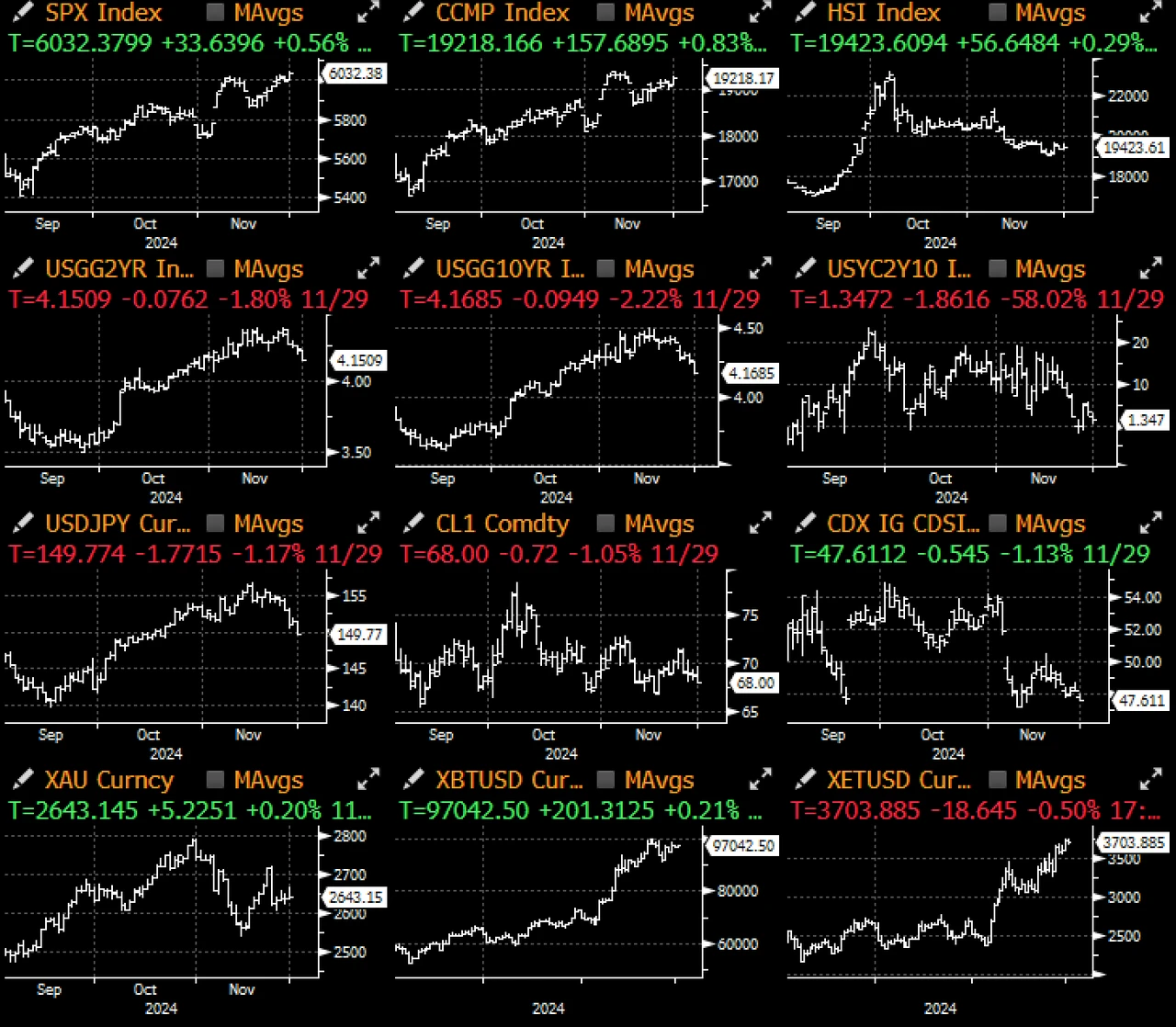

Last week was the Thanksgiving holiday in the United States, resulting in light market trading volume and an overall consolidation pattern. The U.S. stock market is set to make history again, with 2024 expected to be one of the best-performing years on record, and 5 out of the past 6 years have seen double-digit returns.

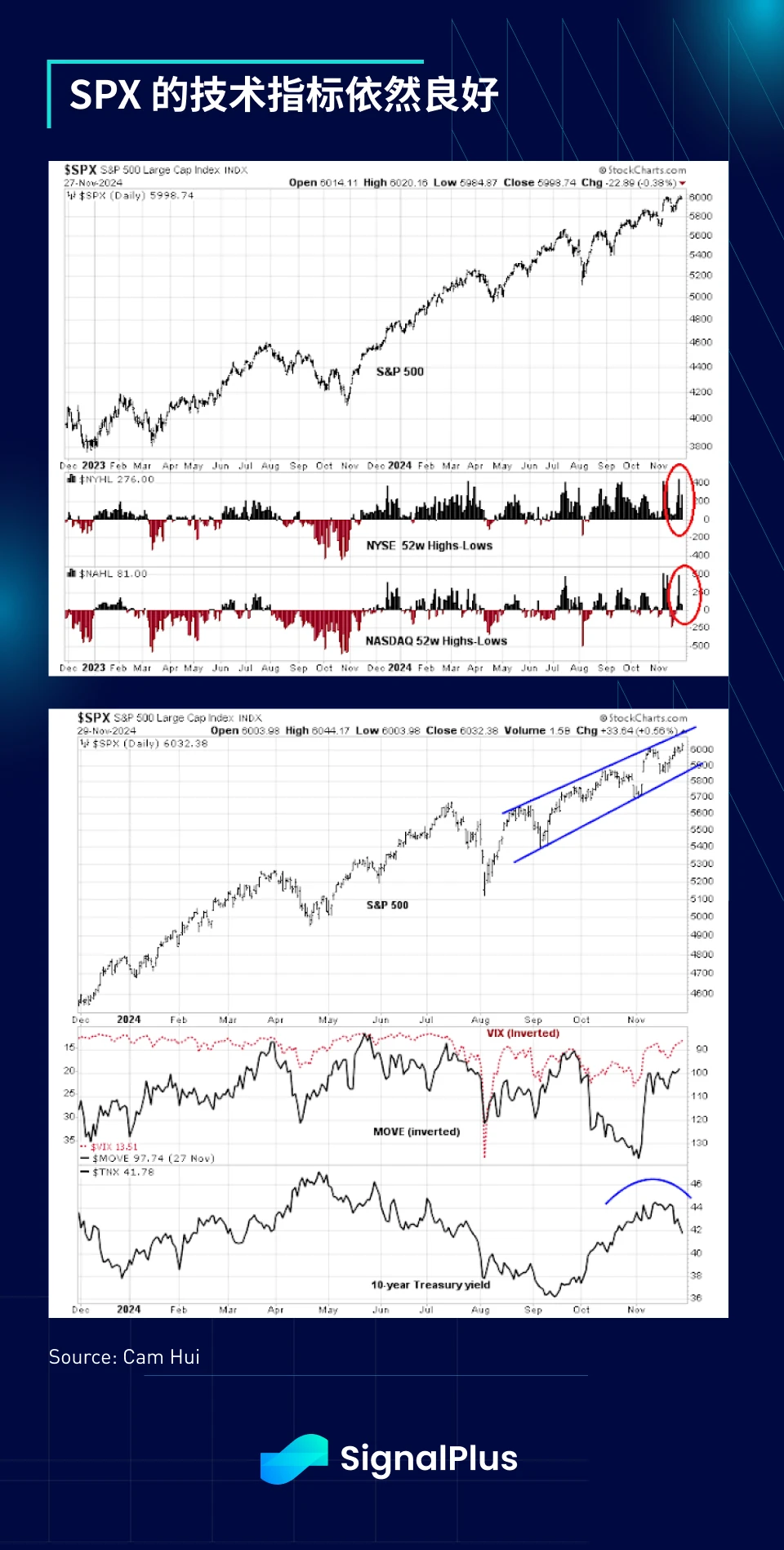

Market breadth remains supportive, with the difference between the number of new highs and new lows for stocks over 52 weeks still looking healthy. The upward trend remains intact, and the volatility index (VIX) is on a downward trend. Additionally, after Trump announced that Scott Bessent would serve as Treasury Secretary, the U.S. bond market returned to calm, with the 10-year yield dropping nearly 35 basis points from its October peak.

Aside from his so-called "support for cryptocurrencies" stance, Bessent is also a supporter of fiscal hawks and an independent Federal Reserve. His proposed 3-3-3 plan (reducing the fiscal deficit to 3% of GDP, increasing real GDP growth to 3%, and boosting daily energy production by 3 million barrels) has brought relief to the U.S. fixed income market, and since his nomination, the yield curve premium has remained stable at current levels.

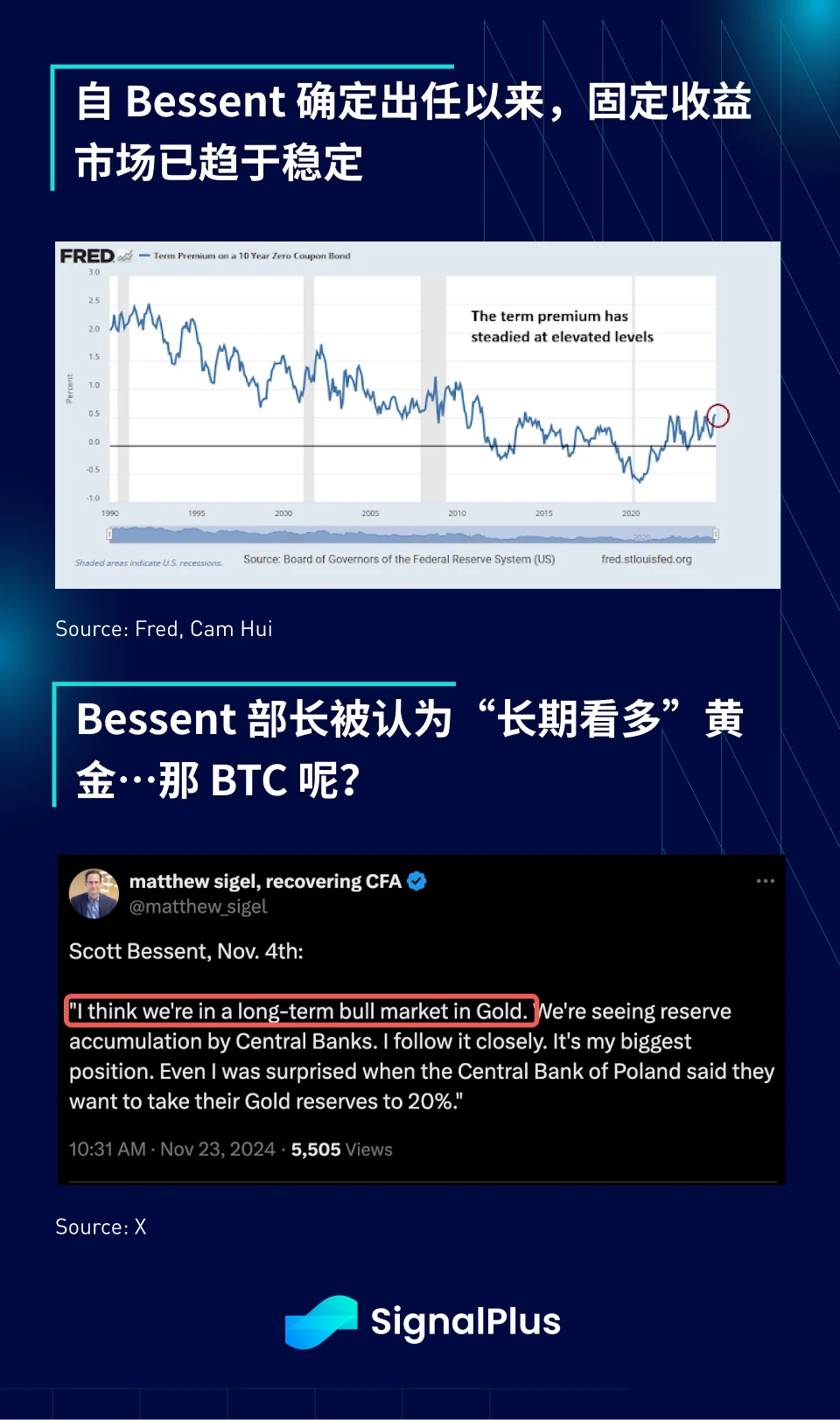

Despite lingering doubts about his core views, reporters studying his early speeches found that due to the central bank's continued accumulation, he is "long-term bullish" on gold. Will this have a spillover effect on Bitcoin, especially in light of recent discussions about strategic reserve portfolios? At the very least, the next four years are sure to be very interesting.

Traders will return to a busy week, anticipating the last non-farm payroll data release of the year. Although concerns about rising inflation have just emerged, the market still expects about a 65% chance of interest rate cuts. However, considering the strong economic conditions, the forward expectations for rate cuts in 2025-2027 have been significantly reduced. In terms of employment data, the market expects overall employment figures to rebound to around +160,000, while the unemployment rate is expected to remain around 4.3%. Given the recent weakness in PMI surveys and high-frequency employment data, the final data results may also come in below expectations, but unless there is an extremely surprising outcome, risk sentiment is likely to remain positive.

Optimism in the cryptocurrency market remains widespread, but this week's focus is on Ripple. Amid expectations that the government will withdraw its long-standing lawsuit, XRP surged an astonishing 73%, helping it surpass USDT to become the third-largest cryptocurrency by market capitalization. Anticipating this development, whale addresses have been actively buying (and are now selling) XRP over the past month.

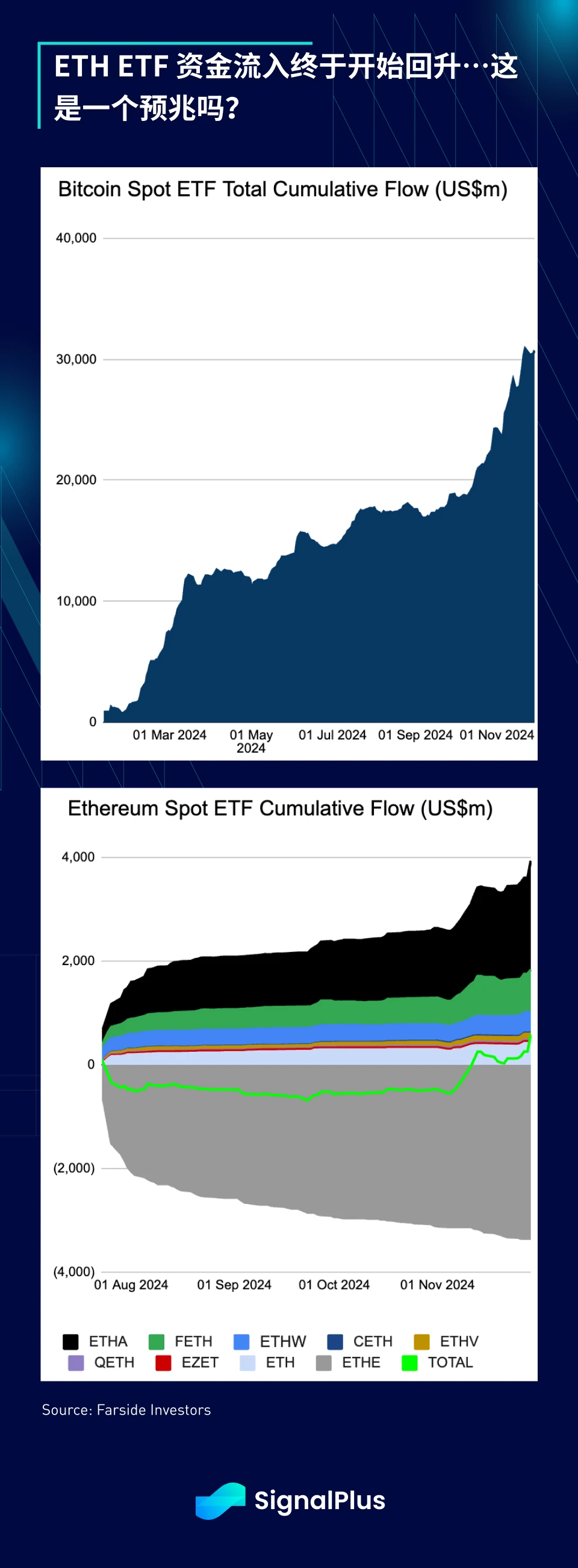

The current rally is primarily concentrated in mainstream coins (excluding ETH), with BTC leading the charge, while altcoins are still struggling to return to January's highs. Although the recent success of L2 and protocol-transforming blockchains (such as Hyperliquid) continues to dominate attention in the cryptocurrency market, we are seeing some improvement in Ethereum through the inflow of ETH ETFs, with over $330 million flowing in last Friday. Will we see more secondary mainstream coins rebound before the end of the year?

In any case, the fundamental indicators for cryptocurrencies remain optimistic, with the market capitalization of stablecoins finally surpassing the highs seen during the Terra-Luna period. Stablecoins are typically the first stop for most fiat currency users entering the cryptocurrency market, and a higher market capitalization (price-fixed and thus entirely driven by quantity) indicates greater mainstream participation.

As investors pour more new funds in, will we see faster growth in the new year? Let's hope so!

You can use the SignalPlus trading indicator feature at t.signalplus.com to get more real-time cryptocurrency information. If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlusCN, or join our WeChat group (add the assistant's WeChat: SignalPlus123), Telegram group, and Discord community to interact and exchange ideas with more friends.

SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。