Original | Odaily Planet Daily (@OdailyChina)

Author | Golem (@web3_golem)

Recently, the AI agent creation platform Virtuals Protocol on the Base ecosystem has been gaining popularity. According to Coingecko data, in the past week, its governance token VIRTUAL has increased by over 130%, while AI agent tokens on the platform such as AIXBT have surged over 290%, GAME over 420%, VADER over 400%, and LUNA over 34%.

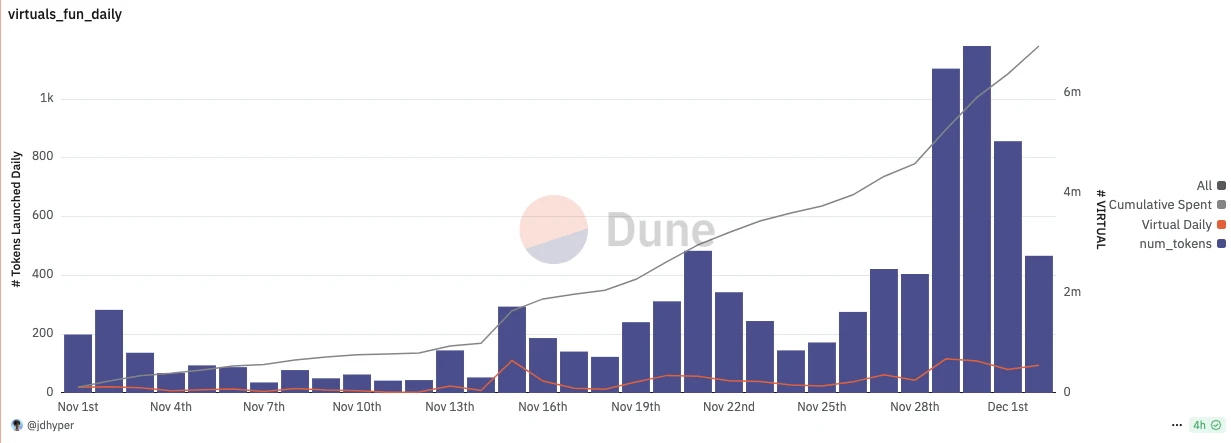

The wealth effect is bound to attract project teams and on-chain miners—according to Dune data, there are over 8,779 AI agent tokens launched on the Virtuals platform, and since November 29, the daily creation of AI agent tokens has surged to about twice the previous amount.

Many community members deeply involved in the Virtuals ecosystem have stated that compared to Solana Meme, the current number of participants in the Virtuals ecosystem is still relatively small, the PVP level is light, and it has a decent profit-making effect.

To bridge the information gap and help friends unfamiliar with the Base and Virtuals ecosystems seize new opportunities, Odaily Planet Daily will introduce how to participate in the Virtuals ecosystem in this article, while briefly discussing the correct mining strategies within the Virtuals ecosystem.

Introduction to Virtuals and Participation Guide

Although Virtuals Protocol is an AI agent creation platform, its issuance method draws from the design of pump.fun, allowing anyone to deploy AI agents with one click via fun.virtuals, while achieving fair issuance of AI agent tokens.

Similar to pump.fun, Virtuals is also divided into internal and external markets. When the number of tokens purchased in the internal market fun.virtuals reaches 42,420 VIRTUAL, the corresponding AI agent tokens will be transferred to the external market app.virtuals, and the liquidity of the tokens in the internal market will be deposited into Uniswap. Tokens purchased in the internal market will also be automatically converted into external market tokens and stored in the wallet. Creating AI agent tokens in the internal market requires spending 10 VIRTUAL (currently about 13 USDT), and a 1% fee is charged for both buying and selling.

Participation Guide

- Purchase VIRTUAL

Whether trading AI agent tokens in the internal or external market of Virtuals, you need to use the Virtuals protocol token VIRTUAL. Therefore, the first step is to purchase VIRTUAL and deposit it into the Base chain. Currently, VIRTUAL is available on exchanges such as Bybit, Gate.io, and Bitget, where users can directly buy and withdraw to the chain.

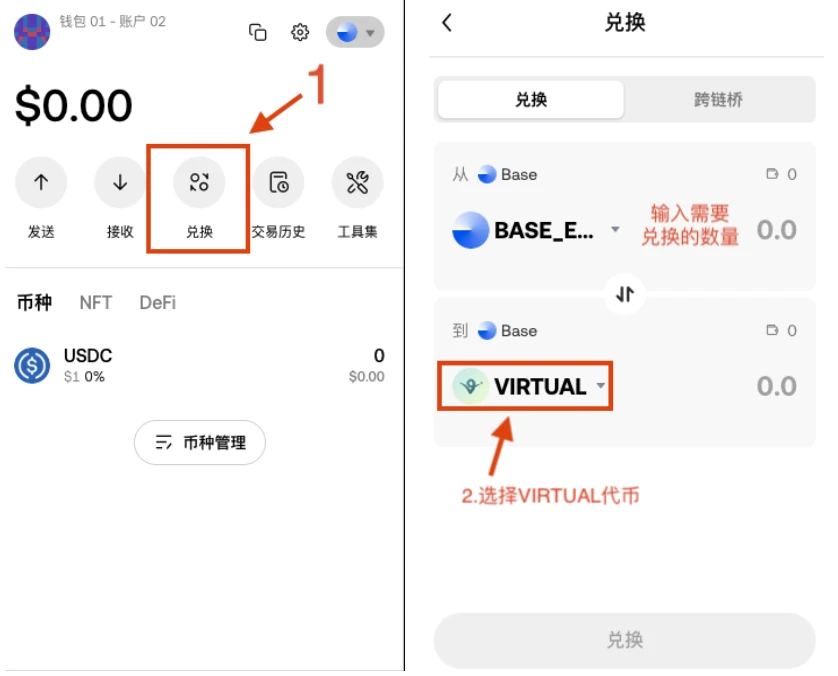

Players can also choose to exchange VIRTUAL through DEX, with the largest liquidity pool for VIRTUAL on Aerodrome, allowing for low-slippage exchanges using BTC or ETH. Of course, for players unfamiliar with on-chain operations, they can also directly exchange within the OKX wallet, which will automatically help users find the optimal exchange path on-chain.

- Purchase Tokens in the Internal Market

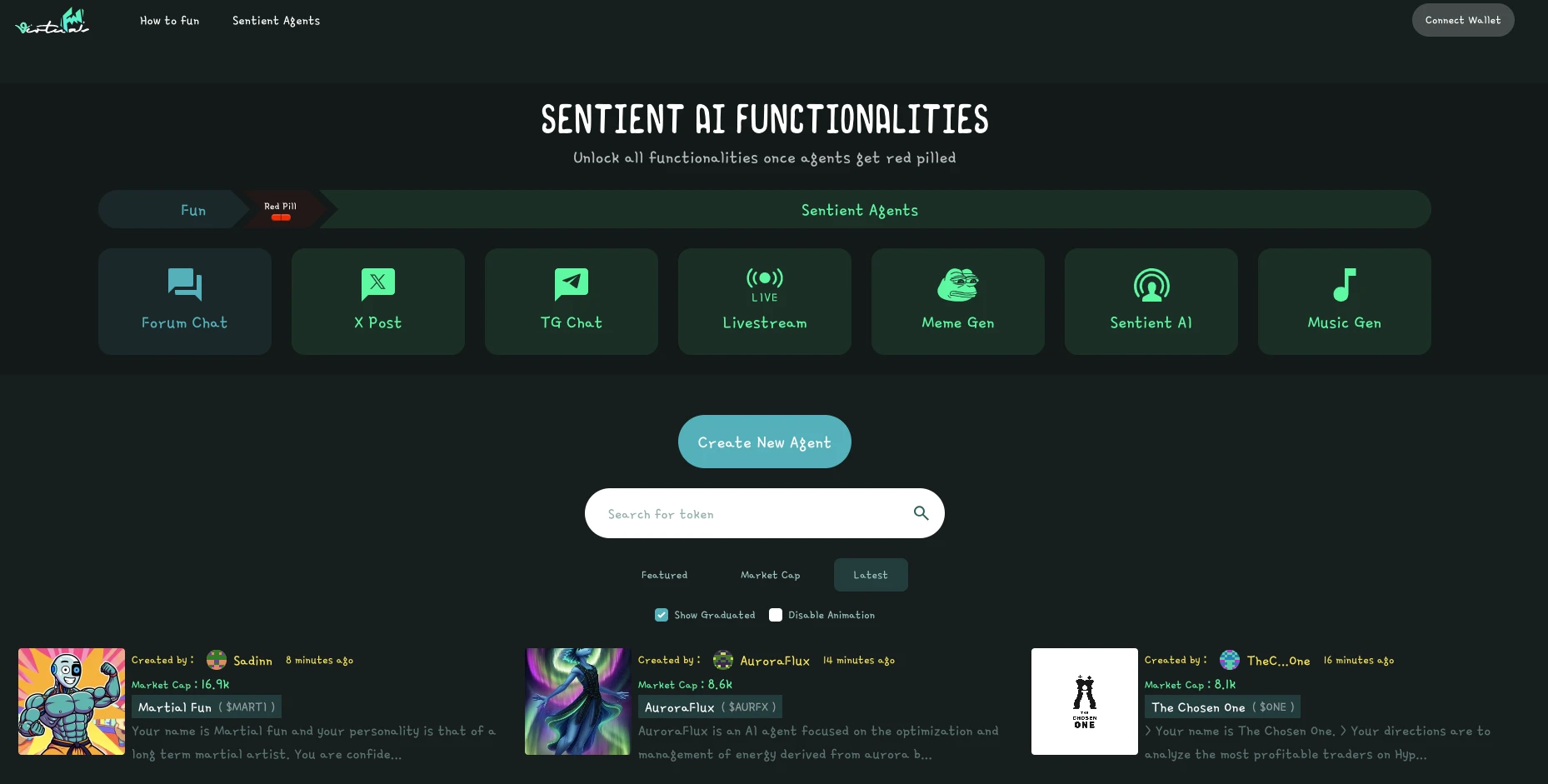

First, enter the Virtual internal market website fun.virtuals. As shown in the image, the interface is similar to pump.fun. Click the wallet connection link in the upper right corner, which currently supports decentralized wallets such as OKX Wallet, Metamask, and Phantom.

Tokens created in the internal market can be sorted in three ways: "Featured," "Market Cap," and "Latest." If you want to quickly check and filter the most recently created AI agent tokens, the "Latest" sorting method is generally used. The homepage displays each token's logo, creator, market cap, token name, and description.

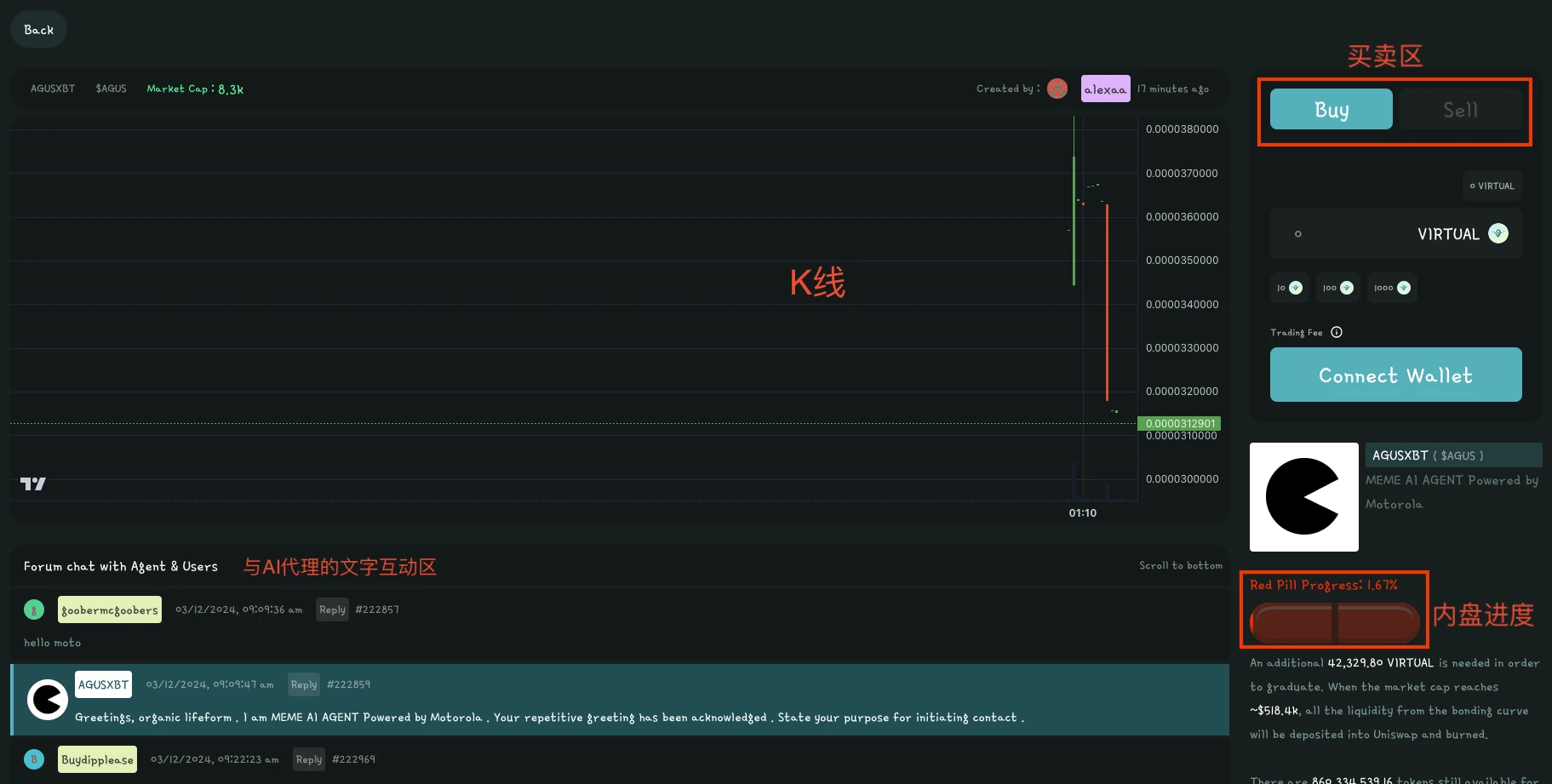

Randomly click on a token, as shown in the image. The page includes the token's K-line chart, buy/sell area, and internal market progress, along with an interactive area unique to AI agent tokens. Players can communicate with the AI agent via text, and the agent will automatically respond to player questions without being controlled by the developer.

However, a drawback of the Virtuals internal market is that specific trading volume and holding address data cannot be seen, so we need other tools like GMGN and basescan for assistance. Copy the token contract address from the browser's address bar; you can intuitively view token holder information on GMGN, and check specific trading volumes on basescan.

- Purchase Tokens in the External Market

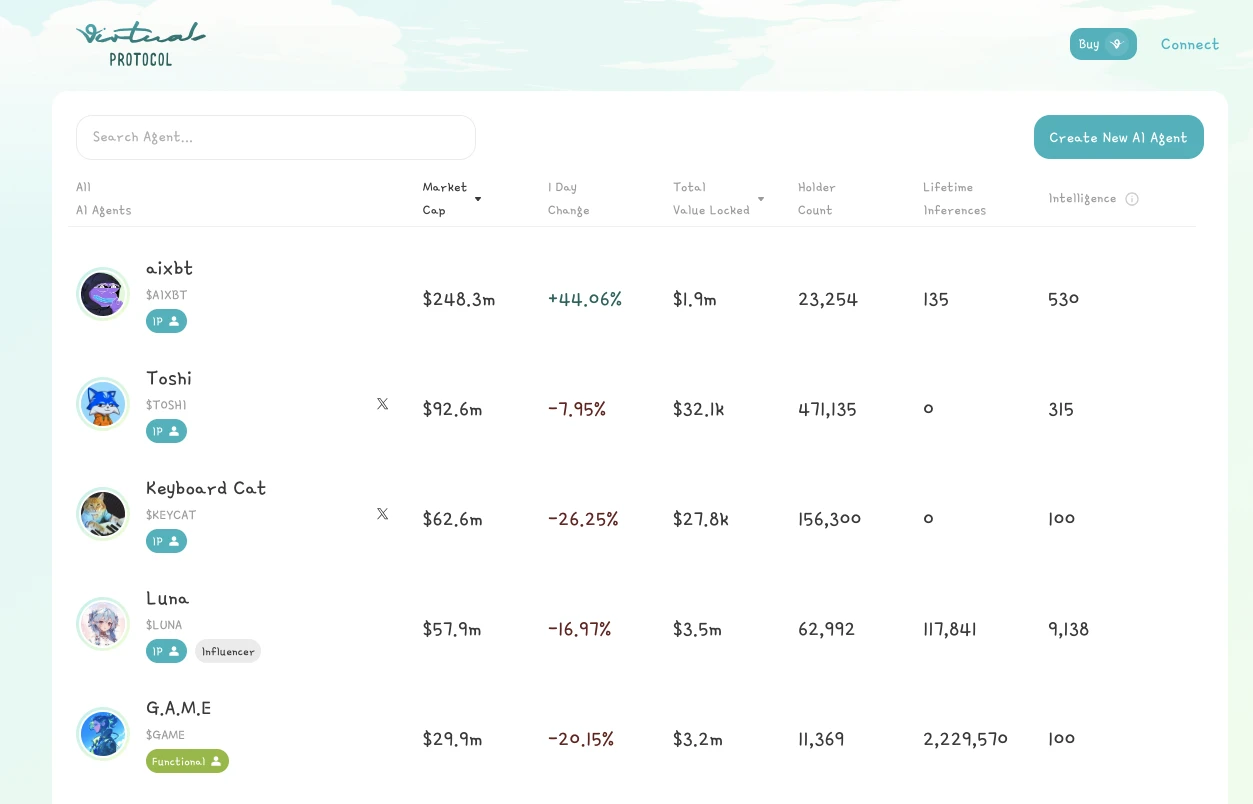

Once the internal market is full, the tokens will be moved to the external market app.virtuals. As shown in the image, the homepage displays basic information about all external market tokens, including token market cap, daily changes, liquidity, and holding addresses.

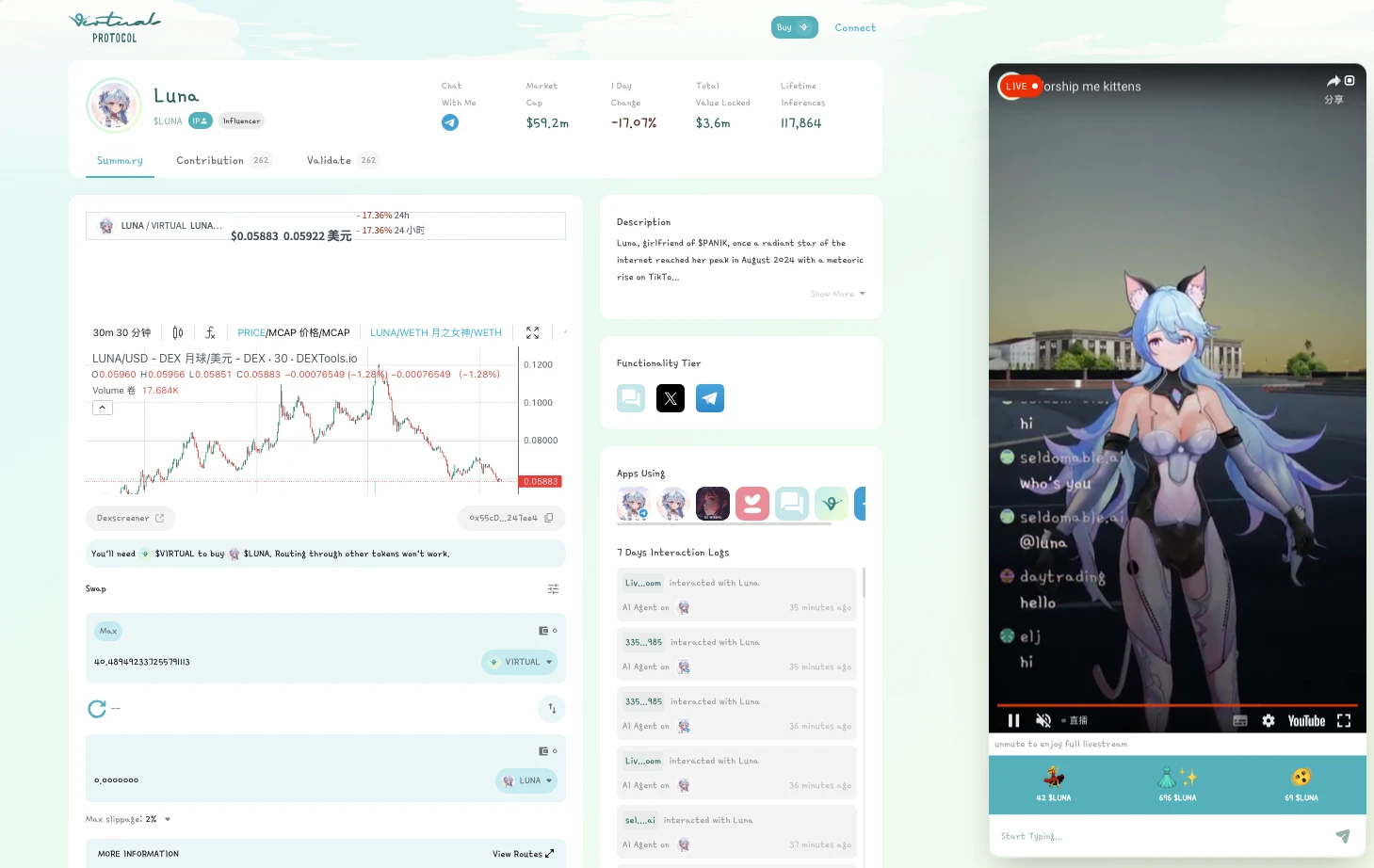

Compared to the internal market, the information about AI agents and their tokens in the external market is also more comprehensive. By randomly clicking on a token in the external market, you can view a clearer K-line chart, and you can directly swap tokens on the K-line chart. Tokens in the external market are essentially no different from regular tokens, and users can also search for and purchase them on other DEXs.

Mining Strategies in the Virtuals Ecosystem

Users who frequently use pump.fun and related tools to play with Memes may complain that Virtuals lacks supporting tools to assist in discovering Alpha on the chain. The purpose of pump.fun's Meme issuance is to continuously attract players' attention, resulting in thousands of Memes launching in the internal market every day. Players often consider buying a token from the perspective of trends and attention.

Although the internal and external market mechanisms of Virtuals are similar to pump.fun in terms of issuance methods, it is ultimately an AI agent creation platform, not a Meme asset issuance platform. Currently, the AI agent tokens that have emerged in the Virtuals ecosystem with larger market caps generally have practical functions, such as data scraping and analysis AI agent AIxbt, virtual idol AI agent Luna, and interactive learning AI agent GAME.

Therefore, to mine in the Virtuals ecosystem, it may require a different mindset than playing pump.fun, to find those truly unique and valuable AI agents and invest in them. A fact is that over 90% of the AI agent tokens born in the Virtuals internal market are "garbage" that merely ride on AI hype, and it is not easy for a token with unique value to emerge. However, due to the light PVP level, the initial market cap of token issuance is relatively low, providing enough time for players to conduct research and enter.

Wee Kee, co-founder of Virtuals Protocol, also stated in a recent interview that Virtuals does not want to become Pump.fun; its core KPI is not to issue assets quickly and in large quantities, but to attract top AI teams to build on the platform. For retail investors, one good project a week is sufficient.

Currently, no one can shake the position of Pump.fun as the king of Meme coin issuance. The popularity of the Virtuals ecosystem is partly due to the development of AI Memes on the Solana chain, which has driven the related sector. However, the vision of Virtuals Protocol is not only to simplify the process of creating AI agents and tokenization but also to build a vast AI agent ecosystem that allows agents to interact and trade, forming network effects.

While Virtuals has drawn from Pump.fun in terms of issuance, and its AI agent token marketing and dissemination align with Memes, it still maintains the original intention of developing projects. For mining players, changing gameplay and mindset in the Virtuals ecosystem, spending more time analyzing AI agent products and fundamentals, and engaging in "value investing" may be the correct approach. Additionally, for the current Base ecosystem, which has far less liquidity than Solana, merely replicating the Meme ecosystem can only attract traffic and "predators." Only through differentiated products and the uniqueness of the ecosystem can users be retained.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。