Some are investing, while others are speculating.

Written by: Zhou Yixiao, Silicon Star Pro

After Trump won the U.S. presidential election, the market anticipated that he would ease regulations on cryptocurrencies. Trump had previously stated that Bitcoin mining should be concentrated in the U.S., a policy that could impact the AI industry. In the early hours of November 23, the price of Bitcoin briefly reached $99,660, once again setting a new historical high and approaching the $100,000 mark.

Both Bitcoin mining and AI training require a significant amount of energy and computing power. The simultaneous development of both will inevitably create competition for electricity and hardware resources. This means that AI training businesses may be affected by fluctuations in Bitcoin prices, especially when miners compete for limited hardware resources. In other words, an increase in Bitcoin prices could drive up the costs of AI training.

AI VS BTC

With the tremendous success of ChatGPT, AI companies are racing to train and run their own models, hoping to surpass OpenAI's flagship product. This has generated a massive demand: the inference process of AI models is much more complex than the indexing and retrieval processes of search engines, with the energy consumed by a single ChatGPT query being about ten times that of a Google search.

This has led AI companies to urgently seek cheap energy and large plots of land to accommodate related equipment. In North America, some regions have implemented a queuing system for large data centers to connect to the power grid. However, once a company receives preliminary approval, building a data center from scratch can take years and cost millions of dollars, along with a lengthy regulatory and administrative approval process.

Internationally, large-scale Bitcoin mining has traditionally been an extremely profitable business. However, it is also affected by the volatile cryptocurrency market. After the cryptocurrency market crash in 2022, many miners were forced into bankruptcy or completely shut down their operations.

In 2023 and early 2024, mining companies that survived the market downturn reaped profits. However, this year's Bitcoin halving (which reduces miners' rewards) did not trigger the dramatic price increases seen in previous cryptocurrency cycles to offset the impact of the reduced rewards. Since April of this year, the long-term sideways movement of Bitcoin prices has compressed miners' profit margins, forcing some miners to seek diversification in their business models to hedge against the risks of cryptocurrency price fluctuations.

Four years ago, when the data center and Bitcoin mining company IREN considered entering AI training, they believed that the business volume at that time was insufficient from a commercial perspective. However, now, an increasing number of large Bitcoin mining companies have begun to replace some of their mining equipment with devices used for running and training AI systems. These companies believe that providing computing power to AI companies may yield a safer and more stable source of income than mining.

Today, the collaboration between the artificial intelligence and Bitcoin mining industries is a natural fit, as both sides have complementary needs. AI companies require the existing sites, cheap energy, and infrastructure that Bitcoin miners have. Meanwhile, Bitcoin miners pursue the stable income brought by AI businesses and the potential profits from the current AI boom.

Some Bitcoin mining companies have chosen to lease their sites to AI clients. In June of this year, Core Scientific, a Bitcoin mining company that was on the brink of bankruptcy in 2022, announced that it would host over 200 megawatts of GPUs for the AI startup CoreWeave. Core Scientific stated that AI companies have begun purchasing mining sites at prices higher than those in the mining market, referring to Bitcoin mining facilities as "the power shell of the data center industry."

Other Bitcoin mining companies operate GPUs themselves. Bitcoin mining company Hut 8 received a $150 million investment from Coatue Management to build AI infrastructure. Some facilities of the Australia-based mining company IREN share space between GPUs for AI and ASIC devices for Bitcoin mining. Bitcoin provides immediate income but is highly volatile. AI relies on customers, and once customers are secured, it becomes more stable. Nasdaq-listed company Bitdeer is also building its own AI data center in Singapore.

A seemingly attractive business

However, only a few overseas mining companies can achieve this transformation. Additionally, the equipment used for Bitcoin mining is called ASIC, which stands for Application-Specific Integrated Circuit, meaning it cannot be used for other tasks. Mining companies cannot seamlessly transition mining equipment into AI scenarios.

An AI Infra industry practitioner told Silicon Star, "For example, training models typically use H100, while mining uses 4090."

In other words, to serve the AI industry, Bitcoin miners must purchase entirely new equipment, and the requirements for data centers in AI and Bitcoin mining are different. Entering a completely new and highly complex industry is already fraught with challenges, not to mention competing with well-funded tech giants like Google, Amazon, and Microsoft.

Therefore, not all mining companies can replicate the high-level collaboration between Core Scientific and CoreWeave. Especially for smaller miners, they actually have limited resources to offer to the AI industry.

In China, virtual currency mining has already been banned, and there are no miners transitioning to AI. However, companies from other industries are looking to get a piece of the AI wave, either by directly entering the field or by establishing computing power subsidiaries to engage in "computing power leasing." According to statistics, there are over 100 listed companies in the A-share market focused on computing power leasing, including "lottery printing king" Hongbo Co., Ltd. and "monosodium glutamate king" Lianhua Holdings, among others. On video platforms, there are even stories like "I sold a house in my hometown, bought 800 graphics cards, and partnered with my middle school classmates to do computing power leasing."

In an ideal scenario, the business model of computing power leasing only requires an initial investment in GPU server equipment, hosting the hardware in a professional intelligent computing center, and then leasing the computing power to end users, with hardware operation and software services managed by the intelligent computing center.

However, in reality, this may not be a good business. The demand for computing power leasing comes from the development of the AI large model industry, while the rental costs for high-end hardware used to train AI are rapidly decreasing. Featherless.Ai CEO Eugene Cheah pointed out that the rental price for overseas H100s once reached as high as $8 per hour but has now dropped to below $2 per hour. This is mainly because some companies signed computing power leasing contracts early on, and to avoid wasting idle capacity, they began reselling reserved computing resources, while the market largely opted for open-source models, leading to a decrease in demand for new models.

The domestic computing power leasing market is also experiencing a similar "computing power surplus" phenomenon, but "the leasing market is unlikely to lower prices because everything was bought at high prices initially," a practitioner in the intelligent computing industry told Silicon Valley Star.

"It's still this fast"

There is a saying in the cryptocurrency circle: "computing is power," and this phrase has now circulated into the AI circle.

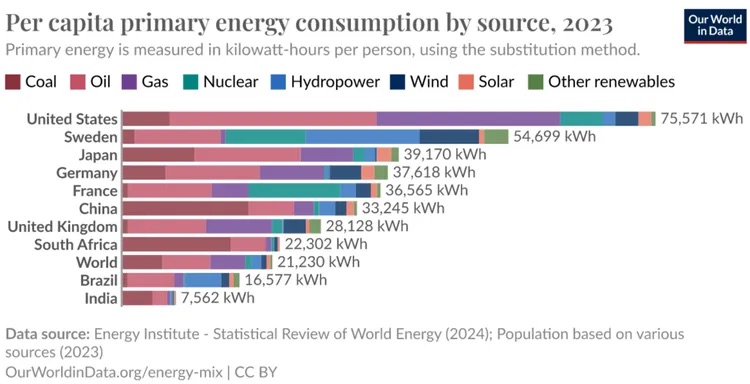

Behind computing power is energy, and there is a close relationship between developed countries and high energy consumption, as can be seen when comparing per capita electricity generation (kilowatt-hours, kWh). In other words, obtaining surplus energy is a necessary condition for the manifestation of civilizational progress. After all, new layers such as manufacturing, transportation, public services, urbanization, and computing are built on top of basic survival levels like agriculture, all of which require energy support.

In this dimension, the infrastructure originally established to serve cryptocurrencies is now providing solutions for the computing power demands of the AI era. This is undoubtedly an opportunity for the overseas digital currency mining industry, which has long sought to shed its speculative image, to prove its value. As long as this trend continues, leading companies will benefit from the enthusiasm and liquidity brought by AI.

In every wave of technological innovation, there is always a "gold rush." For speculators among them, what they chase is always profit itself, regardless of whether the target is digital currency, artificial intelligence, or tulips from three hundred years ago; it seems unimportant.

After the Bitcoin halving, some miners face a dilemma: either continue mining and hoarding coins, hoping for a rise in Bitcoin prices, or transition to AI data centers, hoping to ride the wave of artificial intelligence and make a quick profit. Now that the coin price has reached a historical high, some people are once again lamenting, "It's still this fast." But there is another saying in the cryptocurrency circle: "Holding coins is harder than holding a virgin."

As people oscillate between the cryptocurrency and AI circles, this repetitive process reminds one of Keynes's words: speculators do not care who is the most beautiful; they only care about who will be chosen in the beauty contest.

And this "beauty contest" will continue indefinitely.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。