Author: Nancy, PANews

As the secondary market gradually warms up, the structure of the crypto ecosystem is undergoing subtle changes, with market liquidity gradually withdrawing from on-chain activities. In the bullish atmosphere, many projects are accelerating their pace to launch their own tokens, attempting to attract more capital and user attention. Meanwhile, the strong performance of various crypto projects in recent sectors has further stimulated investment sentiment, and the market's expectation for a "altcoin season" is growing stronger, with many starting to look for potential crypto assets.

DeFi and L1 Become the Main Forces in Token Issuance, Token Distribution Strategies Undergo Optimization Adjustments

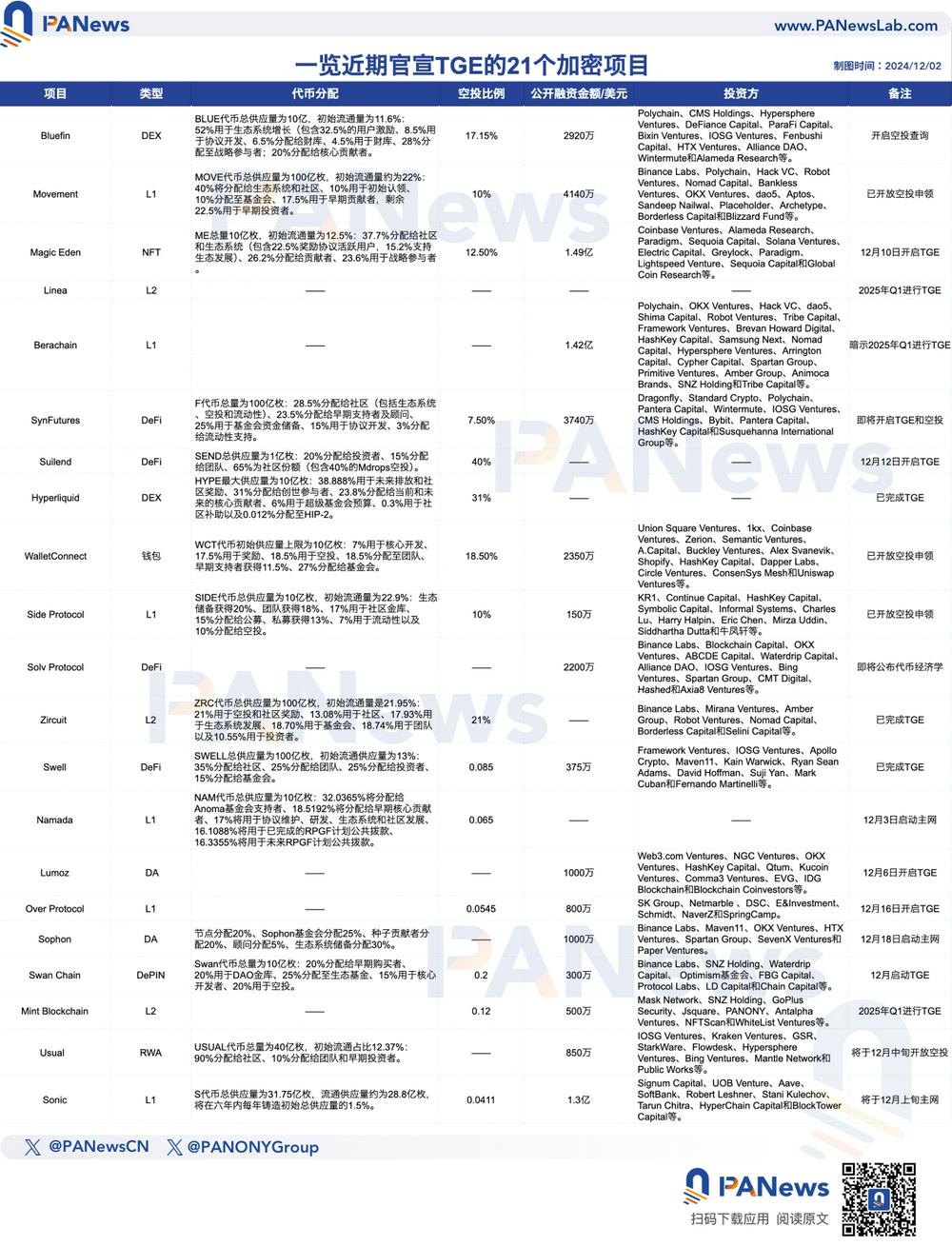

Recently, the crypto market has seen multiple projects announcing token issuance. PANews has compiled a list of 21 crypto projects that have recently announced their Token Generation Events (TGE), covering sectors such as DeFi, L1, NFT, L2, and DAO, with DeFi and L1 projects being the main forces in token issuance, accounting for nearly half of the projects.

From publicly available information, these projects are generally favored by the capital market, with a total financing amount exceeding $620 million, involving well-known investors such as Polychain, Binance Labs, Coinbase Ventures, Dragonfly, Wintermute, Alliance DAO, GSR, and DeFiance Capital. VC backing is often seen as an important symbol of a project's reliability and potential, adding more credibility and promise to these projects.

However, alongside capital involvement, the ongoing decline in token prices due to high Fully Diluted Valuation (FDV) and low circulation has gradually sparked strong dissatisfaction and controversy in the market. In the face of this dilemma, market attention has begun to shift significantly, including a turn towards relatively fair and decentralized crypto assets, such as MEME coins. For example, 10x Research recently released a report stating that the Google search trend for "Meme Coins" has reached an all-time high, surpassing the previous peak in March 2024. This data indirectly confirms that investors are currently more inclined towards community-driven and fairer investment opportunities.

In terms of token distribution, many projects have begun to adjust the previously low initial circulation issues to avoid the dilemma of limited sustainable growth space caused by high FDV. For instance, Movement has an initial circulation of 22%, Side Protocol at 22.9%, and Zircuit at 21.95%. This change reflects the market's reflection on the low circulation and high FDV model, especially in such projects where ordinary investors often become the "victims" of liquidity exit.

Moreover, token distribution strategies are increasingly focused on ecosystem building and community participation. For example, Bluefin allocates 52% of the total token supply for ecosystem growth, Movement allocates 40% to the ecosystem and community, Magic Eden allocates 37.7% to the community and ecosystem, and Usual allocates 90% of tokens to the community. Such strategies help enhance the community cohesion and market competitiveness of the projects, better supporting their long-term development.

Particularly in terms of airdrop intensity, the average token airdrop ratio for these 21 projects reaches 14.9%, with Suilend, Hyperliquid, Zircuit, Swan Chain, and WalletConnect reaching 40%, 31%, 21%, 20%, and 18.5% respectively, significantly exceeding the average. Notably, Hyperliquid, with an average airdrop value of $28,500 per person, has become one of the largest crypto projects in terms of airdrop scale this year. Airdrops, as an effective means to attract and incentivize community members, continue to play an important role in project promotion, providing substantial returns for early supporters and effectively enhancing the project's influence and visibility.

Multiple Factors May Assist in the Return of Altcoin Season, but It Cannot Rely Solely on Bitcoin's Driving Effect

The intensive announcements of token issuance by crypto projects are closely related to the market recovery and the relaxed policy environment in the United States. Recently, as Bitcoin continues to rise, mainstream public chains, DeFi, the metaverse, L2, and gaming sectors have experienced strong rebounds. At the same time, the intensified PVP competition in the MEME market has deterred many players, and market attention is gradually shifting towards the secondary market.

"Altcoin season may be about to start," top trader Eugene stated recently.

According to a report released by Bitfinex, the overall crypto market has reached a new cycle high, with the market capitalization of altcoins now approaching the $984 billion peak in May 2021, indicating that speculative funds are shifting from Bitcoin to altcoins. Historically, such fund rotation often signals the arrival of "altcoin season," where altcoins outperform Bitcoin in terms of price increases. Crypto analyst Mikybull Crypto noted that Bitcoin's dominance in the crypto market has fallen below its two-year support line, which may indicate that the market has "officially entered altcoin season." The decline in Bitcoin's dominance suggests that investors are taking profits from their BTC positions and reallocating some funds to altcoins.

QCP also pointed out that the recent decline in Bitcoin's market cap share reflects a trend where funds may gradually shift from BTC to ETH and other altcoins. Additionally, data disclosed by IntoTheBlock shows that November recorded the highest net outflow of stablecoins from centralized exchanges (CEX) since April, amounting to approximately $4.5 billion. Coupled with strong price performance, this indicates that traders are locking in profits, and these funds may be redeployed into altcoins or reserved for future downturns.

Furthermore, as the crypto market gradually moves towards the mainstream, the relaxed crypto policy environment in the U.S. has also sparked optimistic sentiment regarding the overall industry development, including altcoins. According to previous reports by PANews, the new list of members for Trump's administration has been gradually revealed, with many publicly expressing a friendly attitude towards cryptocurrencies, potentially bringing more positive policy expectations for the industry. Notably, the impending departure of Gary Gensler, the chairman of the U.S. SEC, is seen as a change that may provide more room for the further development of the crypto industry. It is also worth mentioning that with the ETF applications for coins like Solana, XRP, and LTC, market expectations are rising.

However, CryptoQuant CEO Ki Young Ju also pointed out that compared to the previous bull market, the current rise in Bitcoin is mainly driven by institutional investors and spot ETF demand, which differ from crypto exchange users and do not intend to shift assets from Bitcoin to altcoins. Additionally, since institutional investors primarily operate outside exchanges, asset rotation becomes less likely. While institutions may allocate mainstream altcoins through investment tools like ETFs, small-cap altcoins still rely on retail users from exchanges. For the total market cap of altcoins to reach new highs, a significant influx of new funds into exchanges is required, but the current levels are below historical peaks, indicating a reduction in liquidity brought by new users. Therefore, altcoin projects should focus on developing independent strategies to attract new funds rather than relying on momentum from Bitcoin.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。