Author: Ray's New World, Blockbeats

Since October, listing coins on CEX has become a new discipline. Whether it's ACT, PNUT, or MOODNEG, countless people have become wealthy from these new coins. Every batch of players who are poised to take advantage of these potential listings holds their breath when CEX releases announcements, hoping to be that lucky one.

However, besides those who prepare in advance, there is a group of players like Xiao Z who focus on studying CEX announcements, forming a strategy known as "announcement trading." With his understanding of CEX, Xiao Z not only successfully positioned himself for some potential listings (like CAT MOODNEG) but also made considerable profits after the CEX announcements were released (such as PEPE, ACT, OL). Therefore, Blockbeats specifically talked to Xiao Z about the lesser-known world of announcement trading.

Blockbeats: When did you start paying attention to "announcement trading"?

Xiao Z: I entered the market during the last bull run in 2021, so I have experienced a full cycle of bull and bear markets. In 2022, I saw an article by the founder of a project on Zhihu, and inspired by Vida's article on Zhihu, I began to study CEX announcements. There are actually many opportunities in announcements, but they are often overlooked. For example, during the last bull market, the listing effects on Binance and Coinbase were significant; many people profited by positioning themselves in advance, but some also chased after the announcements and still achieved results.

Moreover, during the 2021 bull market, there weren't as many VC coins as there are in this current bull market. For instance, some coins would launch with market caps in the hundreds of millions or even billions, only to end up being a pump-and-dump. At that time, many coins launched with market caps of just a few million or tens of millions, allowing "announcement traders" to achieve considerable profits through early positioning. Some savvy investors would exploit testing vulnerabilities in announcements, discovering leaks and positioning themselves accordingly. In this round, the listing effects on Upbit and Binance are also good, but it seems that not many people in the Chinese community are paying attention. I think this area is still relatively untapped, so I started researching it. However, the strategies in this round are quite different from the last; the listing effects on Coinbase are not as strong, and there are very few small-cap projects launching on exchanges.

Blockbeats: Can you give some examples of testing vulnerabilities? How do savvy investors discover these vulnerabilities?

Xiao Z: I can give a few simple examples of vulnerabilities. The first vulnerability is due to engineer oversight. For instance, take a certain CEX; it has not only a main webpage but also different announcement pages. When they want to release a listing announcement, it will be published on the announcement page. There are many interfaces across different websites, and sometimes developers or testing engineers may overlook something. For example, a news announcement that was expected to be released at 10 PM might leak on the backend at 9:50 PM, and then a formal announcement comes out 10 minutes later. This is a common vulnerability.

Another example is the vulnerability of testing engineers. For instance, a testing engineer at a certain CEX might repeatedly test a coin on a specific chain using the same wallet. If the CEX is testing a B token on the Solana chain, and the engineer previously tested an A token, this wallet might be the one the engineer has been using. Some on-chain experts can capture these testing wallets to obtain potential listing information.

Blockbeats: What do you think about the listing effects of Coinbase this round? Why are they much weaker compared to the last round?

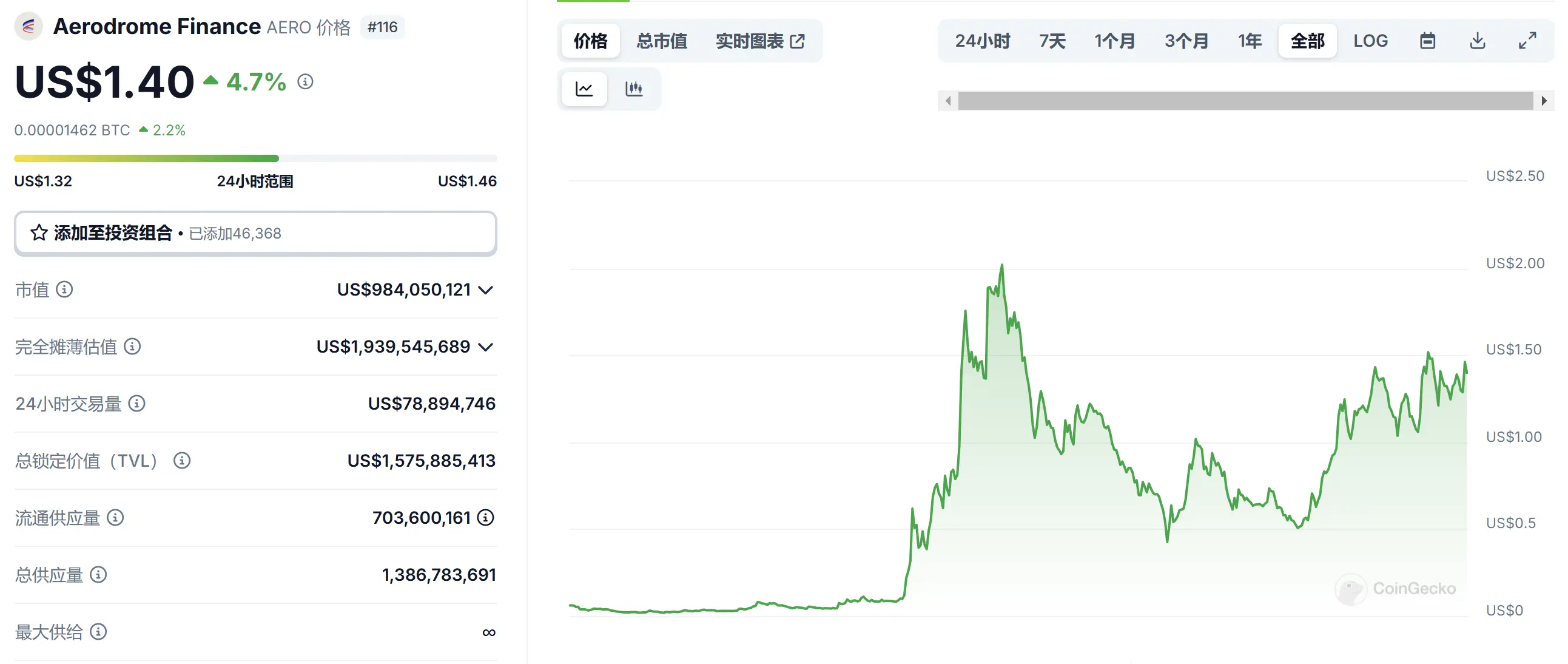

Xiao Z: Coinbase's performance this round is indeed not as impressive, and the beneficial effects are not as strong as in previous years. I think this is mainly due to regulatory reasons. However, there are still some coins with decent listing effects. For example, in the RWA sector, ONDO initially launched on Coinbase and increased by several times. Another example is AERO; Aerodrome Finance is a DEX on Base, and when it launched on Coinbase earlier this year, its price was only $0.09. After launching, it started to surge, reaching a peak of $2.3, which is about a 20-fold increase from its bottom. Of course, this is also thanks to its low market cap at launch; AERO initially had only a $10 million market cap, making it easier to pump.

In addition to the low market cap opportunities, there are also some high market cap opportunities, such as some meme coins that have launched. For example, PEPE surged 50% after launching on Coinbase recently. Of course, there are other factors involved, like Upbit and Robinhood. However, meme coins like WIF and FLOKI also saw increases of over 30% after launching on Coinbase. Overall, while there are still opportunities, the listing situation on Coinbase this round is relatively average, possibly due to regulatory reasons. However, this bull market on Coinbase has sparked a wave of innovation from the Base ecosystem. If Ethereum has any hope, its only savior lies within the Base ecosystem. All the interesting innovations in the Ethereum ecosystem, such as new concepts like AI pump.fun, are flourishing on Base, while other L2 chains are basically dead.

Blockbeats: What aspects of announcement research are you currently focusing on the most?

Xiao Z: During the last bull market, I was still in a novice stage, randomly researching various topics—sometimes leverage, sometimes contracts, sometimes chain games. In fact, I only started researching announcement-related information from this round, 2023 to 2024. A friend of mine developed a program similar to a news monitoring tool that can track more CEX announcement information. In addition to a few leading CEXs, I am also paying attention to some second-tier CEXs.

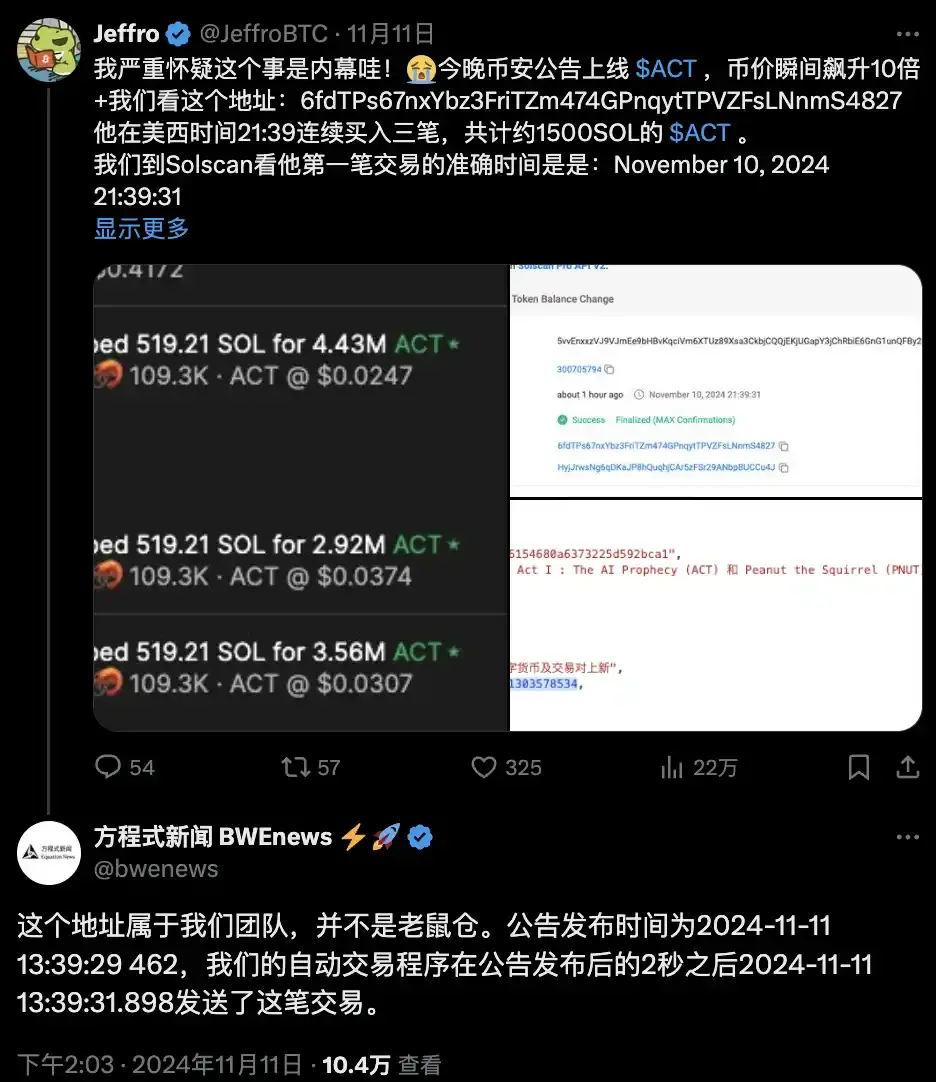

After each CEX releases an announcement, I study to see if there are any opportunities. I analyze the content of the announcement and its news effects, and I continuously review my findings. Gradually, I also learned about news trading, or what is now popularly called event-driven trading. For example, many are familiar with the news from the project, which profited $1 million from ACT through this "news trading." However, the trading methods of the project require some technology and are not suitable for everyone to apply. So I began to carefully study some manual trading opportunities that are more friendly to players without much technology.

For instance, there was a capitalization dispute with a16z's Eliza. It actually follows the same logic as Neiro, but the latter launched on a leading CEX. Can it be replicated? I don't think so. Eliza also has controversies regarding "community" and "conspiracy groups," with both sides fighting fiercely. At that time, the uppercase ELIZA was performing much better than the lowercase version, and many people relied on the previous logic of Neiro to chase the lowercase version, leading to many being trapped. I didn't jump in at the beginning of the debate; I was just observing. The turning point for me was when I saw on HTX's announcement that HTX would list the lowercase version, which prompted me to enter the market. This indicated that the CEX supported the lowercase token. As a result, the lowercase version did indeed surpass the uppercase version.

In fact, it's not just the leading CEXs; the announcements from various CEXs hide wealth codes, but they need to be analyzed in conjunction with specific hot topics, the broader environment, and the fundamentals of the tokens.

Blockbeats: Can you share more examples of "announcement trading"?

Xiao Z: Of course. For example, there have been many opportunities in recent announcements on OKX. For instance, I bought the token OL at a price of $0.025 and sold it at $0.1; very few people noticed such opportunities. On November 18, OKX announced that it would launch the spot trading of the native token OL for Openloot. The deposit opening time was set for 2 PM that afternoon, with the auction time from 8 PM to 9 PM on November 19, and the opening time at 9 PM. Most people would stop reading here, or might not even click on the announcement. Let's look at the fundamentals of Openloot. Openloot is an NFT trading platform for the game Bigtime, where users can use OL as a payment method when purchasing or renting high-value items or buying NFTs from major sales. OL's initial circulation was only 200 million, while the total supply is 5 billion, resulting in a very low initial circulation rate. The game token for Bigtime initially launched at a very low opening price. However, Bigtime initially restricted trading for Chinese users, allowing only API orders or requiring users to deposit Bigtime into the exchange to trade, so many people were unaware. It opened at $0.002 and surged dozens of times a day later.

So after researching, I believe OL has the same low opening gene as Bigtime. Additionally, during the auction phase on November 19, OL's auction price was around $0.02 (it eventually opened at around $0.025). Based on $0.02, OL's circulating market cap was only $4 million. Even if you didn't buy the low-priced OL during the auction, OL maintained a market cap of around $10 million for a long time after opening, still providing a favorable risk-reward ratio.

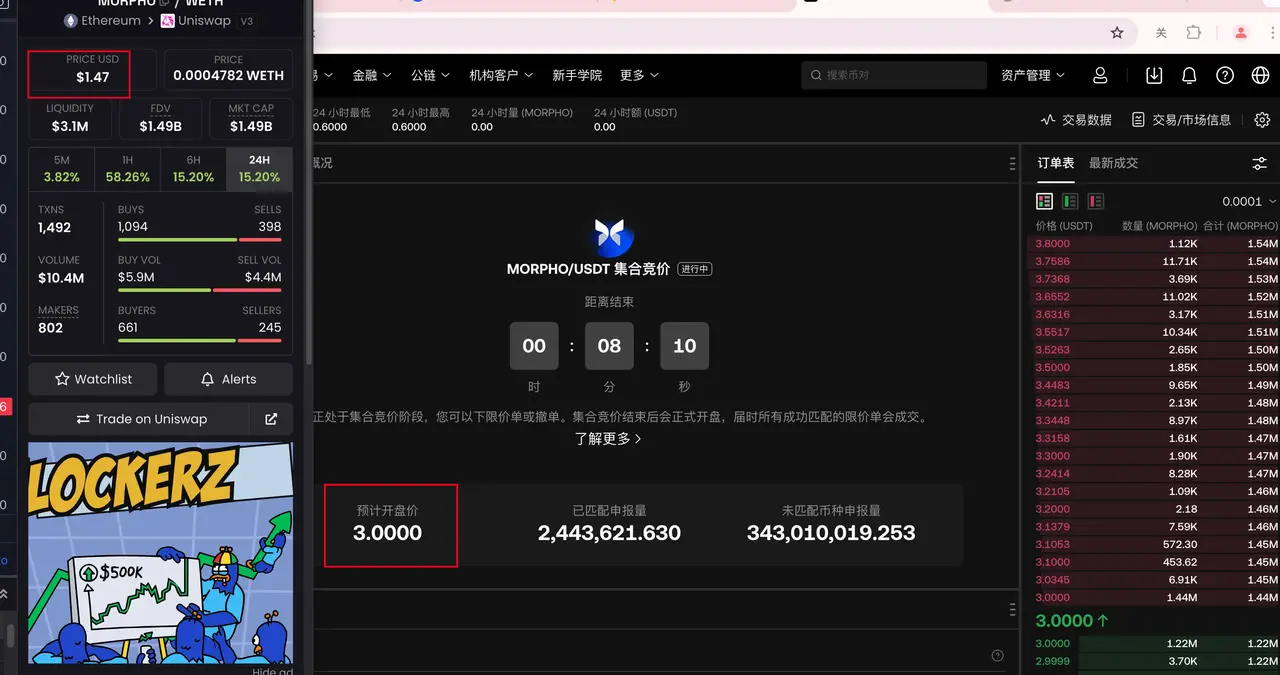

Another example is the recent Morpho. Although MORPHO's market cap is not as "cheap" as OL, opportunities still exist. First, we still need to research the project's fundamentals. MORPHO is an old DeFi project from 2021, with a total supply of 1 billion tokens, just like OL, but only 100 million tokens are in circulation, giving it a total market cap of around $100 million. A $100 million market cap is neither high nor low, and in most people's eyes, it doesn't provide a favorable risk-reward ratio. However, on November 21, from 5:05 PM to 6:05 PM, MORPHO began its auction. The opening auction price reached as high as $4, while on-chain, MORPHO initially fluctuated around $1. After seeing the auction price, we had about an hour to withdraw tokens on-chain and deposit them into the exchange. Even if the withdrawal speed was slow, there were still 2 hours after the listing to fully smooth out the price difference.

So the core is still to study CEX announcements, to research all CEX announcements, and see if there are any opportunities that are not easily discovered by others.

Blockbeats: After seeing each exchange announcement, what strategies do you employ to respond?

Xiao Z: You need to look at different types of exchange announcements. Some reflect the timing for you. For example, the announcement of OL's listing was released two days in advance, giving you those two days to thoroughly research the fundamentals and information about the coin. For instance, what is the cost for gold miners or early investors at the opening circulation? Additionally, how much of the coin is locked up at the opening circulation, and how much is actually available for sale? What is the situation across different exchanges? This type of announcement gives you ample time to conduct your research.

Another type of announcement does not give you time to research; you need to be prepared in advance to position yourself. For example, when the ACT coin was listed on BN, as soon as you see the announcement, you should immediately check its fundamentals, such as market cap and where there is liquidity. Then, based on your strategy, you should quickly buy in. Generally, the beneficial effects of spot trading are far greater than those of futures. When you see that ACT has a market cap of only tens of millions, you should buy immediately because the risk-reward ratio is very favorable. A market cap of tens of millions for a listed asset can be considered very cost-effective. At the same time, you should review and summarize why these coins were listed and how their fundamentals are. What strategy should I adopt next time I encounter a similar situation? However, these sudden announcements require quick reflexes. Projects like the one mentioned have made a lot of money through such methods, and after the ACT event, I believe everyone is gradually starting to understand their trading methods. Some even specifically follow their addresses.

In addition to spot announcements like ACT, there are also contract announcements. We usually believe that the listing effects of spot trading are far greater than those of contract trading. For example, MOODENG had a market cap of only 60 million before it was listed, and it had been declining for a long time. Although this coin was only a contract, its market cap was low enough, and the fundamentals at that time were very good, so even with a contract listing, it had a strong listing effect. If you bought MOODNE at that time, you might only lose 50%, but once it was listed on Binance for spot trading, it could potentially see a 3-5 times increase, making the risk-reward ratio quite attractive. This kind of strategy can be played, but if a coin's market cap is already in the hundreds of millions, then whether you position yourself in advance or not, it may not be very suitable.

Blockbeats: What do you think about projects in other ecosystems? For example, the recently popular Desci concept.

Xiao Z: The narrative of Desci actually started appearing in 2022, but it was during a bear market. At that time, there was not much liquidity in the market, so this concept did not gain traction. During the bear market from 2022 to 2023, the founder of Coinbase invested in a project called RSC, and he often promoted his project on social media. For a long time, there was not much buzz, but suddenly in December last year, there was an explosion of interest.

Then it went quiet for a long time until this year when BN announced investments in Bio, including some actions regarding Desci by CZ and Vitalik in Bangkok, which I won't elaborate on here. Because of these opportunities, the concept of Desci has reignited this year. Desci definitely belongs to a powerful narrative, but this narrative was pushed by "top influencers" rather than naturally fermenting from the grassroots. Such a strongly promoted concept is hard to evaluate.

For example, some concepts led by Coinbase, like Depin. The entire track of Depin is currently very quiet; you basically see everyone talking about "meme" and "AI," and very few are discussing Depin. At that time, Coinbase listed many Depin tokens, such as MOBILE HONEY, and later BN also "followed suit" by listing IO. However, the market may not necessarily buy into such strongly promoted concepts, and the results have already shown that. Desci is also of this type, so I think people need to do their research on Desci, be ready to act, and respond flexibly.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。