Author: Helen Partz, CoinTelegraph

Translated by: Wu Zhu, Golden Finance

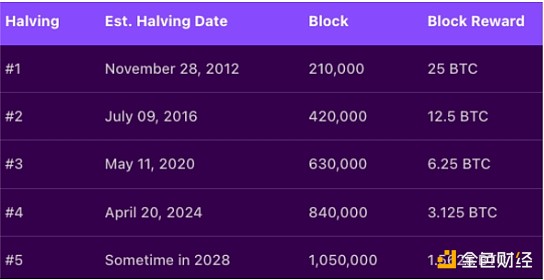

Bitcoin is the largest cryptocurrency by market capitalization and experienced its first halving event 12 years ago, reducing the block reward from 50 BTC to 25 BTC.

Since then, the Bitcoin block reward—an incentive for crypto miners to validate Bitcoin transactions and secure the network—has been reduced to 3.125 BTC after three halvings, significantly limiting the supply of newly mined BTC entering the market.

On the 12th anniversary of Bitcoin's halving, the trading price of Bitcoin is close to the historical high of around $99,600 set on November 22, partly due to the fourth halving event in April.

Bitcoin halving dates and block rewards. Source: BitDegree

As the community celebrates the anniversary of the first Bitcoin halving, this article revisits some key historical milestones of BTC and changes in the mining ecosystem.

1.2 Million Bitcoins Left to Mine

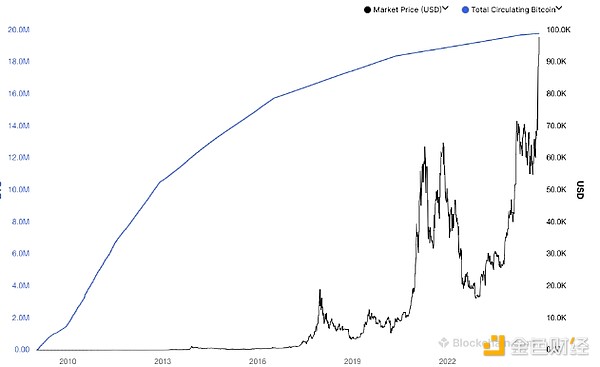

As of November 27, the circulating supply of BTC is 19.8 million, with 1.2 million left to mine until the capped supply of 21 million is reached.

The supply cap of Bitcoin is 21 million, which is one of the fundamental principles of the Bitcoin network, aimed at providing asset scarcity.

Total circulating Bitcoin. Source: Blockchain.com

Although the number of 1.2 million BTC is small compared to the amount of Bitcoin already mined, the process of mining the remaining BTC will require miners to spend more time and effort due to the reduced rewards and increased mining difficulty.

According to MinerStat, the current Bitcoin mining difficulty rate is 1.023 trillion, having first surpassed the 1 trillion mark on November 5. The next Bitcoin difficulty adjustment is expected to occur on December 2.

Bitcoin Miners Are Far from Yielding, Bitcoin Sets New Price Records

Despite the challenges posed by high Bitcoin mining difficulty and lower block rewards, Bitcoin miners are far from yielding due to the ongoing rise in the cryptocurrency market.

According to CoinGecko, as of the writing of this article, the trading price of Bitcoin is $95,364, up 154% over the past year. Since the last Bitcoin halving event on April 20, 2024, the price of this cryptocurrency has also surged significantly, increasing by about 45%.

According to a report from European cryptocurrency investment firm CoinShares, despite the rise in Bitcoin in 2024 leading to an increase in dollar-denominated block rewards, Bitcoin miners have been taking measures to reduce costs and adopt artificial intelligence.

CoinShares stated in an October mining report, "The Bitcoin mining industry has faced significant challenges this year, with both revenue and hash prices declining."

In July, when the BTC trading price was around $56,500, Bitcoin mining company TeraWulf considered merging due to low profit margins.

Some major cryptocurrency mining companies, such as Marathon Digital, sold a large amount of mined BTC this year after the fourth halving, citing the need to improve efficiency and maintain competitiveness. Marathon also shifted to actively purchasing Bitcoin and announced the issuance of $250 million in convertible preferred notes in August.

On the other hand, El Salvador is intensifying efforts to find alternative Bitcoin mining methods utilizing geothermal volcanic energy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。