Master Discusses Hot Topics:

Recently, many fans have approached me to learn about projects in the primary market, and even some newly launched small coins. To be honest, I generally do not recommend that everyone dip their toes in—unless you are doing it for fun, who would want to jump around in this water?

The reason is simple: first, I rarely conduct research on these projects, but I do have some insights into the market's tricks. After all, having seen many "harvesting" dramas, I know how the actors perform.

Don't think that trading is just about luck; following the hype is like playing Russian roulette with no technical skills involved. You might as well buy a lottery ticket for a more thrilling experience!

Secondly, many big shots in the blockchain circle have made their fortunes by "harvesting." Some do it openly—launching a "sham coin" or starting a "scheme"; others do it secretly, like "staking Ethereum" and then throwing coins at you with zero cost.

Or they might set up a "blockchain high-tech company" in name while actually harvesting your wallet in disguise. Think about it, those big shots are just waiting for the right moment to take out their sickles to harvest. As for when to harvest? That depends on when their dinner preparations are about done. Whether they harvest or not depends on the market atmosphere and their mood.

Next, let's talk about the Federal Reserve's interest rate cuts this month. Given the current situation, the probability of a rate cut remains low. Microsoft's situation is somewhat anxiety-inducing, but don't forget, there are still a group of friends asking me about macro data, like PMI and non-farm payroll data.

First, PMI isn't very influential, but non-farm payroll data can cause some fluctuations. This Friday, the non-farm payroll data will be released, with the unemployment rate expected to rise from 4.1% to 4.2%, and wage growth is also declining—this is typical weak economic data.

Although this data itself doesn't benefit the economy, it at least provides an excuse for the Federal Reserve to cut rates. After all, with rising unemployment and declining wages, the Federal Reserve won't be happy, and economic risks won't bring them more joy. However, we can't say that an economic recession is definitely coming; let's first see if the labor statistics can bring us some surprises.

As for Bitcoin, as long as the Federal Reserve continues to cut rates, Bitcoin is unlikely to see significant corrections this month. It already gave a slight correction at the end of November, and there may be a short-term rebound. After all, Bitcoin tends to run up whenever it gets the chance, following the rate cuts.

For those bearish friends, some are looking at a drop to 80,000 or even 76,000. I can only say that this range is too large and too detached from reality. If you really want to be bearish, you need to wait for Bitcoin to drop below 90,850 and close below 93,000; only then might there be support at the lowest of 85,755.

However, if Bitcoin does not drop below 94,750 in the short term, and if it drops but cannot close back above 95,855, then it won't continue to decline. Conversely, if Bitcoin rebounds and stands above 97,450, support will be moved back up to 95,755, followed by a rebound to 98,200-98,700, which are two key positions everyone should pay attention to.

Master Looks at Trends:

Resistance Levels Reference:

First Resistance Level: 96,750

Second Resistance Level: 98,000

Support Levels Reference:

First Support Level: 95,000

Second Support Level: 94,300

Today's Suggestions:

Currently, the selling area for the rise has not broken through, and the high area is still adjusting. Due to a lack of sufficient upward momentum, trading volume has not increased significantly, so multiple retests are needed to digest the selling area above.

We are currently at a psychological support and previous low point area, which is also an important short-term support line. In the short term, since the price is still fluctuating along the upward trend line, it is recommended to first observe whether there is a downward breakout, using the candlestick patterns and trading volume on lower time frames to assist in judgment.

The maximum downside space is the second support at 94.3k, and attention can be paid to the trend of the 120-day moving average. If the downside is accompanied by increased trading volume, it indicates a higher possibility of a decline. Currently, Bitcoin can still maintain a rebound strategy for layout.

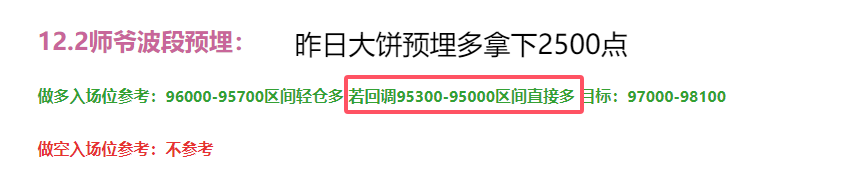

12.3 Master’s Band Strategy:

Long Entry Reference: Light long in the 94,300-94,750 range. If it retraces near 93,800, go long directly. Target: 96,750-98,000.

Short Entry Reference: Not applicable.

This article is exclusively planned and published by Master Chen (public account: Coin God Master Chen). For more real-time investment strategies, solutions, spot trading, short, medium, and long-term contract trading techniques, operational skills, and knowledge about candlesticks, you can join Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Warm reminder: This article is only written by Master Chen on the official account (as shown above), and any other advertisements at the end of the article and in the comments are unrelated to the author!! Please be cautious in distinguishing between true and false, thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。