Recently, the price of Bitcoin has continued to rise, once reaching $99,000 per coin, setting a new historical record. In the short term, Bitcoin may seek new support or resistance levels amid fluctuations, while in the medium to long term, its price direction will depend on multiple factors such as global liquidity, economic outlook, and regulatory attitudes.

Data shows that after Bitcoin's halving in 2012, 2016, and 2020, it experienced significant gains in December. In December 2012, the price rose from $12.57 to $13.45, yielding a return of 7%. In December 2016, the return was 30.8%, and in December 2020, it was 46.92%. The returns for this month are still worth looking forward to. Notably, Bitcoin's price rose by 7.35% in September this year, marking its best performance in history; historically, whenever Bitcoin has closed higher in September, it has continued to rise until the end of the year.

Chu Yuechen: Bitcoin and ETH Market Analysis and Trading Reference for December 2

Bitcoin has been oscillating around the range of $95,000 to $98,000 from last week until today. This morning, Bitcoin faced resistance and retraced near $98,200, with the current price fluctuating around $96,500. Overall, Bitcoin has not yet chosen a direction for a breakout. In our previous articles, we have detailed various factors that support our bullish outlook on Bitcoin. Additionally, we have entered long positions multiple times at $92,000 and $95,000, yielding considerable returns.

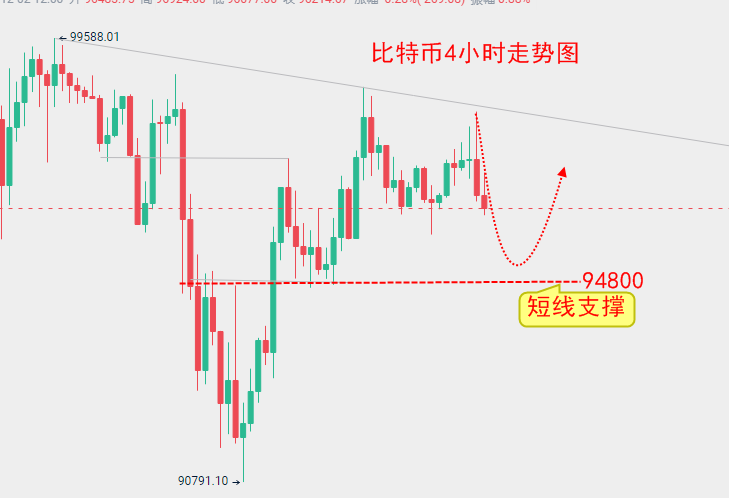

From the 4-hour chart, Bitcoin's short-term support remains in the range of $94,500 to $95,000, which has been validated multiple times last week. Therefore, if there is an opportunity to enter this range during the day, we should still look to place long positions. Since it is a fluctuating market, we do not need to set our targets too far; a profit target of $2,000 is sufficient, with a stop loss set at 1,000 points.

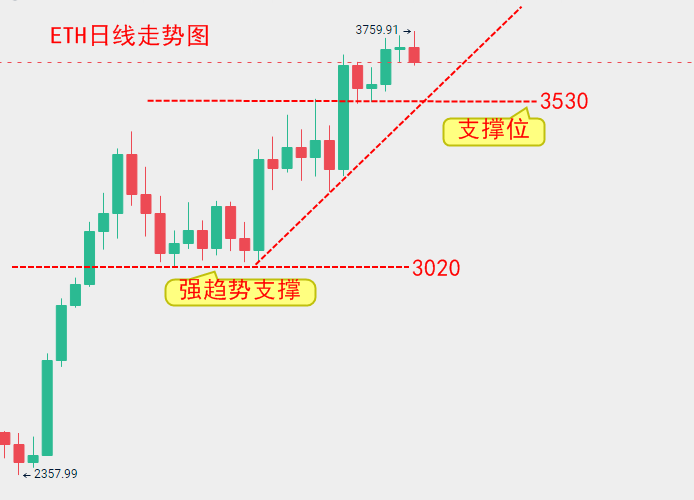

Additionally, from the daily chart, while Bitcoin stabilized at high levels last week, ETH experienced some catch-up gains, and can even be said to be leading relative to some altcoins. This is a positive phenomenon for the entire crypto market. After Bitcoin rises and stabilizes at high levels, other assets rotate and catch up, leading to an increasing total market capitalization in the crypto space.

For ETH, pay attention to the $3,600 round number and the support level at $3,530. In contract trading, you can use $3,530 as a stop-loss level to enter long positions; how to proceed depends on your risk tolerance, so I won't elaborate further here.

As mentioned earlier, based on historical experience, Bitcoin has always risen in December after a September increase following each halving. Whether this month will validate that experience remains to be seen.

Market conditions change in real-time, and there may be delays in article publication. The strategy points are for reference only and should not be used as the basis for entry. Investment carries risks, and profits and losses are your own responsibility. Daily real-time market analysis, along with experience exchange groups and practical trading groups, welcome to get real-time guidance. Live explanations of real-time market conditions will be held at irregular times in the evening.

For more real-time market analysis, please follow the public account: Chu Yuechen

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。