Author: Michael Saylor

Compiled by: Felix, PANews

Microsoft plans to vote on a proposal to "evaluate investing in Bitcoin" at its annual meeting on December 10. If the proposal passes, Microsoft will become the largest publicly traded crypto investment company, surpassing MicroStrategy and Tesla. As the voting approaches, Michael Saylor delivered a 3-minute speech to the Microsoft board, explaining why Bitcoin should be adopted. In his speech, Michael Saylor stated that Bitcoin represents "digital capital," is the core opportunity of the next wave of technological innovation, and signifies the greatest digital transformation of the 21st century, recommending that Microsoft adopt Bitcoin as a core corporate strategy. Below are some highlights from the presentation slides used in the speech:

There are seven technological waves that Microsoft cannot miss:

- Personal Computers

- Graphical User Interfaces

- The Internet

- Mobile Computing

- Cloud Computing

- Artificial Intelligence

- Digital Capital

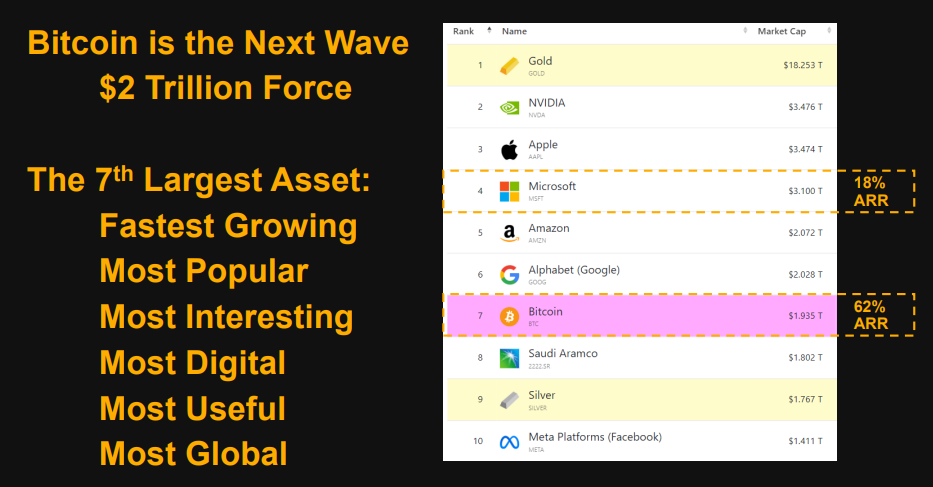

The greatest digital transformation of the 21st century is the transformation of capital, and Bitcoin is digital capital. Bitcoin is currently the seventh largest asset globally, the fastest-growing, most popular, most interesting, most digitalized, most useful, and most globalized. Additionally, Microsoft's current ARR (Annual Recurring Revenue) is 18%, while Bitcoin's ARR is 62%.

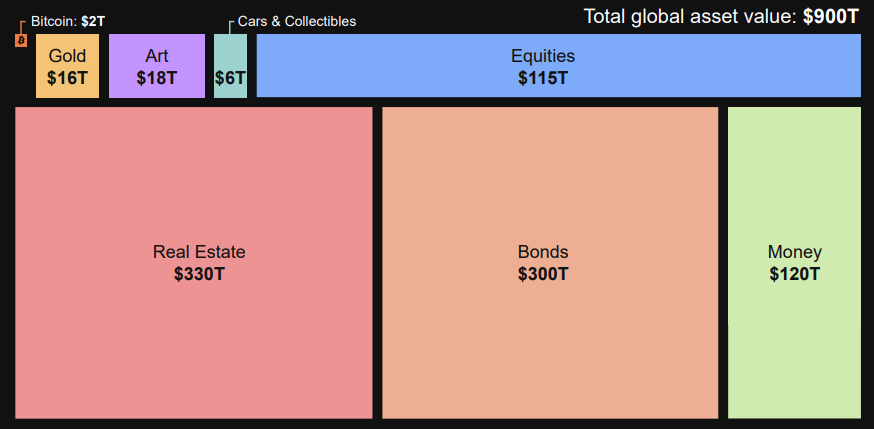

Currently, global wealth is distributed across various assets. In the current approximately $90 trillion global asset market, Bitcoin's market value is about $2 trillion.

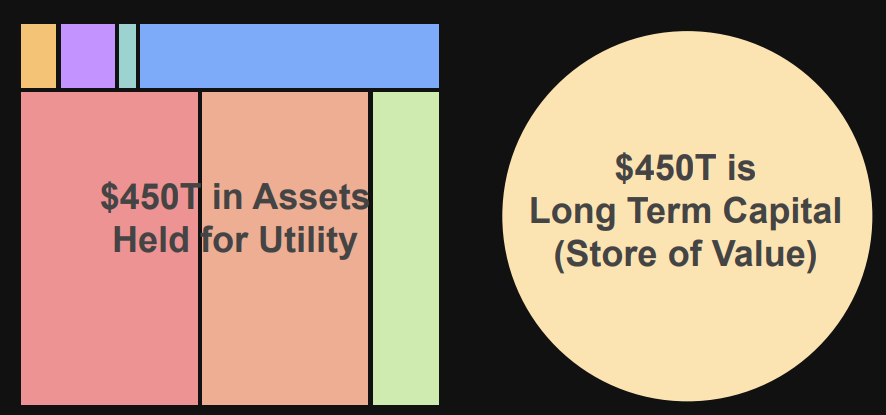

Global wealth is distributed between utility-providing assets and other capital-preserving assets. Of this, $45 trillion belongs to long-term capital (value storage). However, due to risk factors such as regulation, taxation, competition, obsolescence, economic and political turmoil, and crime, over $100 trillion in assets are lost each year.

Digital capital is superior to physical capital both economically and technologically, and long-term capital is transitioning to digital capital (Bitcoin). Bitcoin offers advantages similar to owning buildings but without the obvious liabilities of fixed assets. For example: no taxes, no concerns about transportation, tenants, torts, weather factors, building decay, and regulatory bodies. In contrast, Bitcoin possesses characteristics such as being intangible, indestructible, permanently existing, remotely transferable, programmable, divisible, convertible, and configurable.

It can be said that Bitcoin is a revolutionary advancement in capital preservation.

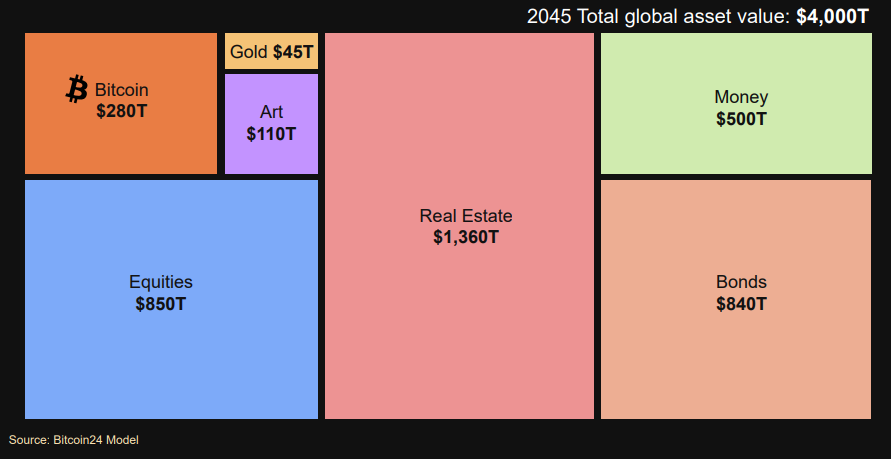

Furthermore, Bitcoin's market value is expected to grow from the current $2 trillion to $280 trillion by 2045, surpassing traditional assets like bonds and gold.

At the same time, Bitcoin is backed by digital, political, and economic forces. The current Bitcoin network has a hash rate exceeding 750 Exahash, with 622 million crypto users and 400 million Bitcoin holders.

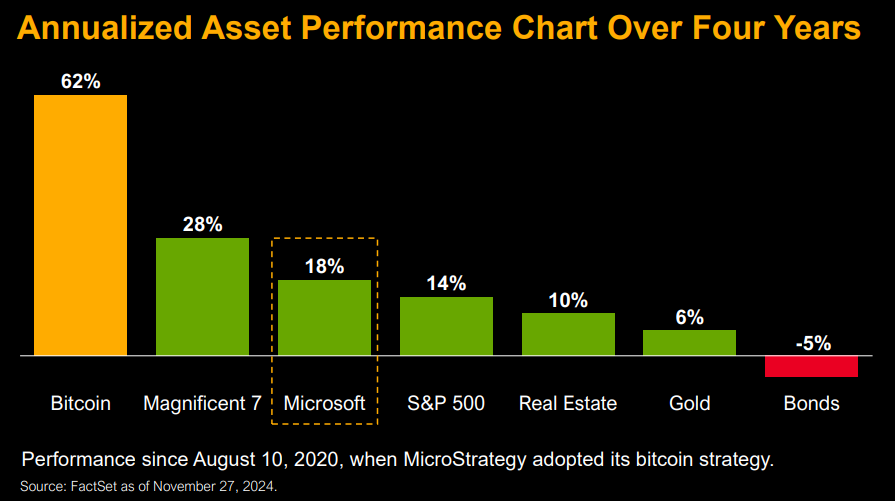

According to a four-year annual asset performance chart, Bitcoin is the best-performing uncorrelated asset on corporate balance sheets.

Performance since MicroStrategy adopted a Bitcoin strategy on August 10, 2020

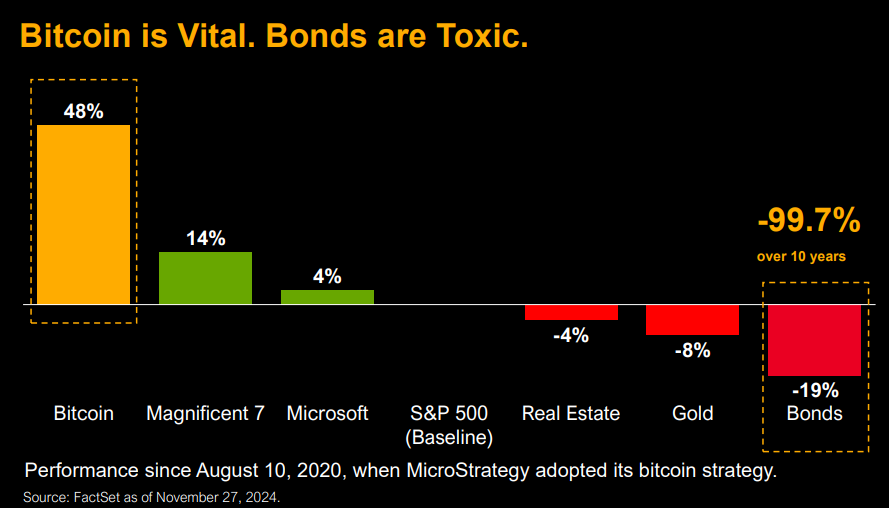

Bitcoin's annual performance is ten times higher than Microsoft's, while bonds have performed even worse.

Performance since MicroStrategy adopted a Bitcoin strategy on August 10, 2020

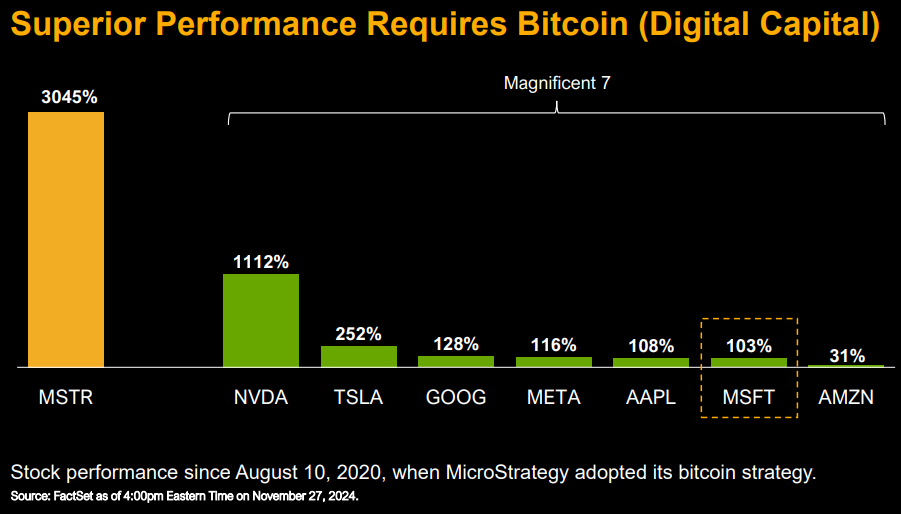

The outstanding performance of corporate stocks is inseparable from Bitcoin (digital capital). Since MicroStrategy adopted a Bitcoin strategy on August 10, 2020, MicroStrategy's stock price has increased by 3045%, while Microsoft's (MSFT) stock price has only increased by 103%.

Performance since MicroStrategy adopted a Bitcoin strategy on August 10, 2020

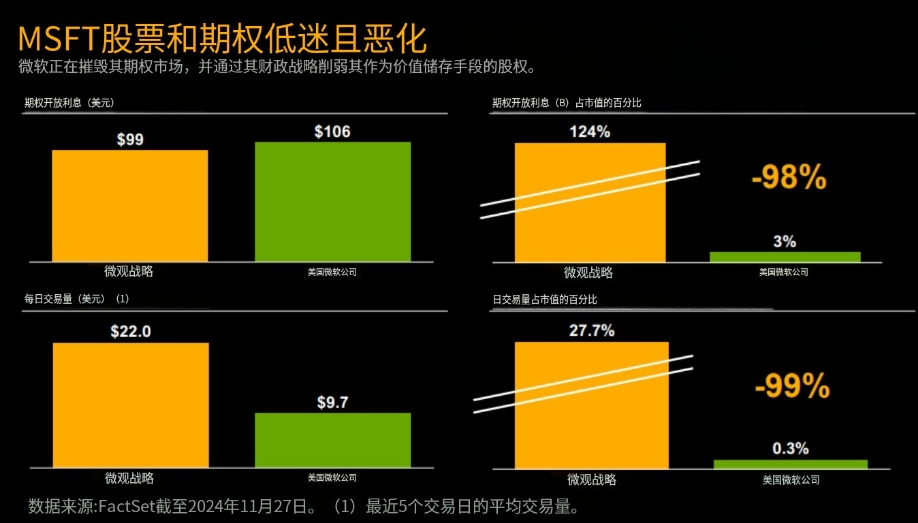

Additionally, MSFT (Microsoft) stock and options are weak and deteriorating (Microsoft is reducing the options market and stocks as a means of value storage through its financial strategy).

Today, Bitcoin has become an institutional asset and is now a viable alternative to corporate bonds. The number of public entities holding Bitcoin has surged:

Moreover, a wave of political support for Bitcoin is surging, with endorsements from governments, Wall Street, and several prominent political figures. This includes the White House, the Senate, the House of Representatives, and Wall Street, with notable figures such as Donald Trump, JD Vance, Robert Kennedy, Howard Lutnick, and Elon Musk. At the same time, support for a strategic Bitcoin reserve in the U.S. is also increasing, with Trump stating, "Never sell your Bitcoin."

2025 will be the first year of a full revival for cryptocurrencies. It is expected that:

- Wall Street will adopt ETFs

- FASB will implement fair value accounting

- There will be over 250 supporters of cryptocurrencies in Congress

- Bitcoin Strategic Reserve Act

- Repeal of SAB 121

- End of the legal war against cryptocurrencies

- Digital asset framework

In this context, Microsoft must make a choice:

- Stick to the past: traditional financial strategies based on government bonds, buybacks, and dividends

- Embrace the future: innovative financial strategies based on Bitcoin as a digital capital asset

- Regress: buy back $100 billion annually, increasing investor risk and slowing growth

- Progress: invest $100 billion annually, reducing investor risk and accelerating growth

Microsoft has already repurchased $200 billion in capital over the past five years.

Buybacks and dividends amplify Microsoft's risk factors, and Bitcoin is the best way to break this vicious cycle. As an asset, Bitcoin has no competitors, and there is no counterparty risk from nations, companies, creditors, cultures, or currencies. It is recommended that Microsoft seize this opportunity of the era and take a leading position in global digital financial innovation.

Related reading: MicroStrategy's stock price faces short selling, Bitcoin holdings exceed $32.6 billion, can the leverage game continue?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。