Hong Kong has launched a tax exemption policy for profits derived from virtual assets, which will have a profound impact on the entire cryptocurrency industry.

Written by: Mankun Blockchain Legal Services

When considering where to establish investment vehicles for investing in virtual assets, whether it be funds or single-family office investment tools, tax issues should be a primary consideration. Hong Kong is known for its favorable tax policies; for example, it adopts a territorial principle, meaning that businesses are only taxed on profits generated within Hong Kong. This creates a favorable environment for international companies, as offshore income is not taxed.

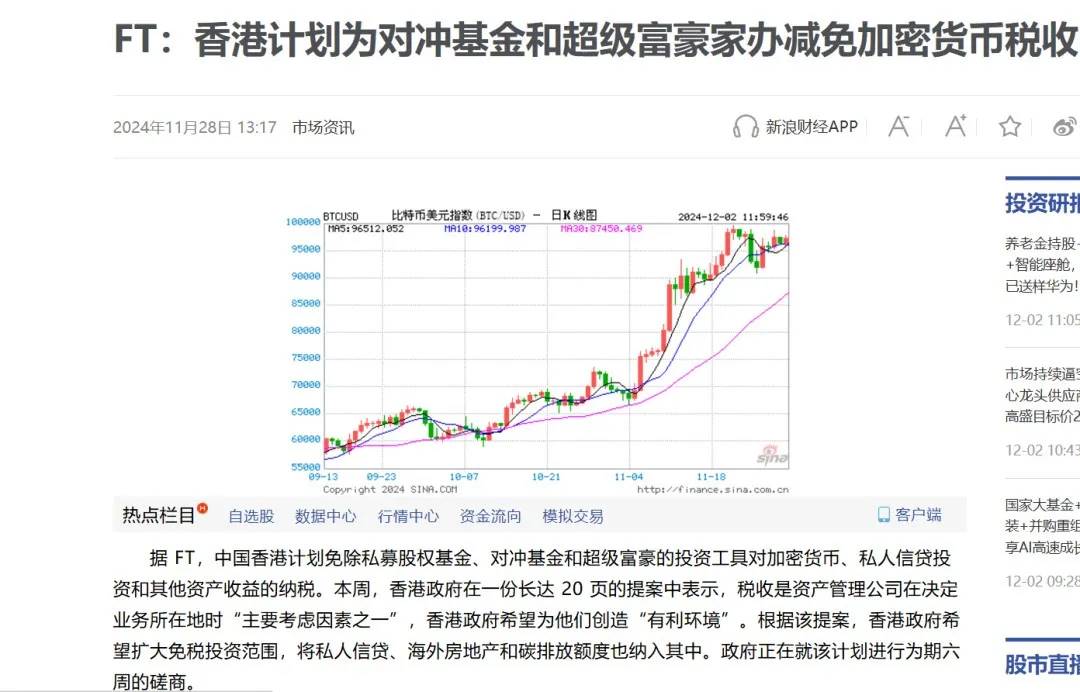

▲ Screenshot from Sina News

▲ Screenshot from Sina News

Now, when we talk about Hong Kong's "profits tax," there are some important exemption provisions. However, until recently, virtual assets had not been included in the list of exempt assets in Hong Kong.

However, this situation is about to change…

Proposed Changes Regarding the Tax Treatment of Virtual Assets in (i) Private Fundraising Funds and (ii) Single Family Office Investment Tools

Currently, Hong Kong is publicly soliciting opinions on introducing a new profits tax exemption policy for virtual assets. The Hong Kong Financial Services and the Treasury Bureau has proposed in the consultation document to expand the existing profits tax exemption scope to cover (i) private fundraising funds and (ii) single family office investment tools, specifically including but not limited to:

Overseas real estate

Carbon credits and emission derivatives or quotas

Private credit investments and loans

Virtual assets

(i) Private Fundraising Funds

In Hong Kong, there is a unified tax exemption system that provides profits tax exemptions for eligible private funds, including those established in the form of limited partnership funds and open-ended fund companies. Under this system, private funds can enjoy profits tax exemption on income generated from their investments (such as capital gains, interest, and dividends), provided that these funds meet specific criteria. These conditions include being managed by an investment manager licensed under the Securities and Futures Ordinance, and the fund's activities must primarily relate to investment rather than commercial or trading activities.

However, until now, there has been controversy over whether virtual assets can be included in Hong Kong private funds and whether this would affect the applicability of Hong Kong's unified tax exemption system. Therefore, the new proposal brings much-needed clarity to this issue, indicating that virtual assets can indeed be considered "qualified investments" and thus enjoy profits tax exemption.

It is worth noting whether the government will further clarify in the consultation document the tax treatment of other cryptocurrency-related income or derivatives. For example, it is currently unclear how cryptocurrency-related income such as staking rewards will be classified for tax purposes in Hong Kong.

(ii) Single Family Office Investment Tools

Currently, Hong Kong has a law ensuring that eligible single family office investment tools can enjoy profits tax benefits, providing a 0% preferential tax rate applicable to assessable profits from qualifying transactions and ancillary transactions. However, virtual assets are currently not included in this scope. Therefore, if the new proposal in the consultation document is enacted, the scope of designated assets will be expanded to include virtual assets. Virtual assets will include common cryptocurrencies such as Bitcoin, Ethereum, as well as certain utility tokens, security tokens, and stablecoins.

Potential Impact of Hong Kong as a Virtual Asset Hub

The introduction of a profits tax exemption policy for virtual assets in Hong Kong will have a profound impact on the entire cryptocurrency industry. Here are some specific potential impacts:

▲ Screenshot from the news

1. Attracting Global Investors

The new tax policy will attract investment managers and high-net-worth individuals from around the world, viewing Hong Kong as their preferred virtual asset investment hub. In particular, hedge funds and family offices seeking to maximize after-tax returns may be more inclined to establish investment vehicles in Hong Kong. Additionally, this policy may also attract international virtual asset exchanges, custody service providers, and other ecosystem participants to expand their businesses in Hong Kong, further solidifying Hong Kong's position in the global cryptocurrency industry.

2. Promoting Local Economic Growth

As more investment managers and family offices establish themselves in Hong Kong, local professional service industries such as legal, accounting, tax, and banking will benefit from the additional demand. This will not only help drive growth in related industries but also lead to an increase in job opportunities. At the same time, the Hong Kong government, through such policy guidance, demonstrates its supportive stance towards crypto technology and virtual assets, providing confidence to attract more tech-oriented companies.

3. Incentivizing Innovation and Ecosystem Development

Hong Kong's inclusive attitude towards virtual assets and clear tax policies will incentivize more startups, developers, and investors to enter the virtual asset space. This may accelerate innovation in areas such as decentralized finance (DeFi), blockchain infrastructure, and tokenized assets. The rapid development of these emerging fields will make Hong Kong not only a center for capital aggregation but also a laboratory for global crypto innovation.

4. Enhancing International Competitiveness

Currently, Hong Kong and Singapore are in fierce competition for the status of Asia's virtual asset hub. By offering competitive tax policies, Hong Kong can gain an advantageous position in this competition, especially in attracting virtual asset funds and family offices. The Goods and Services Tax (GST) imposed on virtual asset transactions in Singapore may make Hong Kong more attractive in this regard. Furthermore, Hong Kong's close ties with mainland China provide a unique strategic advantage for international investors looking to enter the vast mainland market.

Next Steps to Watch

The consultation period for the consultation document will end on January 3, 2025. We will closely monitor this consultation document and its conclusions to further share the impact of these new changes on the industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。