The Korean aunties who relied on XRP to move into their big villas in Jiangnan during the last round are back to let the market feel the power of kimchi.

Written by: 1912212.eth, Foresight News

Although Bitcoin has been consistently blocked at the $100,000 mark, funds have clearly flowed into the altcoin market. Data shows that Bitcoin's market share has dropped to 55.25%, while Ethereum has risen to 12.74%. The ETH/BTC exchange rate has stabilized above 0.037, and smaller altcoin sectors have begun their performance.

In the public chain sector, ADA has risen over 15% today, priced around $1.3. The weekly chart shows a rare five consecutive increases, achieving over 400% returns from a low of $0.3. FTM has increased over 17% today, priced around $1.2. AVAX has risen over 10% today, with a 7-day increase of over 20%, and XRP has seen a 7-day increase of over 85%, currently priced at $2.7.

In the RWA sector, ONDO has even set a new historical high, currently priced at $1.65, with a 24-hour increase of over 35% and a 7-day increase of over 64%. In the DeFi sector, LINK has risen 24.49%, MKR has risen 16.08%, and AAVE has also recorded an increase of over 11%.

The market's upward trend is encouraging; what are the reasons?

Tether Issues 16 Billion New USDT on Ethereum and TRON

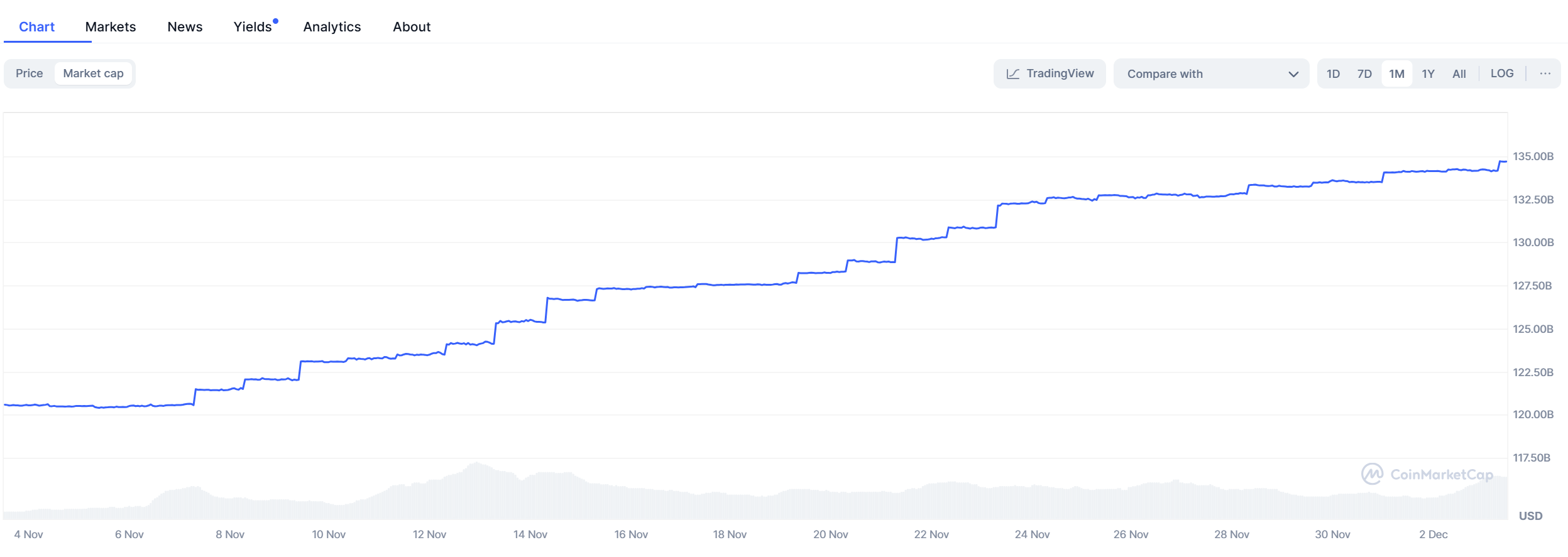

Lookonchain monitoring shows that Tether Treasury minted an additional 1 billion USDT around 6 AM today. Since November 6, Tether Treasury has cumulatively minted 16 billion USDT on the Ethereum and Tron chains.

The market cap of USDC has also risen from $15 billion at the beginning of this month to around $40 billion.

Currently, the total market cap of stablecoins has risen above $193.9 billion, setting a new historical high, with a total increase of 2.3% over the past week.

The continuous growth of stablecoin market cap represents that incremental funds are still entering the market to chase tokens of smaller market cap projects. After the hype around new projects, older projects are also welcoming their spring.

Positive Shift in U.S. Regulatory Policies

Bitwise CEO Hunter Horsley recently stated, "In the past 30 days, Coinbase's market cap has increased by about $30 billion, and XRP's market cap has increased by about $100 billion. The shift from regulatory resistance to regulatory support in the U.S. is one of the largest and most important structural catalysts we have seen in the crypto space. Its impact has just begun."

Trump is set to officially take office as the next president on January 20, but he has been making frequent moves in personnel arrangements recently, planning to expand the CFTC's regulatory authority over the crypto market and delineate responsibilities with the SEC. Additionally, according to sources cited by FOX Business reporters, Trump will announce the successor to the SEC chairman tomorrow.

Since SEC Chairman Gary Gensler announced he would step down when Trump takes office, the market has been eagerly anticipating the SEC's successor. Although the specific candidate is still unknown, the market generally believes that the next SEC chairman will change from a strict style to a more crypto-friendly attitude.

Observant market investors have noticed that the leading gainers in the market, such as ADA and XRP, are also benefiting from the shift in U.S. policies, soaring in price. Positive news continues to emerge, with WisdomTree submitting an XRP ETF S-1 registration document to the U.S. SEC. ADA has also been listed on Robinhood US alongside XRP and SOL.

As early as November 25, DWF founder Andrei Grachev analyzed that the U.S. elections would have a huge impact on the market, and in the short term, domestic projects and top VCs in the U.S. would be the most profitable.

Inflow of Buying Power from the Korean Market

The frenzy of cryptocurrency trading in Korea was already famous during the last bull market cycle. Recently, as the market continues to rise, buying power from Korea has been pouring in.

On major Korean cryptocurrency exchanges Upbit and Bithumb, the number of user accounts aged 60 and above has reached 775,700 (as of the end of September), a 30.4% increase from the end of 2021. This age group holds a total of 6.7609 trillion won in cryptocurrency assets, with an average investment of about 8.72 million won. Meanwhile, the balance of demand deposits in Korea's five major banks is 592.67 trillion won, a decrease of 26.95 trillion won since the end of June, marking a new low since January of this year.

In November 2024, CryptoQuant data shows that the monthly total trading volume of stablecoins on Korea's top five CEXs—Upbit, Bithumb, Coinone, Korbit, and GOPAX—was approximately 16.17 trillion won ($11.5 billion). This figure includes the total trading volume of stablecoins such as Tether (USDT) and USDC issued by Circle, and it has increased sevenfold from about 2 trillion won recorded at the beginning of the year. This is also the first time that Korea's monthly stablecoin trading volume has exceeded 10 trillion won.

XRP has seen particularly frenzied buying. Ryan Kim, a partner at Korea's largest crypto venture capital firm Hashed, stated on social media that in 2014, Ripple Labs sold XRP in Korea through the "Ripple Market Korea" project in a Ponzi scheme, attracting a large number of Korean investors. These early investors may have already seen substantial returns, and there is a real XRP community in Korea, which is why Koreans are buying XRP in large quantities.

CoinGecko data shows that the trading volume on the Korean CEX Upbit reached $18.449 billion in the past 24 hours, ranking second among CEXs, while the top-ranked CEX Binance had a trading volume of $50.572 billion yesterday.

The Trump effect, combined with expectations of interest rate cuts, has accelerated the shift of Korean funds from banks to risk assets.

Summary

Bitcoin spot ETFs saw inflows of $6.5 billion in November alone, setting a new historical high and far exceeding any other month this year. Currently, the BTC price is supported by continuous buying from spot ETFs, with a large amount of funds flowing out of Bitcoin and Ethereum into various sectors and both new and old projects. Matrixport analysis indicates that if Trump’s nominations for the Treasury and SEC are realized, the narrative in the crypto market may evolve into a DeFi revival. The crypto market may maintain a trend of oscillating upward until Trump officially takes office.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。