The future trend is "Agents that can operate independently and collaborate with each other."

Author: Sleeping Crazy in the Rain

GM, the December outlook is here.

Dino coins are not my area of expertise, and it's hard to grasp these ancient coins. This outlook mainly wants to discuss some directions I am observing.

If you find this content useful, feel free to like and share 🫡

1/ AI Agent

After a series of hype around AI Memecoins, AI Agent applications, and infrastructure, it's time to focus on the long term.

Let me share my personal perceptions ⬇️

It's unlikely that new pure AI MEMEs will emerge; only $GOAT and $ACT, which have been listed on Binance, remain after the wave of elimination (I don't have much opinion on $TURBO). However, both $GOAT and $ACT are market-making by Wintermute, and I believe those on the ride are suffering, like me.

The market's aesthetic is improving: AI MEME → AI Agent applications → more sophisticated AI Agent applications & AI Agent infrastructure.

My thoughts on future developments ⬇️

- AI Agents with entirely new output forms will be more popular;

For example, the AI Agents currently popular in the market are mostly Twitter bots, where the competition is more about "content novelty," such as market analysis from $AIXBT. As long as you produce differentiated high-quality output, the market will pay for it.

Differentiated high-quality output encompasses two levels: one is new content forms, where the key is "traffic," meaning the ability to attract a sufficient audience. Currently, it's text content, but we can see new AI Agents exploring and trying video content and podcast content (including $ZEREBRO and $LUNA releasing music singles, as well as $POD working on podcast-related matters); the second is new behavioral patterns, such as launching an Agent that can trade memecoins independently. In the future, we should see more exploration of new behavioral patterns (this is also why I was optimistic about $FLOWER and $LOLA). If new behavioral patterns yield good results, the market will pay for it.

- The market will increasingly show demand for AI-related infrastructure;

This is easy to understand, so I won't elaborate further. Building tall buildings from the ground up relies on a solid foundation. $VIRTUAL, $AI16Z, and $VVWIFU are representatives of this type of token. In addition to these basic issuance facilities, we should also pay attention to the infrastructure that integrates these facilities, such as Seraph on Virtuals.

- The future trend is "Agents that can operate independently and collaborate with each other";

We can already see this trend, such as what $UBC is currently doing (Agent to Agent). In the future, AI Agents on Virtuals may also develop in this direction. $LUM is the beginning of this type of conceptual token; it is a cultural meme without practicality (although there are already teams starting to do some things based on $LUM, I still haven't fully grasped their ideas).

P.S. Currently, my $LUM is in a loss state; mentioning it does not constitute financial advice.

2/ Ethereum

I personally believe Ethereum will experience a wave of main upward momentum (referring to the EB exchange rate), but I'm not sure when this main upward momentum will appear. I still hold the view from November ⬇️

BTC ETF will have a spillover effect;

Large institutions like BlackRock are working on RWA on Ethereum, which means the underlying value of Ethereum cannot be ignored;

The rise of the Base AI Agent ecosystem;

From the price performance, tokens like $ONDO, $LINK, $UNI, and $ENS have started to become strong. This means the market has begun to focus on Ethereum-related Beta targets. This is a bullish signal.

As for the choices of Ethereum Beta, there are three directions: 1. ETH staking-related ($LDO, $EIGEN LRT); 2. DeFi & RWA ($AAVE, $UNI, $COW, $MKR, $ONDO, $LINK); 3. Meme ($MOG, $PEPE, $SHRUB). I personally prefer DeFi-related ones and hold $PNP and $EGP to indirectly hold $PENDLE and $EIGEN.

3/ Public Chain War

In the previous article about Stacks, I mentioned that the public chain war is about to begin again— in December you can see: 1) The Fantom Sonic mainnet is about to launch; 2) The Avalanche9000 mainnet will launch on December 16; 3) Aptos data growth + institutional adoption + ETP; 4) Stacks introducing sBTC after the Satoshi upgrade to gain more adoption, etc.

Most of the surviving old public chains are starting to take advantage of the good market to stir things up. We should see a new round of Layer 1 battles in December and Q1 of next year. Don't forget that this public chain war has a brand new participant: HyperLiquid. From my perspective, the $HYPE vehicle is not as heavy as we imagine, and there are fewer participants/holders from the Chinese community (especially compared to $ACT and $PNUT). In the future, $HYPE still has expectations for listing.

I think the ones mentioned above are all quite good; their common point is "willing to release expectations to drive prices" (my favorite among old public chains is Fantom). I will write another article to introduce the updates of Fantom and Avalanche.

In addition to Layer 1, I will pay attention to $METIS and Base in the Ethereum Layer 2. You can keep an eye on this project @ScoreMilk on Metis; it is the reason I am interested in Metis.

Lastly, a word about Base: Base has a very unique tone, and when participating, try not to focus on whether its concept is good or not, but rather whether it meets the needs of the Coinbase Cabal. Otherwise, even if the concept is good, it is likely to be a one-time flow.

4/ Chain Abstraction

Just a brief mention of chain abstraction.

Chain abstraction/intention abstraction is a concept I am quite optimistic about, as it can lower the entry barriers to blockchain and the complexity on-chain.

In this track, I only look at products, not token prices— as long as the product is useful, the price fluctuations of the token are not that important. Moreover, I believe chain abstraction/intention abstraction still needs time to improve and develop.

Friends who like this track can pay attention to the project @ParticleNtwrk. Particle is a modular & chain abstraction Layer 1 (which I have introduced before), and its core function is to "provide users with a single address and interaction front end across chains through a universal account." You can also take a look at the chain abstraction framework of @NEARProtocol.

https://x.com/stacy_muur/status/1859920525142941722

5/ What else is worth mentioning in December?

This week $IO will announce something (remember the AI trio I was optimistic about? $IO $GRASS $TAO);

12.10 $ME TGE (we can see some signs of NFT recovery, which I personally think may be related to Opensea);

Coinbase will delist $WBTC;

Pay attention to the AI infrastructure on Solana, $SHDW $SNS;

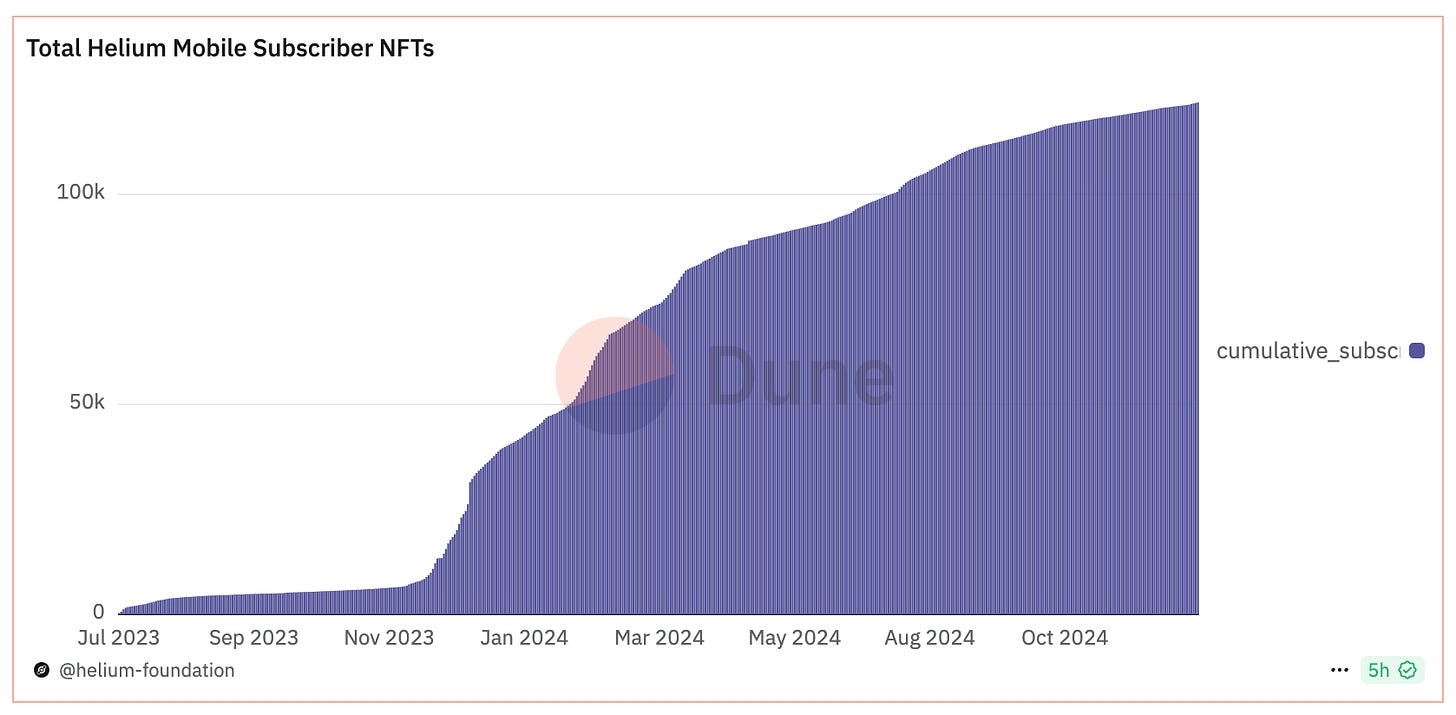

$HNT is a project I am very optimistic about; I believe $HNT will perform well in this round (just look at the Mobile data, although few people mention it, Mobile users have actually maintained a good growth rate) ⬇️

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。