Author: Revc, Golden Finance

Recently, the price of XRP surged to $2.84, with a market capitalization exceeding $146 billion, making it the third-largest cryptocurrency in the world. This phenomenon is primarily driven by the following factors:

- New product layout: Ripple is actively launching ETFs and stablecoins, attracting more institutional investors.

- Positive policy expectations: The new U.S. government is expected to adopt more favorable cryptocurrency regulatory policies.

- Market capital inflow: Whale accounts are active, driving market sentiment high.

As XRP boosts market sentiment, related concept projects such as AVAX, LINK, ONDO, and HBAR have recorded an average increase of over 30%. With the continuation of favorable policies, the market expects Wall Street capital to prefer blockchain infrastructures that are stable and corporately operated, to facilitate the entry of real-world assets (RWA) and stablecoin capital.

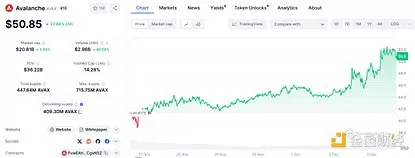

Avalanche—AVAX

AVAX recorded a 22.86% increase in the past 7 days, with a nearly 100% increase in 24-hour trading volume. Emin Gün Sirer, founder and CEO of Ava Labs, revealed in response to community questions on the X platform that Avalanche (AVAX) is in discussions with the incoming U.S. government. He stated that the team would not flaunt political relationships with the government on social media but would showcase results in a "fully Avalanche style" and suggested the community "plan accordingly."

Avalanche (AVAX) is a blockchain platform focused on supporting the creation of decentralized applications (dApps) and custom blockchain networks, featuring high scalability, fast processing speeds, and strong interoperability. The platform employs a unique consensus protocol called the Snowman Consensus Protocol, operating under a proof-of-stake (PoS) framework. The Avalanche platform consists of the following three main blockchains:

- X-Chain: Used for asset creation and exchange.

- C-Chain: Supports smart contracts and is compatible with the Ethereum Virtual Machine (EVM).

- P-Chain: Used for coordinating validators and subnet management.

Recent Developments in Avalanche

1. Avalanche9000 Upgrade

- Launch costs for Layer 1 blockchain (L1) reduced by 99.9%.

- Gas fees on C-Chain decreased by 96%.

- Enhanced cross-chain interoperability.

This upgrade has been launched on the Fuji testnet and is planned for deployment to the mainnet, providing developers with a more straightforward custom blockchain creation process.

2. Community and Ecosystem Growth

Community activity in Avalanche has significantly increased, and its infrastructure and dApp ecosystem have been strengthened through collaboration with Amazon Web Services (AWS).

3. Avalanche Rush and DeFi Expansion

The Avalanche Rush project provides incentive mechanisms for DeFi protocols (such as Aave and Curve). Despite initial complaints about low APY, this project has significantly enhanced liquidity and user base, driving the expansion of the entire ecosystem.

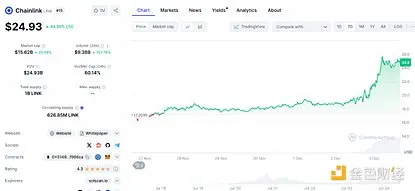

Chainlink—LINK

LINK recorded a 44.8% increase in the past 7 days, with a nearly 757% increase in 24-hour trading volume. Recently, the Trump family's cryptocurrency project World Liberty Financial (WLFI) announced it would adopt Chainlink as the standard solution for on-chain data and cross-chain interoperability. The protocol plans to first integrate Chainlink oracles on the Ethereum mainnet to provide price feed support and assist the upcoming Aave v3 lending protocol. WLFI will connect to the Chainlink ecosystem, which currently supports over $16 trillion in transaction volume. With Chainlink oracles, the WLFI protocol will be able to access reliable financial market data, supporting the launch of various assets such as USDC, USDT, ETH, and WBTC.

Chainlink is a decentralized oracle network designed to enhance the capabilities of blockchain applications by securely connecting smart contracts with real-world data and external APIs. It enables blockchain smart contracts to interact with external systems and serves as a crucial infrastructure for the real-world asset (RWA) sector. Chainlink's native token LINK is used to pay node operators for data retrieval and provision, ensuring the economic sustainability of the network.

Chainlink's technology continues to expand and has been successfully integrated into multiple blockchain platforms, including Ethereum, Arbitrum, Avalanche, Base, Optimism, and Solana. Numerous projects utilize Chainlink to provide price information, cross-chain interoperability, and other services. Recently, Chainlink announced partnerships with financial institutions such as ANZ, Swift, and UBS, and launched Chainlink Economics 2.0 to support network sustainability while introducing Chainlink Scale to help the blockchain ecosystem improve efficiency.

Chainlink recently announced the launch of CCIP Private Transactions, supported by the newly released Chainlink Blockchain Privacy Manager. This privacy feature will help financial institutions ensure the confidentiality, integrity, and compliance of data when conducting transactions across blockchain networks. Additionally, Chainlink is collaborating with the EU company 21X to promote the launch of a tokenized asset settlement system, providing reliable pricing for financial data and on-chain event data connections. The Central Bank of Brazil (BancoCentralBR) has also chosen Chainlink standards for secure settlements in its Drex project, ensuring safe operations across borders, blockchains, and currencies.

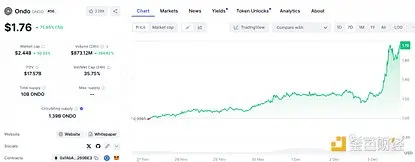

ONDO

ONDO recorded a 75.65% increase in the past 7 days, with a nearly 291% growth in 24-hour trading volume. Ondo Finance is a protocol dedicated to tokenizing traditional financial assets (TradFi) and introducing blockchain. Through tokenization, it provides on-chain financial products aimed at institutional investors, intending to make finance more inclusive for a broader range of investors. Ondo's native token ONDO plays a key role in governance, staking, and ecosystem incentives.

Ondo has made significant progress in tokenizing U.S. Treasury bonds, launching products such as OUSG (U.S. Government Bond Fund) and USDY (Yield Stablecoin), which have garnered widespread attention. Meanwhile, Ondo has successfully completed FinCEN registration, further enhancing its compliance. Through technical integration with Polyhedra Network and LayerZero, Ondo has also achieved cross-chain interoperability. Additionally, Ondo's collaboration with PayPal USD (PYUSD) provides round-the-clock exchange functionality.

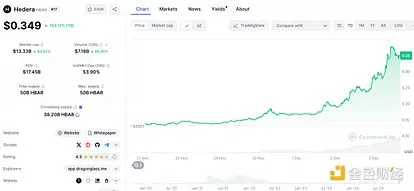

Hedera—HBAR

HBAR recorded a 163.12% increase in the past 7 days, with a nearly 95% growth in 24-hour trading volume.

Hedera plays a core role in a project with one of the world's largest asset management companies, BlackRock, achieving the tokenization of money market funds (MMF) through collaboration. This project involves several key partners, including:

- Archax: Provides trading and custody services.

- Ownera: Supports underwriting and compliance during the tokenization process.

- HBAR Foundation: Provides technical and financial support.

In this collaboration, Hedera utilizes its blockchain technology to achieve ledger records for tokenized assets, ensuring data transparency and security. Tokenization makes the trading of traditional assets more flexible and efficient, simplifying the purchase and redemption processes.

Hedera employs a Hashgraph consensus algorithm based on a directed acyclic graph (DAG), which has the following notable features:

- High efficiency: Capable of processing thousands of transactions per second with very low latency.

- Controlled nodes: Led by enterprise nodes, meeting high demands for stability and consistency from enterprises.

- Semi-centralized: Compared to fully decentralized public chains, Hedera is more suitable for enterprise-level application scenarios.

This design makes Hedera particularly suitable for financial institutions like BlackRock, providing strong support for the issuance and trading of tokenized assets.

Summary

The recent recovery of the cryptocurrency market is attributed to the boost from favorable policies and technological innovations. The strong performance of XRP has driven the rise of related concept projects, especially AVAX, LINK, and HBAR, which have solidified their market positions through ecosystem collaboration, tokenized asset applications, and technological advancements. In the future, the RWA and DeFi stablecoin sectors will become core areas for the deep integration of the cryptocurrency industry with traditional finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。