Market Game Theory Intensifies: How Will the Future Unfold After High-Level Consolidation?

Written by: ChandlerZ, Foresight News

After reaching a high of $99,600 on November 26, Bitcoin fell over 8% on the 27th, briefly dropping to around $90,800. As of December 3, Bitcoin's price has rebounded to around $96,000, but the fluctuations have been relatively intense.

Bitcoin is just a step away from the $100,000 mark, indicating that the market is facing a critical technical breakthrough point. This historic price level is not only an important psychological barrier but could also become a turning point for further price increases.

However, it is evident that as we approach this price level, the internal divisions within the market are gradually widening. On one hand, institutional funds represented by MicroStrategy continue to increase their positions, supporting the buying demand for Bitcoin and driving the price up; on the other hand, long-term holders in the market choose to sell at high prices to realize profits. This game between large holders and institutions has led to significant resistance in the market's upward momentum, making it difficult for prices to break through this important threshold.

In simple terms, the ongoing buying by institutional funds and the selling behavior of long-term holders are in opposition, creating pressure and challenges for the market's upward movement.

Who is Selling

In this year-end rally, long-term investors have begun to sell off their Bitcoin reserves significantly, taking advantage of increased liquidity and demand.

Since September, the Bitcoin sold by long-term investors has peaked at approximately 507,000 BTC. Although this number is large, it is still lower compared to the 934,000 BTC sold during the significant price increase in March 2024.

Notably, the current selling pace of long-term investors has surpassed the historical peak in March 2024, with the Bitcoin they are realizing profits from accounting for 0.27% of their total holdings daily. This pace has only exceeded this level for 177 days in history, indicating that this group of investors is becoming more aggressive in their selling rhythm.

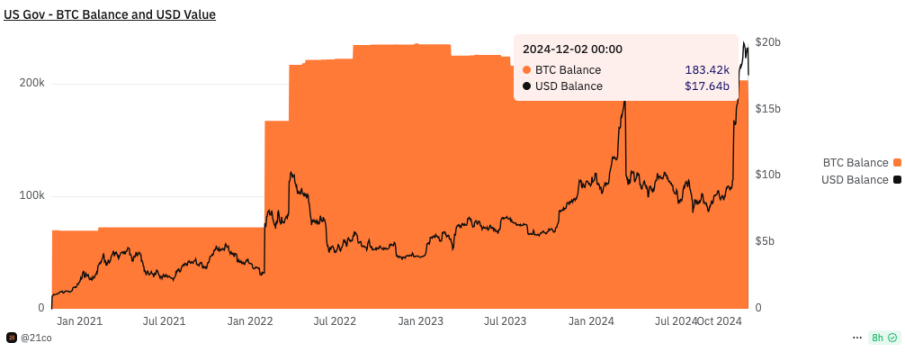

Additionally, the U.S. government is also simultaneously selling Bitcoin seized from Silk Road. According to Arkham data, in the early hours of December 3, an address marked as belonging to the U.S. government transferred 19,800 BTC to Coinbase Prime, valued at approximately $1.92 billion.

Previously, a federal court in Northern California ruled that the U.S. government could legally dispose of these seized Bitcoins. Battle Born Investments attempted to appeal for ownership of these Bitcoins, but the Supreme Court's ruling rendered their request void. Due to a lower court's order for the U.S. government to "dispose of the seized defendant's property according to the law," U.S. Marshals or other agencies may soon receive court instructions to sell this batch of Bitcoins that were stolen from Silk Road.

In October, the U.S. Supreme Court declined to hear the appeal regarding 69,370 Bitcoins related to Silk Road from Battle Born Investments and others, meaning these Bitcoins may soon be auctioned off.

Dune data shows that the U.S. government currently holds 183,422 Bitcoins, valued at approximately $17.64 billion, primarily sourced from the 2020 Silk Road and Bitfinex hacking cases.

Who is Buying

While long-term holders are beginning to distribute their Bitcoin reserves, the other end of the market is actively absorbing Bitcoin. Large institutional investors, especially companies like MicroStrategy and MARA, continue to show strong interest in Bitcoin, driving demand growth through capital injection and stabilizing the market's value support to some extent.

MicroStrategy purchased 15,400 Bitcoins for approximately $1.5 billion at an average price of $95,976 per Bitcoin between November 25 and December 1.

During the same period, MicroStrategy also sold 3,728,507 shares of its company stock, raising approximately $1.5 billion in funds. As of December 1, the company stated that it still has about $11.3 billion worth of stock available for sale from its planned $21 billion equity issuance and $21 billion fixed-income securities financing. This financing plan is expected to raise a total of $42 billion over the next three years, primarily for further Bitcoin purchases.

According to Saylortracker data, as of December 1, MicroStrategy holds a total of 402,100 Bitcoins, with a total value exceeding $38 billion.

This announcement marks MicroStrategy's fourth consecutive week of large-scale Bitcoin purchases. On November 11, MicroStrategy founder Michael Saylor stated that the company had purchased 27,200 BTC for approximately $2.03 billion, with an average cost of $74,463; on November 18, MicroStrategy announced that it had used proceeds from stock sales to purchase 51,780 Bitcoins for $4.6 billion between November 11 and 17, with an average purchase price of $88,627; on November 25, Michael Saylor again stated that MicroStrategy had purchased 55,500 Bitcoins at an average price of approximately $97,862, totaling about $5.4 billion.

Coincidentally, Bitcoin mining company MARA has also joined the ranks of Bitcoin strategic reserves. On December 2, MARA announced an increase in the total principal amount of its 0.00% convertible senior notes due in 2031 to $850 million (initially announced as $700 million).

MARA also granted initial purchasers of the notes the option to purchase up to $150 million in total principal amount of notes within 13 days from the date of the initial issuance. The net proceeds will be used to purchase more Bitcoin and for general corporate purposes, which may include working capital, strategic acquisitions, expansion of existing assets, and repayment of additional debts and other outstanding obligations.

According to the company's third-quarter financial report, as of October 31, MARA held 26,747 BTC on its balance sheet, produced 2,070 BTC in the third quarter, and purchased 6,210 BTC, of which 4,144 BTC were bought using proceeds from a $300 million convertible senior note issuance, at an average price of $59,500.

MicroStrategy has continuously increased its Bitcoin holdings through debt financing over the past few years, while MARA, as a major Bitcoin mining company, is also expanding its Bitcoin assets through ongoing mining activities and strategic purchases. It is these institutions' continuous buying that forms an important force in the Bitcoin market, offsetting some of the selling pressure from retail investors and injecting signals of long-term investment into the market.

In addition to MicroStrategy and MARA, U.S. listed companies such as SAIHEAT, Genius Group, Anixa Biosciences, AI company Genius Group, Israeli clinical-stage immunotherapy company Enlivex Therapeutics, and Chinese concept stock listed company SOS, among others, have also clearly indicated their intention to purchase Bitcoin as part of their corporate asset reserves. Especially in the current macroeconomic environment, low interest rates, rising inflation, and uncertainty in returns from traditional asset classes have prompted more institutions to include Bitcoin in their asset allocation to achieve diversification and asset preservation.

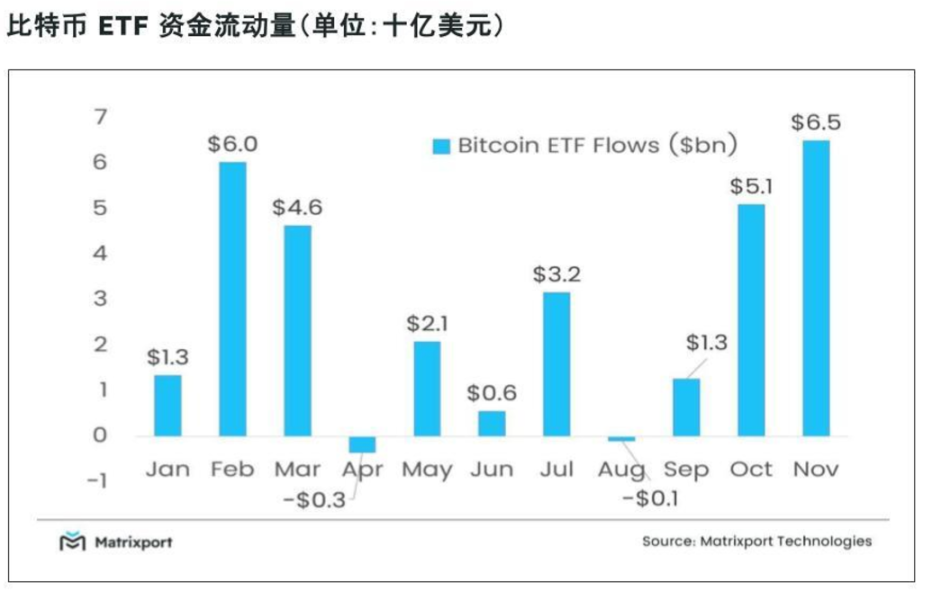

Furthermore, the monthly inflow of funds into Bitcoin spot ETFs has surged to $6.5 billion, setting a new historical high, far exceeding any previous month's record.

Against this backdrop, we can consider that the evolution of the Bitcoin market is at a critical turning point. First, the $100,000 price threshold may become a key node for Bitcoin to break through its current levels. With the continuous entry of institutions and steady growth in market demand, Bitcoin's price may attract broader market attention and participation as it approaches this important psychological price level, potentially pushing it into a new phase.

However, institutions often exhibit hesitation before such important thresholds, and this wait-and-see attitude may lead to a certain degree of volatility and adjustment in the market after a smooth trend, especially in the short term, where price volatility may intensify, putting pressure on the market.

Additionally, it is important to clarify that there are fundamental differences in the cost structure and investment objectives between institutions and long-term holders in the Bitcoin market. Long-term holders typically hold Bitcoin with a lower cost basis and a longer-term perspective, aiming for value growth in the future. In contrast, the entry of institutional investors, especially those announcing their Bitcoin positions at relatively high points, may face higher entry costs and a more complex market environment, including stock prices.

Looking back at the peaks of previous bull markets, we can see that many institutions entered the market at high prices, ultimately facing the risk of price corrections. Therefore, in the current market environment, while institutional participation brings new momentum to the Bitcoin market, investors should remain vigilant, carefully assess market risks, and avoid blindly chasing highs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。