Original | Odaily Planet Daily (@OdailyChina)

At the end of November, after a month of anticipation, the airdrop of Hyperliquid's native token HYPE finally concluded. At the opening, the price of HYPE tokens was around $3, and within just a few days, it surged over 300% to nearly $10, attracting significant market attention, with some exclaiming in disbelief: “If I had known, I would have claimed more!”

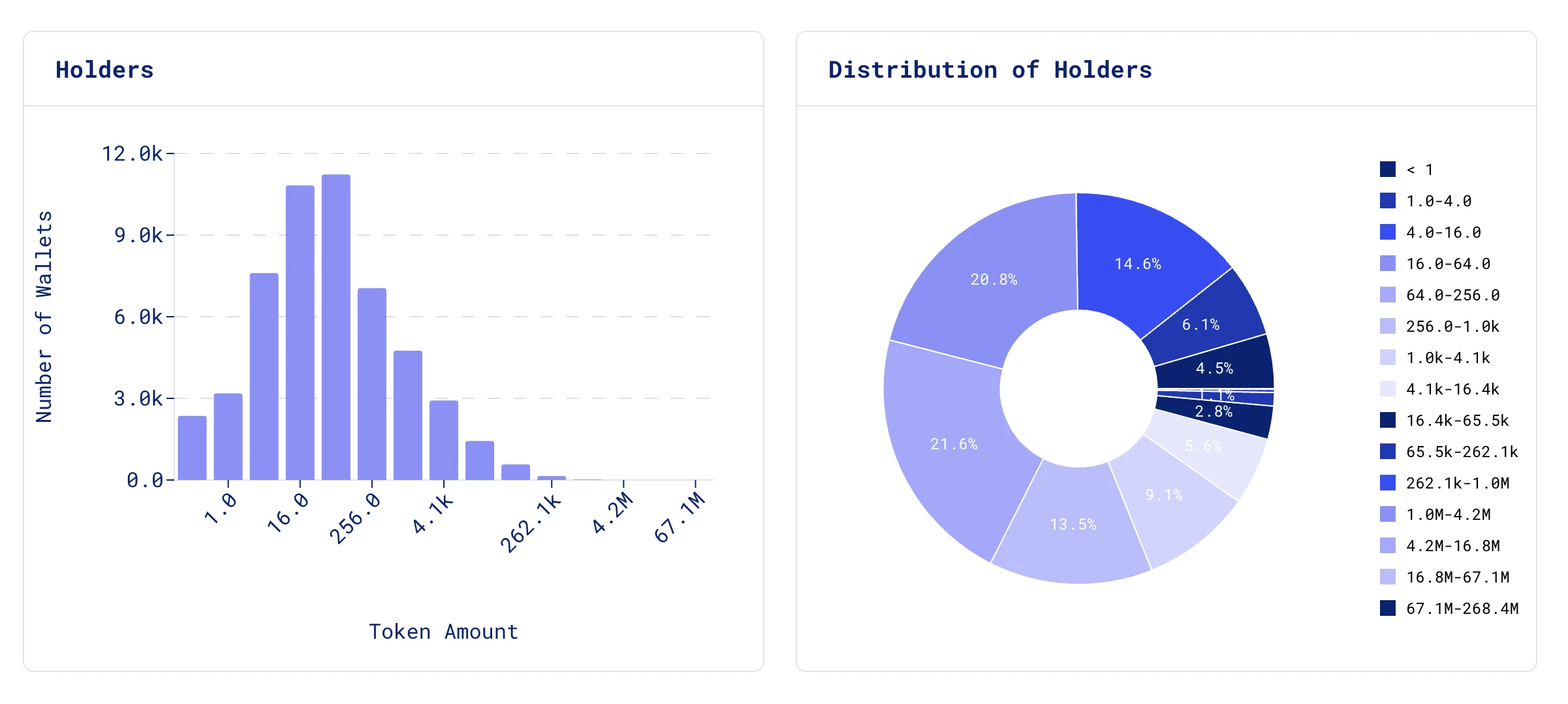

According to ASXN data, Hyperliquid airdropped a total of 274 million HYPE tokens, with 94,028 wallet addresses participating; the average airdrop amount per address was 2,915.66 HYPE, with a median of 64.53 HYPE. Based on the historical peak price of nearly $10, the average return per address from the airdrop is close to $30,000, making it the "most generous airdrop of the year."

Odaily Planet Daily will discuss the airdrop model of Hyperliquid, industry perspectives, and updates on the current token issuance model in this article for readers' reference.

An Unconventional Genesis Airdrop: Hyperliquid Splurges 310 Million HYPE Tokens

As early as October 14, Hyperliquid officially announced the establishment of the Hyper Foundation—an organization aimed at supporting the development of the Hyperliquid blockchain and ecosystem, and planning to launch the HYPE token TGE.

At that time, the official statement indicated that "the native token HYPE is crucial for the further development of HyperBFT proof-of-stake consensus, HyperEVM, and the roadmap. As part of the genesis distribution, eligible users can choose to receive HYPE and optional Hypurr NFTs."

As November approached, Hyperliquid's official team began intensive preparations for the genesis airdrop:

On November 27, Hyperliquid took strong measures against "witch" activities on the eve of the airdrop—officially stating that approximately 100 entities held over 27,000 addresses, attempting to gain disproportionate points through large-scale and systematic actions. In response, the points of these addresses would be multiplied by 2% or 20%, depending on the scale of the witch activity. Affected addresses would be marked as "witch activity detected" on the points page. Additionally, Hyperliquid allocated 8 million points for activities in May, and 8.4 million points for activities in early October and November, bringing the total points to 57.9 million.

Subsequently, the Hyper Foundation issued a notice, reminding users who recently started using Hyperliquid L1 and those who missed out earlier to review and accept the terms and conditions of the Genesis Event by 23:59 UTC on November 28.

On November 28, the Hyper Foundation officially announced that the genesis event for Hyperliquid's native token HYPE would go live at 15:30 Beijing time on November 29, with the following details:

The maximum supply of HYPE is 1 billion tokens, distributed as follows:

38.888% for future emissions and community rewards;

31.0% allocated for the genesis distribution;

23.8% allocated to current and future core contributors;

6.0% for the super foundation budget; 0.3% for community grants; 0.012% allocated to HIP-2.

Tokens will be issued over time, with 76.2% allocated to the community. Qualified participants in the genesis event will receive 310 million tokens, which will be fully unlocked. Unallocated tokens will be transferred to future emissions and community rewards. 60 million HYPE will be allocated to the Hyper Foundation budget, 300 HYPE for grants, and 120,000 HYPE for Hyperliquidity (HIP-2). 388,880,000 unminted HYPE will be reserved for future emissions and community rewards. Core contributor tokens will be locked for 1 year post-genesis. Most vesting schedules will be completed between 2027-2028; some will continue beyond 2028. The genesis distribution strictly excludes core contributors. No allocations were made for private investors, centralized exchanges, or market makers.

When the news broke, there were many voices of skepticism in the market, especially regarding the last sentence's rules, prompting exclamations: “Hyperliquid actually has no intention of actively courting CEXs, nor any allocations for private placements or market makers?”

However, in hindsight, the 310 million token genesis airdrop has seen over 274 million claimed, and the 24-hour trading volume on Hyperliquid reached $270 million, achieving the effect of driving up the HYPE token price with limited chips, demonstrating the wisdom of this decision.

Of course, the average airdrop amount does not mean that all users left "satisfied"; this HYPE token airdrop still represents a "victory for the big players."

According to ASXN data, only 18.9% of airdrop wallet addresses received more than 1,000 tokens (valued at around $10,000 at peak), with the breakdown as follows:

4,700 wallets received 1,000-4,100 HYPE tokens, accounting for 9.1%;

2,900 wallets received 4,100-16,400 HYPE tokens, accounting for 5.6%;

1,400 wallets received 16,400-65,500 HYPE tokens, accounting for 2.8%;

570 wallets received 65,500-262,000 HYPE tokens, accounting for 1.1%;

147 wallets received 262,000-1 million HYPE tokens, accounting for only 0.3%.

In other words, the HYPE token airdrop still aligns with the "80/20 rule," where approximately 20% of addresses received nearly 80% of the total airdrop.

Wallet address analysis chart

Nevertheless, Hyperliquid has managed to balance the interests of community users with the distribution of token airdrops, earning high praise from the community.

Moreover, industry insiders have also given positive feedback on Hyperliquid and this genesis token airdrop event, a sentiment that had been emerging months prior.

The "Wealth Creation Code" with Early Signs of Industry Praise

In August, Su Zhu had written, “The theory of 'fat applications' has become a reality,” stating that both Pumpfun and Hyperliquid adopted a business model involving high efficiency and low-risk investment (VC) participation, dominating the on-chain value on Solana and Arbitrum as a single application.

At that time, he predicted that more similar applications would emerge, heralding a new wave of cryptocurrency adoption.

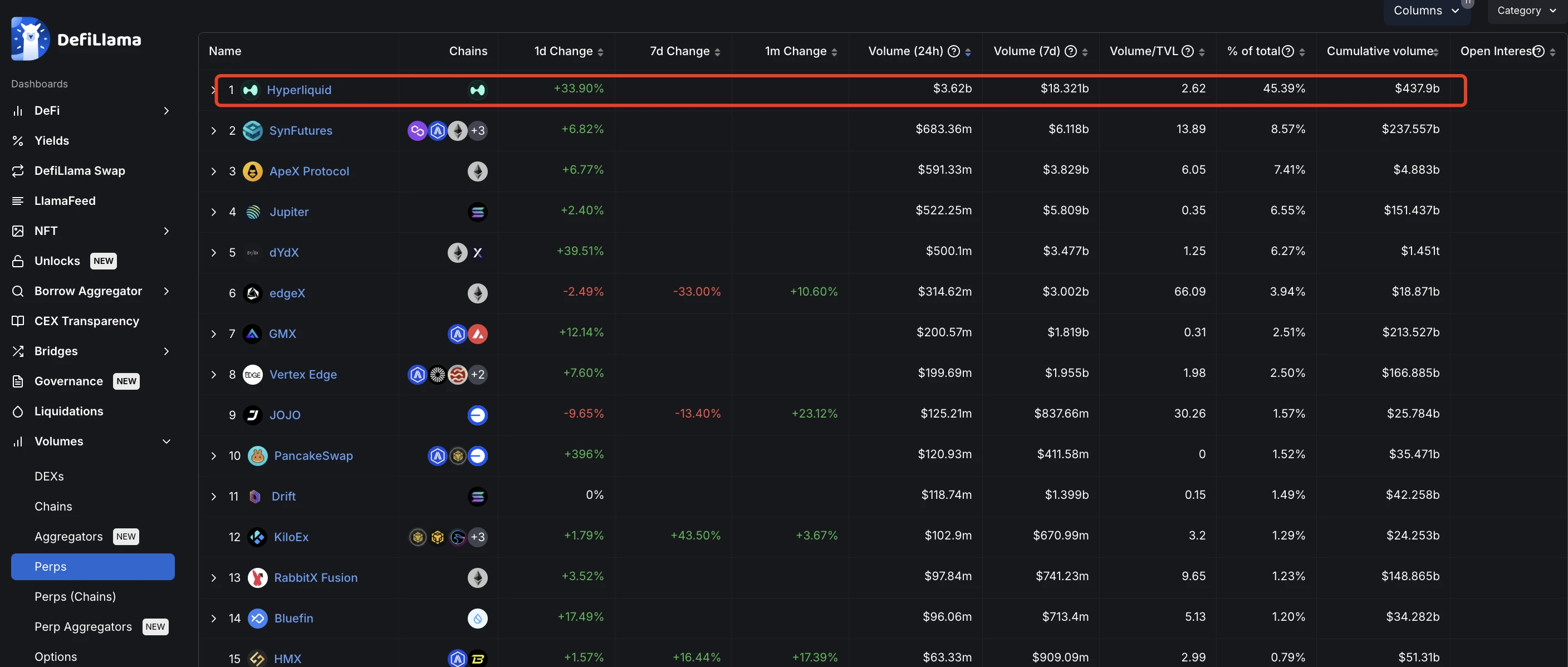

In October, the crypto data analysis platform Kaito AI published an analysis stating, “The emergence of Hyperliquid is worth studying; over the past 3 months, its market share in derivatives trading has been 31%.” According to the chart, the second place was dydx with a market share of 16.76%, and the third was GMX with a market share of 11.16%.

Being able to capture nearly one-third of the market share in the highly competitive derivatives trading sector showcases Hyperliquid's product dominance and project operational capabilities.

This information was also echoed by several community users:

Core community contributor Chabusi stated: “Hyperliquid has proven with facts that the amount of airdrop shares has nothing to do with which exchange you go to. When you unite with a community that won't betray you, the community will also give you the greatest trust.”

Community user Junzhu also expressed affirmation of Hyperliquid's focus on community: “Hyperliquid is a very community-driven project. Such projects will definitely reach the peak!”

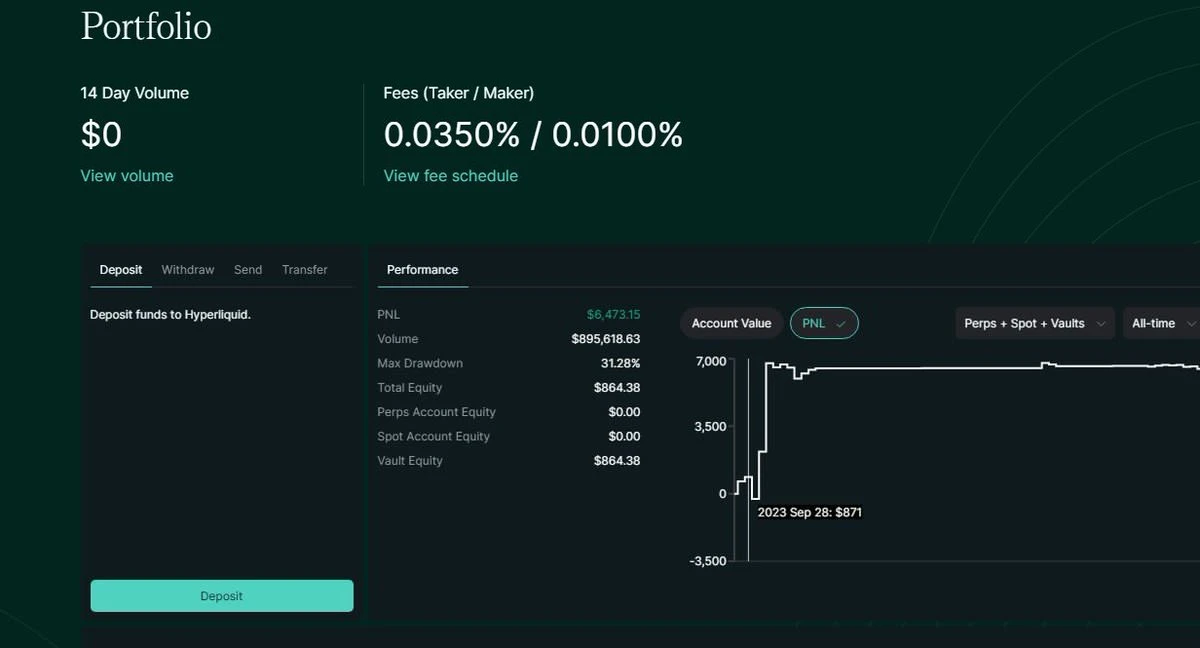

Community user "Big Gambler" posted: “Spent only about 270 USDT, gained over 6,000 USDT in contract trading profits; airdrop points close to 200,000 USDT (plus holding HYPE tokens) and one limited NFT.” This can be considered a model of "winning big."

Community user "Big Gambler" shares profit screenshot

Moreover, Hyperliquid's outstanding performance during the airdrop event has also attracted attention and recognition from Jesse Pollak, the head of the Base protocol.

Previously, he posted: “Hyperliquid shows that it’s a good thing to build a product that people love before injecting price complexity. We see the same thing on Base—starting without a token allows us to focus on solving real problems, which means we have to work hard for it every day. It’s important to clarify: Hyperliquid is not the only data point in this regard. In fact, the entire history of startups demonstrates this. Undoubtedly, the most important thing is to build a world-class product that people love. That’s it.”

Hyperliquid co-founder Jeff Yan also provided an official explanation regarding the project’s airdrop activity, stating that: “It’s encouraging to see tens of thousands of community members gain life-changing wealth during the Hyperliquid genesis event. Importantly, none of these people are insiders; Hyperliquid is a tribute to the original spirit of Bitcoin, where ownership belongs to the believers and doers, not to rent-seeking insiders.”

Additionally, he added: “Finance is humanity's greatest invention and the only effective way to coordinate human efforts across time and space. However, the traditional financial system contradicts its fundamental goal of empowering individuals, such as: being opaque and centralized; owned and operated by privileged insiders; failing to embrace technological innovation to better serve users. Hyperliquid is the evolution of finance, but Hyperliquid will only be successful when it encompasses all areas of finance.” This move also reveals Hyperliquid's ambition for further transformation and innovation in the financial sector.

In contrast, there is an ongoing discussion about the updates to Hyperliquid's token airdrop model.

From CEX Listings to DEX Listings: The Underlying Trends Behind the Meme Coin Cycle

According to Coingecko data, the current price of HYPE tokens is stable at around $8.5, with a circulating supply of approximately 333 million tokens; the market cap is about $2.88 billion; the FDV is approximately $8.589 billion. Previously, at its peak price, its FDV was close to $10 billion. The reason this project, which “did not provide any allocations for private investors, centralized exchanges, or market makers,” has reached this point is primarily due to the following factors—

1. Times Have Changed—Market Environment Provides Opportunities for DEX Listings

Looking back, the main advantages of CEX listings were their ample liquidity and large user base, making them the preferred choice for many projects. Countless projects aimed for “To Exchange” or even “To Binance” as their core goal from inception, hoping that listing on a CEX would complete the final step of token launch and secure the broadest exit liquidity.

However, as we enter 2024, the market environment has quietly changed—

First, with the approval of Bitcoin and Ethereum ETFs, the number of “newbie traders” entering the crypto industry through altcoin channels has sharply decreased. For ordinary investors, investing in BTC and ETH through ETF funds has become a lower-threshold and more convenient investment option, leading to a reduction in overall industry liquidity.

Second, with the meme coin craze that began in March, more and more crypto players have flocked to the on-chain world, making DEX listings the preferred choice for many crypto projects, including meme coin projects. On-chain liquidity has also been steadily increasing, sufficiently supporting the development of token projects after DEX listings.

Third, the previously popular “high FDV, low circulating supply” VC tokens have cooled in this cycle. The bull market clustering around listings was originally a “wishful thinking” for such projects, but after liquidity was divided among ETFs and on-chain projects, it has become difficult to sustain more VC investment projects that continue to “suck” liquidity from CEXs. “To CEX-style entrepreneurship” has gradually become a choice with very low ROI.

In summary, Hyperliquid's development and airdrop first capitalized on the favorable factor of “timing.”

2. The Product Has Changed—Hyperliquid's Strong Product Power Support

At the same time, Hyperliquid's strong product capabilities have also provided robust support for liquidity entry and subsequent increases in token prices.

According to Hyperliquid community core contributor Chabusi introduction, “In simple terms, users can collateralize their positions when opening contracts on Hyperliquid, and lending platforms can hedge risks through contracts.” Meanwhile, “HyperEVM can tokenize HLP/Vaults/Perp positions for broader DeFi applications, allowing for collateralization while improving capital efficiency.”

In addition, crypto KOL Godot previously provided a detailed introduction to Hyperliquid during the airdrop distribution, emphasizing its advantage of “providing a CEX-like experience on DEX” and explaining its trading volume data. According to DefiLlama data, Hyperliquid's total trading volume has reached $437.9 billion, which is considered a “phenomenal performance” for a trading platform that has been online for only about a year.

Hyperliquid has seized market demand and entered the trading market through on-chain order books, effectively occupying a “geographical advantage.”

DefiLlama data

3. Community Building—Hyperliquid Says NO to VCs

In terms of “human factors,” Hyperliquid has also made significant efforts: this is not only reflected in the fact that the token share distribution did not reserve portions for private placements, CEXs, or market makers, but also in its community building efforts. The fact that Hyperliquid has repeatedly postponed the airdrop registration time indicates that the project values the community users' experience and has generally followed up and explained community user feedback in a timely manner. This can also be seen from the past industry viewpoints of project co-founder Jeff Yan.

Conclusion: Hyperliquid Opens New Developments in DeFi 2.0

In May of this year, when Hyperliquid announced that “Hyperliquid L1 will support native EVM,” it was already targeting the development of DeFi 2.0. Now that the HYPE token genesis airdrop has concluded, what awaits further exploration includes not only the launch of various spot trading options but also the optimization and resolution of issues related to unsustainable liquidity incentives and excessive collateralization that plagued DeFi 1.0.

Although its development time is still short, in the long run, Hyperliquid is moving towards its vision of becoming the “on-chain Binance.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。