Original | Odaily Planet Daily (@OdailyChina_)

_

Today, the native token HBAR of the L1 blockchain Hedera broke through 0.38 USDT, reaching a high of 0.39 USDT, with a 24H increase of over 40% and a monthly increase of over 104%, bringing the price back to the level of November 2021.

The Hedera blockchain was launched as early as 2019. On November 13 of this year, the crypto investment firm Canary Capital submitted an HBAR ETF application to the U.S. SEC. Compared to the massive attention and discussions triggered by the ETF applications of SOL, XRP, and LTC, HBAR has not garnered as much interest, and many crypto players who entered the market during this bull run have not even heard of the project.

So, what exactly is the Hedera blockchain? What other reasons are behind the surge in HBAR's price? Odaily Planet Daily will provide a brief introduction and analysis of Hedera in this article.

Introduction to Hedera

Hedera is a decentralized, open-source proof-of-stake public blockchain that employs a leaderless, asynchronous Byzantine Fault Tolerance (ABFT) Hashgraph consensus algorithm at its technical core. According to data from its official website, Hedera's consensus finality takes only 2.9 seconds, with an average transaction cost of $0.0001, while the network has low energy consumption, with an average energy consumption of just 0.000003 kWh per transaction, compared to Solana's energy consumption being 170 times higher.

Developers can utilize the Hedera blockchain for real asset tokenization, building DeFi and NFT ecosystems, creating decentralized identities, and using native consensus timestamps to create low-cost, scalable, and publicly verifiable data logs—recording paid events, supply chain origins, IoT sensor data, and more.

The Hedera blockchain is governed by a board and the Hedera Governing Council, which consists of up to 39 term-limited and highly diverse leading organizations and companies, including well-known firms and institutions such as Google, Dell, and abrdn.

HBAR is the native token of the Hedera blockchain, used for network transaction fees and as a staking token in the POS mechanism. The total supply of HBAR is 50 billion, with a current circulating supply of over 38.19 billion, giving it a circulating market cap of $13.28 billion, ranking 19th in the crypto market.

Up to this point, Hedera gives the impression of being just another standard L1.

What other reasons are behind the surge in HBAR's price?

As the price of HBAR tokens rises, the market generally attributes the main reason to the positive news of the HBAR ETF application submitted by Canary Capital on November 13, with HBAR rising over 30% on the day the news was announced.

Generally speaking, price increases triggered by news do not last long. On November 26, Bloomberg ETF analyst James Seyffart also stated that the SEC's decisions regarding the ETF applications for SOL, XRP, LTC, and HBAR may extend until the end of 2025.

With the positive news landing and the actual ETF approval still far off, we initially thought HBAR's price would retreat. However, HBAR's price remains on an upward trend, having returned to the levels seen during the bull market in November 2021. Therefore, Odaily Planet Daily summarizes the following four reasons:

The emergence of altcoin ETFs, HBAR is undervalued compared to other tokens

Currently, there is a surge in altcoin ETFs, with ETF applications for SOL, XRP, LTC, and HBAR being submitted in succession. Additionally, according to ETF Store President Nate Geraci, at least one issuer is currently attempting to apply for an ETF for ADA (Cardano) or AVAX (Avalanche). Although in the past month, HBAR's token has outperformed SOL, XRP, and LTC with a 104% increase compared to their respective increases of 40%, 32%, and 25%, HBAR's market cap remains relatively low, even ranking below DOT at 19th place.

In fact, before Canary Capital submitted the HBAR ETF application, it had already launched the HBAR Trust in the U.S. in October, specifically serving qualified individual and institutional investors. Canary Capital CEO and former Chief Investment Officer of Valkyrie Funds Steven McClurg also stated that this move is also paving the way for the future launch of the HBAR ETF.

Therefore, as one of the few altcoins currently supported by institutions and having submitted an ETF application, investors may believe that HBAR tokens are undervalued and still have significant growth potential.

HBAR board member likely to become the next SEC chair

With Trump set to take office soon, the next chair of the U.S. Securities and Exchange Commission is also a focus of the crypto market, and HBAR board member Brian Brooks is one of the potential candidates for the next SEC chair. According to prediction market Kalshi data, although former SEC commissioner Paul Atkins from the George W. Bush administration has a 70% chance of winning, Brian Brooks still has a 20% chance.

If Brian Brooks is successfully nominated by Trump as the next SEC chair, it would not only mean that the SEC may become more crypto-friendly, but it would also be a significant positive for HBAR, and this expectation is sustaining the upward trend in HBAR's price.

Additionally, according to FOX Business reporter Eleanor Terrett report, sources have revealed that Trump may announce his choice to replace Gary Gensler as the new SEC chair as soon as tomorrow. This answer is expected to be revealed soon.

Development driven by the RWA trend

The RWA sector is also gradually revitalizing, with institutions increasing their investments in RWA. The stablecoin issuer Tether launched the asset tokenization platform Hadron by Tether on November 14, and Visa introduced the Visa Tokenized Asset Platform (VTAP). The Hedera blockchain is also actively developing RWA, with Hedera's official data indicating that the value of assets tokenized through the Hedera blockchain has reached $50 million, having provided tokenization services for well-known companies such as Dovu, abrdn, and Shinban Bank.

Canary Capital CEO and former Chief Investment Officer of Valkyrie Funds Steven McClurg also stated that Hedera exemplifies the type of enterprise technology that connects cryptocurrency with real-world scalability, and it is expected that the application of this technology will continue to grow.

FOMO in the South Korean market

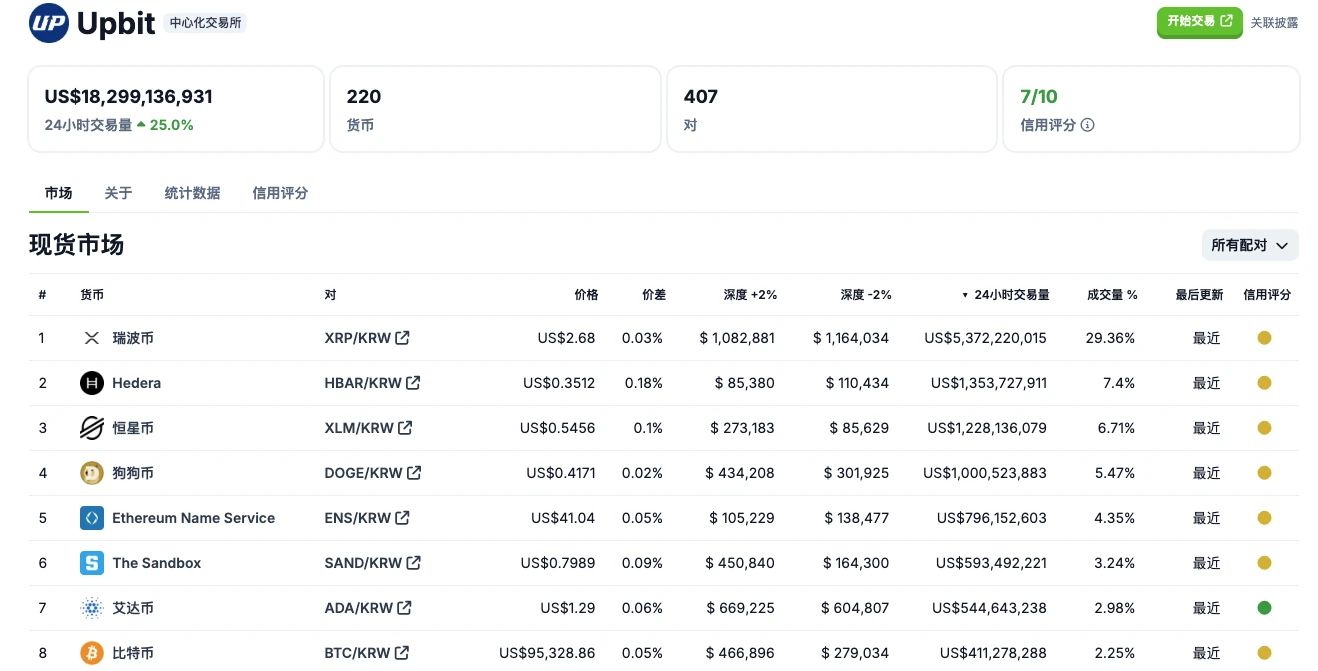

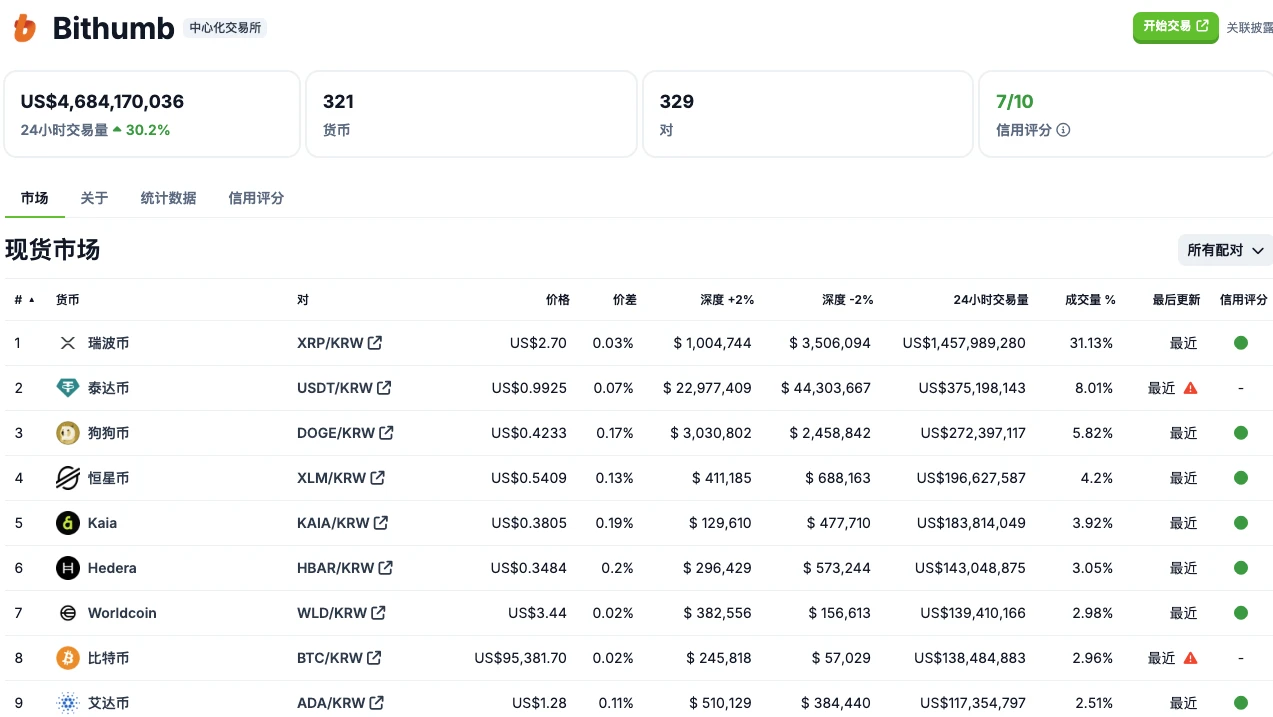

In terms of trading volume, HBAR is also experiencing FOMO in the South Korean market. According to CoinGecko data, on South Korea's largest exchange Upbit, the highest 24H trading volume is XRP, with a trading volume exceeding $5.372 billion; HBAR follows with a 24H trading volume exceeding $1.353 billion, three times that of BTC. Meanwhile, compared to Binance, HBAR's 24H trading volume on Binance exceeds $1.289 billion, which is less than Upbit.

At the same time, on another South Korean exchange, Bithumb, HBAR's 24H trading volume reached $1.43 billion, surpassing even the trading volume of BTC on that platform and even exceeding HBAR's 24H trading volume on Upbit.

It is evident that the South Korean market is not only a major buying market for XRP but also a significant buyer for HBAR.

The arrival of the altcoin season brings new life to old tokens

Trends are always unstoppable. Over the past year, altcoins have performed poorly, first caught in the controversy of VC tokens being "overvalued with low circulation" and massive unlocks, then facing the phenomenon of BTC reaching new highs while the altcoin market remained sluggish, and finally contending with the impact of meme coins. Even seasoned crypto industry figures, such as Cobo co-founder and CEO Shen Yu, previously asserted that "there is no altcoin season in this cycle."

As a result, the sector rotation "though late, has arrived," and the altcoin season has ultimately come. According to analysis by Odaily Planet Daily's Nan Zhi, the funding rate is in a safe zone, and the market share of altcoins is approaching the starting point of the first launch in 2021. _(Related reading: _Reviewing the market data of the past four years, at what stage of the bull market are we?)

The market is accustomed to seeking reasons for price increases, and HBAR may just be a microcosm, representing that perhaps in a true altcoin season, even "old tokens" can make market players dizzy with their gains. Instead of lamenting, it might be better to join the trend.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。