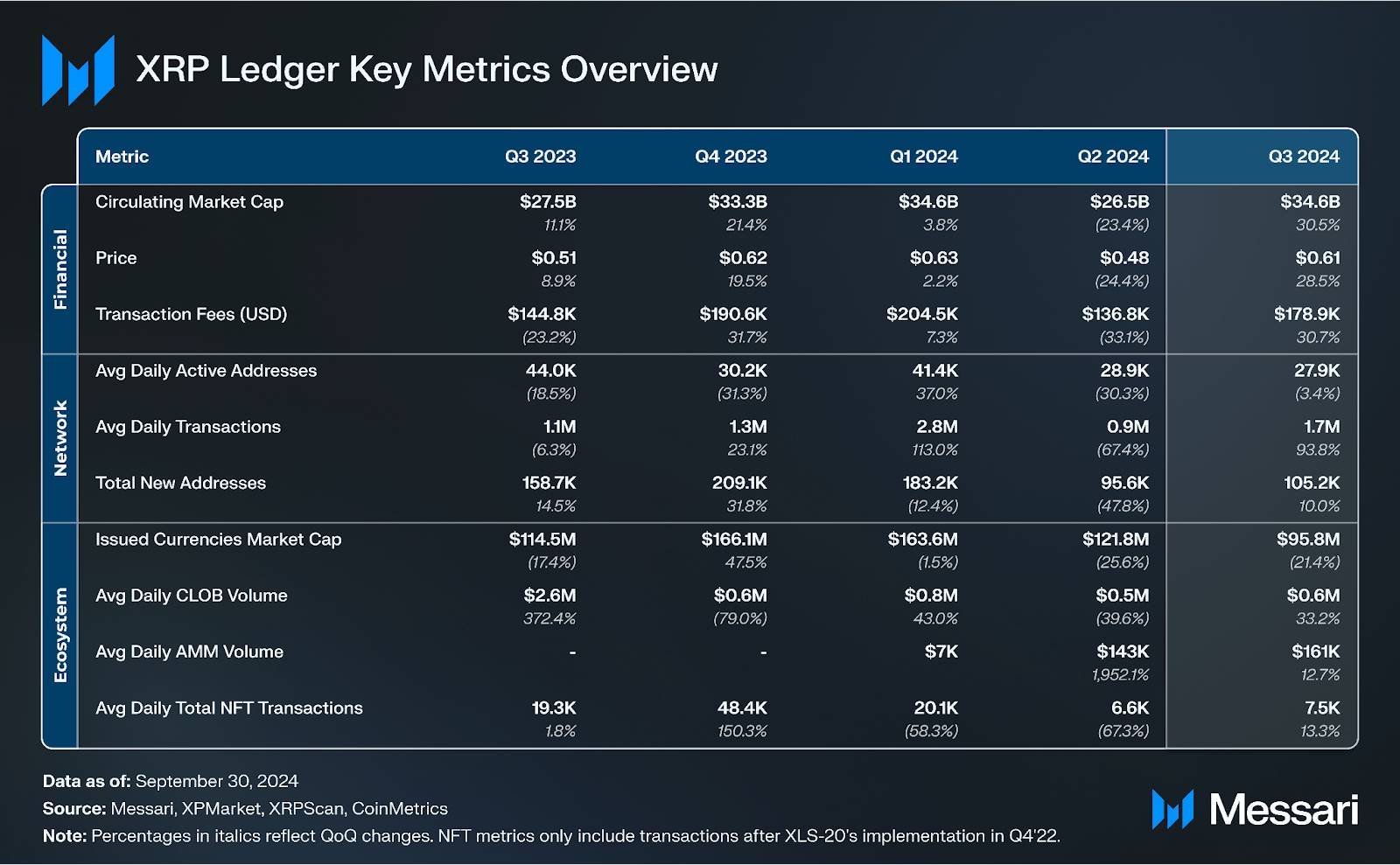

Key Metrics

Financial Analysis

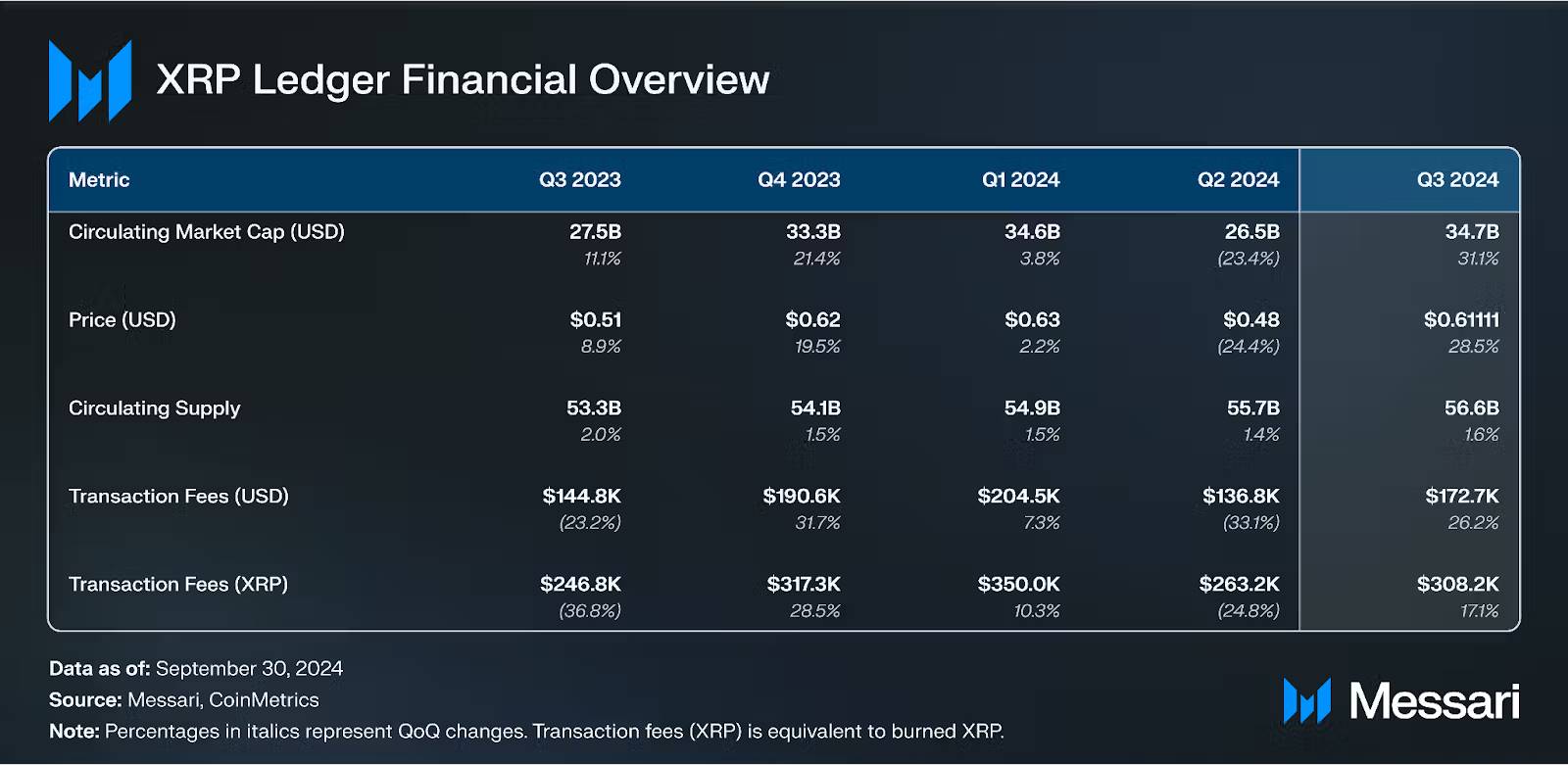

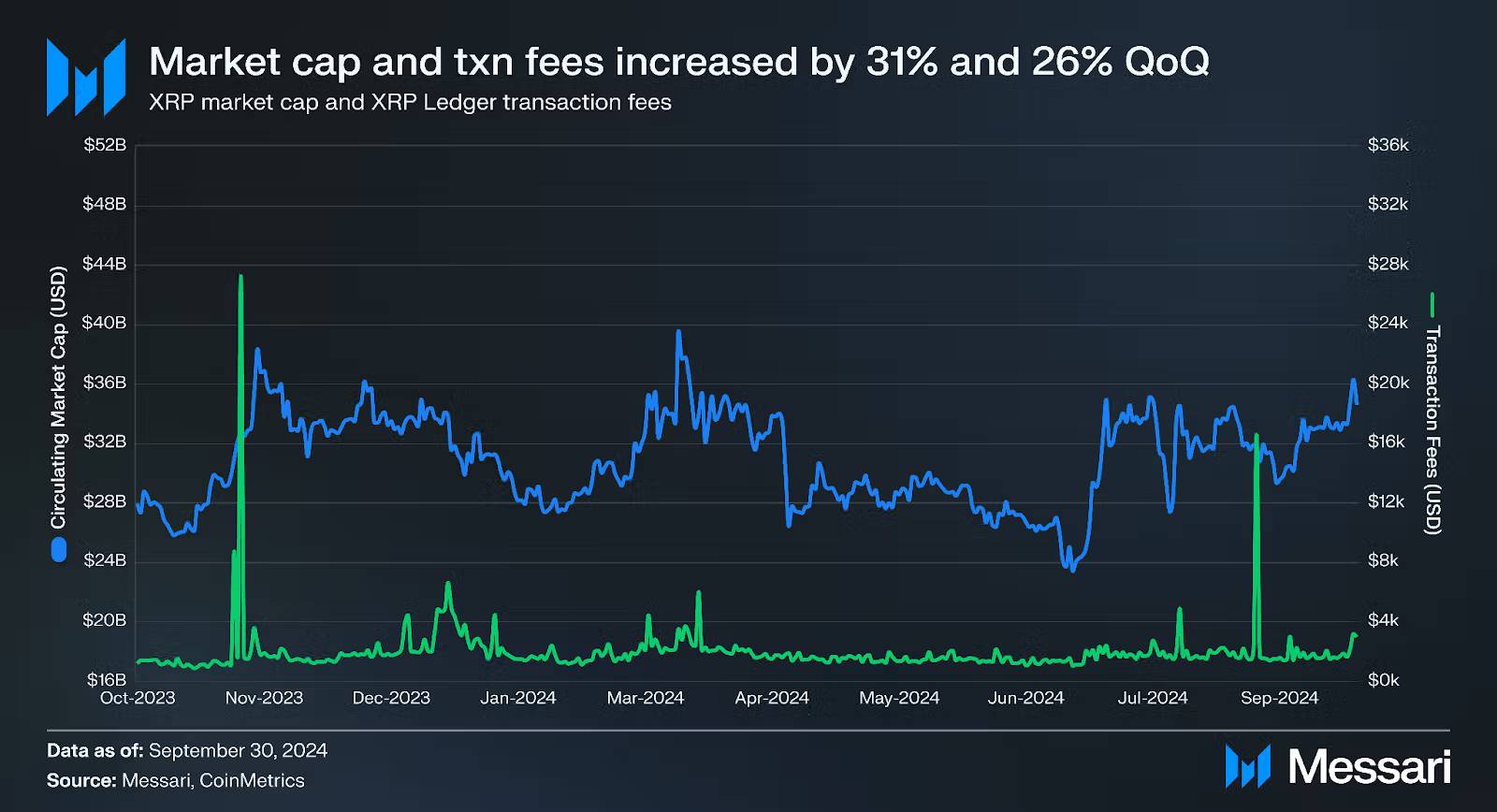

As of the end of the third quarter of 2024, XRPL's native token XRP ranks seventh globally in terms of market capitalization among crypto assets, with a market cap of $34.7 billion. Its circulating market cap increased by 31.1% month-over-month, while the price rose by 28.5%. The reason for the market cap growth outpacing the price is that the circulating supply also increased by 1.6% month-over-month. Notably, in September this year, asset management firm Grayscale launched an XRP trust fund, providing a new investment channel for qualified investors. Additionally, in October and November, ETF issuers such as Bitwise, Canary, and 21Shares submitted S-1 filings to launch XRP-based exchange-traded funds (ETFs).

In the XRPL network, transaction fees are systematically burned, creating a deflationary effect on the total supply (10 billion XRP). Since the network's launch, nearly 13 million XRP have been burned (approximately $7.9 million as of the end of the third quarter of 2024). The low burn rate is primarily due to XRPL's very low transaction fees (less than $0.002 per transaction). Meanwhile, 1 billion XRP (approximately $610 million as of the end of the third quarter of 2024) is released from escrow accounts to Ripple each month. Any XRP not used or distributed by Ripple in that month is re-deposited into a new escrow contract. This mechanism will continue until the remaining approximately 39 billion XRP are fully circulated. At that point, the burned transaction fees will be the only variable affecting the supply of XRP.

Unlike many other cryptocurrency networks, XRPL does not distribute rewards or transaction fees to validators. Under its adopted Proof-of-Association (PoA) mechanism, the primary incentive for validators is to support the decentralization of the network, a model similar to full nodes in Ethereum or Bitcoin, rather than traditional validators or miners. The PoA consensus mechanism relies on trust relationships between nodes, which are managed and organized through a Unique Node List (UNL).

Notably, XRP's market cap increased by 31% month-over-month, significantly outperforming the overall crypto market's approximately 3% month-over-month decline. From an annual perspective, XRP's circulating market cap grew by 26% year-over-year. In the XRPL network, transaction fees are burned rather than distributed to stakers as in other networks. Nevertheless, the burning of transaction fees reduces the total supply of XRP, thereby enhancing the value of the remaining XRP. In a sense, this mechanism effectively transfers wealth from users paying transaction fees to XRP holders.

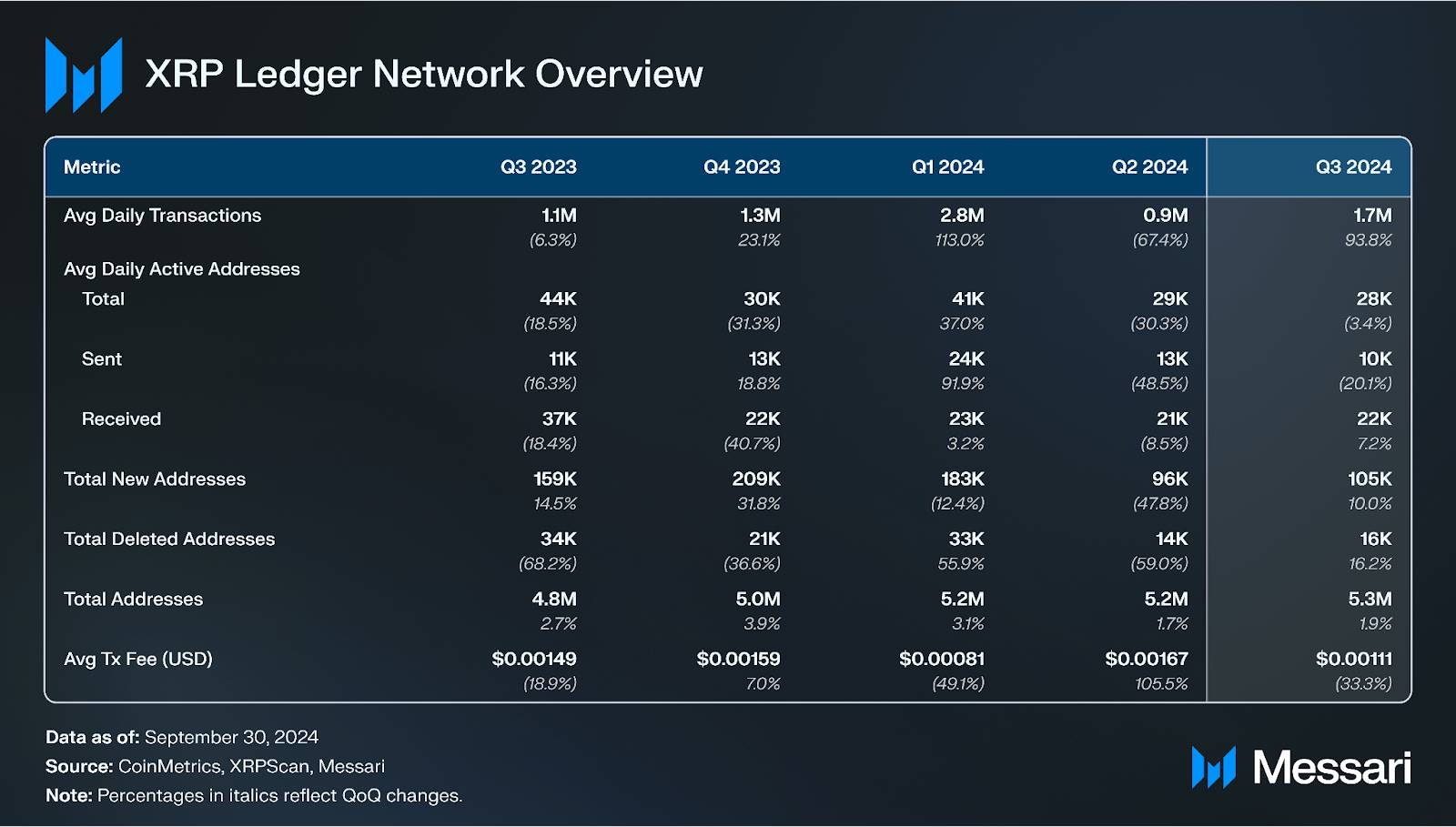

Network Analysis

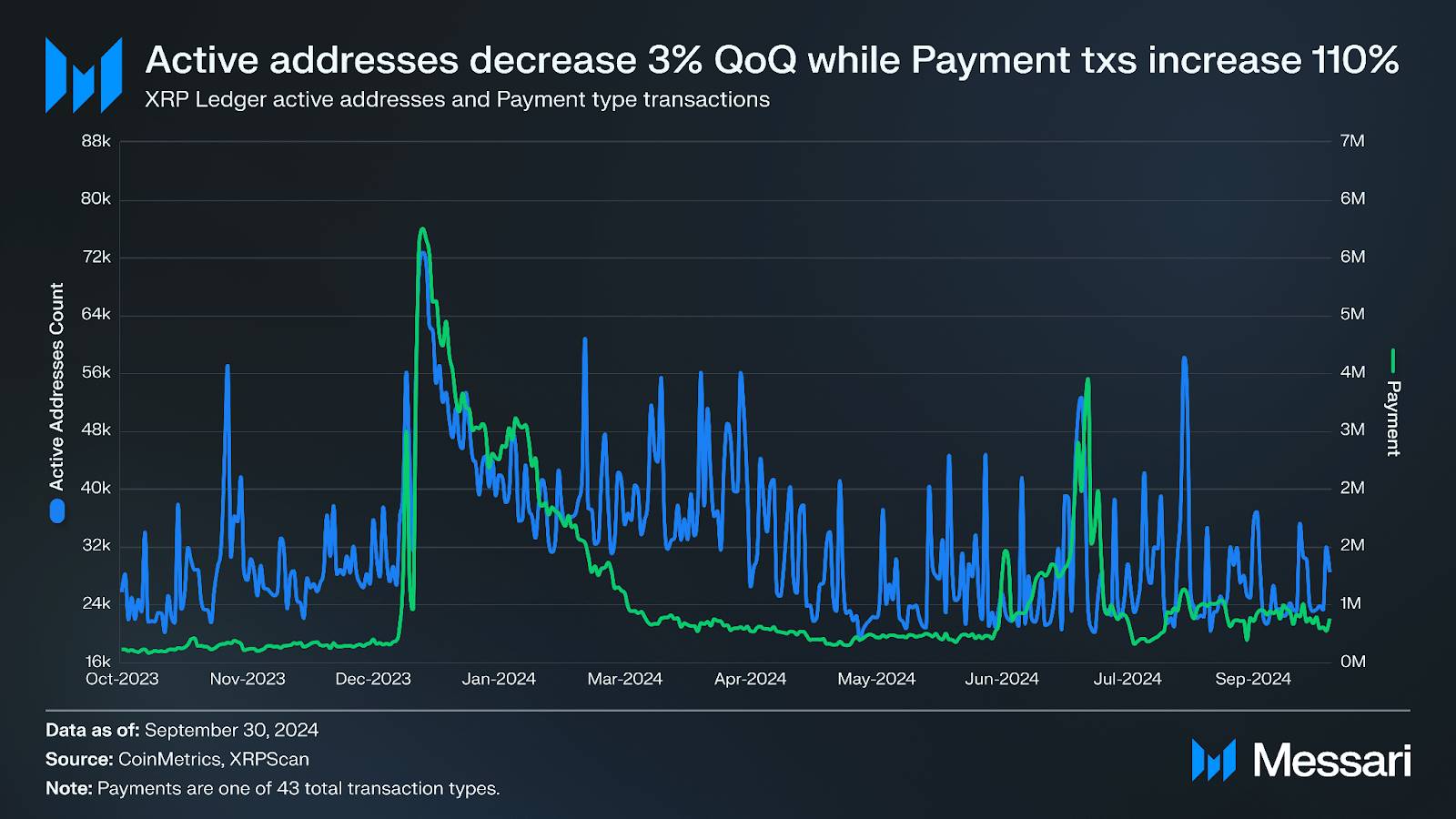

In the context of a general decline in network metrics in the previous quarter (except for the total number of addresses), several indicators showed a rebound in the third quarter of 2024. Among them, the daily transaction volume increased by 94% month-over-month, reaching 1.7 million; the number of new addresses also grew by 10%, reaching 105,000. However, according to Ripple's third-quarter report, this growth was primarily driven by microtransactions (with individual transaction amounts below 1 XRP), which seemed to be related to spam messaging activities. From an annual perspective, the number of new addresses added quarterly decreased by 34% from the third quarter of 2023 to the second quarter of 2024.

In the XRPL network, the creation and deletion of accounts are significant because creating each account requires a deposit of 10 XRP, which can be reclaimed upon account deletion. This mechanism makes the account metrics of XRPL more reliable compared to other networks that allow zero-cost account creation, and it reduces the risk of Sybil attacks.

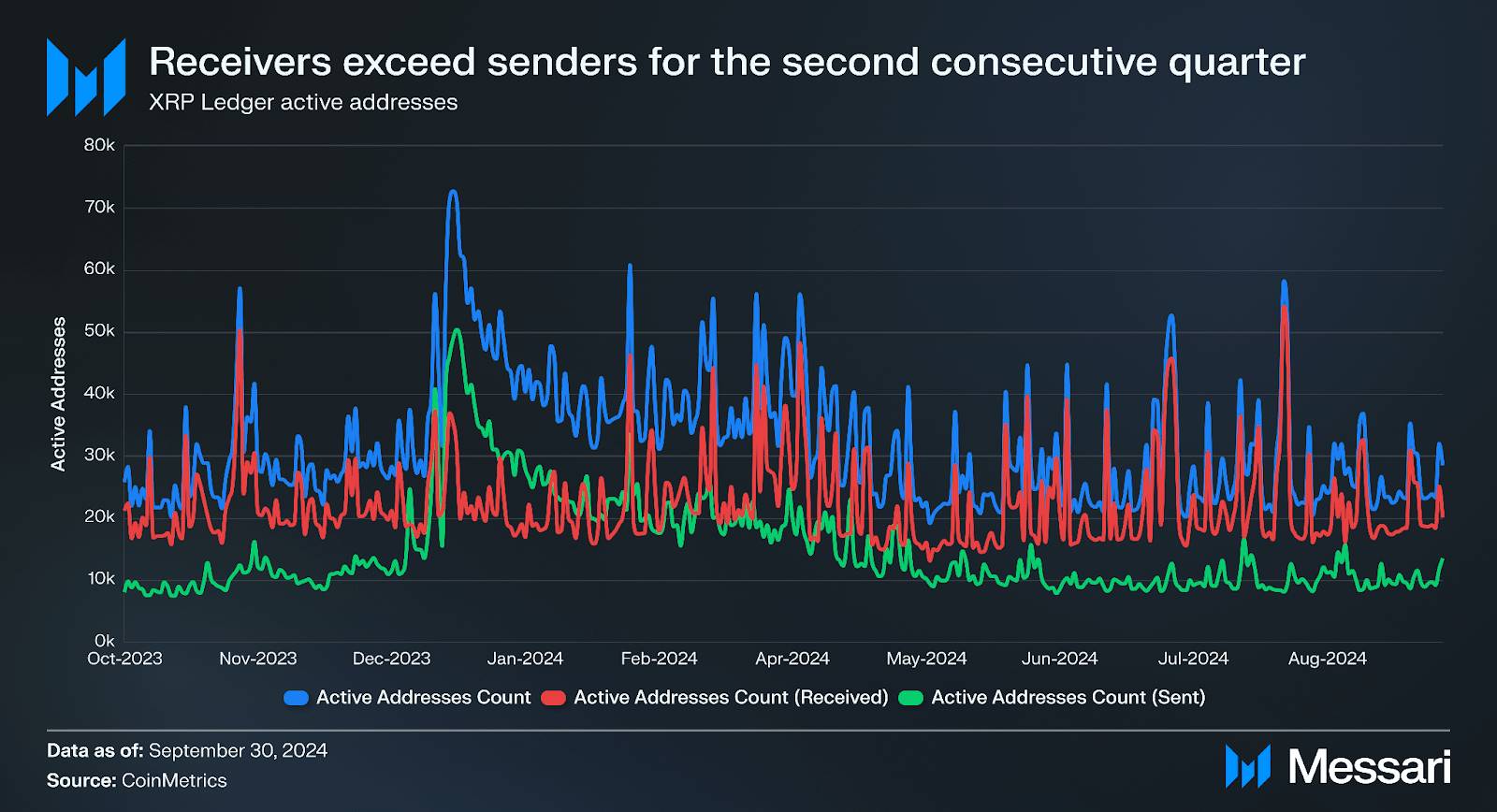

Despite a rebound in transaction volume, the total number of active addresses on XRPL decreased by 3% month-over-month. This overall decline is primarily due to a 20% decrease in active sending addresses (i.e., unique senders), while active receiving addresses (i.e., unique receivers) only increased by 7%.

Notably, XRPL supports Destination Tags, allowing a single address to receive and track XRP deposits for multiple users. This design can lead to an underestimation of the daily active address count. For example, an account on a centralized exchange may represent a large number of users, whereas on other networks (like Ethereum or Bitcoin), each user typically requires a separate address to receive tokens.

In this quarter, the number of active receiving addresses exceeded active sending addresses for the second consecutive quarter. The number of active receiving addresses reflects the total number of addresses that received transfers or other transactions. When the number of receiving addresses exceeds that of sending addresses, it usually indicates that more previously inactive wallets have received tokens. This phenomenon is common in airdrop activities, where tokens are distributed to reward and attract community members. Due to the low transaction fees on the XRPL network or support for batch transactions, airdrops are more practical on this network.

After experiencing two consecutive quarters of decline, payment transaction volume surged by 110% this quarter due to the spike in inscription activities that began at the end of 2023. In contrast, the total number of active addresses decreased by 3%, as mentioned earlier. Historical data shows that when there is a slight surge in network activity, the difference between active receiving and sending addresses is often driven by centralized exchanges and custodial platforms. These platforms commonly use destination tags to identify transaction destinations and primarily facilitate deposits and withdrawals through payment transaction types. Therefore, the number of receiving addresses for payment transactions always exceeds that of sending addresses.

Additionally, users generally prefer to create wallets on centralized exchanges or custodial platforms to quickly obtain the initial XRP required to create a self-custody wallet. After acquiring the initial XRP, many users withdraw it to their self-custody wallets, leading to a decrease in active sending addresses while increasing active receiving addresses.

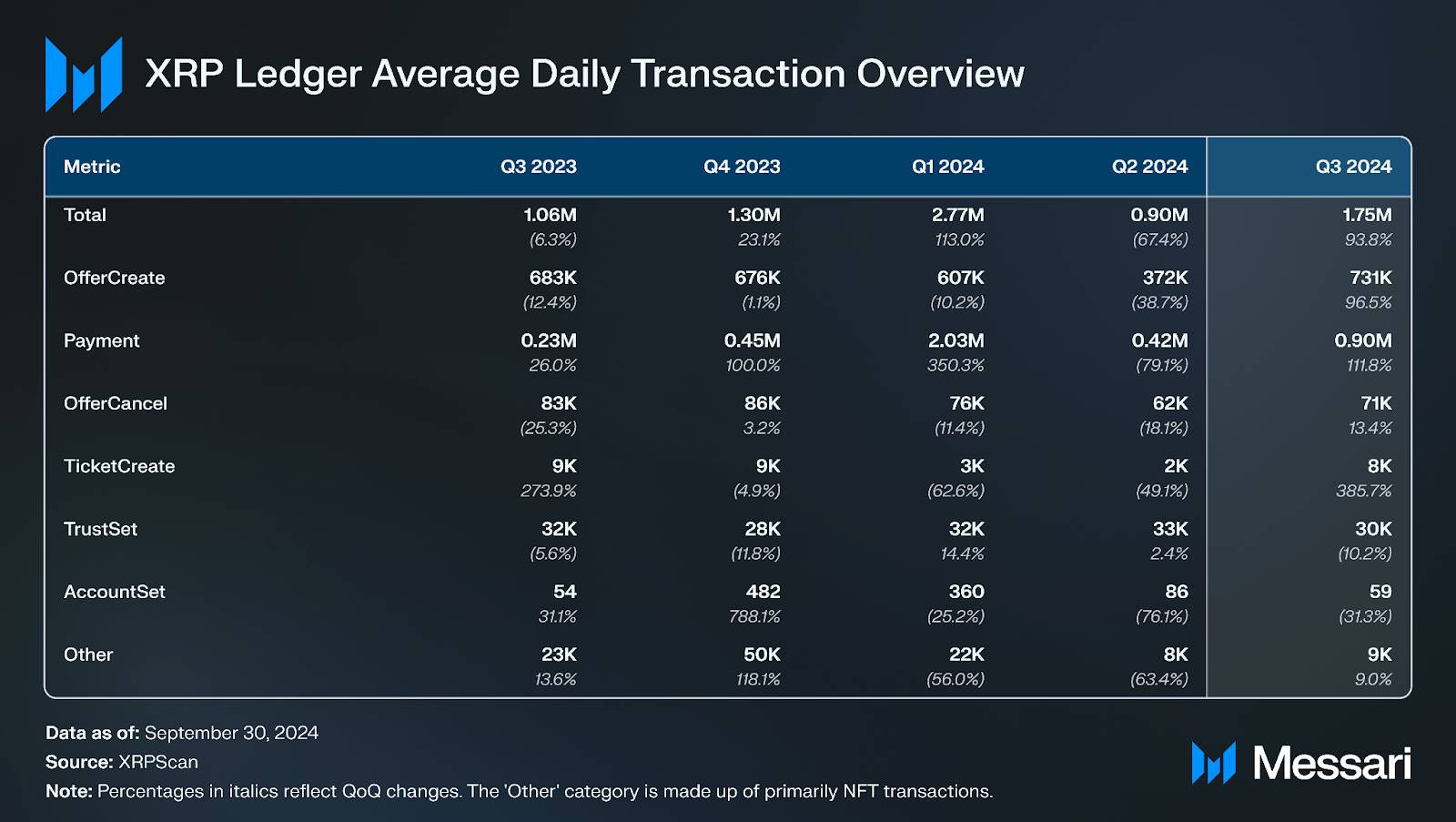

The total daily transaction volume on XRPL includes 43 different transaction types, such as payments, escrow creations, NFT burns, and account deletions. The average daily transaction volume increased by 94% month-over-month, growing from 900,000 transactions per day to 1.75 million transactions per day.

Before the first quarter of 2024, OfferCreate was the most dominant transaction type. OfferCreate is used to submit orders on the order book but does not necessarily result in an immediate trade unless matched with existing open orders. It is primarily used to initiate DEX limit orders, while buy or sell requests on the order book are represented by Offer objects. Some unfilled orders generate new orders, similar to the UTXO model. Additionally, users can cancel unfilled orders through OfferCancel transactions. Trust Lines (Trust Lines) are structures that hold tokens and protect accounts from receiving unwanted tokens, while TrustSet transactions are used to open or close these trust lines.

The transaction shares of payment transactions and OfferCreate increased by 9% and 1%, respectively. Before the first quarter of 2024, OfferCreate was the most common transaction type on the XRPL network.

Overall, the average daily total transaction volume increased by 94%, from 900,000 transactions to 1.75 million transactions per day. The "other" category of transactions includes transaction types related to NFTs, escrows, multisigs, setting signature keys, and more. Detailed information on these transaction types can be found in the ecosystem overview section.

Decentralized Exchange (DEX)

CLOB (Central Limit Order Book)

The Central Limit Order Book (CLOB) of XRPL is primarily responsible for handling trades of fungible tokens (also known as issued currencies or simply tokens). CLOB has been a core component of XRPL since its inception, with the advantage of reducing reliance on third-party trust and avoiding the inherent risks of smart contracts by integrating liquidity. Currently, most transactions on XRPL come from the local CLOB. Although XRPL has only one CLOB, multiple markets (also known as gateways) provide users with access interfaces. These markets share liquidity and offer a convenient operating experience for regular users.

AMM (Automated Market Maker)

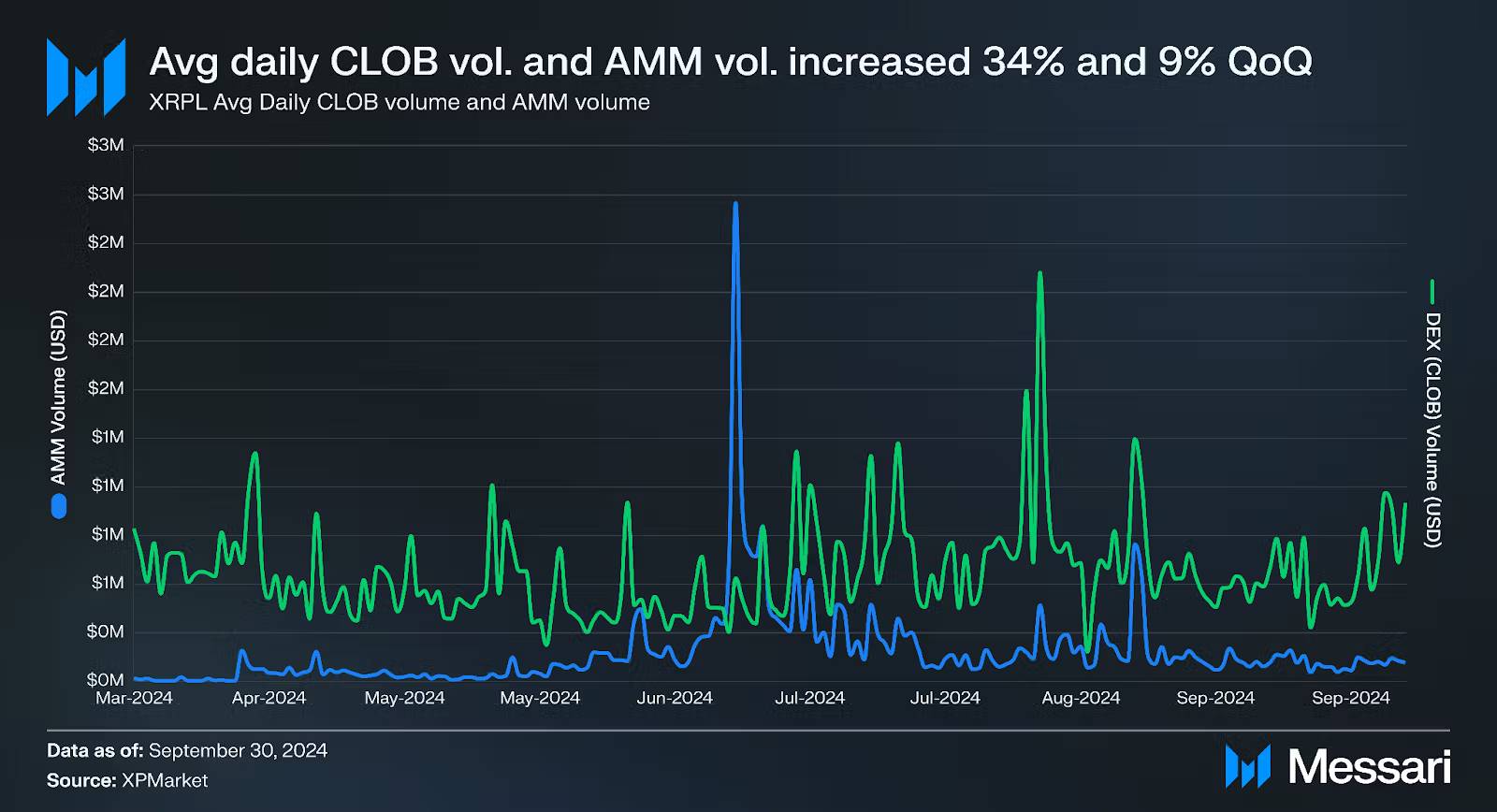

Building on the existing CLOB, XRPL introduced Automated Market Makers (AMM) in March through the XLS-30 standard. AMM operates through liquidity pools, pricing assets algorithmically rather than creating preset orders. Liquidity pools allow token holders to earn transaction fees by providing liquidity. Notably, orders can be routed through both AMM and CLOB simultaneously, as both work together to form the core functionality of the DEX.

In September, XRPL activated a revision to better match transaction sizes, optimizing AMM's exchange rates. Additionally, in September, Hummingbot released its XRPL connector (as part of Hummingbot 2.0), supporting automated market making and arbitrage strategies on XRPL.

Servers

Nodes and validators (referred to as servers) all run the same client software: rippled. Since the release of version 2.2.3 in September of the third quarter, over 55% of nodes have upgraded to V2.2.3. As of the end of the third quarter, XRPL had 621 nodes and 109 validators supporting it. Since the second quarter, the number of nodes has increased from 602, while the number of validators has decreased from 119.

XRPL servers participate in federated consensus as part of the XRPL Proof-of-Association (PoA) consensus mechanism. Validators do not stake tokens or receive economic rewards. Instead, the system is based on trust between nodes. Each node sets up a list of trusted nodes, known as the Unique Node List (UNL). Additionally, the Negative UNL is a feature that adjusts the server's "effective UNL" based on the current online and operational status of validators. UNLModify transactions were called an average of 4.3 times per day in the third quarter, marking changes in the Negative UNL, indicating that trusted validators have gone offline or come back online.

Ecosystem Analysis

Although the XRPL ecosystem has many features similar to programmable settlement networks like Ethereum, Solana, and Cardano, XRPL itself does not natively support smart contracts. However, in September, Ripple, along with the broader XRP community, announced plans to introduce native smart contracts on XRPL through upcoming XLS proposals. These smart contracts will be permissionless, allowing users to run them without prior approval, and will support XRPL's built-in functionalities such as escrow, NFTs, authorized trust lines, payment channels, DEX, and AMM.

The reason XRPL does not enable arbitrary smart contracts at the base layer is due to design considerations aimed at maximizing security, performance, and stability. Instead, XRPL has some core functionalities (such as decentralized exchanges and issued currencies) directly built into the protocol. XRPL supports various forms of assets, which are represented on-chain through Tokens (also known as issued currencies or IOUs) that can represent any currency, commodity, or unit.

Decentralized Finance (DeFi)

The total market capitalization of fungible tokens (i.e., issued currencies) decreased by 24% month-over-month, reaching $95 million. There are over 3,800 listed assets on XRPL, but the top token, SOLO, accounts for 34% of the total market cap. The top four tokens collectively account for 71% of the total market cap.

As of the end of the third quarter, the top tokens on XRPL ranked by market capitalization are as follows:

Sologenic (SOLO) has a market cap of $34.3 million, with 228,000 holders. SOLO is primarily used to pay transaction fees on the Sologenic gateway.

Bitstamp BTC (BTC) has a market cap of $12.5 million, with 4,500 holders. Bitstamp BTC is a wrapped version of Bitcoin provided by Bitstamp.

Gatehub Fifth ETH (ETH) has a market cap of $11.3 million, with 26,000 holders. Gatehub Fifth is a wrapped version of Ether provided by GateHub.

Coreum (CORE) has a market cap of $8.9 million, with 71,000 holders. CORE is the native token of the Coreum sidechain developed by the Sologenic team.

Trust Lines are a mechanism in XRPL for holding fungible tokens while ensuring that users are not forced to hold unwanted tokens. Therefore, trust lines make the token behavior metrics on XRPL more reliable. The first two trust lines for an account are free, but each subsequent token object (such as issued currencies) requires locking 2 XRP (known as owner reserve). Additionally, creating a new address requires a base reserve of 10 XRP. These requirements significantly increase the cost of implementing Sybil attacks (i.e., manipulating network metrics by fabricating multiple false identities) on XRPL. Therefore, the number of holders becomes a reliable indicator of token adoption on XRPL, especially when the supply of fungible tokens far exceeds that of NFTs.

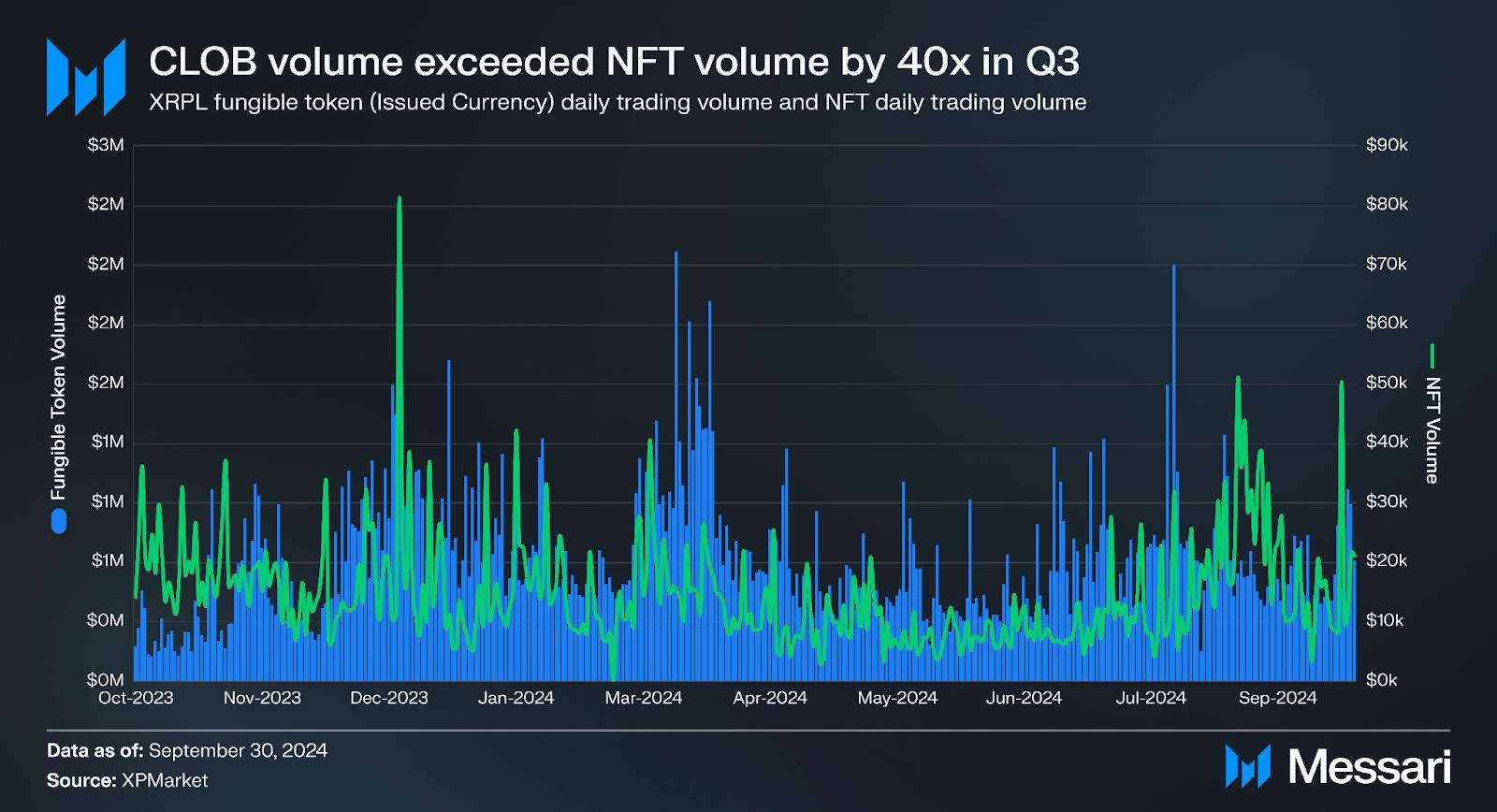

The daily trading volume on the Central Limit Order Book (CLOB) on XRPL increased by 34% month-over-month, reaching $640,000, while the daily number of transactions increased by over 1,110%, reaching 740,000 transactions. At the same time, the average daily number of CLOB traders increased by 1% to 2,300 people. Sologenic is the primary DEX on XRPL (the leading gateway for native DEX), ranked first in trading volume for issued currencies. Other well-known DEXs (gateways) include XPMarket and xrp.cafe.

Since its launch in March, AMM trading volume exceeded CLOB trading volume for six consecutive days in June, peaking at $2.5 million. Although it did not reach the daily high of the third quarter, the average daily trading volume of AMM still grew by 9% to approximately $160,000, reflecting an increase in sustained usage. Existing platforms like Sologenic and xrp.cafe as well as new platforms like Orchestra Finance and Moai Finance have all integrated these protocols. Some notable features offered by these protocols include the continuous auction mechanism from Orchestra Finance to reduce trading fees, and the introduction of a Telegram trading bot ( First Ledger ) by the team behind xrp.cafe. Liquidity on AMM is shared across all DEXs (gateways), just like CLOB.

On XRPL, stablecoins and wrapped tokens stand out particularly in terms of the number of holders. Gatehub and Xaman (formerly Xumm) have collaborated to offer a total of 14 digital assets on XRPL. As of the end of the third quarter, the leading stablecoins and wrapped tokens (also known as IOUs) on XRPL are as follows:

Bitstamp BTC: Market cap of $12.5 million, with 4,500 holders.

Gatehub Fifth (ETH): Market cap of $11.3 million, with 26,000 holders.

Gatehub USD: Market cap of $3.4 million, with 20,000 holders.

Bitstamp USD: Market cap of $2 million, with 7,000 holders.

In April of this year, Ripple first announced plans to launch a USD-pegged stablecoin on XRPL and Ethereum. This stablecoin will utilize XRPL's native features while adopting the ERC-20 standard on Ethereum. The stablecoin will be fully backed by USD deposits, short-term U.S. Treasury bills, and "other cash equivalents," and will undergo monthly third-party audits. In many cases, introducing a trusted stablecoin in a new environment can significantly enhance liquidity (for example, the iUSD launched on Cardano in 2023), especially as an ideal trading pair asset in AMMs.

Since then, Ripple has provided some additional updates regarding RLUSD. In August, Ripple announced that RLUSD was undergoing internal testing on XRPL and Ethereum, awaiting regulatory approval. In October, Ripple President Monica Long announced that RLUSD was "operationally ready," and Ripple announced several exchange partners for the token and an RLUSD advisory committee. Notably, RLUSD is issued under the New York Trust Company charter to ensure strict oversight and regulation.

Despite this, stablecoins on XRPL have not yet reached the adoption levels of major stablecoins on other networks, such as USDT and USDC. USDT has a market cap of up to $125 billion, while USDC has a market cap of $37 billion.

Also in April, a proposal was made to introduce a native lending protocol on XRPL (XLS-66), allowing users to lend and borrow supported assets such as XRP, wBTC, and wETH using a single asset vault (XLS-65). Unlike over-collateralized lending protocols like Aave, this protocol aims to provide on-chain fixed-term loans and interest loans through off-chain underwriting, risk management, and insurance funds, similar to the model implemented by TrueFi on Ethereum.

In September, both proposals underwent several updates, including a single asset vault for directly holding assets, as well as vaults and loan agreements that support compliant and regulatory asset issuers to reclaim and freeze assets.

Axelar, a full-stack interoperability protocol (i.e., a crypto overlay network), integrated with XRPL in the first quarter. It connects the XRPL ecosystem to over 60 networks, including Ethereum and the Cosmos ecosystem. As AMMs develop, Axelar's connectivity makes it easier to obtain liquidity from many of the highest TVL networks.

Real World Assets (RWAs)

Real World Assets (RWAs) can be utilized on XRPL in various ways. In August, OpenEden launched tokenized U.S. Treasury bills (T-bills) on XRPL, with Ripple committing to allocate $10 million to OpenEden's TBILL token. Additionally, Archax and Ripple are developing a mechanism for financial institutions to tokenize RWAs on XRPL, aiming to bring hundreds of millions of dollars of RWAs to XRPL next year. Zoniqx and Ripple are also working to introduce Zoniqx's tokenization services to XRPL. Notably, the recall feature will allow asset issuers to attempt to transfer RWAs on-chain while maintaining compliance.

In the last quarter, Meld Gold announced a partnership with Ripple to bring fungible gold and silver assets to XRPL. Additionally, Tiamonds is a tokenized diamond project where users can hold NFTs representing real-world diamonds on the xrp.cafe marketplace.

In addition to RWAs, XRPL is also seen as a tool for other institutional products. Ripple is one of the main companies driving the application of XRPL technology in institutional and governmental scenarios. The company is committed to providing on-demand liquidity services, asset custody, and tokenization solutions using XRP and XRPL.

NFTs

On XRPL, the creation and transfer of NFTs are built into the core protocol, eliminating the need for smart contracts, similar to the issuance of currencies on XRPL (also known as native tokens). In October 2022, NFTs achieved functional standardization through the XLS-20 standard, bringing multiple advantages to users, including royalties and anti-spam features. These features not only help users avoid receiving unnecessary tokens but also assist in maintaining legal compliance by avoiding contact with tokens and smart contracts that are prohibited in certain specific areas.

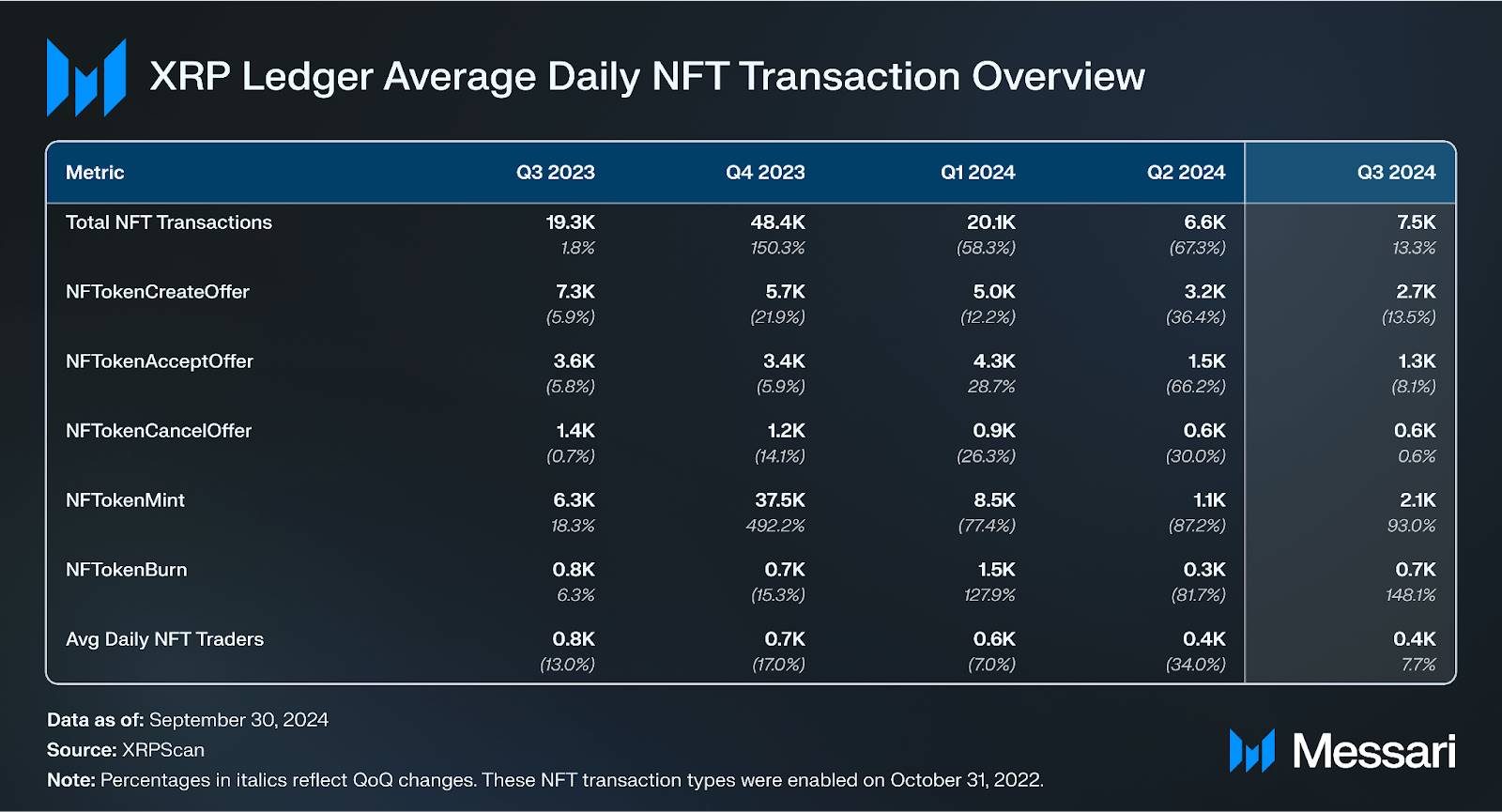

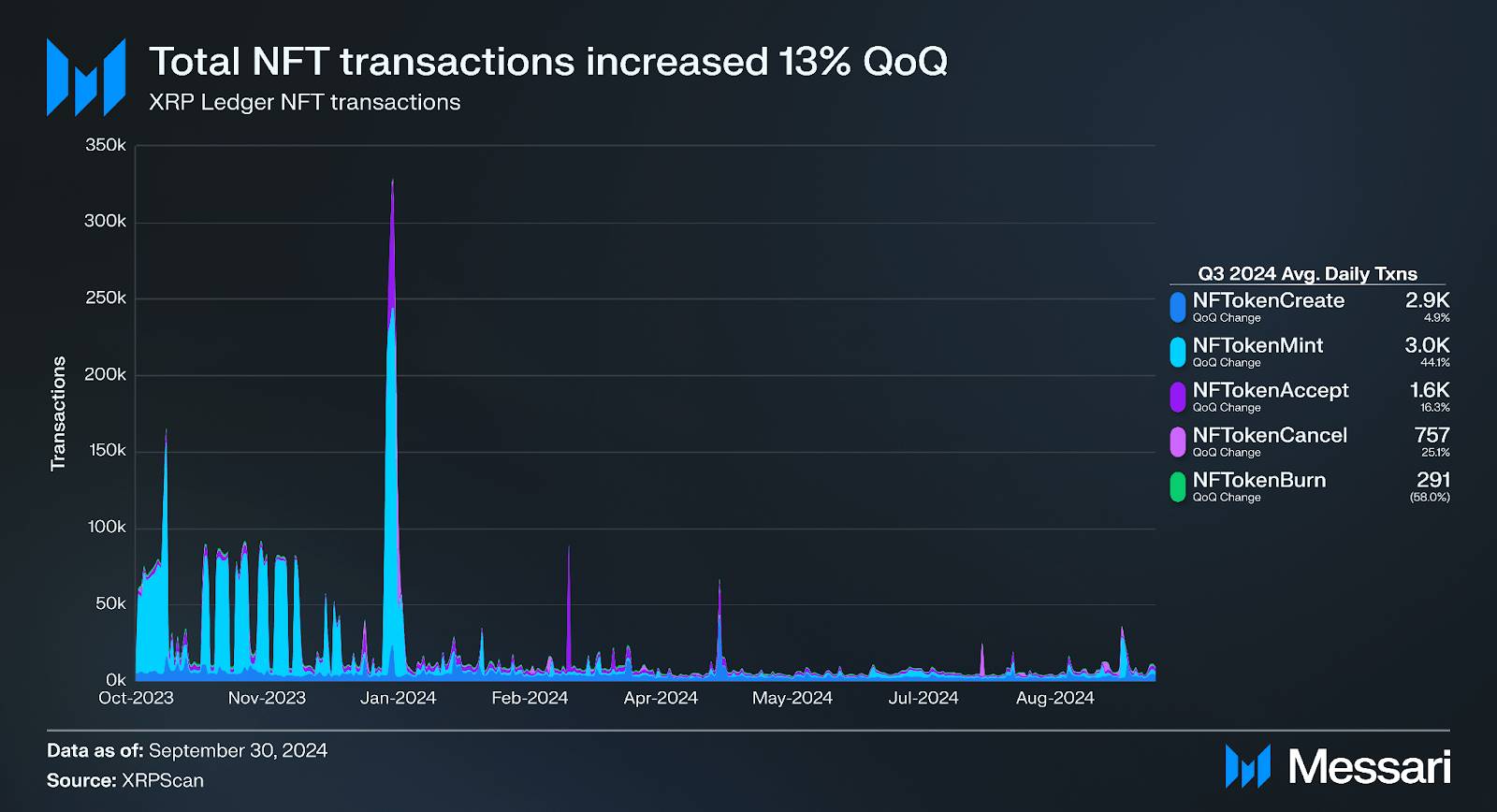

In the third quarter, the transaction volume for minting and burning NFTs increased by 93% and 148%, respectively, indicating active market activity. However, the transaction volume for NFT creation and accepting offers decreased by 13% and 8%, while the volume for canceling offers remained roughly the same as the previous quarter. These data reflect the dynamic changes in the NFT market on XRPL.

In the fourth quarter of 2023 and the first quarter of 2024, due to a surge in NFT minting activity, NFTokenMint became the most common type of NFT transaction on XRPL, surpassing NFTokenCreateOffer. However, in the second and third quarters of 2024, NFTokenCreateOffer regained its status as the dominant transaction type. This change aligns with the overall trend of the OfferCreate transaction type dominating on XRPL (OfferCreate is a transaction type used to create buy and sell orders). As of the end of the third quarter of 2024, the total number of NFTs minted through the XLS-20 standard reached 6.7 million, with over 3.4 million minted in just the fourth quarter of 2023.

Many well-known NFT projects have emerged on XRPL, including:

Game-related NFTs, such as Zerpmon, a blockchain game similar to Pokemon;

Digital collectibles from traditional Web2 companies, such as brand collections from Ducati Motorcycles and digital assets from the FIFA World Cup League;

Tokenization solutions for real-world assets, such as tokenized diamonds from Tiamonds and carbon credit programs launched by Xange.

Additionally, last quarter, xrp.cafe launched its automated NFT launch platform, allowing any user to easily publish NFT collections on XRPL.

Sidechains

Several sidechains developed for XRPL are in progress, with some already online. XRPL has always maintained the simplicity of the main chain (L1) while providing higher programmability for general and specific use cases through sidechains. This design allows XRPL to expand its functionality while maintaining efficiency.

Coreum

Coreum (CORE) is an enterprise-grade L1 blockchain focused on interoperability and scalability. The network runs a WASM virtual machine and employs a Bonded Proof-of-Stake (BPoS) consensus mechanism, securing the network through staked tokens. Coreum's native token, CORE, is used to pay transaction fees, stake, and reward validators.

Coreum was developed by the Sologenic team to address user needs that XRPL cannot efficiently meet. Its initial goal was to support secure tokenization, such as tokenized stocks and synthetic assets from the NYSE. In March 2024, Coreum completed the integration of the Inter-Blockchain Communication (IBC) protocol, connecting to all IBC-supported networks, including Cosmos Hub, Ethereum, and BSC. Subsequently, Coreum achieved the following significant updates:

In June 2024, it integrated with Picasso Network to achieve IBC interoperability with Solana;

Integrated Band Protocol's Band Oracle to bridge real-world assets (RWAs) to IBC-supported chains;

Launched the Coreum V4 upgrade in July 2024, introducing new features such as smart contract extensions, asset recovery capabilities, and dynamic NFT data.

Currently, users can transfer assets between Coreum and XRPL through the non-custodial Sologenic bridge. This interoperability brings more flexibility and scalability to the XRPL ecosystem.

XRPL EVM Sidechain

Last quarter, the Ripple team announced the XRPL EVM Sidechain as the official name for the EVM sidechain proposal by Peersyst, aimed at introducing smart contracts into the XRPL ecosystem. The sidechain is designed to grant EVM developers and functionalities access to the XRPL ecosystem with a general scope. The sidechain is built on the Cosmos SDK (specifically evmOS) and connects to XRPL via the XRPL-EVM bridge. The devnet is currently online and uses the Comet BFT PoS consensus mechanism (a variant of Tendermint) to create a block approximately every 3.9 seconds.

The latest version of the Peersyst EVM sidechain was deployed on devnet V2 in the second quarter of 2023. Dapps such as the identity protocol XRPDomains have been deployed on the testnet. Significant new features in the latest version include:

Support for transferring XRP, IOU, and ERC-20 tokens via bridging;

Introduction of a Proof-of-Authority consensus mechanism, where a group of trusted nodes is responsible for validating transactions;

Support for verifying smart contracts on the block explorer.

Cosmos IBC interoperability was enabled in May, allowing tokens to be bridged from IBC-supported chains to XRPL. Additionally, in June, the Ripple team announced that Axelar will replace the current implementation of the bridge design proposed in the cross-chain bridge (XLS-38d) specification as the exclusive bridge for the XRPL EVM sidechain. This will include sourcing the native Gas token (eXRP) for the sidechain from XRPL. In a subsequent announcement, Peersyst stated that the XRPL EVM sidechain will launch "later this year" after integrating Axelar.

Root Network

The Root Network sidechain is a blockchain-based NFT system focused on UX and the Metaverse, operated by Futureverse. The Root Network and its bridging with XRPL and Ethereum are in alpha stage, and the bridging was upgraded in September to allow bidirectional bridging of any tokens between XRPL and the Root Network.

Root Network is built on a Substrate fork, using XRP as the default Gas token and supporting EVM smart contracts. The network employs a delegated Proof-of-Stake (dPoS) consensus mechanism (via ROOT tokens). The development plans for Root Network align with XRPL, intending to integrate the XLS-20 NFT standard and source liquidity from XRPL decentralized exchanges (DEXs). Additionally, through the FuturePass account abstraction feature, Root Network will provide users with social recovery, asset management, more flexible wallet options, and a familiar user experience similar to Web2.

Hooks

Hooks are an innovative feature developed by the XRPL Labs aimed at providing XRPL with smart contract-like programming capabilities. Although Hooks are not Turing complete and cannot implement complex arbitrary logic, they allow for attaching conditions and triggers to transactions, similar to scripts on the Bitcoin or Cardano (pre-Alonzo upgrade) UTXO chain. Through Hooks, developers can implement various functionalities, including scheduled payments, allocating royalty income to creators, limiting transaction volumes, or specifying counterparties. In July, the XRPL Labs team launched the latest Hooks testnet written in JavaScript (JS), one of the most widely used programming languages.

Governance

The XRP Ledger (XRPL) uses an off-chain governance process that allows community members and organizations to propose changes to the network. Users can submit proposals (also known as amendments) to the " XRPL-Standards " repository on the project GitHub. The block-generating validators on the network can then run the proposed amendment's version of the XRPL source code. If 80.00% or more of the block validators support the amended source code for two weeks, it will be implemented as the new source code for the network. Validators that do not support the amended source code will be blocked from contributing to consensus until they update to the new version.

Some important proposals that have recently passed include:

Decentralized Identity ( XLS-40 ): Decentralized Identity (DID) was enabled at the end of October, allowing for verifiable, self-sovereign digital identities on XRPL for use cases such as compliance, access control, digital signatures, and secure transactions.

Price** Oracles** ( XLS-47 ): This amendment was enabled in November, bringing price oracles to XRPL for pricing wrapped/bridged assets. Now, anyone can call OracleSet to create or update existing price oracles, or call OracleDelete to delete existing price oracles. Oracle providers Band Protocol and DIA previously integrated with XRPL in July. After enabling the oracles, the Get Aggregate Price API call aggregates asset prices from all live oracles while discarding any outliers.

Additionally, several important governance proposals were put forward in the third quarter of 2024:

Multi-Purpose Tokens ( XLS-33 ): Proposal to introduce the Multi-Purpose Token standard (MPT). MPT supports metadata to store parameters about issued RWAs, such as the maturity date of tokenized bonds. Combined with the clawback feature enabled in the first quarter of 2024, XRPL continues to add features to provide more control for compliant token issuers.

AMM Clawback ( XLS-74 ): Proposal to support clawback functionality on AMMs. Regulated tokens like RLUSD need to have clawback capabilities to maintain fully compliant AMM liquidity pools.

Simulated Trade Execution ( XLS-69 ): A new simulated API method proposed for developers to safely experiment with transactions for testing and refinement.

Permissioned Domains ( XLS-80 ): This proposal introduces permissioned domains that can only be accessed by users based on their decentralized identity (DID). Notably, this amendment builds on the on-chain credential support first proposed last quarter (XLS-70). XLS-70 will add support for creating, accepting, and deleting credentials on XRPL as part of identity management, which was first introduced in decentralized identity (XLS-40) that was implemented at the end of October.

In September, it was announced that entities supporting XRPL, including Ripple, InFTF (formerly XRPL Foundation), XRPL Labs (and Xaman), XRPL Commons, and other members of the XRP community, began discussions to establish a new XRP Ledger Foundation. Additionally, the XRPL Foundation assets agreed to be transferred to a new independent foundation, whose governance structure includes developers, users, scholars, validators, and infrastructure providers. As part of the transition process, the existing XRPL Foundation team established a new Inclusive Finance Technology Foundation (InFTF), which will merge into a foundation entity in the future.

Other Important Updates

In the third quarter, the XRPL ecosystem further enhanced the overall utility of the network through multiple new integrations, partnerships, and feature upgrades:

Peersyst launched the XRPL Snap, integrating Metamask wallet with XRPL integration.

Immersive announced a partnership with Xahau Network to introduce self-custodied on-chain Mastercard credit cards to XRPL.

Futureverse is an AI and metaverse technology and content company that announced plans to integrate Ripple Custody to securely custody its digital assets.

Ripple announced the launch of Ripple Payments in Brazil, with Mercado Bitcoin, the largest cryptocurrency exchange in Latin America, as its first customer. Additionally, Ripple announced a partnership with Brazil's Fenasbac to support fintech development on XRPL through the Next accelerator program.

Ripple introduced a "Try it" feature for the Ripple Payments API to allow developers to test API requests in real-time without logging in or using real funds.

XRPScan announced the launch of a beta version of the XRPL Advanced Search Engine, which allows users to search and filter by over 100 different transaction fields.

XRPL infrastructure developer Girin Labs announced it has received funding from Ripple's XRP Ledger Japan and Korea Fund. Girin Labs is developing the Girin Wallet for XRPL and the Lotus Protocol, which is a liquid staking token and lending protocol on the Root Network XRPL sidechain.

XRPL Community Support Program

In September, the XRPL Grants Program introduced artificial intelligence (AI) as a new funding avenue. Previously, in May, Ripple announced changes to the XRPL Grants Program, including revised applicant screening criteria, rolling applications, incorporating other XRPL-based project developers into the screening process, providing feedback sessions for potential applicants and rejected applicants, and launching a feedback survey for applicants. Additionally, the XRPL Accelerator Program will have two tracks in 2024: the Launch Program for early-stage projects and the Scale Program for later-stage projects. In July, the first cohort of the Launch Program was announced, while the second Scale Program cohort began in September 2024.

Also in July, Ripple announced a partnership with the Dubai International Financial Centre (DIFC) to connect developers with DIFC's innovation hub, and in August announced a partnership with APAC DAO to support developers building on the XRP Ledger in Southeast Asia. Other community support programs include the XRPL Hackathons and the Aquarium Residency provided by XRPL Commons for developers. The RippleX Bug Bounty Program also pays bounties to individuals or groups who identify and report bugs in the ripple, xrpl.js, xrpl-py, and xrpl4j repositories.

Summary

The native order book (CLOB) and automated market maker (AMM) of XRPL saw transaction volume increase by 34% and 9% respectively in its second full quarter. Additionally, XRPL's average daily transaction volume grew by 94%, reaching 1.7 million, with the number of new addresses increasing by 10% to 105,000. However, this growth was primarily driven by small transactions (1 XRP), which, according to Ripple's Q3 2024 report, may be related to spam messaging activities.

Several key proposals were also enabled in the third quarter, including decentralized identity (DID) to support verifiable digital identities and price oracles for pricing wrapped or bridged assets. Furthermore, Ripple's USD stablecoin RLUSD has been in private testing on XRPL and Ethereum since August, awaiting regulatory approval. Meanwhile, Ripple and the XRP community are developing native smart contract functionality for XRPL, as well as a lending protocol that supports users in lending and borrowing assets (such as XRP, wBTC, and wETH) through single-asset vaults. With the gradual implementation of these upgrades, XRPL is expected to attract more users in the future, further enhancing network activity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。