Almost certainly not, because MicroStrategy has a sufficiently thick safety cushion.

Written by: Ethean

Many people are discussing whether $MSTR is the $BTC version of Luna. From both the perspective of value anchoring and the design of accelerated mechanisms, the two have essential differences, but the idea of quickly starting with one foot on the left and the other on the right is consistent. Borrowing from the idea of $MSTR, the crypto world might be able to create a never-ending $BTC version of LUNA.

- LUNA has no value anchoring, while MicroStrategy has BTC reserves and business income as value support.

- LUNA's dual-token algorithm model accelerates the death spiral, while MicroStrategy's ATM and convertible bonds provide sufficient safety cushion.

- Borrowing from the idea of $MSTR, injecting real returns, DeFi might be able to create a never-ending $BTC version of LUNA.

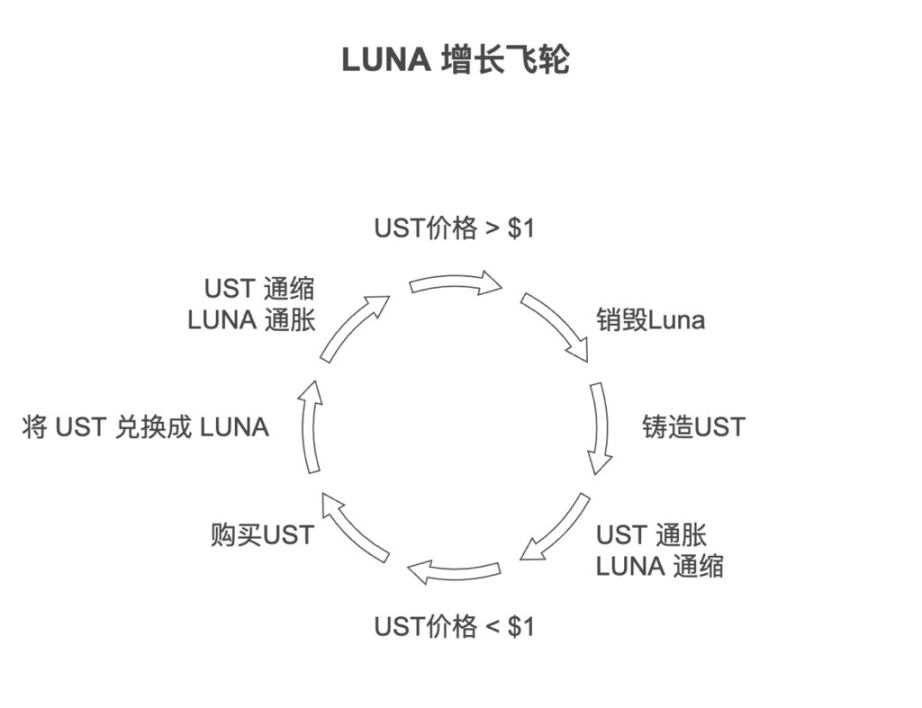

LUNA - Dual-Token Algorithm Model

Terra has created a dual-token algorithm stablecoin model, using LUNA to absorb the volatility of UST and maintaining balance through arbitrage. The price logic of LUNA is:

Increasing application scenarios and demand for UST → UST price rises → Arbitrage behavior causes UST inflation, LUNA deflation → LUNA price rises.

The lending protocol Anchor is an application scenario created by Terra to absorb UST, providing UST depositors with an average annual yield of 20%. However, the logic that allows Anchor to operate sustainably is attracting deposits with low interest rates and then lending out at high interest rates.

Therefore, the value logic behind LUNA requires the market to maintain high demand for UST to create revenue sources for the Anchor protocol, thus feeding back into the LUNA ecosystem. Once the popularity of UST fails to meet expectations, a consensus collapse will trigger a death spiral.

Will this situation replay in $MSTR?

The answer is almost certainly not, because $MSTR has a sufficiently thick safety cushion.

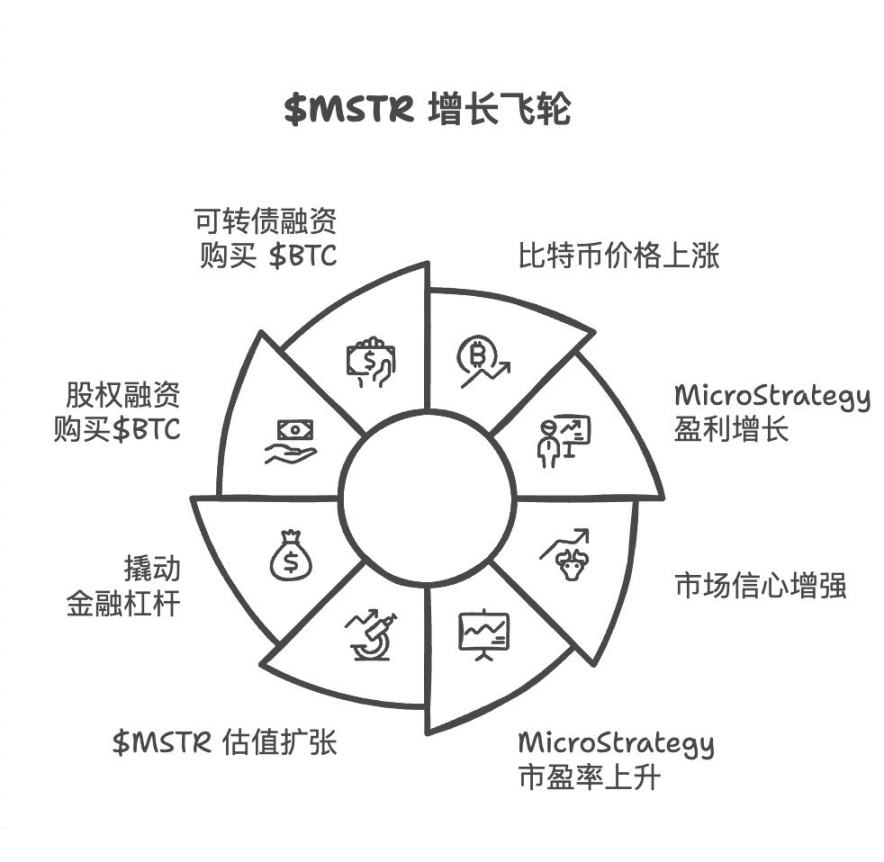

The growth flywheel of $MSTR can be divided into two parts: the Davis double-click and financial leverage.

1. "Davis Double-Click = Linear (Profit Increase) + Exponential (P/E Rise)"

$BTC price rises → MicroStrategy profit growth → Market confidence in the company's future prospects increases → Price-to-earnings ratio (P/E) rises → $MSTR valuation expands exponentially.

---> The positive premium brought by $MSTR's valuation expansion supports it to continue leveraging financial leverage.

2. "Financial Leverage = ATM + Convertible Bonds"

MicroStrategy raises incremental funds through equity financing (ATM) and convertible bond financing, using the incremental funds to purchase BTC, further increasing equity per share.

---> The increase in equity per share supports the strengthening of the Davis double-click.

$MSTR has BTC as a value anchor, and with the consensus around BTC becoming stronger, the likelihood of falling into a death spiral is very low. Additionally, MicroStrategy's ATM and convertible bond designs have already left themselves with a significant exit strategy.

I have detailed the growth flywheel logic of $MSTR in this post.

MicroStrategy's current debt and business levels are also sufficiently healthy, as referenced in @lianyanshe's analysis.

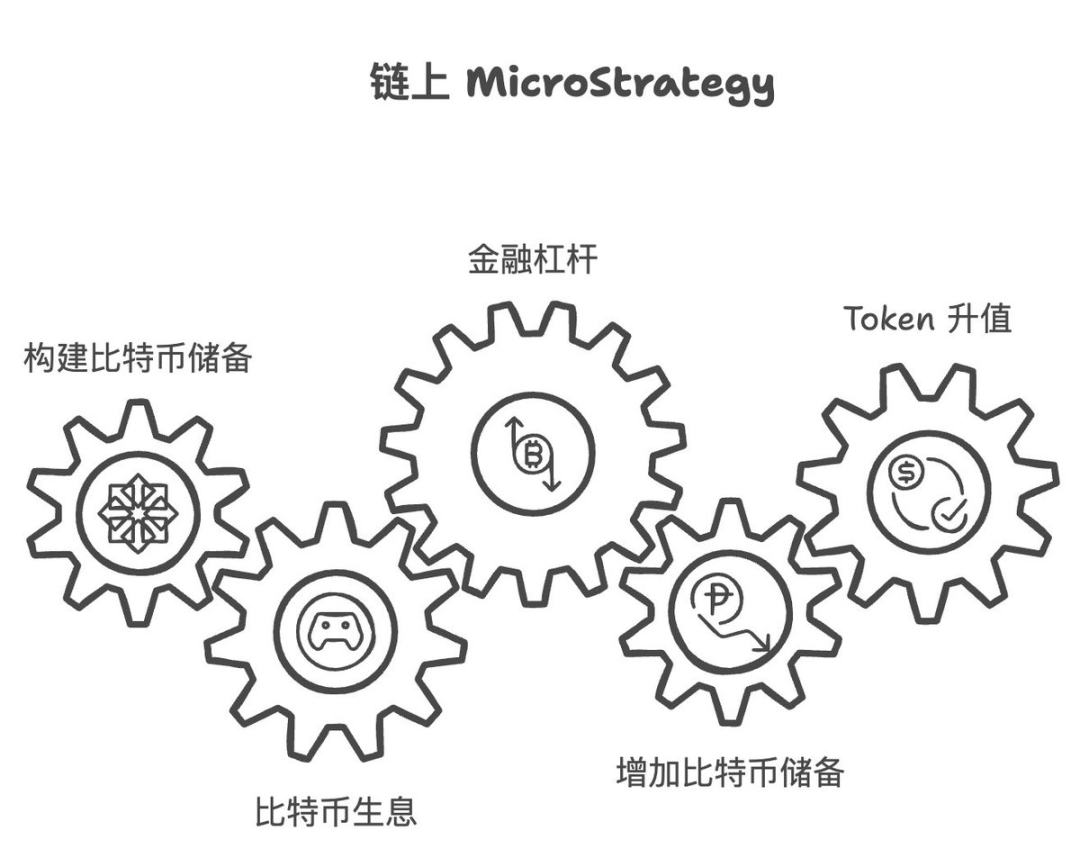

How the crypto world can replicate $MSTR's growth flywheel to create a never-ending $BTC version of LUNA

First, DeFi already has the capability to issue on-chain stocks and convertible bonds.

Second, the advantages of on-chain MicroStrategy include:

The raised Bitcoin reserves can participate in DeFi for yield-generating activities, increasing business income and enhancing protocol safety cushions.

$MSTR's trading restrictions in the U.S. stock market create a high entry barrier. Ni Da proposed an interesting #BTCFi framework that can solve the entry barrier issue and increase BTC liquidity.

Blockchain technology can ensure the transparency and traceability of Bitcoin reserves, eliminating black box risks.

In 2024, the crypto world is still haunted by LUNA. In fact, if a solid value anchor is found, combined with the economic model of a growth flywheel, it might be possible to achieve an on-chain MicroStrategy, quickly activating the liquidity potential of Bitcoin and providing new momentum for the expansion and financialization of the entire blockchain ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。