Projects built on Sui raised a total of $16.3 million in the second and third quarters of 2024, a 41.7% increase compared to the previous two quarters.

Author: Jake Koch-Gallup

Compiled by: Deep Tide TechFlow

Key Insights

Sui launched the Mysticeti consensus mechanism, reducing consensus latency by 80%, shortening it to 390 milliseconds while processing 100,000 transactions per second, significantly enhancing efficiency.

Sui completed integration with Circle's USDC and plans to introduce Circle's Cross-Chain Transfer Protocol (CCTP). This collaboration drove Sui's market capitalization to grow by 139% quarter-over-quarter, reaching $4.8 billion, ranking it 21st in market cap.

On May 30, 2024, the number of active addresses on Sui reached a historical peak of 2.2 million. This day also unlocked 9.3% of the token circulation, with newly unlocked tokens flooding the market, leading to a surge in trading and transfer activities.

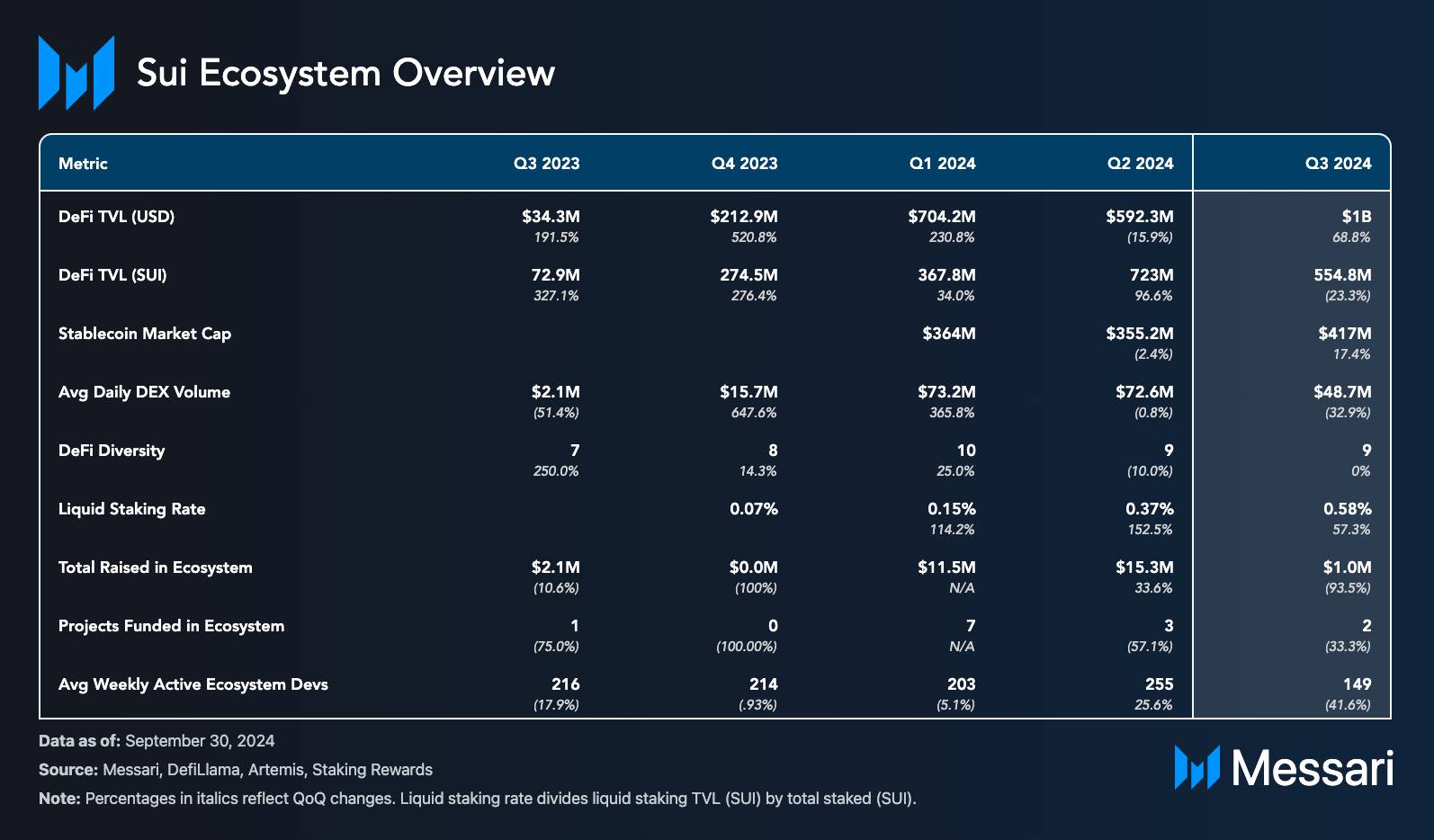

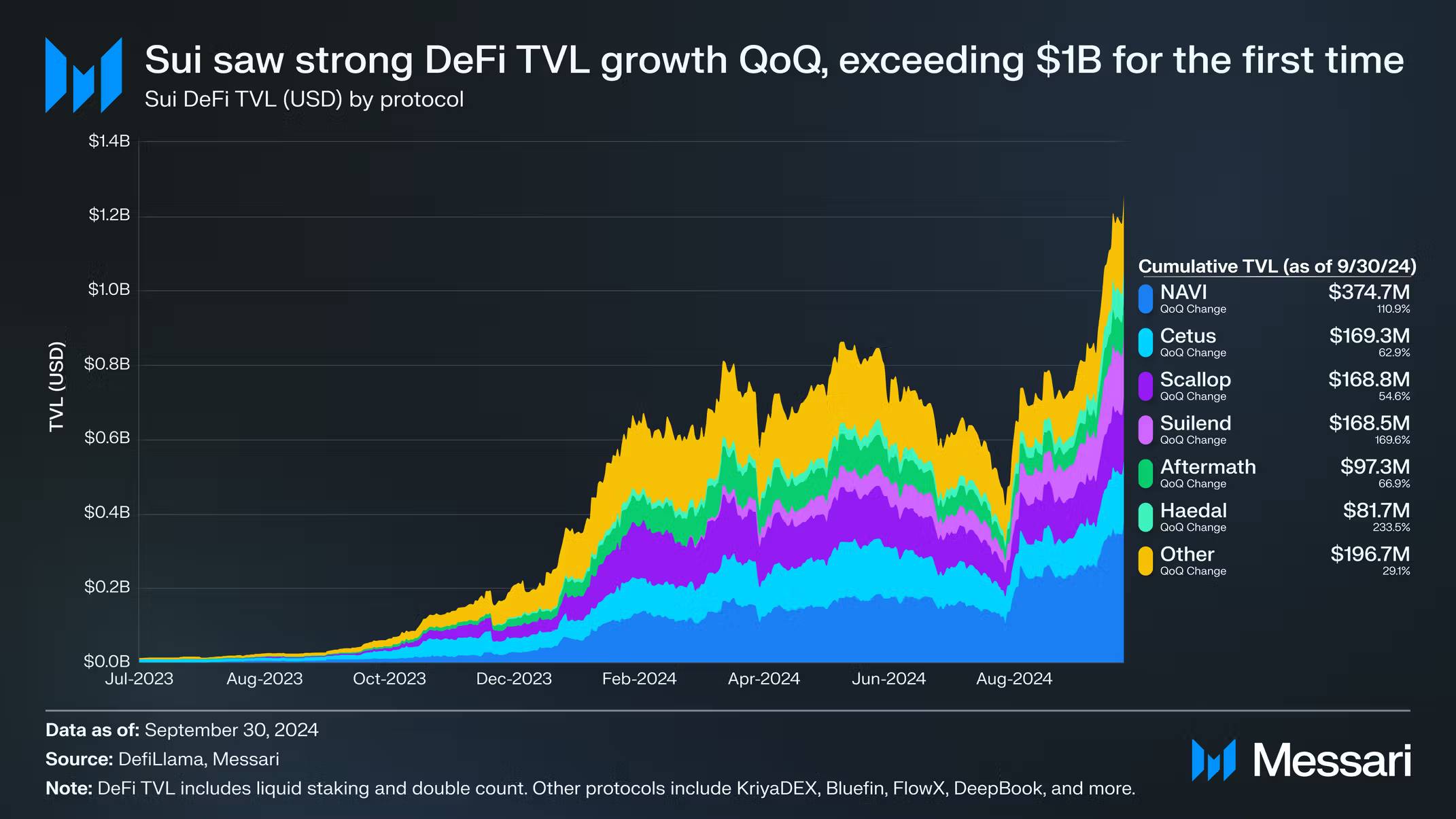

In the past two quarters, Sui's total value locked (TVL) in DeFi grew by 42%, reaching $1 billion. This growth was partly due to DeFi protocols like NAVI, Scallop, and Cetus launching new features and ecosystem funds, while the price of SUI also increased by 117.1% from the second to the third quarter.

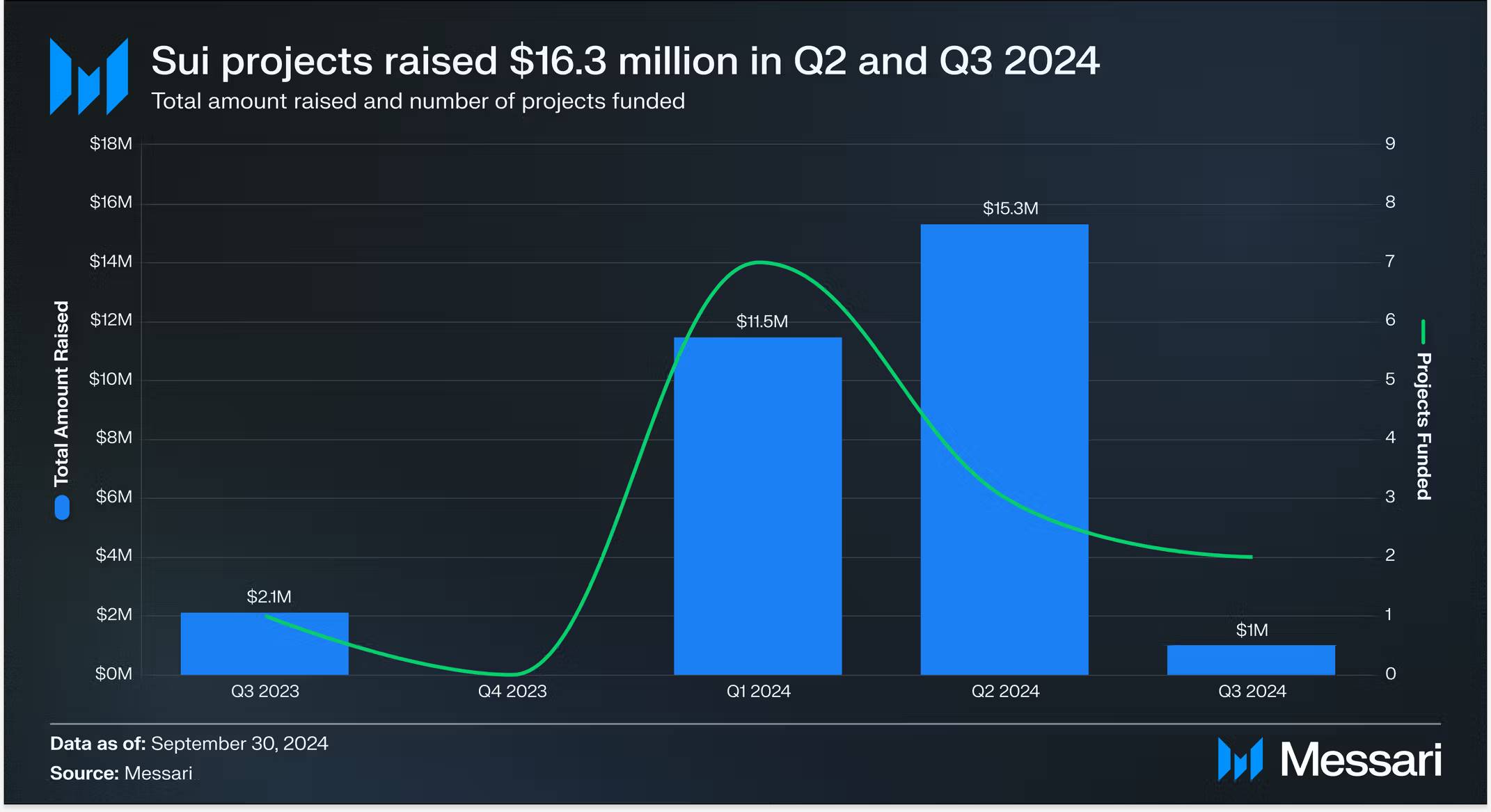

Projects built on Sui raised a total of $16.3 million in the second and third quarters of 2024, a 41.7% increase compared to the previous two quarters. Funded projects include Ambrus Studio, XOCIETY, and RECRD.

Introduction

Sui (SUI) is a first-layer blockchain based on Delegated Proof of Stake (DPoS), designed for high scalability and low-latency transactions, aiming for mass user adoption. The core development team of Sui, Mysten Labs, was founded in 2021 by Evan Cheng, Sam Blackshear, Adeniyi Abiodun, Kostas Chalkias, and George Danezis. These founders previously led Meta's blockchain projects Diem and Novi and have work experience at top institutions like Apple, Alan Turing Institute, Microsoft, R3, and Oracle. Mysten Labs raised a total of $336 million in funding in 2021 and 2022, and approximately $49 million in several public token sales in 2023 (KuCoin, OKX, Bybit, and BitForex). Sui launched its mainnet in May 2023.

Sui's technical architecture is filled with innovations, including an object-centric data model, the Mysticeti consensus mechanism, the Sui Storage Fund, and the Sui Move programming language. Sui Move is an improvement of the Move language developed by Mysten Labs co-founder Sam Blackshear based on his work at Novi. Compared to other Web3 programming languages, Sui Move offers greater flexibility and security. Unlike Solidity which relies on sequential transaction processing, Sui Move's object-centric data model allows for parallel transaction processing, enhancing efficiency. Additionally, 5 of the OWASP Top 10 vulnerabilities cannot occur in Move, and 3 other vulnerabilities have been partially mitigated.

Several other protocols and products aimed at improving user onboarding and experience have also been launched on Sui, including Sponsored Transactions, which allow gas fees to be extracted from end users; zkLogin, enabling Sui users to transact using OAuth credentials; Sui Bridge, a native bridge for cross-chain interoperability; and Sui Kiosk, a decentralized system for commercial applications. The development of the Sui ecosystem is led by the Sui Foundation, with Mysten Labs being the initial contributor to the development of the Sui blockchain protocol. For complete onboarding information on Sui, please refer to our coverage report.

Website / X (Twitter) / Discord

Key Metrics

Financial Analysis

In the first quarter of 2024, the cryptocurrency market grew by 63.6% overall. However, in the second quarter, the market entered a cooling phase, declining by 16.4%. SUI's performance aligned with the overall trend, with its circulating market cap decreasing by 15.7% in the second quarter. However, by September 2024, SUI broke this downward trend, with its circulating market cap surging by 133.3% within a month. This growth was primarily due to the integration with USDC and CCTP, as well as the launch of the Grayscale Sui Trust. By the end of the third quarter of 2024, SUI's circulating market cap reached $4.8 billion, a quarter-over-quarter increase of 139.4%, rising to 21st place in the cryptocurrency market cap ranking. Although the token unlock in May 2024 released 10.19% of the total supply, which initially put downward pressure on the price, the price gradually aligned with the market cap growth thereafter.

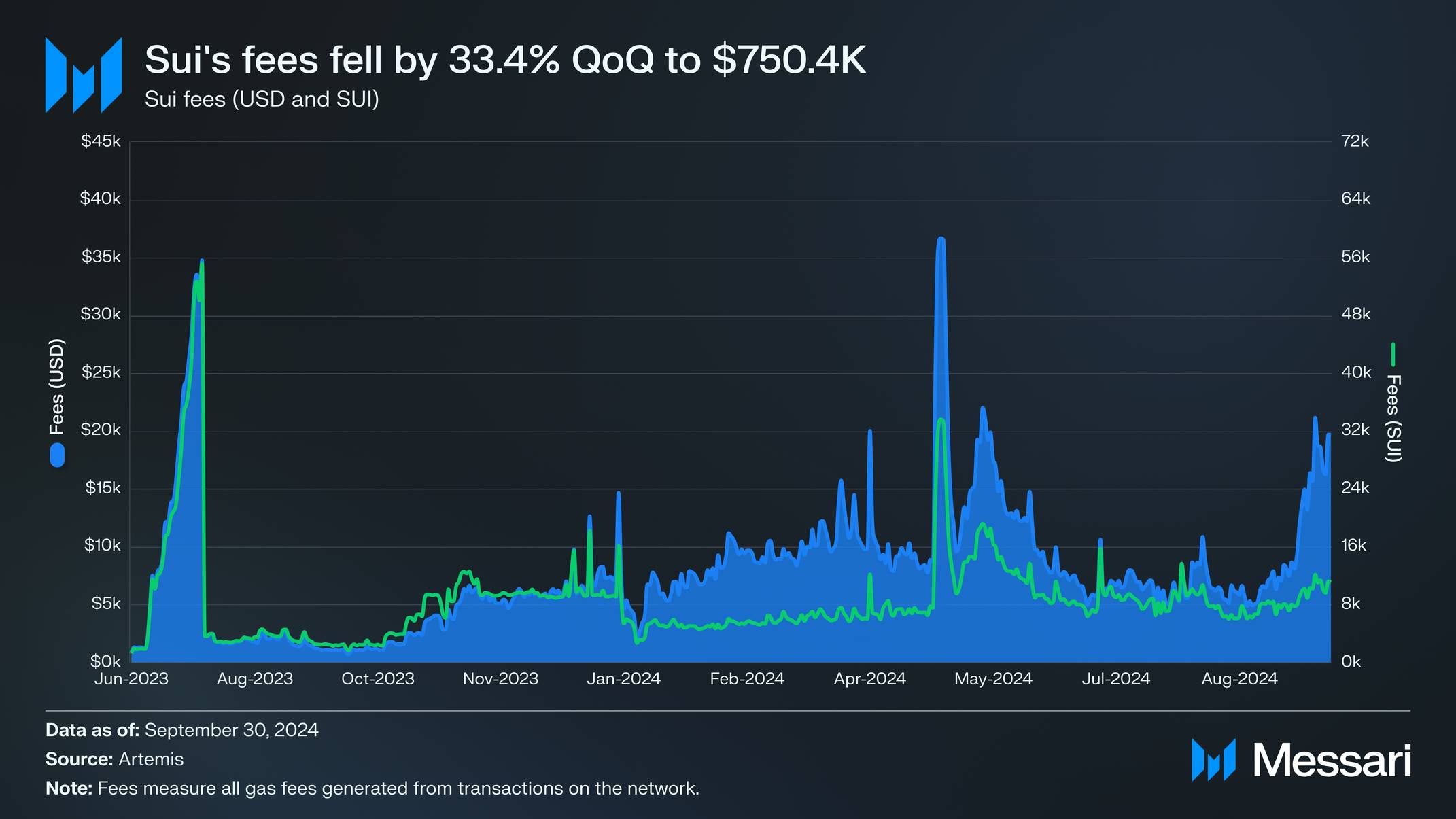

The fees on the Sui network are primarily composed of gas fees generated from transactions, including computational costs and non-refundable storage fees. These fees are ultimately distributed to network validators. Due to a surge in transaction activity following the token unlock in May 2024, Sui's total fees in the second quarter reached $1.1 million (approximately 1 million SUI), setting a historical high. As the market activity from the initial unlock gradually diminished, fees in the third quarter decreased by 31.8% quarter-over-quarter, falling to $750,400 (approximately 789,900 SUI).

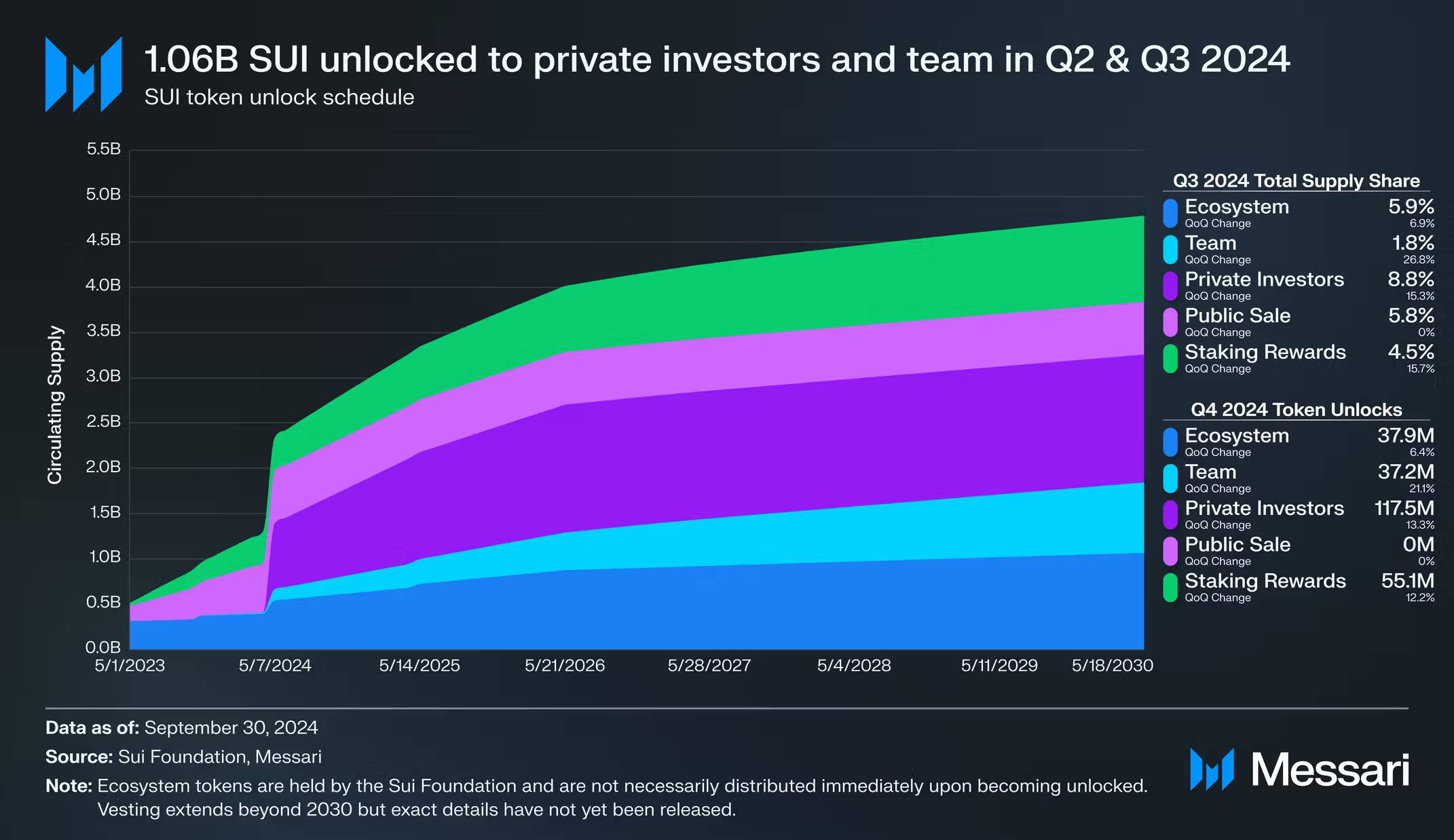

The total supply of SUI is fixed at 10 billion tokens, with 1 billion specifically allocated for staking rewards. As of the end of the third quarter of 2024, the annual inflation rate of SUI relative to the remaining 9 billion tokens is 0.44%. This rate will decrease by 10% every three months until all staking reward tokens are distributed.

In addition, token unlocks are also a major source of inflationary pressure. As of the end of the third quarter of 2024, 26.8% of the total supply of SUI has been allocated, an increase of 10.3% compared to the second quarter and 117.9% compared to the first quarter.

The following are the major unlocking events:

-

Ecosystem: Unlocking 147.5 million SUI (worth approximately $262.6 million) for community reserves.

Public Sale: Unlocking 34.6 million SUI (worth approximately $61.6 million) for community access programs.

Total: Unlocking 182.1 million SUI (worth approximately $324.1 million as of September 30, 2024), accounting for 2.02% of the total unlock amount and 1.82% of the total supply.

-

Team: Unlocking 109.4 million SUI (worth approximately $194.7 million) to reward early contributors.

Investors: Unlocking 496 million SUI (worth approximately $882.8 million) for Series A investors; unlocking 231.9 million SUI (worth approximately $412.7 million) for Series B investors.

Total: Unlocking 837.2 million SUI (worth approximately $1.49 billion as of September 30, 2024), accounting for 9.30% of the total unlock amount and 8.37% of the total supply.

Through these unlocking events, the circulating supply of SUI significantly increased, further driving changes in market trading activity.

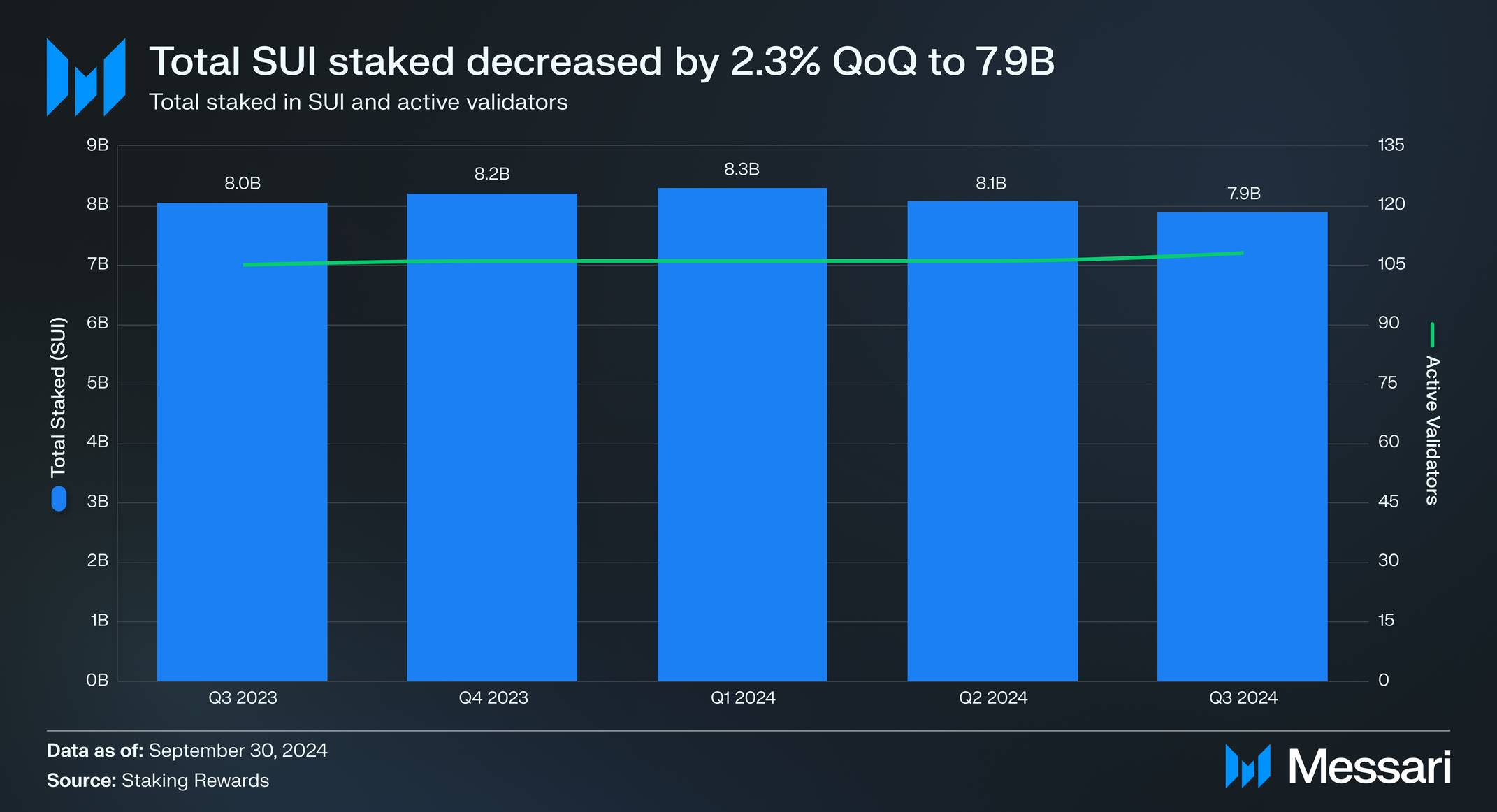

In the second and third quarters of 2024, a total of 1.45 billion SUI tokens were unlocked (worth approximately $2.58 billion as of September 30, 2024), accounting for 14.5% of the total supply. By the end of the third quarter of 2024, 78.8% of the stakable supply had been staked, a decrease of 2.3% from the previous quarter. It is important to note that even locked tokens can participate in staking and earn liquid staking rewards. Therefore, the stakable supply of SUI is based on the total supply rather than the circulating supply. Due to the high staking rate, SUI's annual real yield is slightly below zero at -0.31%.

Network Analysis

Usage

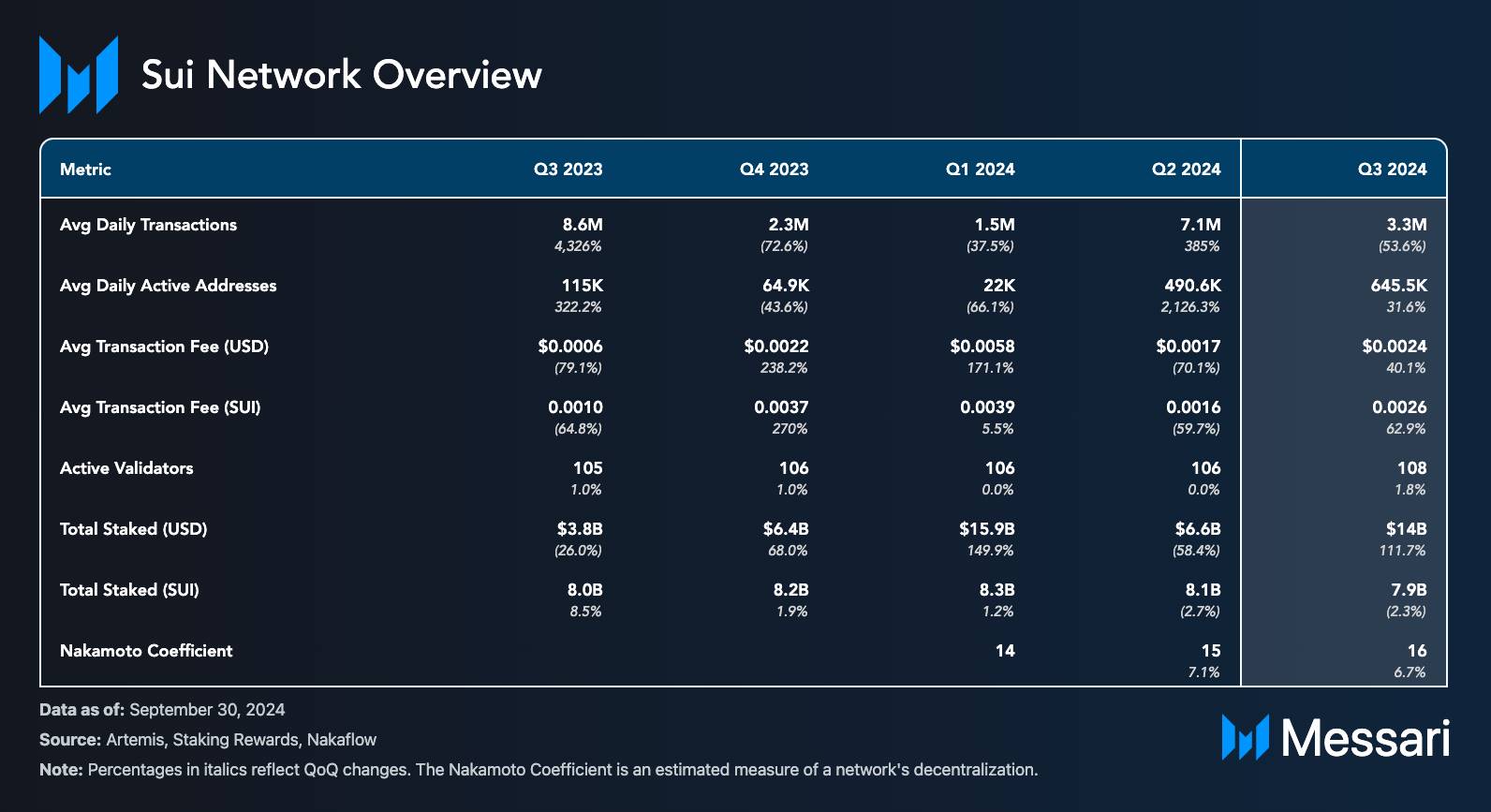

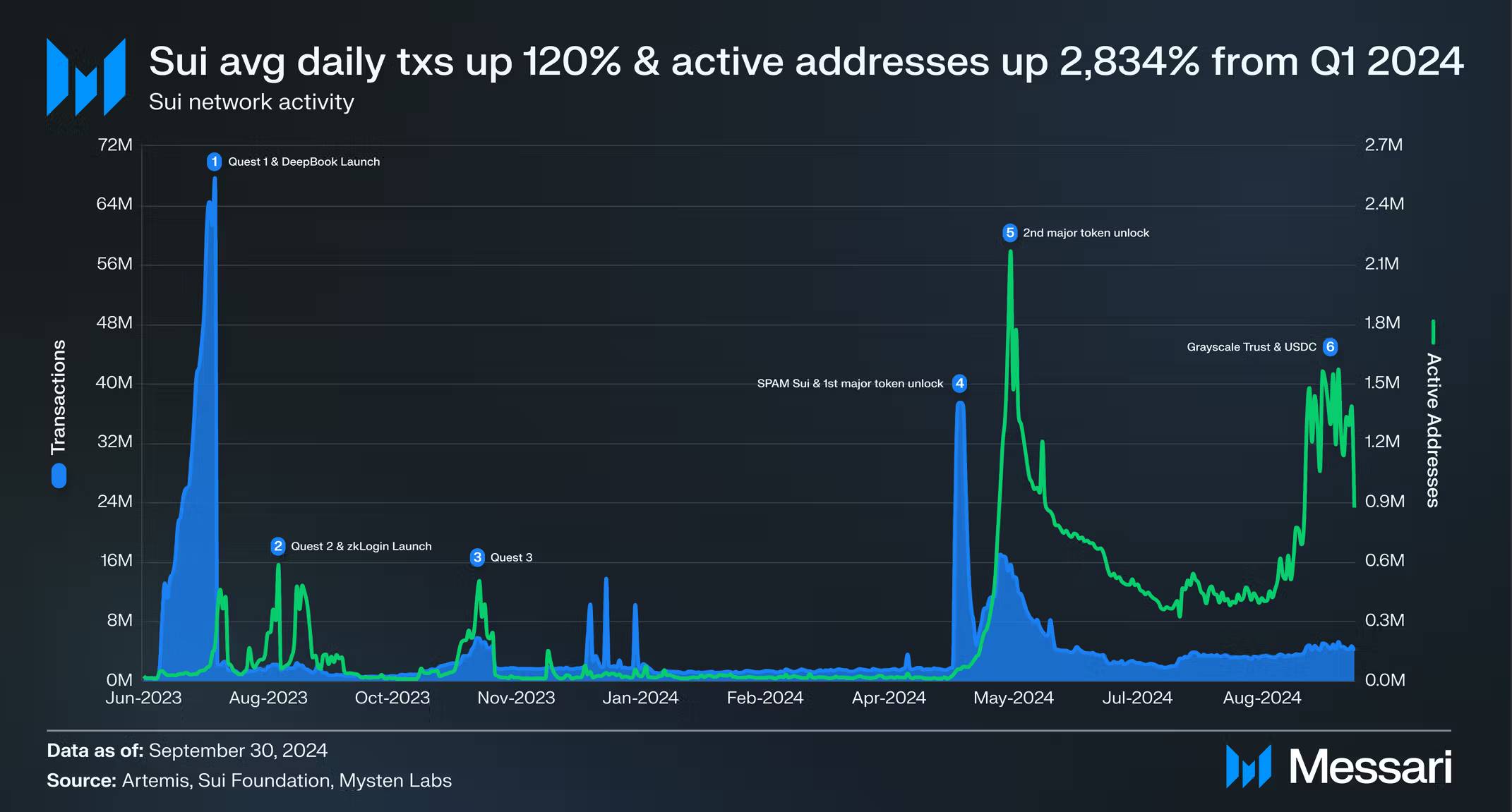

The activity on the Sui network (measured by daily transaction volume and daily active addresses) significantly rebounded after the major token unlocking event in May 2024. In the second quarter of 2024, the average daily transaction volume increased by 385% quarter-over-quarter, reaching 7.1 million; however, it decreased by 53.6% in the third quarter, falling to 3.3 million. The number of daily active addresses grew by 2126% quarter-over-quarter in the second quarter, reaching 490,600, and continued to grow by 31.6% in the third quarter, reaching 645,500.

In the past two quarters, Sui's single-day transaction volume peaked at 37.5 million on May 4, 2024, primarily due to:

SPAM Sui application incentive mechanism: This application encourages users to send a large number of transactions on the Sui network by rewarding them with SPAM tokens. During the peak transaction volume period, 82.7% of the transactions came from SPAM Sui users.

Token unlock driving: The first token unlock event on May 3, 2024, led to a large number of users transferring and trading newly unlocked tokens, further stimulating trading activity.

The number of active addresses peaked around the second SUI token unlock on May 30, 2024, reaching as high as 2.16 million. Subsequently, in September 2024, with the launch of the Grayscale Sui Trust and the announcement of the USDC and CCTP integration, the number of active addresses rebounded again.

Despite the significant increase in transaction volume, Sui's average transaction fees decreased by 59.7% in the second quarter. Fees rebounded in the third quarter, increasing by 62.9%, but the average transaction fee remained at 0.0026 SUI (approximately $0.0024), keeping the cost of millions of transactions per day very low. In addition to extremely low gas fees, Sui also supports waiving gas fees for users through sponsored transactions. For example, through the Gas Station API provided by infrastructure provider Shinami, the monthly peak of sponsored transactions reached 41 million in the first year after the Sui mainnet launch; and through Shinami's node services, the coverage of sponsored transactions reached as high as 87%.

Additionally, in the previous quarters, the Quest activities launched by Mysten Labs (Quest 1, Quest 2, and Quest 3), as well as the releases of products like DeepBook and zkLogin, also made significant contributions to the growth of transaction volume and active addresses on the Sui network.

Security and Decentralization

The total amount of SUI staked gradually decreased from a peak of 8.3 billion in the first quarter of 2024 (accounting for 83% of the total stakable supply). It decreased by 2.7% in the second quarter and further declined by 2.3% in the third quarter to 7.9 billion. However, due to the increase in SUI prices, the total staked value in USD showed a different trend, increasing by 112% quarter-over-quarter to reach $14 billion. This made Sui the third largest blockchain network by staked market value.

Since the launch of the Sui network, the number of active validators has remained relatively stable, increasing slightly from 104 to 108. As the Sui Foundation and Mysten Labs hold a large amount of SUI tokens on behalf of the ecosystem, they are able to distribute staking more evenly among validators, thereby enhancing the decentralization of the network. As of the end of the third quarter of 2024, Sui's Nakamoto coefficient was 16, higher than the median of many proof-of-stake networks. This indicates that Sui has a high level of security in terms of decentralization.

Upgrades and Roadmap

The Sui network frequently undergoes protocol upgrades. Starting from version 41 of the Sui protocol in the second quarter of 2024, it has been upgraded to version 59 by the end of the third quarter. Here are some important new features:

Native Randomness: Provides unpredictable, uncontrollable, and fast random number generation capabilities through threshold cryptography and distributed key generation (DKG) technology, enhancing the fairness and security of the network.

Elliptic Curve Operations: Introduces elliptic curve operations in the Move programming language, supporting more powerful cryptographic functions, thereby enhancing the security of decentralized applications.

Programmable Transaction Blocks (PTBs): The upgraded PTBs only allow TransferObjects or MergeCoins operations to be executed after commands involving randomness, ensuring the consistency of transaction logic.

In early 2024, Sui announced a consensus upgrade, expanding its Narwhal-Bullshark consensus algorithm. The Mysticeti consensus mechanism went live on the mainnet in August 2024, significantly optimizing performance. With a throughput of 100,000 transactions per second (TPS), consensus latency was reduced by 80%, down to 390 milliseconds, while also lowering the CPU requirements for validators. Researchers tested the performance of Mysticeti with 50 validator nodes: at 100,000 TPS, the consensus latency was 400 milliseconds; at 200,000 TPS, the latency was 500 milliseconds; and at 400,000 TPS, the latency was 1 second.

Mysticeti also optimized transaction processing by distinguishing between "owned objects" and "shared objects." This design reduced the communication requirements between validators while maximizing the efficient use of network bandwidth, thereby enhancing overall transaction processing capacity.

Through these upgrades, Sui not only improved network performance but also further solidified its advantages in decentralization and security.

In July 2024, Sui launched an indexing framework, a flexible data ingestion framework that provides developers with customized on-chain data access services. Through this framework, developers can collect raw on-chain data and derived datasets, creating tailored data streams for specific applications, enhancing the flexibility and efficiency of data processing.

In the same month, Sui announced integration with Amazon Web Services (AWS) for blockchain node operation programs. This collaboration allows developers to more easily deploy and manage Sui full nodes in the AWS cloud environment while leveraging the high availability, scalability, and reliability provided by AWS, enhancing the stability of node operations.

Updates in September 2024

Sui announced plans to integrate Circle's native USDC stablecoin and Cross-Chain Transfer Protocol (CCTP). On October 8, 2024, native USDC officially launched on Sui, making it the first Move programming language-based blockchain to support native USDC. In the future, the integration of CCTP will enable secure, permissionless cross-chain transfers of USDC across multiple blockchains, including Arbitrum, Base, Ethereum, and Solana.

Additionally, the Sui Bridge went live on the mainnet on the last day of the third quarter, providing important native functionality for cross-chain interoperability. At launch, Sui Bridge supported asset transfers between Sui and Ethereum, with plans to gradually expand support for more tokens, assets, and blockchains. During the testnet phase, Sui Bridge attracted 24,000 unique Ethereum addresses through incentive programs, completing over 184,000 transactions.

Sui plans to collaborate with more protocols to fully integrate Circle's CCTP and continue upgrading its network. The network's release schedule has been arranged several months in advance. Furthermore, Sui plans to achieve unified exclusive objects for Mysticeti in the fourth quarter of 2024, further optimizing network performance.

Ecosystem Overview

Decentralized Finance (DeFi)

Sui's decentralized finance ecosystem has seen significant growth over the past two quarters. Its total value locked (TVL) increased from $592 million in the second quarter to $1 billion by the end of the third quarter, surpassing the $1 billion mark for the first time. If liquid staking and double counting are included, Sui's DeFi TVL grew by 82.5% quarter-over-quarter, reaching $1.26 billion by the end of the third quarter. However, the TVL measured in SUI decreased from $723 million to $555 million, indicating that the dollar growth of TVL was primarily driven by the increase in the price of SUI tokens. During this period, the price of SUI tokens rose by 117.1%, from $0.82 to $1.78. Over a longer timeframe, from the first quarter to the third quarter, Sui's TVL (measured in SUI) grew by 50.8%, reflecting the intrinsic expansion of the DeFi ecosystem.

As of the end of the third quarter of 2024, the lending protocol NAVI became the highest TVL protocol on Sui, with a TVL of $374.7 million, accounting for 29.8% market share. In April 2024, NAVI launched the NAVI X ecosystem fund, allocating 10 million NAVX tokens to support innovation and development in the DeFi ecosystem. In August, NAVI launched NAVI Pro, offering a more user-friendly interface, advanced DeFi strategies, and higher yields. Additionally, NAVI introduced LST leverage strategies to enhance capital efficiency using liquid staking tokens.

The lending protocol Scallop had a TVL of $168.8 million at the end of the third quarter, with a market share of 13.4%. In July, Scallop launched Wrapped sCoins to improve the visibility and usability of Sui wallets and platforms. Furthermore, in the third quarter, Scallop's historical lending volume exceeded $80 billion.

The lending protocol Suilend had a TVL of $168.5 million at the end of the third quarter, with a market share of 13.4%. Suilend was developed by the Solend team, marking Solend's first attempt outside the Solana ecosystem. Suilend launched a points program to reward users for deposits, distributing 10 million points daily, recorded on the Sui blockchain as non-transferable tokens.

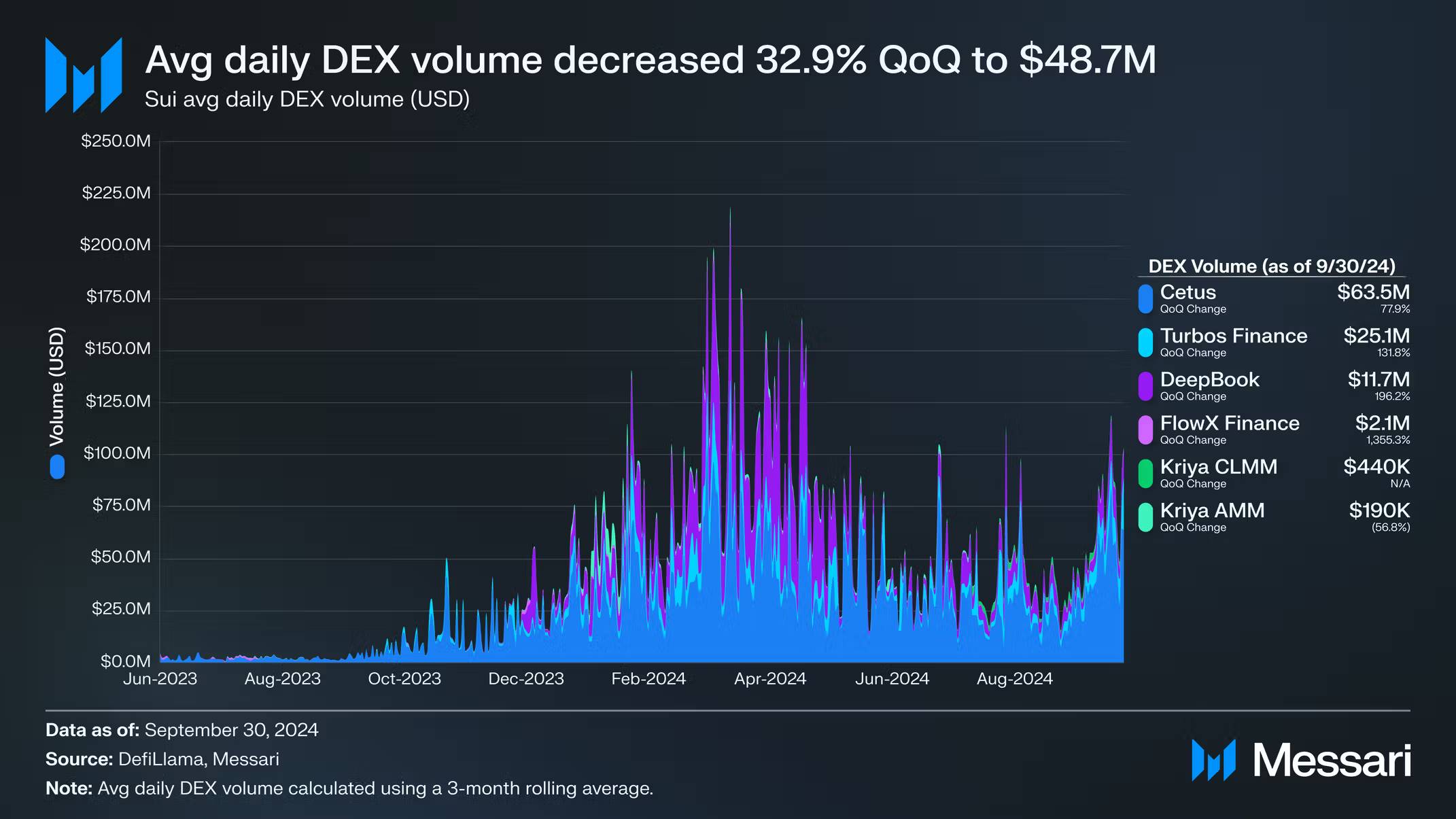

Sui's average daily decentralized exchange (DEX) trading volume gradually declined from a peak of $73.2 million in the first quarter of 2024, decreasing by 0.8% in the second quarter and further declining by 32.9% in the third quarter to $48.7 million. Among them, Cetus and DeepBook led with average daily trading volumes of $34.6 million and $16.4 million, respectively. Other notable DEXs included Turbos ($7.5 million), KriyaDEX ($862,500), and FlowX Finance ($623,300).

Sui's leading decentralized exchange Cetus had a TVL of $169.3 million at the end of the third quarter, with a market share of 13.5%. In the second quarter, Cetus had over 1.2 million users and a total trading volume exceeding $8.8 billion. It launched the Cetus limit order feature and announced a partnership with the Sui Foundation to launch the Cetus Aquarium incubator program. In the third quarter, Cetus launched Cetus Plus, a new swap aggregator on the Sui network, enhancing the DeFi experience through improved order jumping, splitting features, and faster swap responses. Cetus also launched a beta version of Cetus DCA, providing users with average cost strategies.

As of the end of the third quarter, Sui's native liquidity layer DeepBook has accumulated a trading volume exceeding $500 billion. DeepBook has been integrated into numerous protocols, including Cetus, Kriya, FlowX, and Hop Aggregator. Its V2 has been used by 740,000 wallets across 100 million transaction blocks. DeepBook V3 was released on October 14, 2024, introducing dynamic trading fees, improved gas efficiency, flash loans, cross-pool shared liquidity, and the DEEP token. As of October 31, the TVL of DeepBook V3 was $22.58 million, with a cumulative trading volume of $89.23 million. The initial price of the DEEP token was $0.0176, with a circulating supply of 2.5 billion tokens (25% of the total supply). As of October 31, its price had risen by 204.6% to $0.0536. Active traders (market makers) can deeply stake across various pools to receive lower taker fees, market maker rebates, and participate in governance. The launch of DEEP has stimulated activity in Sui's DeFi ecosystem, with Cetus facilitating an average daily trading volume of $17.3 million in DEEP. With the introduction of new tokens, Sui's DeFi trading infrastructure is expected to evolve as the utility of these assets continues to expand.

The leading Perps protocol on Sui, Bluefin, had a TVL of $17.2 million at the end of the third quarter. In July 2024, Bluefin announced the launch of its governance token BLUE after receiving funding from Flow Traders.

Other notable DeFi protocols on Sui include Aftermath Finance, a DEX aggregator, liquid staking, and liquidity mining protocols; Haedal, a one-click liquid staking platform; and AlphaFi, a yield aggregator.

Other DeFi-related activities in the second and third quarters of 2024 include the launch of Fordefi's institutional-grade MPC DeFi wallet, Netki's compliance oracle, First Digital's stablecoin FDUSD, and Agora's AUSD stablecoin.

Consumers

Gaming

In the second and third quarters of 2024, the Sui network continued to expand beyond DeFi, making significant progress in consumer applications such as gaming, NFTs, and DePIN.

At the Korea Blockchain Week in September 2024, Sui announced SuiPlay0X1, a handheld gaming device that supports both blockchain-native and traditional games. SuiPlay0X1 is set to launch in early 2025, featuring PlaytronOS, an optimized gaming operating system based on Linux that supports multiple game stores, including Steam, Epic Games Store, and GOG.com. It will have built-in Sui's zkLogin and Sui Kiosk SDK, connecting asset ownership directly to the device's account system. Pre-orders start at $599, accepting payments in SUI, SOL, or ETH.

SWAYE is a Web3 gaming platform on Sui that launched its first game in May 2024. OG Battlefront is an arcade-style Telegram game designed to create "the most accessible Web3 game" using account abstraction, Telegram's API, and artificial intelligence.

DARKTIMES is a blockchain-based Nordic fighting game supported by Animoca Brands and developed by Animoca's Blowfish Studios, which previewed its pre-alpha game testing at the Korea Blockchain Week. It launched the TIMES token in September 2024 and plans to start alpha testing in November 2024.

XOCIETY is a popular shooting game with RPG elements developed by NDUS Interactive, set to launch in early access in November or December 2024. Built on Unreal Engine 5, it features PvP and PvE gameplay, utilizing Sui's dynamic NFTs for in-game asset ownership.

Sui has partnered with the world's largest martial arts organization ONE Champions to integrate its technology into ONE Fight Arena. ONE Fight Arena is a Web3 mobile game developed by Animoca's Notre Game, scheduled for release in the first quarter of 2025.

NFTs

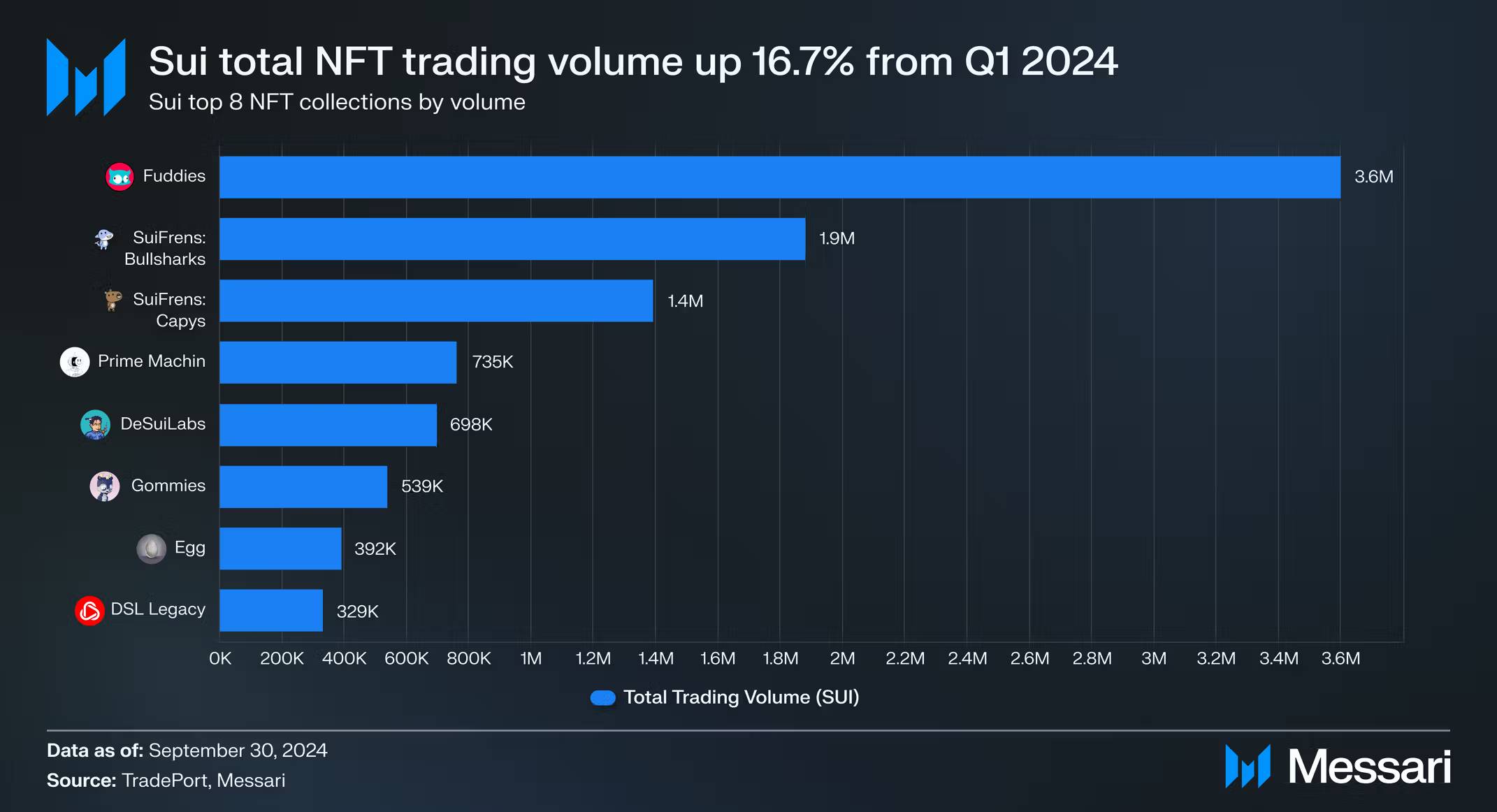

Since its launch, the total trading volume of NFTs has reached 13.3 million SUI, a 16.7% increase from the first quarter of 2024. The leading markets by trading volume include Clutchy (5.7 million SUI), TradePort (2.5 million SUI), and BlueMove (2.2 million SUI). The top NFT series by quantity include Fuddies (3.6 million SUI), SuiFrens: Bullsharks (1.9 million SUI), SuiFrens: Capys (1.4 million SUI), Prime Machin (735,000 SUI), DeSuiLabs (698,000 SUI), Gommies (539,000 SUI), Egg (392,000 SUI), and DSL Legacy (329,000 SUI).

Sui Generis is the rebranded incarnation of the Tombheads NFT auction house, which migrated from the Sonic blockchain earlier this year and launched on Sui in April 2024 here. Sui Kiosk is used for enforcing royalties, restricting trades, and creating soulbound NFTs. The team has also collaborated with Aftermath Finance to develop fragmented NFTs for its S1 Collection.

Artfi is an art investment platform that allows individuals to purchase shares of high-end artworks by splitting them into 10,000 individually numbered NFT shares. Artfi initially operated on the Polygon blockchain and transitioned to Sui at the end of May 2024. On June 17, 2024, Artfi launched the ARTFI token to pay for NFT marketplace transaction fees and reward stakers.

On the other hand, the multi-chain NFT marketplace and aggregator Hyperspace announced it would cease operations on the Solana and Sui Layer-1 blockchains on September 17, 2024. During its operation, Hyperspace achieved a total NFT trading volume of 1.7 million SUI on Sui.

Other Use Cases

BytePlus, a subsidiary of TikTok's parent company ByteDance, took its first step into blockchain in April 2024 by partnering with Sui. BytePlus will collaborate with Mysten Labs to adapt its recommendation solutions, augmented reality products, and other services to the Sui blockchain.

Innovative manufacturing company 3DOS announced in September 2024 that it would integrate its global 3D printing network with the Sui blockchain. This integration will enable peer-to-peer connections among users, 3D printers, and manufacturers, with 3DOS aiming to build the world's largest distributed 3D printing network.

AI startup Atoma Network announced its integration with Sui to support its inference network, providing AI service support for developers. These services include automated code generation, workflow automation, and risk analysis for DeFi protocols, helping developers utilize AI technology more efficiently in blockchain applications.

Institutional Interest

In the second and third quarters of 2024, Sui attracted increasing institutional attention. Grayscale launched the Grayscale Sui Trust in September 2024, a Sui investment product designed for accredited investors. Following this news, the price of the SUI token rose by 89% at the end of the third quarter.

In June 2024, UK-based digital asset custody service provider Copper partnered with Sui here to gradually expand its custody capabilities. This partnership is being implemented in phases, including custody support for SUI and native Sui tokens, as well as future staking support and DeFi connections.

Zero Hash is a cryptocurrency and stablecoin platform that integrated with Sui in July 2024. This allows businesses to embed Sui technology for value transfers between fiat currencies, cryptocurrencies, and stablecoins. Institutional clients of Zero Hash, including Stripe, Shift4, and Franklin Templeton, can utilize SUI tokens in their operations.

Infrastructure

Mysten Labs announced the release of Walrus in June 2024, a decentralized blob storage network powered by Sui, designed for blockchain applications and autonomous agents. Walrus aims to provide cost-effective and highly resilient data storage. Mysten Labs launched a developer preview in July, currently storing over 22 TB of data. From August to October, they hosted a virtual developer network hackathon called Breaking the Ice, gathering over 200 developers building applications on Walrus. Notable Web3 media outlet Decrypt announced in September that it would store 100% of its content inventory on Walrus.

In September, Mysten Labs released the Walrus white paper and outlined the following development phases:

Walrus will become an independent decentralized network and launch its native utility token WAL.

The operation of Walrus will rely on a delegated proof-of-stake mechanism driven by the WAL token, with storage nodes responsible for network operations.

An independent Walrus Foundation will be established to promote the technological development and ecosystem expansion of the network.

In May 2024, Mysten Labs introduced enhancements to the Sui social login primitive zkLogin, adding multi-signature recovery and support for Apple accounts. These updates provide users with more account recovery options and allow iOS applications to easily support Sui wallet creation. zkLogin enables users to create Sui addresses using social logins from Google, Facebook, or Apple without handling sensitive cryptographic materials.

In June 2024, the Sui Name Service (SuiNS) introduced subnames and a new naming standard. The transition from the .sui suffix to the @ prefix allows users to bridge Web2 and Web3 more seamlessly, and subnames can create hierarchical identities (e.g., @gia creates games@gia). This update was accompanied by improvements to the website and user experience. In August 2024, SuiNS announced its plans to launch SuiNS governance tokens and transition towards decentralization. The NS token has not yet launched, and an official release date has not been announced. Future potential initiatives include shorter name registrations, NFT avatar generators, dynamic widgets, auction systems, and fiat gateways.

Sui partnered with Google Cloud to enhance the security, scalability, and AI capabilities of Web3 applications. Key initiatives of this partnership include integrating Sui blockchain data into BigQuery public datasets for analysis, using Google Cloud's generative AI platform Vertex AI to assist Web3 developers with debugging and code generation, and creating AI-based code auditing tools to ensure security. This collaboration also leverages Google Cloud's infrastructure for scalability and integrates zkLogin to bridge traditional and decentralized applications.

Development and Growth

In the second quarter of 2024, three Sui-based projects announced several rounds of financing, raising a total of $15.3 million, a 33.6% increase from $11.5 million in the first quarter. In the third quarter, venture capital cooled down, with only two projects announcing a total funding of $1 million. Projects that raised funds in the past two quarters include Ambrus Studio, XOCIETY, and RECRD, with the SUI Foundation participating as an investor.

Sui Basecamp (April 2024): The largest event in the Sui community took place in Paris, attracting over 1,100 participants from 65 countries. Over two days, the event hosted 44 sessions with more than 100 speakers, focusing on Sui's development in gaming and DeFi. Attendees participated in panel discussions, social events, and hands-on workshops to gain insights into the future of the Sui network.

Sui Foundation Grant Recipients (March/April 2024): Ten projects received funding to accelerate the development of Sui, with eight projects focusing on enhancing the developer experience through better tools, such as new integrated development environments (IDEs) and zero-knowledge proof technologies. Notable awardees include Alphaday, Birdeye, Spark Payments, and SWAYE.

DeFi Incubator (May 2024): The Sui decentralized exchange Cetus and Aftermath Finance launched new incubators, with an initial donation of $2 million from the Sui Foundation to support early-stage projects. These incubators aim to foster innovation by providing resources, guidance, and financial support to emerging teams in the DeFi space.

SUI Academic Research Awards (June 2024): Nineteen proposals from universities such as the University of California, Berkeley, Yale University, New York University, and École Polytechnique Fédérale de Lausanne were accepted. These proposals focused on blockchain technology, smart contract programming, and Sui-based products. The Sui Foundation allocated an additional $1 million for further research funding, covering topics such as zero-knowledge proofs and consensus protocols.

Sui Overflow Hackathon (March to June 2024): The first global hackathon for Sui received over 350 project submissions from 79 countries, resulting in 32 winners. Top projects included Pandora Finance (Consumer), Hop Aggregator (DeFi), and AresRPG (Gaming).

Sui Foundation Grant Recipients (May/June/July 2024): Ten projects received funding covering areas such as advanced analytics, DeFi, and game development. Recipients included Belong.net, Gamifly, Goldsky, Var Meta's Unity SDK for Sui, and Verichains' Sui Move Decompiler here.

RFP Grant Recipients (July 2024): The first batch of funders for Sui's Request for Proposals (RFP) program has been announced. Selected projects include the minting infrastructure from Byzantion Inc., the loyalty platform from HashCase, and the consumer engagement platform from Arden Lab Inc.

Sui Builder House: Singapore (September 2024): This one-day event held in Singapore brought together over 600 participants from various communities and industries. It included significant announcements about the future of the Sui ecosystem, networking, and discussions.

Summary

In the past six months, Sui has launched several important upgrades and expanded its ecosystem. By introducing the Mysticeti consensus mechanism, Sui has reduced the network's consensus latency by 80%, achieving a latency performance of 390 milliseconds under a high load of 100,000 TPS. Meanwhile, Sui's cross-chain capabilities have also significantly improved, launching the Sui Bridge and integrating Circle's native USDC stablecoin, with plans to support Circle's CCTP functionality in the future. These technological advancements have contributed to the steady growth of Sui's DeFi ecosystem, with a total value locked (TVL) increasing by 42% to reach $1 billion, driven by the rise in SUI token prices and new features from DeFi protocols like NAVI, Scallop, and Cetus. On May 30, 2024, the number of active addresses on the Sui network reached a historical peak of 2.16 million, coinciding with a token unlock event on that day.

Institutional interest in Sui continues to grow. For example, Grayscale launched an investment trust product focused on Sui, while partnerships with companies like Copper and Zero Hash further solidify its position in the institutional market. In the second and third quarters of 2024, Sui-based projects collectively raised $16.3 million in funding, a 41.7% increase compared to the previous two quarters. Additionally, Sui continues to expand its technical capabilities and ecosystem scale through collaborations with Google Cloud and the launch of infrastructure projects like Walrus. In the future, Sui plans to collaborate with more protocols to fully integrate Circle's CCTP while continuously optimizing its network performance to provide stronger support for developers and users.

If you have any comments or suggestions regarding this report, please fill out the feedback form. All feedback is strictly governed by our privacy policy and terms of service.

This report is commissioned by the Sui Foundation, and the content is independently produced by the author, not representing the views of Messari, Inc. or the commissioning party. The commissioning agency does not influence editorial decisions or content. The author may hold cryptocurrencies specified in this report. This report is for informational purposes only. It is not intended as investment advice. You should conduct your own research and consult independent financial, tax, or legal advisors before making any investment decisions. Past performance of any asset does not guarantee future results. Please refer to our terms of service for more information.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。