Key Points:

● The total market capitalization of cryptocurrencies is $3.63 trillion, up from $3.4 billion last week, with a weekly increase of 6.8%.

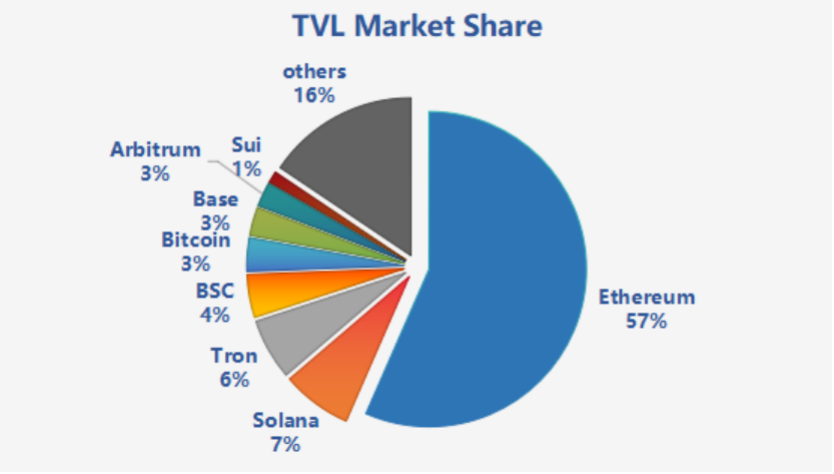

● This week, the total TVL of DeFi is $126.2 billion, an increase of 1.39% from last week. Among the top three public chains by TVL, Ethereum accounts for 57%; Solana accounts for 7%; and Tron accounts for 6%.

● The total market capitalization of stablecoins is currently $193.1 billion, setting a new historical high, with a weekly increase of 1.2%. Among them, USDT has a market capitalization of $128.8 billion, accounting for 69.7% of the total stablecoin market; followed by USDC with a market capitalization of $39.9 billion, accounting for 20.7%.

● From on-chain data, in terms of daily trading volume, SOL remains in the lead, but compared to last week's $4.497 billion, this week SOL's overall daily trading volume has decreased by 37%. In terms of daily active addresses, this week, the active addresses on SOL/BNB/SUI chains have all shown a downward trend compared to last week. Among them, the decline on the SUI chain is the most significant, with an overall decrease of nearly 70%. In terms of total locked value (TVL) and circulating market capitalization, ETH remains the absolute leader in the DeFi space, with a DeFi TVL of $72.1 billion and a circulating market capitalization of $447 billion, far exceeding other public chains.

● Innovative projects to watch: Agentstarter: Virtuals Protocol AI Agent Launchpad; Polytrader: AI-driven Polymarket companion built on the Base and SOL chains. With the help of AI, it can perform social media analysis, database analysis, Polymarket predictions, and search engine modeling; AgentLayer: A decentralized AI Agent public chain that supports Agent economy and AI asset trading on L2 blockchains. AgentLayer is about to launch a new market prediction product called Orbs, which will be available for interaction in the form of a Telegram bot, allowing users to participate in predictions directly on Telegram.

I. Market Overview

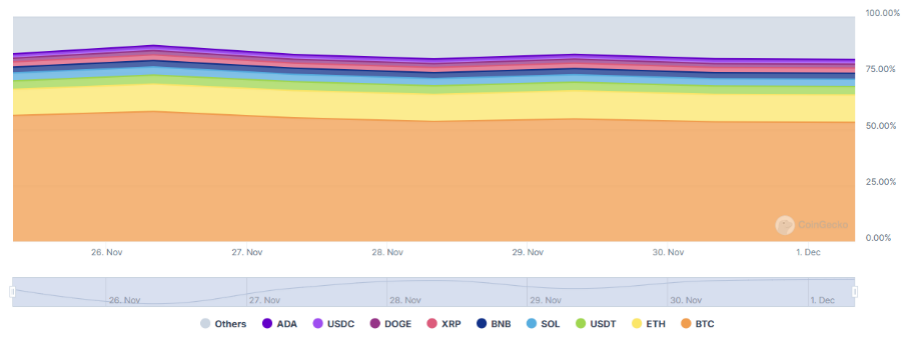

1. Total Cryptocurrency Market Capitalization / Bitcoin Market Capitalization Ratio

The total market capitalization of cryptocurrencies is $3.63 trillion, up from $3.4 billion last week, with a weekly increase of 6.8%.

_Data Source: cryptorank_

As of today, Bitcoin (BTC) has a market capitalization of $1.92 trillion, accounting for 53.03%. Meanwhile, the market capitalization of stablecoins is $193.1 billion, accounting for 5.44% of the total cryptocurrency market.

Data Source: coingecko

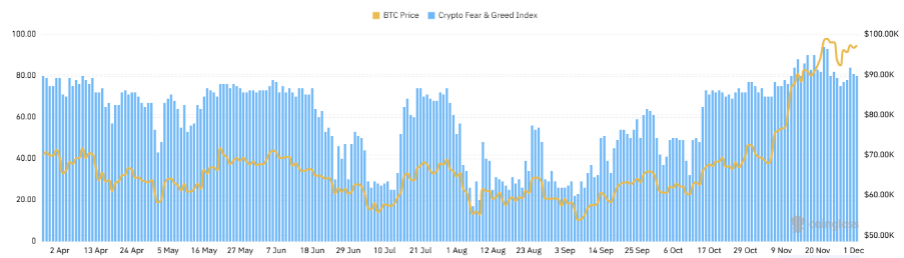

2. Fear Index and ETF Inflow/Outflow Data

The cryptocurrency fear index is at 80, indicating greed.

Data Source: coinglass

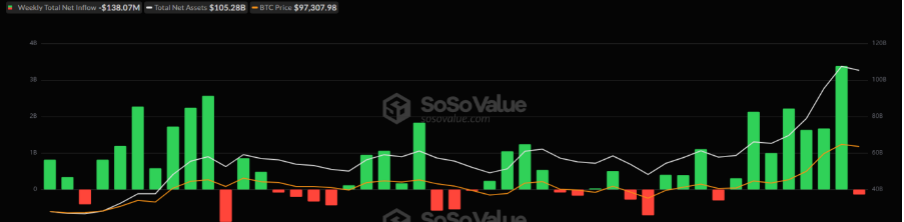

3. ETF Inflow/Outflow Data

As of December 2, 2024, the cumulative net inflow of U.S. Bitcoin spot ETFs is approximately $30.7 billion, and the net inflow of U.S. Ethereum spot ETFs is approximately $573 million. On November 30, according to Farside Investors data, the net inflow of U.S. Ethereum spot ETFs was $332 million, marking the first time it has surpassed Bitcoin spot ETFs.

Data Source: CoinW Research Institute, sosovalue

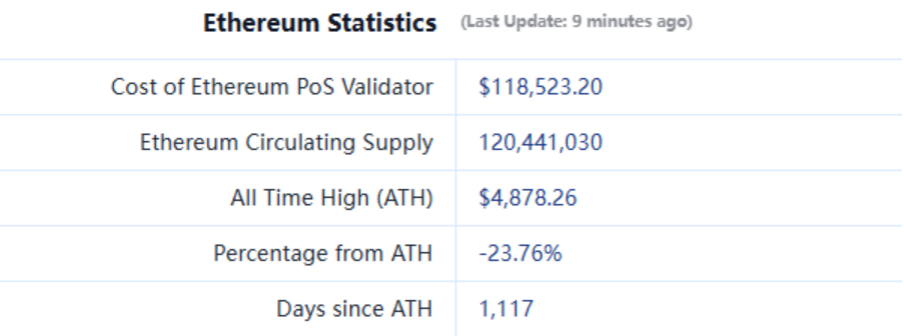

4. ETH/BTC and ETH/USD Exchange Ratios

ETHUSD: Currently at $3,703, with a historical high of $4,878.

ETHBTC: Currently at 0.037965, with a historical high of 0.1238, a decrease of approximately 69.3%.

Data Source: ratiogang

5. Decentralized Finance (DeFi)

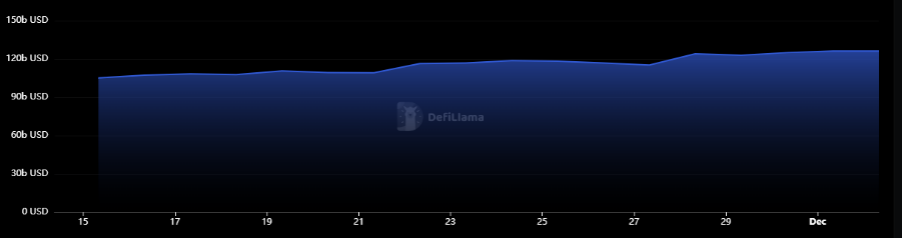

According to DeFiLlama, the total TVL of DeFi this week is $126.2 billion, an increase of 1.39% from last week.

Data Source: defillama

By public chain classification, the top three public chains by TVL are Ethereum at 57%; Solana at 7%; and Tron at 6%.

Data Source: CoinW Research Institute, defillama

Data as of December 2, 2024

6. On-Chain Data

Mainly analyzing the relevant data of major public chains ETH, SOL, BNB, TON, SUI, and APT based on daily trading volume, daily active addresses, transaction fees, and total locked value (TVL).

● Daily Trading Volume and Transaction Fees: Daily trading volume and transaction fees are core indicators of public chain activity and user experience. In daily trading volume, SOL remains in the lead, but compared to last week's $4.497 billion, this week SOL's overall daily trading volume has decreased by 37%. This also reflects a downward trend in the popularity of Meme coins compared to their peak PVP period. In terms of transaction fees, SOL has a significant advantage over the ETH chain.

● Daily Active Addresses: Daily active addresses reflect the ecological participation and user stickiness of public chains. This week, the active addresses on SOL/BNB/SUI chains have all shown a downward trend compared to last week. Among them, the decline on the SUI chain is the most significant, with a decrease of nearly 70% from last week's 1,579,833, reflecting the gradual exit of Meme players from the SUI chain, which needs a new narrative to drive further engagement.

● Total Locked Value (TVL) and Circulating Market Capitalization: Reflecting the maturity of DeFi and the level of user trust in the platform. In terms of TVL, ETH remains the absolute leader in the DeFi space, with a DeFi TVL of $72.1 billion and a circulating market capitalization of $447 billion, far exceeding other public chains.

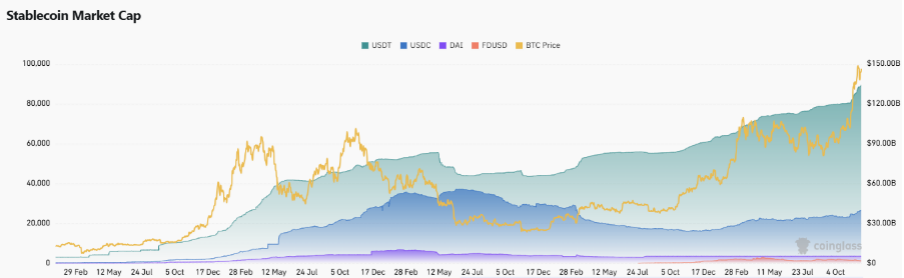

7. Stablecoin Market Capitalization and Issuance Situation

According to Coinglass data, the total market capitalization of stablecoins is currently $193.1 billion, setting a new historical high, with a weekly increase of 1.2%. Among them, USDT has a market capitalization of $128.8 billion, accounting for 69.7% of the total stablecoin market; followed by USDC with a market capitalization of $39.9 billion, accounting for 20.7%; and DAI with a market capitalization of $5.36 billion, accounting for 2.8%.

Data Source: CoinW Research Institute, Coinglass

Data as of December 2, 2024

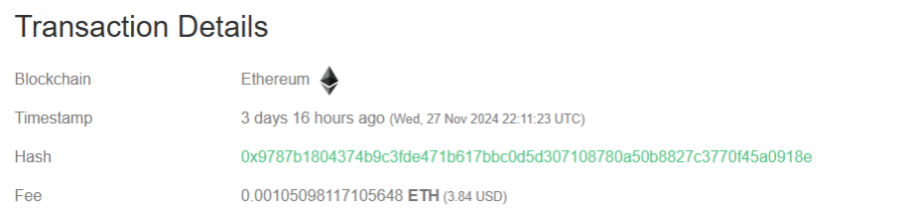

This week, according to Whale Alert monitoring, USDC Treasury issued over 290 million USDC on Ethereum on November 28.

Data Source: Whale Alert

II. This Week's Hot Money Trends

1. Top Five VC Coins and Meme Coins by Increase This Week

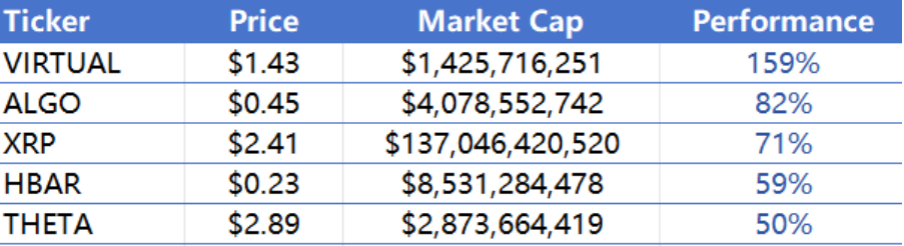

The top five VC coins by increase over the past week

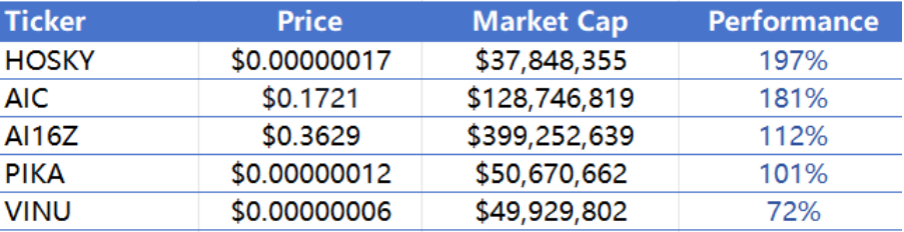

The top five Meme coins by increase over the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of December 2, 2024

2. New Project Insights

● Agentstarter: Virtuals Protocol AI Agent Launchpad.

● Polytrader: AI-driven Polymarket companion built on the Base and SOL chains. With the help of AI, it can perform social media analysis, database analysis, Polymarket predictions, and search engine modeling.

● AgentLayer: A decentralized AI Agent public chain that supports the Agent economy and AI asset trading on L2 blockchains. AgentLayer is about to launch a new market prediction product called Orbs, which will be available for interaction in the form of a Telegram bot, allowing users to participate in predictions directly on Telegram. The product revenue will be used to repurchase the project token $AGENT.

III. Industry News

1. Major Industry Events This Week

● Integrated public chain Supra launches mainnet and initiates TGE: The integrated public chain Supra announced the launch of its mainnet, with the TGE of the SUPRA token going live on November 27, 2024. Supra is a vertically integrated L1 public chain that offers MultiVM support, native oracles, on-chain randomness, cross-chain communication, and automation features. Supra has completed a total of $38 million in financing, with investors including Coinbase and Animoca. Since its testnet launch in August 2024, Supra has processed over 9 million transactions.

● Bitcoin financial public chain SideProtocol opens airdrop registration on November 26: The Bitcoin financial public chain Side Protocol has launched an airdrop, with registration opening on November 26, distributing a total of 100 million SIDE tokens. The $SIDE token will initially be issued under the SPL standard on Solana, with the mainnet expected to launch in January 2025, at which point it can be converted to the mainnet token and participate in staking and governance.

● Core members of daos.fun announce the upcoming release of the daos.fun x pump.fun index: A core member of the DAO launch platform daos.fun, baoskee, tweeted that the daos.fun x pump.fun index is about to be released.

● MetaMask supports U.S. users to purchase cryptocurrencies using Venmo: Crypto wallet MetaMask tweeted that its U.S. users (excluding Texas and New York) can use Venmo to purchase cryptocurrencies, supported by MoonPay. Users can initiate Venmo through the MetaMask extension and mobile devices.

● Base founder states there are no plans to issue tokens: Base founder Jesse Pollak emphasized in a post that the Base network has no plans to launch a token, focusing instead on building globally loved products that solve real problems. He also mentioned the example of Hyperliquid, illustrating that avoiding price complexity before product launch is beneficial.

2. Major Events Coming Next Week

● RWA stablecoin issuer Anzen Finance will conduct a public sale of ANZ on December 2 on Fjord Foundry and Starship, along with the first community airdrop of Anzen.

● The 2024 Taipei Blockchain Week (TBW 2024) hackathon, supported by the Solana Foundation, began online on November 11 and will continue until December 4.

● Web3 game distribution infrastructure MATR1X will release important news on December 5 related to veMax, which may hint at the opening of MAX staking functionality.

● Ethereum L2 Taiko Season 2 will run from September 17 to December 16, 2024, offering a total of 6 million TAIKO token rewards, with 5 million for participants and 1 million for DApps.

● The Chicago Board Options Exchange (Cboe) will launch the first cash-settled index options related to spot Bitcoin on December 2, based on the new Cboe Bitcoin U.S. ETF index. These options will be regulated by the SEC and will offer European-style exercise in addition to cash settlement.

3. Important Financing and Investment from Last Week

● Schuman Financial, seed round, raised $7.36 million, with investors including RockawayX, Faction, Bankless Ventures, Kraken Ventures, Gnosis VC, Daedalus, Nexo Ventures, Delta Blockchain Fund, Archblock, etc. Schuman Financial is a stablecoin issuer that launched EURØP, a euro-backed stablecoin aimed at simplifying global digital payments, on-chain foreign exchange trading, and tokenizing real-world assets. Schuman Financial has obtained a stablecoin issuer license in France and is building an ecosystem around EURØP, including SEPA integration, banking channels, and custodial partnerships with top global banks like Société Générale. (November 26)

● Balance, raised $10 million, with investors including Animoca Brands, Amber Group, Mask Network, GSR, MARBLEX, Web3Port, Nonagon Capital, MetaBlast Group, etc. Balance is a Web3 experience infrastructure aimed at mass user adoption, developed by the Epal team, dedicated to providing a smooth transition experience from Web2 to Web3 through the combination of AI and blockchain technology. (November 26)

● Partior, Series B1, raised $20 million, with investors including Deutsche Bank, Temasek, JPMorgan, Jump Trading, etc. Partior is a payment clearing and settlement blockchain platform developed from the Ubin project, created by J.P. Morgan, DBS, and Temasek with the support of MAS, to achieve end-to-end atomic settlement in multiple currencies, replacing sequential payment settlement methods. (November 27)

● U2U Network, raised $13.8 million, with investors including Kucoin Ventures, Cointelegraph, Chain Capital, IDG Blockchain, Maxx Capital, V3V Ventures, JDI Global, IBG, etc. U2U Network is a DAG-based blockchain compatible with EVM, focusing on providing unlimited scalability and on-demand decentralization. (November 28)

● usdx.money, raised $45 million, with investors including NGC, BAI Capital, Generative Ventures, UOB Venture Management, etc. The first stablecoin product of usdx.money is USDX, and the new funds will be used to promote the application of the stablecoin USDX and sUSDX in various fields. (November 29)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。