This is the 18th article of Whistle, about PayTech.

Author | Beichen

The discussion around PayTech is increasing, with crypto industry giants like Solana, Binance, and Coinbase focusing on Web3 payments, while traditional finance players like Visa, Sequoia Capital, and Temasek are also frequently investing in crypto payments. This evokes a familiar feeling reminiscent of the DePIN phenomenon that occurred in early 2023—both new and old world influential capital are making strategic moves, and the narrative revolves around attracting resources from the real world. In regions like Southeast Asia and South America, USDT has even become a better choice than local fiat currencies.

Various pieces of information from different levels and channels point in the same direction: Web3 payments (PayFi / crypto payments) are gaining momentum. After all, if we compare the global payment market to a dream wedding cake, even a small crumb falling can create a billion-dollar giant, and this gold rush has only just begun.

However, since the concept of Web3 payments encompasses too many unrelated matters, it is necessary to clarify whether we are discussing FinTech (financial technology) centered around stablecoins like USDT that evolved from the traditional financial system, or payment systems based on distributed ledger technology (DLT) that evolved from Bitcoin.

Web3 payments realized through financial technology simply add stablecoins like USDT on top of the existing fiat currency, still relying on the traditional layered clearing and settlement system. The only value of such products lies in stablecoins like USDT acting as shadow dollars; otherwise, they are no different from supporting Q coins or joy beans.

Web3 payments based on distributed ledger technology have made transfers very convenient, but high-frequency payments have not yet been realized. This type of Web3 payment is actually the culmination of economic theories that have been brewing for hundreds of years and have been validated in the crypto experimental field over the past decade. Moving in this direction, you will discover a magnificent journey that is just beginning to set sail at dawn!

1. Web3 Payments Under the Traditional FinTech System

Most so-called Web3 payment products actually refer to stablecoins like USDT, and at the product level, they are still no different from other Web2 payments, developed based on some API of the traditional payment system, just supporting currencies like USDT. Moreover, since they are additionally linked to alternative currencies, the channel costs are actually higher than fiat currencies.

Let’s step out of the complex jargon of technology and finance to clarify the true nature of the traditional FinTech payment system, making it clearer how genuine Web3 payments are.

1.1. The Evolution of Traditional Payment Systems and PayTech

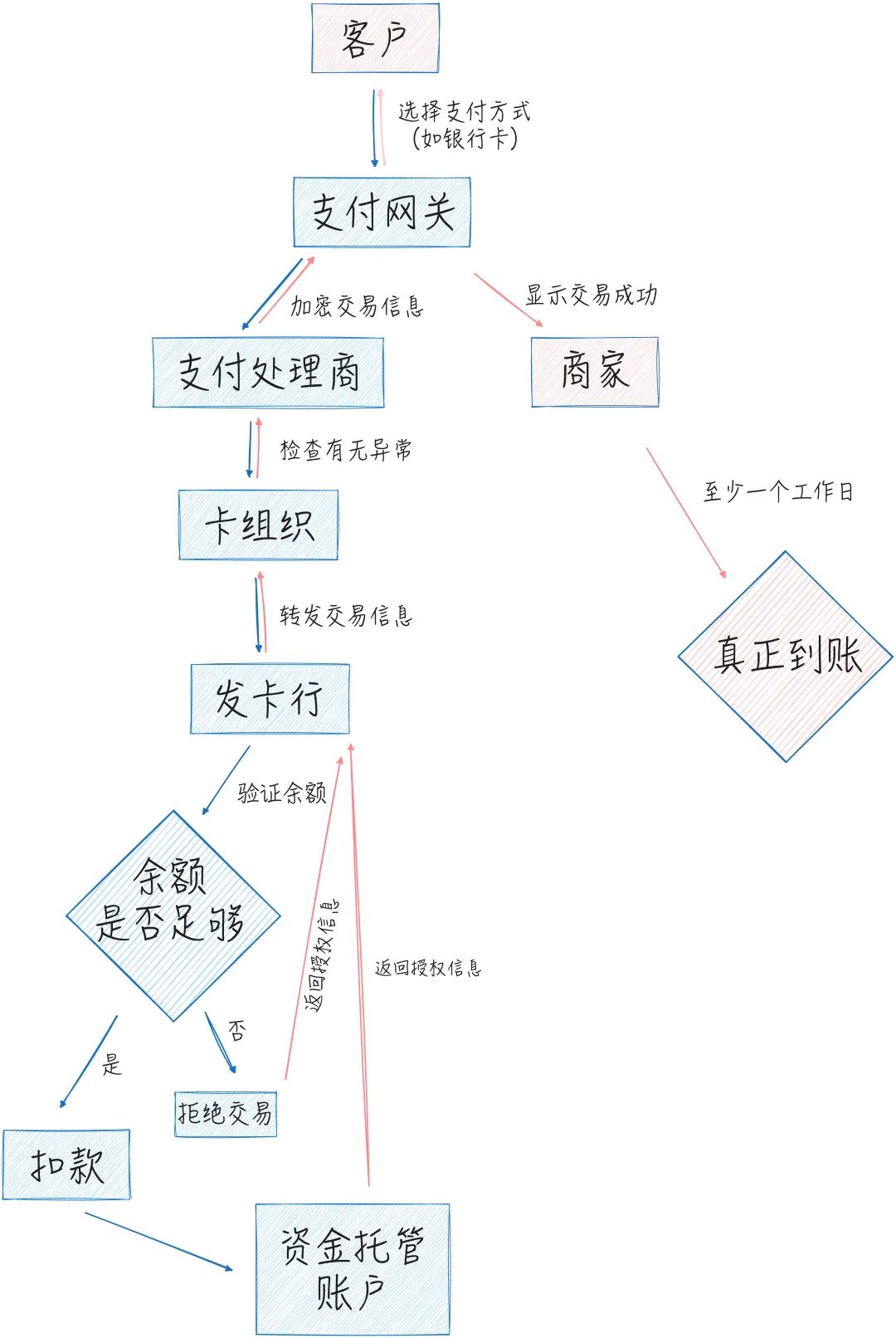

Taking everyday payment scenarios as an example, let’s analyze the traditional payment processing flow. When we check out at a convenience store, we simply scan our phone and confirm the payment, but this less than one-second action involves six or seven parties going through dozens of procedures to complete.

First, the customer chooses a payment method (such as credit card, debit card, or digital wallet like Alipay). After confirmation, the payment gateway encrypts the transaction information and passes it to the payment processor. Once checked for anomalies, it is released and sent to the card organization (like Visa or Mastercard), which then forwards it to the issuing bank of the card to verify sufficient funds. The funds are deducted from the customer’s account (but note that this is not a direct transfer; it is held in escrow first), and then the information is returned along the original path, sequentially through the card organization, payment processor, and payment gateway to the merchant, who then displays a successful payment. However, the actual funds may not arrive for at least one business day, and the clearing and settlement process is quite complex, which will not be elaborated here.

The modern financial system has established such a complex processing flow gradually since the era of postal carriages. FinTech companies have not changed this system; rather, they have entered at a certain point in the process to accelerate information processing, which is the entirety of FinTech's value. After all, with the accumulation of countless transactions, each step represents a massive amount of wealth.

Although banks began electronic operations in the 1970s, the FinTech approach has always been to move business online for faster processing. The internal structure and processes of banks have not changed; at most, they have pushed for centralized construction to compete with third-party payment companies.

Card organizations, as cross-bank clearing networks, have core businesses that resolve issuance, settlement, and reconciliation of cross-bank transactions, and they also began electronic operations in the 1970s, but the business logic remains unchanged from the paper billing era; FinTech has merely accelerated processing speed.

However, card organizations like Visa have launched payment terminals—POS machines—on this basis, quickly dominating the mainstream payment market in retail, and the entire payment ecosystem has since revolved around payment terminals. This has led to the emergence of hardware manufacturers like VeriFone and the differentiation of roles for payment service providers (PSPs), abstracting the tasks of PSPs into payment processors and payment gateways.

If card organizations enable merchants to receive transfers from more banks by forming a banking network, then PSPs further allow merchants to accept transfers from more card organizations and other payment channels (like the later PayPal). As for payment processors and payment gateways, they are responsible for transmitting and checking information at different stages.

The FinTech in the above processes is all about accelerating information processing efficiency; the entire process remains complex and lengthy, and of course, the costs are high. For instance, the seemingly inconspicuous payment processor is expected to exceed $190 billion in market size by 2030.

The truly revolutionary FinTech is PayPal, launched in 1998, where users register accounts/digital wallets with their email addresses, and after recharging, they can transfer funds internally without going through the traditional financial system, incurring fees only when withdrawing to a bank. Although PayPal's processing method is no different from joy beans in gaming companies, this simple and crude approach has forcibly torn a hole in the traditional financial system, compelling traditional finance to awkwardly step into the era of internet payments, at the cost of constant lawsuits and suppression faced by FinTech companies like PayPal.

Despite the rapid commercial growth in the payment field after PayPal, such as the rise of Alipay, which gradually built a financial service platform that could completely replace banks and even established a credit system that surpassed the banking system, the progress in FinTech has only been micro-innovations like QR codes, with no revolutionary mechanisms.

1.2. Web3 Payments Based on Financial Technology

Now, whether from cryptocurrency giants or traditional payment companies, all Web3 payment projects are built on the foundation of traditional payment systems, but they can still be further distinguished.

1.2.1. Traditional Payment Companies: Treating USDT as Joy Beans

Traditional payment companies are actively entering Web3, and while there is consideration for acquiring new users, it is largely a defensive strategy, fearing to miss out on the cryptocurrency trend. Just like candidates in the U.S. elections competing to express support for cryptocurrencies, they are merely expending minimal effort to capture resources in non-core strategic territories.

In fact, traditional payment companies have not changed the traditional financial system in the past, and entering Web3 will not change it either; they are simply leveraging their existing market share advantage to add cryptocurrency as an asset class among the many services they provide, with the technical difficulty equivalent to adding joy beans.

From banks (like ZA Bank) to card organizations (like Visa) to payment service providers (like PayPal), they claim to embrace crypto and indeed conduct considerable research, but what they say is not important; what matters is what they are actually doing. All their business can be summarized as enabling consumers to use bank cards to purchase cryptocurrencies and conduct transfers and payments, essentially serving as a "conversion channel between fiat and cryptocurrencies" to earn exchange fees, which is entirely an OTC market. As for "seamless experiences for end consumers," such technology is not remarkable, as joy beans function similarly.

The traditional payment company that can take a further step in Web3 payments is PayPal, which has issued the dollar stablecoin PYUSD (PayPal USD) on Ethereum and Solana. PayPal claims it aims to "achieve instant settlement using distributed ledger technology (DLT), programmability, smart contracts, and tokenization, and to be compatible with the most widely used exchanges, wallets, and dApps…" This not only allows them to earn exchange fees between fiat and PYUSD but also extends the time funds are held, similar to the original intention behind Binance's launch of BUSD.

PayPal's longer-term goal is to potentially replace bank cards as the primary payment channel. However, currently, it lacks the foundational user base of e-commerce platforms and has not captured the offline merchant market, while major platforms are also launching their own payment tools (like Apple Pay), so the opportunity to return to its peak through PYUSD seems slim.

In contrast to PayPal, which lacks payment scenarios, Square, a payment platform established in 2009, has built a vast merchant payment network offline and promoted its own payment tool CashApp through rate discounts, showing a trend of potentially replacing bank cards as the primary payment channel. Notably, Square's founder, Jack Dorsey, is also a co-founder and former CTO of Twitter.

Square's official entry into Web3 was through the development of Bitcoin mining machines, but its former employees founded the Web3 payment company Bridge in 2023, securing $58 million in investments from firms like Sequoia Capital, Ribbit, and Index, and later sold it to payment processor Stripe for $1.1 billion in October. What Bridge does is allow customers to deposit USD and EUR, create stablecoins, and then use those stablecoins for transfers, treating stablecoins as joy beans, which makes it clear. Of course, I am not criticizing Bridge; in fact, Bridge has quietly realized the grand narrative that Ripple promised years ago.

Similar products include Huiwang, reportedly a Chengdu team, but the reason it has thrived in Southeast Asia is mainly due to the relatively large policy space there, where tools for collecting payments in the black and gray markets are undoubtedly in high demand.

More fundamental than payment tools are the currencies themselves. Now, in addition to USDT and USDC, many stablecoins have emerged for specific scenarios, such as OUSG and USDY launched by Ondo Finance with support from BlackRock, used for investing in short-term U.S. Treasury bonds and bank demand deposits.

In summary, the Web3 payments of traditional payment companies are equivalent to the technical difficulty of joy beans, with the threshold being whether they can find their own payment scenarios.

1.2.2. Cryptocurrency Giants: Eager to Issue Co-branded Debit Cards

If traditional finance earns OTC fees by supporting joy beans, then cryptocurrency giants are doing the opposite, earning OTC fees by supporting debit cards. In short, they are working in both directions to bridge the gap between debit cards and joy beans.

Exchanges like Coinbase and Binance choose to collaborate with established payment giants like Visa and Mastercard to issue co-branded crypto debit cards, not only to leverage traditional financial infrastructure to attract more crypto assets but also for a more subtle reason: brand building. After all, once a card is issued, they can claim to support "the exchange and consumption of cryptocurrencies at over 60 million online and offline merchants worldwide," which can actually be achieved by simply partnering with a member bank of Visa's international organization, or even outsourcing to a third-party card issuer.

There are countless such cases, reminiscent of around 2015 when mobile payment startups emerged, many of which had shell technologies and licenses, yet this did not deter the capital market from favoring this new trend.

The operational costs of co-branded cards from cryptocurrency giants are actually quite high. For example, the OneKey Card launched by hardware wallet OneKey was taken offline after just over a year of operation. According to the announcement, "There are many challenges in simultaneously achieving low-cost operations with a small team, low fees, stable card operations, resistance to black and gray markets, and compliance… Balancing these factors is very difficult."

Later, the concept of PayFi emerged, which is built around sending/receiving settlements, attempting to redefine payments, claiming to "break free from the constraints of the traditional banking system, allowing users to send cryptocurrencies globally at low costs and easily withdraw crypto assets to personal custody." However, based on the current solutions, they are merely capturing the OTC merchant market within the framework of the traditional payment system, and their compliance ultimately means they will be no different from the traditional banking system and joy beans.

The truly revolutionary Web3 payment solutions in PayTech must be based on distributed ledger technology.

2. Blockchain Payments: Regulated and Unregulated Blockchain Payments are Two Different Species

Whether it is central bank digital currencies (CBDCs), private institutions, or public chains, discussions about Web3 payments cannot avoid distributed ledger technology (DLT). Even if many treat USDT as joy beans, at least these joy beans are issued based on DLT.

DLT is essentially a database maintained collectively by multiple nodes, where each node shares and synchronizes the same copy. Blockchain is a type of DLT, but DLT is not necessarily blockchain. With the emergence of Bitcoin triggering the impact of blockchain and cryptocurrencies, DLT is increasingly viewed as a new infrastructure to replace traditional centralized entities for transferring funds, although most remain in the experimental stage as alternatives.

The greatest advantage of DLT is that it operates as a peer-to-peer (P2P) network, so the parties involved no longer need complex intermediary institutions; financial transactions can be verified directly through a public ledger, enabling clearing and settlement, and DLT operates 24/7. Additionally, payments based on DLT have the advantage of currency programmability—not only can different currency rules be defined through smart contracts, but more complex functions can also be achieved when interacting with other smart contracts.

The above are the common advantages of payments based on DLT, but the problem lies in the significant differences between DLTs, which can even lead to reproductive isolation, such as between public chains and consortium chains. Moreover, even among public chains, differences in consensus algorithm types (like PoW and PoS) can lead to vastly different confirmation speeds and cost structures, let alone payment applications built on different types of DLT.

The industry seems to overlook these differences, focusing only on the speed of TPS and compliance. However, the market is different from academia, which relies on peer review (where publishing more papers can lead to authority); ultimately, the development of DLT must be validated by the market.

2.1. Consortium Chains and CBDCs are Products of Compromise

Consortium chains are largely products of compromise with centralized systems—based on DLT technology but strictly controlling access. This seemingly decentralized centralized solution can meet regulatory compliance, but in essence, it remains a closed system. This means it only plays a role in reducing costs and increasing efficiency within a certain segment of the traditional financial system, without changing the system itself.

In the mainstream narrative, central bank digital currencies (CBDCs) seem to be the endpoint of Web3 payments. Although CBDCs are a pseudo-proposition, this is true not only from a technical perspective but also from a monetary perspective. Some CBDC proposals are even less effective than consortium chains, as they are merely centralized databases that borrow some technical features of DLT, such as multi-node and consensus mechanisms. However, more absurdly, some have pieced together a versioned relational database using centralized database technology, lacking blocks and chains, yet boast it as a blockchain innovation, such as Sui.

Thus, payment applications based on consortium chains and CBDCs are merely partial tool iterations of internal organizational clearing and settlement systems, rather than a paradigm revolution involving the entire financial system. Moreover, these tool iterations would theoretically perform better using centralized databases directly.

This phenomenon of using new technology to replicate old business practices is merely a special product of a transitional phase. Hong Kong has already accumulated numerous cases in building financial products based on DLT, but so far, it has not led to a qualitative leap in business. Therefore, let’s focus on those truly built on public chains for Web3 payments.

2.2. Public Chains Imitating Consortium Chains

True Web3 payments should be built on public chains, which is also the original vision of Bitcoin and blockchain. Over the years, this idea has been continuously expanded, and in July of this year, Lily Liu, the chair of the Solana Foundation, officially proposed the concept of PayFi.

She defines PayFi as "a new financial vernacular built around the time value of money," which is financial innovation above the settlement layer. DeFi addresses transaction issues, while PayFi involves broader economic activities—sending and receiving, such as supply chain finance, payroll loans, credit cards, corporate credit, interbank repos, and other scenarios, thus the market is larger.

Lily Liu believes that the success of PayFi must meet three conditions: fast and low-cost, widely used currency, and developers. The final conclusion is that only Solana can perfectly meet these conditions. The previous arguments are not without merit, but this conclusion will certainly attract opposition from many competitors, such as Ripple.

Ripple officially engaged in PayFi in 2012 (before the term even existed), positioning itself as a blockchain that allows global financial institutions to transfer using XRP, once hoped to break SWIFT's monopoly, and in 2019 was selected as one of Forbes' 50 Most Innovative FinTech Companies.

Ripple's Layer 1 is the XRP Ledger, which is a blockchain based on federated learning, strictly speaking, it is a consortium chain, even though it claims to be a public chain (it can only be said to be open source). Its initial business was a copy of Bitcoin, just faster—allowing everyone to use its native asset XRP for transfers.

The Ripple team holds a large amount of XRP and continuously sells it for profit, often using buyback news and collaborating with market makers to increase trading volume in the secondary market. They intentionally blurred the relationship between XRP and Ripple's equity when selling XRP, which led to scrutiny from the SEC, embroiling them in disputes for four years. A recent settlement is expected, but it does not change the basic fact that XRP is largely useless. Ripple later realized that no one would use XRP, a volatile asset, for payments (even Bitcoin is unsuitable for retail payments due to its volatility), so they attempted to launch stablecoin RLUSD, build CBDCs for various countries, and provide asset tokenization and custody services.

If one were to judge solely based on Ripple's promotional materials, one might think that Ripple, with its ability to complete payments in seconds, has covered over 80 payment markets globally, processing transaction volumes exceeding $50 billion. However, Ripple's xCurrent for banks merely records cross-bank transfer information on Ripple's blockchain; the core automatic reconciliation engine technology is essentially no different from traditional clearing institutions. Ripple's acquisition of digital asset custody technology provider Metaco in 2023 primarily reflects the value of licenses and channels. As for using XRP, a volatile asset, for consumer payments, that is an even more absurd proposition.

In summary, Ripple plays the role of a top marketer in the PayFi market. Just like the previously mentioned crypto companies, as long as they collaborate with a member bank of Visa's international organization, they can claim their products "exchange and consume cryptocurrencies at over 60 million online and offline merchants worldwide."

In conclusion, almost all public chains discussing PayFi emphasize how fast it is, how cheap it is, and how compliant it is, but the PayFi products based on public chains (like Huma Finance) are still merely using blockchain as a bookkeeping tool within the traditional payment system. What difference does it have from a consortium chain, except for the lack of KYC?

2.3. Bitcoin Lightning Network and Its Limitations

Therefore, we must look at solutions that are natively built on public chains, but they are often limited by the block size and confirmation time of public chains, making them suitable only for remittance transfers and unable to support high-frequency small payments in daily life. The Bitcoin Lightning Network is a promising solution.

In simple terms, it establishes payment channels off-chain, which are akin to multi-signature wallets created jointly by account A and account B. They both deposit funds into this wallet and can transfer an unlimited number of times (each transfer essentially updates the wallet balance distribution state, forming a new UTXO, or unspent transaction output), and only when the final transfer occurs, which closes the channel, will it be verified by the Bitcoin network. Thus, the Lightning Network can achieve high-frequency payments without altering the underlying mechanism of Bitcoin.

At this point, one might wonder how the balance changes within the payment channel can be secured since they are not recorded on-chain. The security of the traditional financial system relies on the credit guarantees of institutions, but the Lightning Network ensures the security of payment channels through cryptographic techniques such as LN-Penalty and HTLC (Hash Time-Locked Contracts), which will not be elaborated further.

It is important to note that the secure channels discussed earlier are one-to-one, but in actual transfers, it is impractical to establish a separate multi-signature wallet with every individual, leading to one-to-many solutions, which is the multi-hop routing technology. Simply put, if there is a payment channel between A and B, and another between B and C, then A can transfer directly to B, and B can transfer to C, with account B acting as a relay node, eliminating the need for A and B to establish a separate payment channel. According to the six degrees of separation theory, you can connect to anyone in the world through six people.

This one-to-many solution requires relay users to be online regularly and have sufficient funds; otherwise, transactions may fail. The Lightning Network employs multi-path routing and node redundancy technologies to overcome these challenges. However, in practical use, this design is overly idealistic—assuming users are willing to lock up large amounts of funds in advance and tolerate various technical limitations, all of which run counter to the capital efficiency issues that PayFi originally aimed to address.

The Lightning Network solution later expanded from Bitcoin to other public chains. For example, the Fiber Network built on Nervos CKB has Turing-complete smart contract capabilities, making it more flexible in asset management, but it still hasn't escaped the dilemmas posed by the payment channel design.

This raises a profound question: finance exists as a complex system, and mere technological innovation may struggle to reshape the entire payment system. So what kind of design can bring about a systemic paradigm revolution?

3. The Endpoint of Currency is No Currency

Finance has always existed as a complex system, and mere technology is unlikely to bring about substantial change, so it is necessary to re-examine this system.

Finance is a tool system developed to serve real transactions, with currency playing the role of a unit of value accounting, which has led to an extremely complex system of transactions, clearing, and credit. Because we cannot avoid currency, to be precise, we cannot avoid fiat currency, and more precisely, we cannot avoid the US dollar, so the current Web3 payment track and even the entire crypto market's highest pursuit is to be incorporated into the economic system represented by shadow dollars like USDT.

"A man's great fortune lies in the fact that, whether in adulthood or childhood, he must embark on a very arduous path, but this is the most reliable path; a woman's misfortune lies in being surrounded by almost irresistible temptations; she is not required to strive upward, only encouraged to slide down to reach bliss. When she realizes she has been deceived by a mirage, it is already too late; her strength has been exhausted in the failed adventure."

This passage is from Simone de Beauvoir's "The Second Sex," published in 1949. I believe the "woman" in it can be entirely replaced with "crypto," at least the Web3 payment track is currently running recklessly down this path to bliss. What I want to point out is that it is entirely possible to walk down another very arduous path, a path derived from hundreds of years of economic thought, which has already been preliminarily validated in the past decade of crypto experimentation!

3.1. The Evolutionary Logic of Currency

If we trace the history of currency development from shells to digital currency, we arrive at an interesting conclusion—that the intermediary of currency may disappear.

Before currency was born, barter was the norm, but this method was too inefficient; it required precise matching of the needs of both parties, and it was also difficult to provide a fair exchange rate during the swap. Additionally, goods were hard to divide evenly.

Thus, some universally needed and easily storable goods were naturally adopted as general equivalents, entering the commodity currency stage. Examples include animal skins, livestock (by the way, many languages have etymological connections between the word "money" and livestock), grains, cloth, salt, and decorative items like shells.

Later, as the scale of trade expanded, the demands for portability, durability, and divisibility increased, leading to a concentration of currency in metals, entering the metallic currency stage.

However, with the development of trade scale, even precious metal currency became inconvenient for merchants to store and carry in large quantities. They chose to store precious metals with jewelers who had safes and guards, then traded directly with storage receipts similar to warehouse receipts in the market. These receipts gradually gained legal recognition as a form of quasi-currency.

Since, in general, no one frequently retrieves their stored precious metals, jewelers often overissued receipts, establishing the value of these receipts on the basis of the jeweler's credit. This eventually evolved into more specialized banks (in the 18th century, most bankers in London were still members of the goldsmith guild), transitioning to a paper currency stage based on institutional credit, of course, establishing relatively standardized currency issuance and redemption rules.

Speaking of which, the jiaozi, as the earliest paper currency, was issued in a context similar to that of the Southern Song Dynasty, and its subsequent development path was also quite similar, with private commercial institutions issuing and competing freely before being monopolized by the government, using national credit as backing, centralizing the issuance rights in the central bank, and mandating the circulation of printed fiat currency (which is extremely problematic!).

Once entering the stage of state credit currency, the issuance rights of currency have become part of national sovereignty, and the currency itself has not undergone significant changes (at most, it has been liberated from the constraints of the gold standard after the Bretton Woods system collapsed). The subsequent development is about technology.

As trade scales expanded, even paper currency (essentially receipts) could no longer meet demand. However, if both parties have accounts at the same bank, they actually do not need to use paper currency; transactions can be completed through bank transfers, which are purely bookkeeping records, requiring only complex clearing behind the scenes. This clearing can naturally also serve transfers between different banks, gradually forming a banking network and banking credit system, including the credit cards and electronic payments we are familiar with, all within this system. This is why today's financial system is so bloated; it is the result of historical evolution, characterized by strong path dependence.

Looking back, we can see that currency is generated to serve trade, aimed at efficiently matching supply and demand, from commodity currency to credit currency, and even state credit currency is no exception.

However, state credit currency relies on central bank regulation, and regardless of whether the central bank's regulation is correct, the interests of each country's central bank are inconsistent. Therefore, these policies ultimately disrupt the original price structure, guiding resources in the wrong direction, with errors accumulating until they are finally consolidated and cleared. Thus, Hayek advocated for the denationalization of currency, calling for a free currency movement akin to the free trade movement of the 19th century, leading to the formation of a new banking system.

Since currency has evolved from a physical medium of exchange to an abstract unit of account with the evolution of exchange mechanisms (especially clearing systems), can we take a further step to directly complete the exchange of goods and services? After all, the emergence of currency was merely to overcome the limitations of barter. This is not a regression to primitive society; barter was replaced by currency because the market at that time was too small, lacking sufficient coincidences to match demand.

However, with the expansion of market scale and the evolution of exchange mechanisms, these limitations can be overcome. In fact, in the 1990s in Argentina, some communities attempted to use internal credit vouchers as alternative currency, helping vulnerable groups participate in economic activities through barter, achieving phased success (with a peak of 6 million users). However, later due to rampant issuance, it ended up like the junk bonds issued by local governments today. Yet, the crypto world has technically eliminated the possibility of such failures.

However, it should be noted that the author does not extreme believe that currency should be completely eliminated; rather, it is believed that in the future, currency will no longer be needed as a transaction intermediary, but a common standard of value reference is still required, as the ratios between vast amounts of goods are almost endless. The ideal unit of measurement should not be fiat currency with unlimited inflation, but it should also not be assets like gold or Bitcoin with limited supply, as this means that the costs for later holders must be higher than those for early holders, inevitably leading to a tendency for holders to hoard, ultimately causing unnecessary deflation.

3.2. The Experiment of Crypto Punks Represented by Bitcoin

This deeper layer of financial system technology is opened up by Bitcoin's blockchain. As a trustless peer-to-peer value exchange system, it can directly bypass the multi-level clearing system in traditional finance (which merely calculates amounts).

Moreover, in the blockchain world, each token represents some form of value, ownership, or even access rights, meaning they are inherently a form of on-chain native goods or services. They can be exchanged through DEX (decentralized exchanges), bypassing currency as an intermediary to directly calculate exchange rates, so not only is physical currency unnecessary, but currency itself can be entirely eliminated.

This solution may seem like a fantastical tale that Satoshi Nakamoto conjured from thin air, but in fact, as early as 1875, British economist and logician William Stanley Jevons deduced the development path of currency in his work "Money and the Mechanism of Exchange," predicting that the future would enter a barter stage, and he prophetically noted that the US dollar was steadily moving toward becoming an international currency.

Moreover, the cryptographic practices of the past few decades have also been validating this hypothesis. If we trace the starting point, it actually predates the publication of Satoshi Nakamoto's Bitcoin white paper in 2008; even before the internet was opened in 1982, cryptographer David Chaum proposed the idea of anonymous electronic currency, roughly preserving the system through a public record of member consensus, which can be seen as a prototype of blockchain, and achieved in the following year, known as Ecash. However, the digital currency CyberBucks mentioned here is essentially an electronic representation of fiat currency.

Ecash collaborated with some banks, and its vision and approach were similar to most Web3 payments today, forty years later. Bill Gates also engaged with the Ecash team, intending to integrate it into the Windows 95 system for global payments, but it ultimately came to nothing. This idea is quite similar to Zuckerberg's plan to issue a basket of currencies, Libra, and integrate it into Facebook over thirty years later, except that the latter was more radical, directly issuing currency.

The true creation of currency came in 1998 from university student Wei Dai's proposal of B-money, a passionate declaration that opened with a clear statement: "I am interested in Tim May's crypto-anarchism. Unlike the communities traditionally associated with the term 'anarchism,' in crypto-anarchism, the government is not temporarily destroyed but is permanently prohibited and permanently unnecessary. This is a community where violent threats are powerless because violence is impossible. Violence is impossible because its participants cannot be linked to their real names or actual locations."

The fundamental concept of Bitcoin, which emerged a decade later, is derived from this article (especially linking currency to computational costs). It can be said that crypto has been imbued with deep-seated crypto-punk ideals since its inception, destined to pursue free will and power decentralization through cryptography as rebels, ultimately expanding from cyberspace to the real world to reshape finance, communication, and governance. Sadly, today's Web3 has embarked on a pilgrimage in the opposite direction.

In the same year that B-money was proposed, cryptographer Nick Szabo independently proposed the concept of Bit Gold (but no one helped him write the code). It can be said that Bitcoin has a direct inheritance on a technical level, such as the PoW mechanism, timestamps, and chain structure. Additionally, he had already researched smart contracts as early as 1996.

After numerous thoughts and technological hypotheses and experiments, Satoshi Nakamoto ultimately published "Bitcoin: A Peer-to-Peer Electronic Cash System" in 2008. Building on the work of predecessors, he combined consensus algorithms with public key cryptography, truly realizing a decentralized currency and opening the era of blockchain.

However, he stubbornly believed that Bitcoin did not need a scripting system, which provided opportunities for later developers. For example, in 2012, Yoni Assia proposed the concept of Colored Coins, a protocol layer built on Bitcoin for issuing assets that lie between fungible tokens (FT) and non-fungible tokens (NFT), where each attribute represents a color, ultimately forming colored coins from many parameters, thus mapping multidimensional assets in the real world, such as stocks, taxis, shopping vouchers, subscription services, and even original paintings.

Colored Coins allow Bitcoin to represent various digital assets, but due to Bitcoin's functional limitations, it can only issue and trade, still unable to support Turing-complete scripts. Thus, core team member Vitalik Buterin started anew and published the Ethereum white paper "A Next-Generation Smart Contract and Decentralized Application Platform," marking the official emergence of a blockchain with an embedded Turing-complete programming language, allowing anyone to write smart contracts and decentralized applications.

Up to this point, the theoretical preparation from economics and the technical foundation from cryptography have been established, and we should welcome a true paradigm revolution.

Conclusion

A true paradigm revolution is not a pilgrimage of return for the adherents of the old order, but rather a steadfast exploration of a new world beyond experience as rebels.

In the garden of the Web3 payment fork, the path of the adherents is bustling with performances of joyful tricks attracting countless spectators. The path of the rebels, however, is fraught with thorns, destined to be "a very arduous road, but this is the most reliable path."

From Jevons to Hayek, liberal economists have foreseen that currency will eventually return to a more essential form of exchange. From cyberpunk to crypto-anarchism, creators and cryptographers have shown us this possibility in the experimental field of the crypto world.

We have discovered a reliable new paradigm, and in the next article, we will demonstrate how to construct a completely different payment paradigm based on a profound understanding of blockchain characteristics, and in the future, with trends like embedded finance and open banking, attempt to become a brand new financial world.

On this difficult yet reliable path, we look forward to more like-minded partners joining us to contribute in terms of technology stack and business scenarios, pioneering our paradigm revolution. We welcome your attention and discussion!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。